TenXSignalLab

@TenXSignalLab

$FLNC $TE $HIMS $POET $OPEN

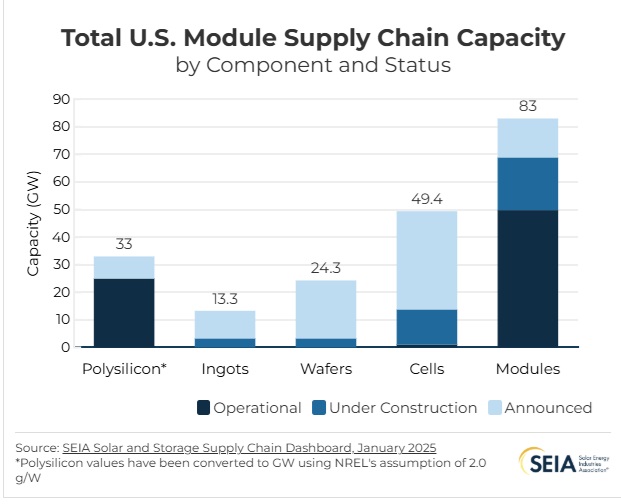

$TE $FSLR US module production surged in 2024 with 50 GW of new capacity. But expanding cell capacity is tougher: only 2 GW added in the first nine months of 2025. TE's G2 will tackle that The harder the problem you solve, the bigger the payoff.

ESS (에너지 저장) 붐은 이미 시작됐습니다. Tesla가 시장을 열었다면, 그다음을 이끌 기업은 $FLNC 독일 Siemens(전력 인프라) + 미국 AES(글로벌 발전사)의 합작회사로, 기술력과 운영 경험을 모두 갖춘 전력산업계의 하이브리드 플레이어입니다. 특히 유럽 에너지 전환과 전력망 안정화 정책에서…

If you read my substack article on $FLNC you'd know that one of the biggest bull cases is that they are one of the only pure play companies in the space and the only one remotely close in scale to the market leader $TSLA

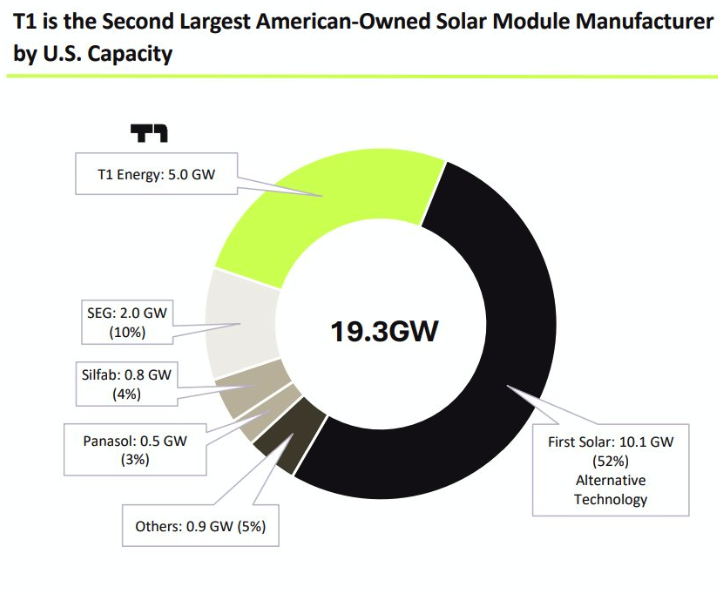

$TE First Solar는 수십 년간 태양광 산업의 선두를 지켜왔습니다. 이제 그 뒤를 신생 기업 TE(T1 Energy)가 빠르게 추격하고 있죠. 지금의 기업가치, 과연 그들의 미래 성장 잠재력을 제대로 반영하고 있을까요?

$TE 실적 발표에서 중요한 점으로, 경영진은 4분기 매출이 1-3분기 총 매출보다 높을 것으로 예상합니다. 이는 기업이 폭발적으로 성장하고 있음을 의미합니다. 4분기 매출 > 1+2+3분기 매출 이제 주목해야 할 점은 G2 공장의 안정적인 건설입니다.

$EOSE $FLNC $TE $FSLR Eventually energy desperation sets in. What do you do when you've spent tens of billions on chips you can't even use? What will clients, investors, and the market think when they find out? How much will you pay for rapidly deployable energy?

$EOSE $FLNC $TE $FSLR Energy desperation season is coming

$TE “Wells Fargo says lock in gains in tech and invest here instead” Where? “The industrials and utilities sectors can allow investors to participate in AI through the booming ancillary data-center trend, but with lower valuations than IT.” Oh. Utilities you say? Like Solar…

Why invest in T1 Energy? Because their website is too good to ignore😏 $TE

현재 $FLNC의 가장 큰 단점은 마진입니다. ESS 배터리 시스템을 구성하는 데 막대한 자본과 소재 비용이 들어가죠. 하지만 그들의 가장 큰 강점은 ARR구조입니다. 단순히 하드웨어를 판매하는 게 아니라, 운영,모니터링,소프트웨어 관리 등 서비스형 전력 플랫폼 모델로 지속적인 매출을 확보하고…

$FLNC Batteries, Energy Storage 3.8B Market cap My take: A spicy shorter-term "battery meta" play with a potential long-term "Amazon" thesis. $FLNC is in a capital-intensive expansion phase with thin margins generating billions in revenue but very little in net profit Key:…

아주 좋은 분석입니다👍 $TE

I have done 2 deep dives into $TE . Helped to build my conviction. PART 1 techdrifts.substack.com/p/t1-energy-70… PART 2 techdrifts.substack.com/p/te-t1-energy…

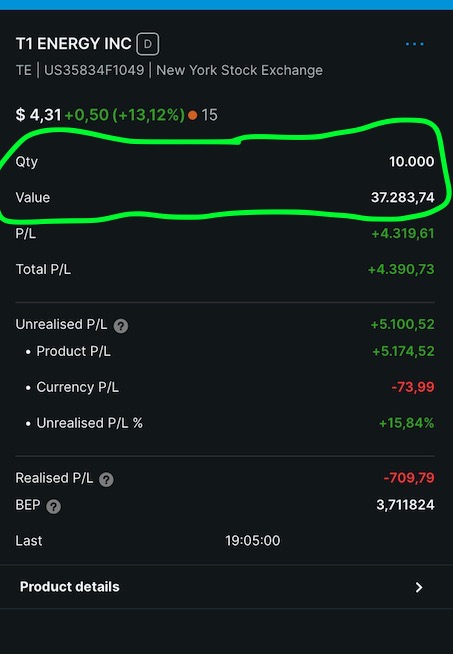

$TE I am holding 10,000 shares and waiting for Trump to TACO on Solar. Values are in Euros. x.com/hiteshkar/stat…

I have done 2 deep dives into $TE . Helped to build my conviction. PART 1 techdrifts.substack.com/p/t1-energy-70… PART 2 techdrifts.substack.com/p/te-t1-energy…

$TE I could be wrong. But imagine this: what if they sign a deal with $TSLA? Sounds crazy. But every big story starts that way.

$FLNC is just getting started.

$FLNC Well, well. Fluence is going to build the largest BESS in Europe. As I already said they will be the biggest beneficiary of this trend in Europe. x.com/hiteshkar/stat…

$TSLA $FLNC $TE Why is $TSLA focusing so heavily on ESS (Energy Storage Systems)? Have you seen the growth rate of Tesla’s ESS segment in recent earnings? They’re already generating massive profits from it. @elonmusk sees the future far ahead of us. As AI evolves, foundation…

United States Trends

- 1. Syracuse 6,078 posts

- 2. #UFCQatar 70.1K posts

- 3. Harden 27.3K posts

- 4. Joe Jackson N/A

- 5. Jeremiyah Love 2,363 posts

- 6. Arman 21.4K posts

- 7. Lincoln Riley N/A

- 8. Fran Brown N/A

- 9. Mercer 3,042 posts

- 10. Zvada N/A

- 11. Ian Garry 9,034 posts

- 12. Belal 10.2K posts

- 13. #GoIrish 4,180 posts

- 14. Sherrone Moore N/A

- 15. Stoops 1,065 posts

- 16. Mizzou 6,188 posts

- 17. Makai Lemon 1,069 posts

- 18. Deuce Knight 2,074 posts

- 19. Malik Benson N/A

- 20. Mike Washington N/A

Something went wrong.

Something went wrong.