TechDev

@TechfDev_52

Entrepreneur | #Bitcoin and crypto analysis

The highly-levered do not get to ride the bucking bull. It's that simple.

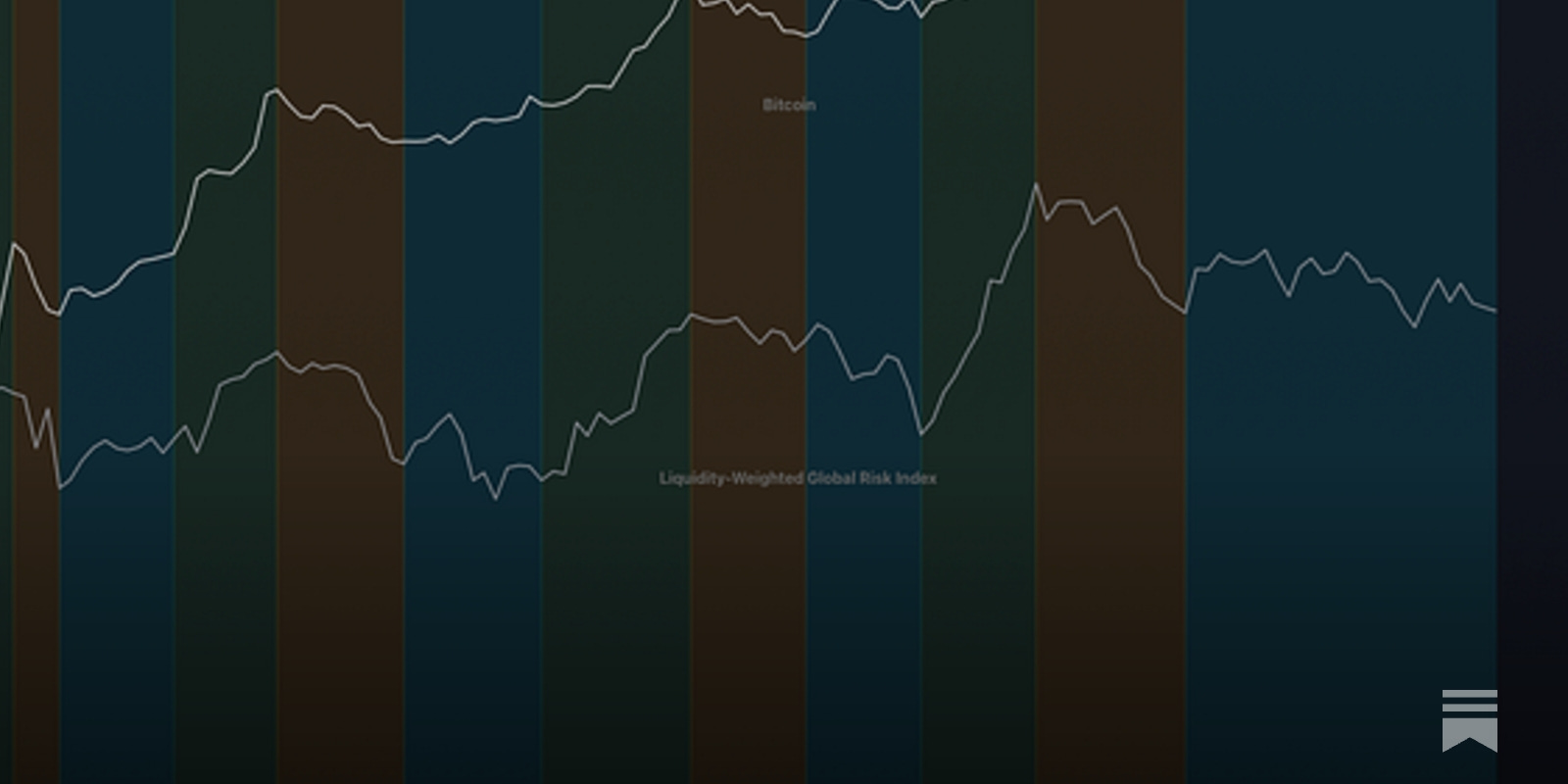

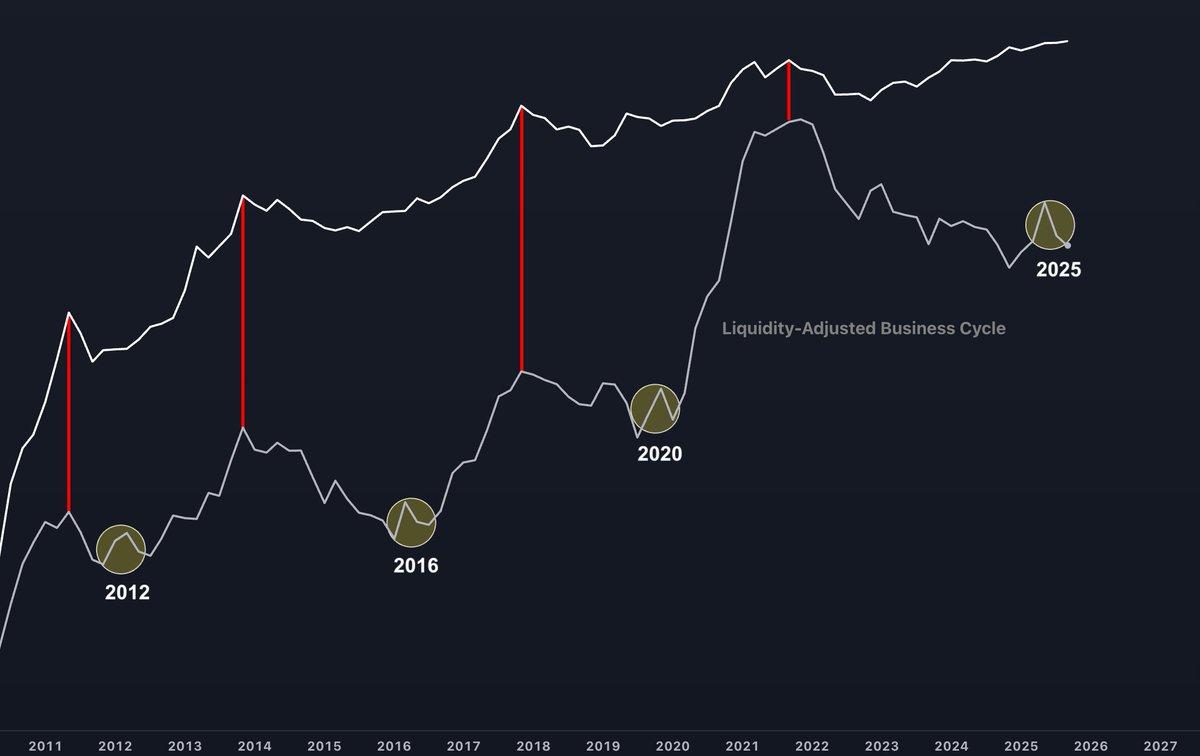

Never been a 4 year Bitcoin cycle. Never been the halving. Always been the business cycle…that previously inflected every 4ish years right near the halving. How do you know? Because it’s also explained every other aspect of Bitcoin’s chart. It’s at a bottom, not a top.

Oct 2020 - ETH tested top of 2 yr range. - Business cycle inflected - Global risk index turned positive Oct 2025 - ETH tested top of 2 yr range. - Business cycle inflected - Global risk index turned positive

Why a cycle top still looks nowhere close…techdev52.com/p/techdev-news…

No way most are ready for Bitcoin’s next move.

If someone calls for an end-of-year top, your question should be “which year?” Why do you see some saying it’s early risk cycle? Because it’s early risk cycle.

The Global Risk Index: A Framework for Cycle Precision techdev52.substack.com/p/techdev-news…

Most seem to have no idea what's coming. Macro altcoin expansion has only just begun.

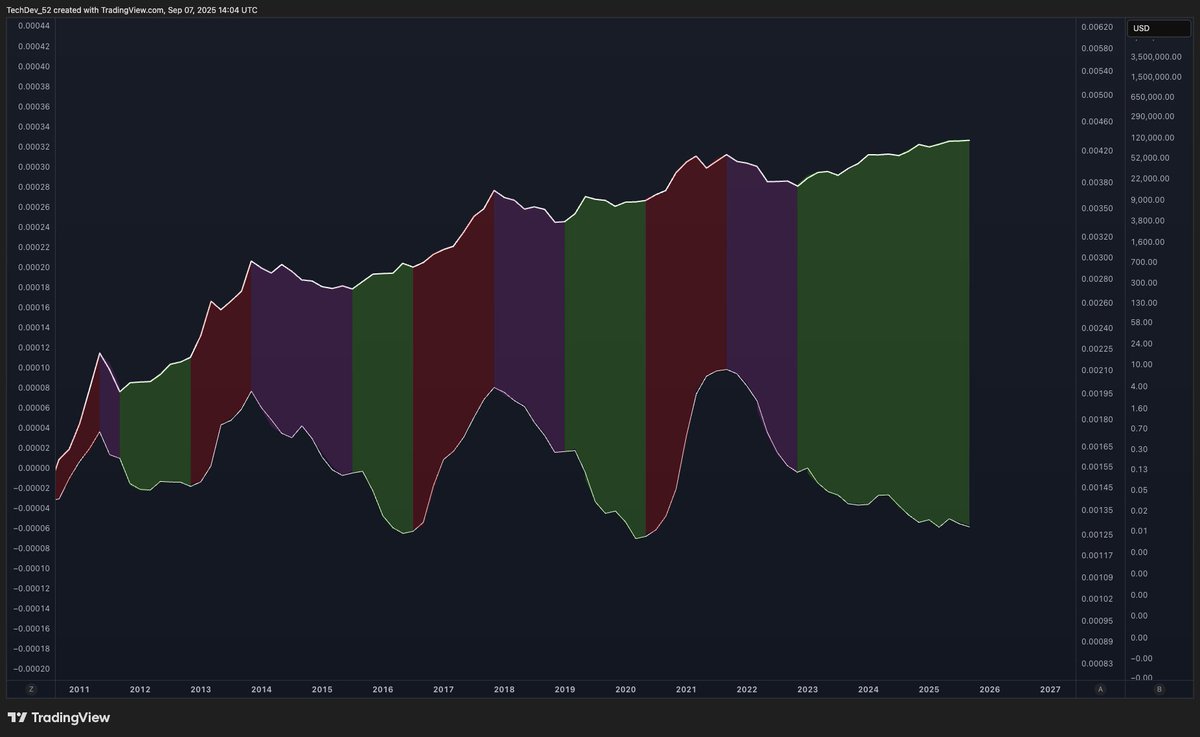

It's... The 2012 setup before the 2013 run. The 2016 setup before the 2017 run. The 2020 setup before the 2021 run. All over again.

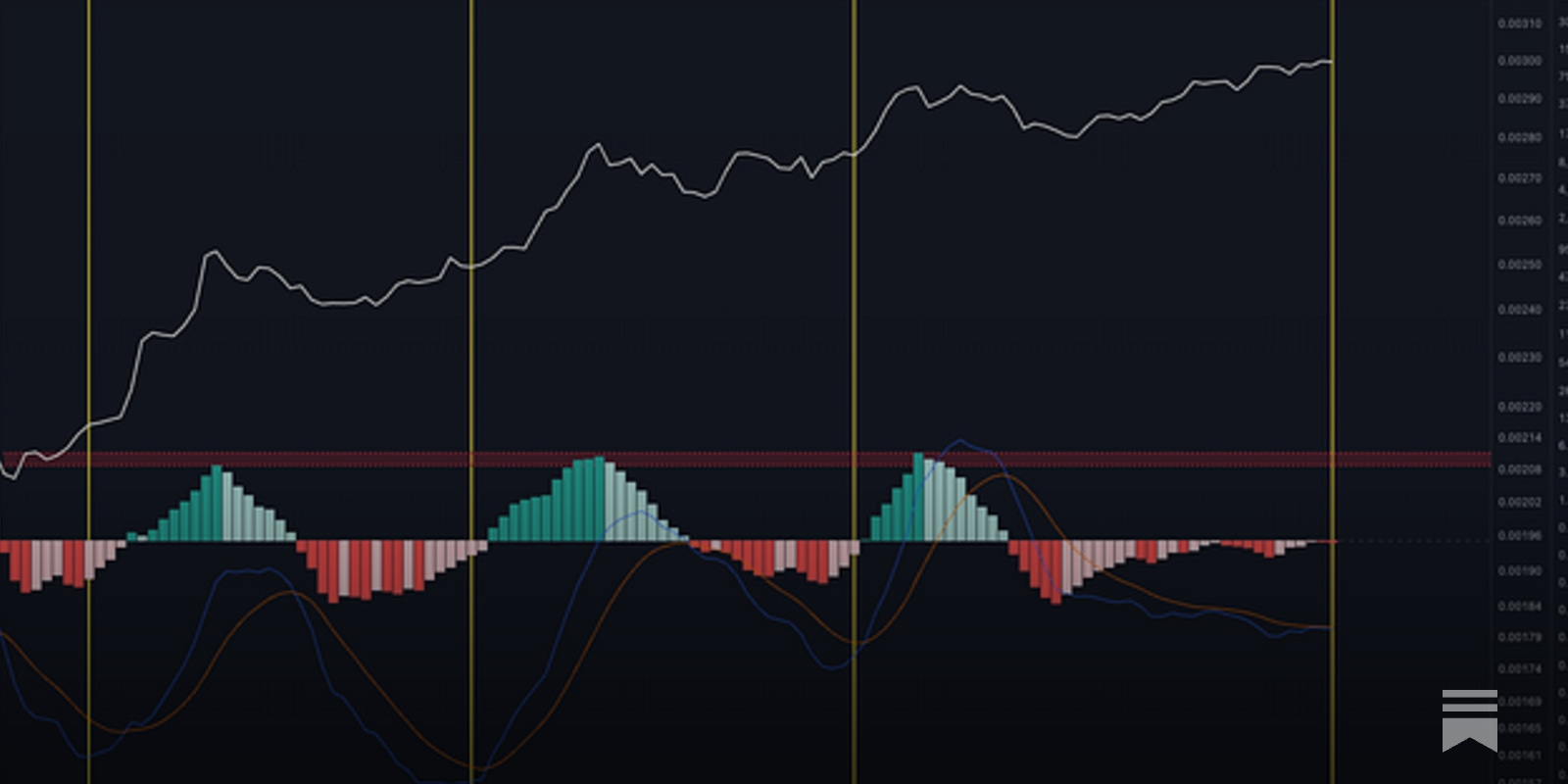

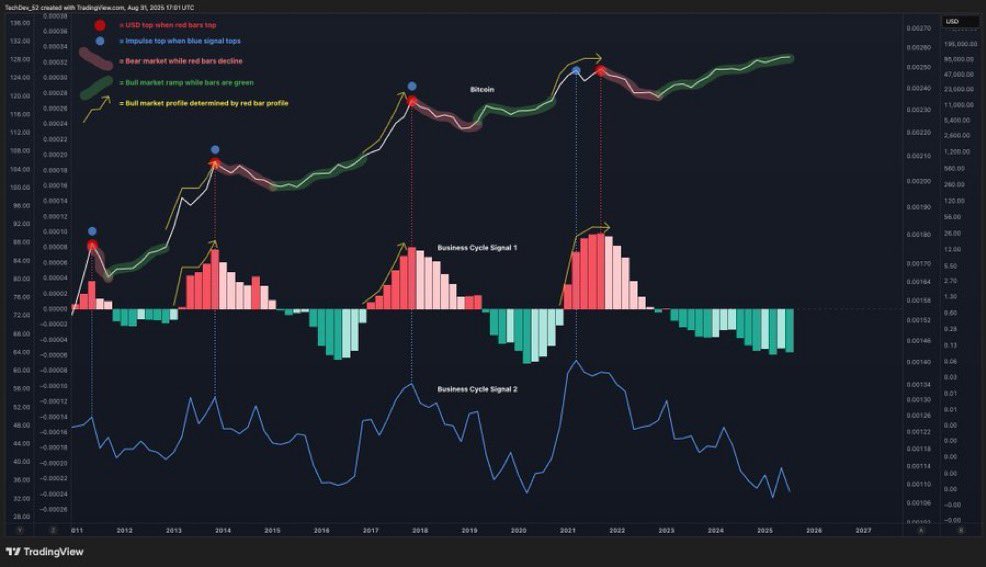

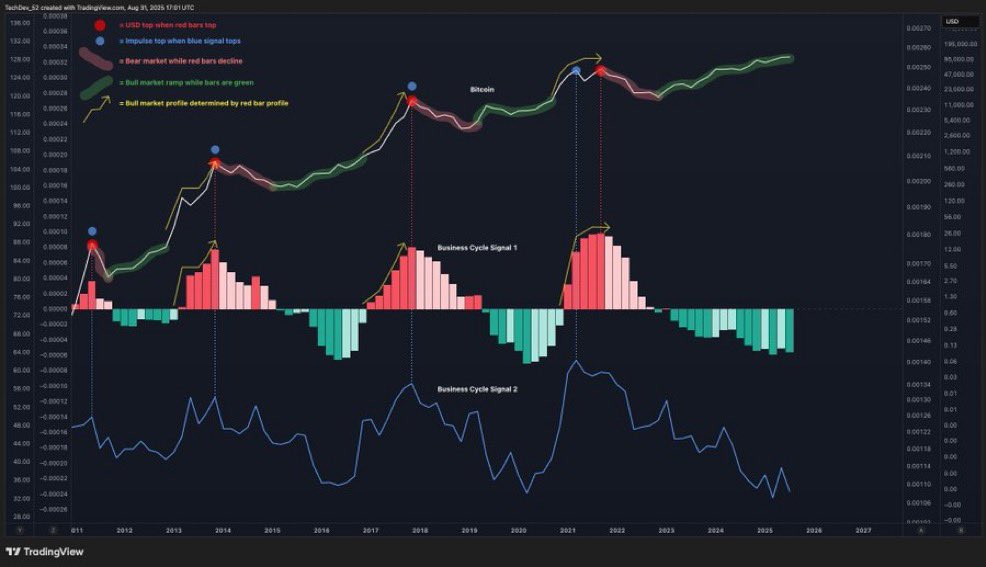

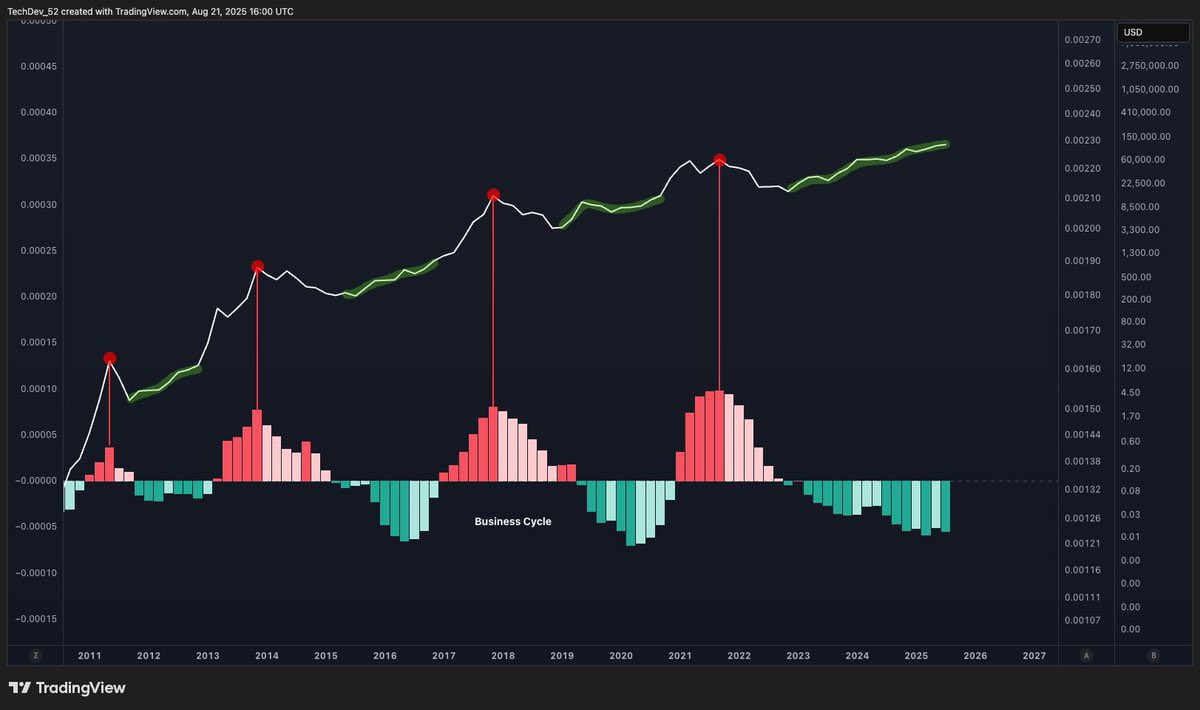

Bear market while reds decline. Bull market ramp when bars green. Goes parabolic when bars go red. Red profile mirrors parabola profile. Impulse tops at blue peaks. USD tops at red peaks. We’re still green. The global business cycle has dictated every aspect of Bitcoin’s.

Two Paths Forward: Navigating the Business Cycle Inflection techdev52.com/p/techdev-news…

Bitcoin Cycles Explained... USD tops at red bar tops. (not even red yet) Impulse tops at blue signal tops. (last cycle only one where red and blue were different - why most alts topped May 2021) Bear market while red bars decline. (ends when bars go green) Bull market ramp…

It’s not just the tops. Every “bear market” has ended precisely as red turned to green. Every “ramp” has lasted as long as bars were green. Every “hockey stick” has been marked by green flipping red (not the halving). And yes, every “top” has been marked by a peak in red.…

I sense the majority of this market is not ready for this next leg.

“If I put $100 in Bitcoin in 2010 I’d have $2.8B now.” No. If you bought $100 of Bitcoin in 2010 and watched it go to: $1k → $100k → $1.7M and did nothing Then watched $1.7M go to $170k and still did nothing Then watched $170k go to $110M and still did nothing Then…

Cup-and-handles. Inverse h&s. Whatever you call them, the small one targets 150k, and the big one 300k.

Every dip continues to have the crowd thinking maybe top, and that should tell you everything you need to know. Timeline on eggshells since 15K. Wall of worry. Worry when it crumbles.

United States Tendencias

- 1. Chargers 36.8K posts

- 2. Vikings 25.5K posts

- 3. #911onABC 10.8K posts

- 4. Herbert 9,875 posts

- 5. #Skol 3,175 posts

- 6. $UNI 1,945 posts

- 7. #TNFonPrime 1,503 posts

- 8. Dallas Turner N/A

- 9. #BoltUp 2,149 posts

- 10. Rempe 3,091 posts

- 11. Oronde Gadsden 2,380 posts

- 12. Logan Cooley N/A

- 13. Isaiah Rodgers N/A

- 14. Athena 10.4K posts

- 15. #RHOC N/A

- 16. Pacers 12K posts

- 17. Vidal 7,807 posts

- 18. Bannon 15.7K posts

- 19. Becton N/A

- 20. Ladd 2,715 posts

Something went wrong.

Something went wrong.