Financial Market Guide

@TheFMGuide

Everything financial markets

🇺🇦❌🇺🇸 NO DEAL — Here’s What Really Happened This Week A wave of new reporting this week paints a clearer picture of where things stand between Zelensky and Trump’s proposed peace plan. According to several outlets, Trump’s draft proposal would require Ukraine to accept major…

🇺🇸 Fed President John Williams says there’s still “room” for a near-term rate cut as inflation risks ease and the labour market cools. Odds of a 25bps rate cut in December just jumped to 67%. Crypto, equities and metals all started to bounce from key areas. Relief rallies next…

Capital rotation is getting closer Few understand

BREAKING 🚨: London Real Estate Market London's most expensive homes are plunging in value 📉📉

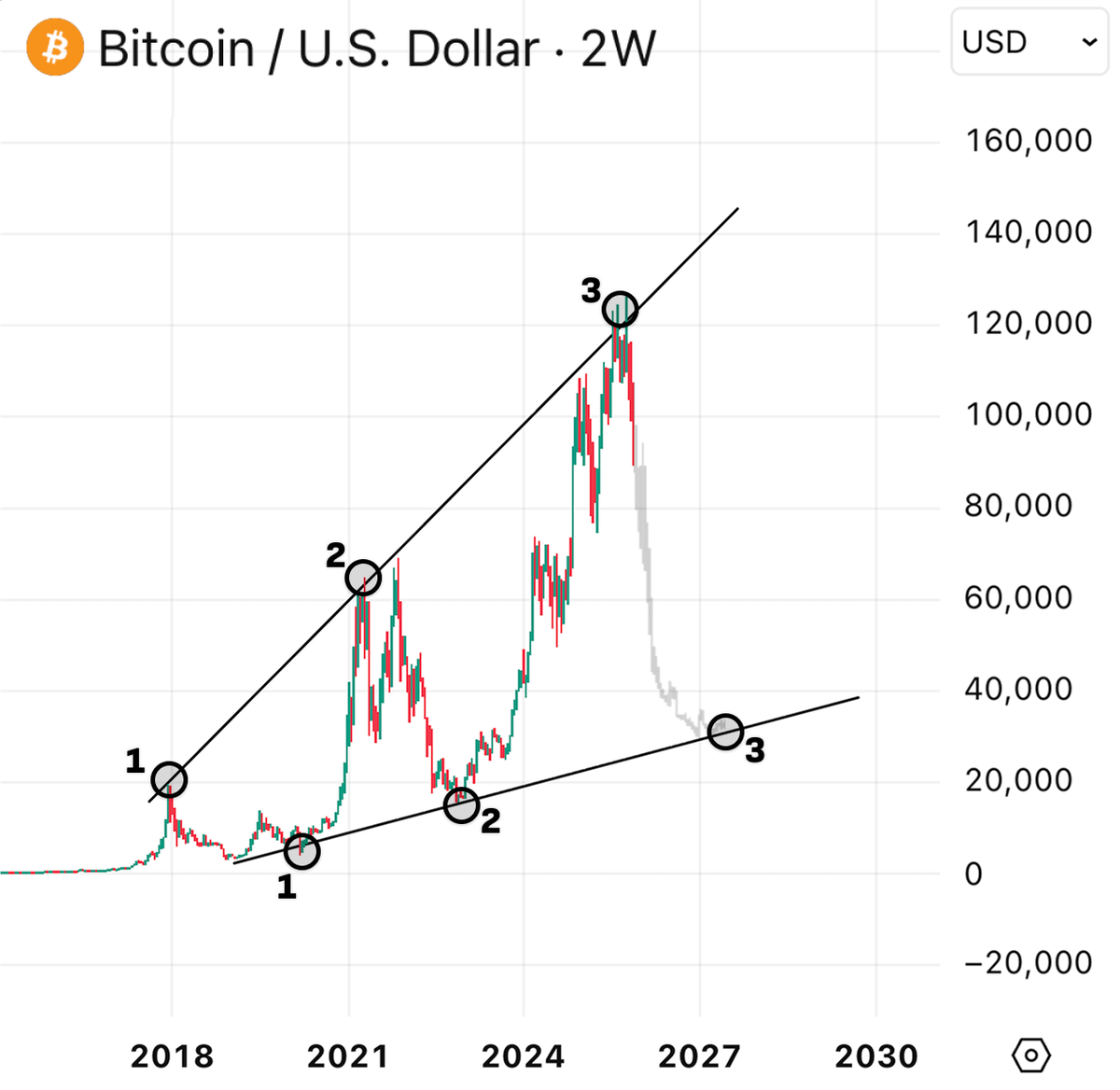

That's exactly why I sold all my $BTC at $102K Yep, maybe I did it a bit early But I didn't risk 5x profit for an extra 20% that's what I am telling everytime and that's exactly how many newcomers get REKT If you're trying to catch the maximum exact top, you're already lost…

I've sold 100% of my $BTC at $102k, after holding it for ~2 years The question arises: What's next? I'm sure of 3 things: 1: Biggest altseason ever is close 2: Buyback $BTC only at $40k> 3: Bull cycle will end in Oct 2025 I spent ~20 hours researching all the data: Here is why…

December cut now priced in at 24% probability BLS says they won’t publish Octobers jobs report numbers Novembers jobs report pushed back to December 16th Septembers jobs report expected later on today in the US session

*FED: 'SEVERAL' SAID DECEMBER CUT 'COULD WELL BE' APPROPRIATE *FED: `MANY' SAW DECEMBER RATE CUT AS LIKELY NOT APPROPRIATE

🇬🇧 UK Inflation Falls to 3.6%: Inside the Data • The headline inflation rate (Office for National Statistics’s CPI) was 3.6% in the 12 months to October 2025, down from 3.8% in September. • The broader measure including owner occupiers housing costs (CPIH) was 3.8%, down…

💥BREAKING: 🇺🇸 US JOBLESS CLAIMS AT 232K IN OCT.

Takaichi: “I need 17tr JPY, print’em” Ueda: “ma’am we are losing control of yields” Takaichi: “do YCC” Ueda: “JPY will implode” Takaichi: “We’ll sell $ reserves” Ueda: “we aren’t allowed to blow up the $ system first and trigger a financial crisis” Takaichi: “damn it”

JAPAN PM TAKAICHI TO MEET WITH BOJ'S UEDA AT 3:30PM JST ON TUES

JAPAN JUST BROKE THE GLOBAL FINANCIAL SYSTEM AND YOU HAVE 30 DAYS November 18th, 2025. Japan’s 20-year bond yield hit 2.75%. Highest in recorded history. This single number just ended the 30-year era that made your retirement possible. The math is simple and fatal. Japan has…

It's wild. Your grandpa who invested in the S&P500 is up 11.5% this year. You who went all in on Bitcoin are almost flat. What do you say at Thanksgiving dinner?

🇯🇵 Japan’s Bond Surge: What It Means Japan’s 20-year government bond yield just hit 2.75%, the highest ever as the government plans a $110B stimulus package. Here’s why global markets are paying attention: 📈 Japan’s Rates Are Rising Higher long-term yields mean borrowing in…

BREAKING: Japan's 10Y Government Bond yield surges to its highest level since June 2008 on talks of a $110 billion stimulus package.

JAPAN JUST KILLED THE GLOBAL MONEY PRINTER AND NOBODY NOTICED The most dangerous number in finance right now is 1.71%. That’s Japan’s 10-year bond yield. Highest since 2008. Here’s why your retirement just got obliterated: For 30 years, Japan printed infinity money at 0% rates…

Words fail me at this point...

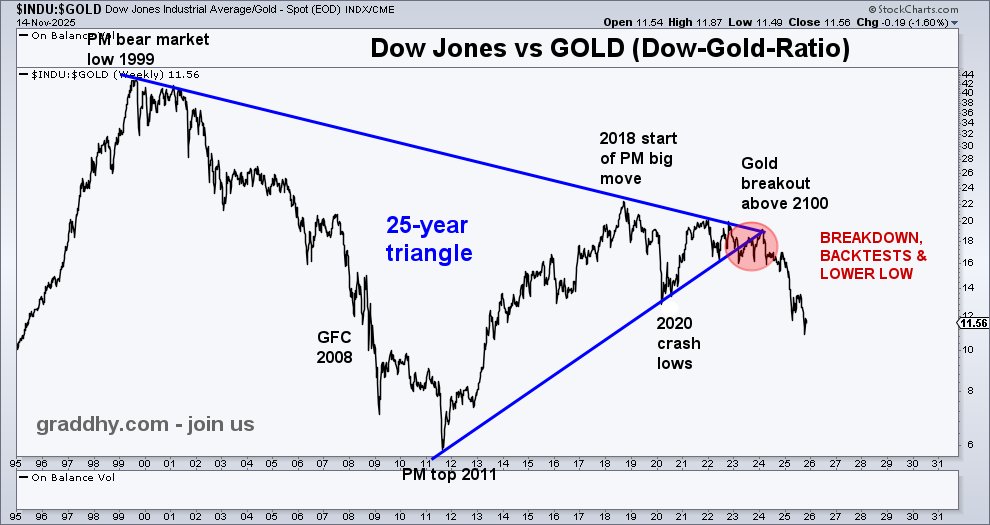

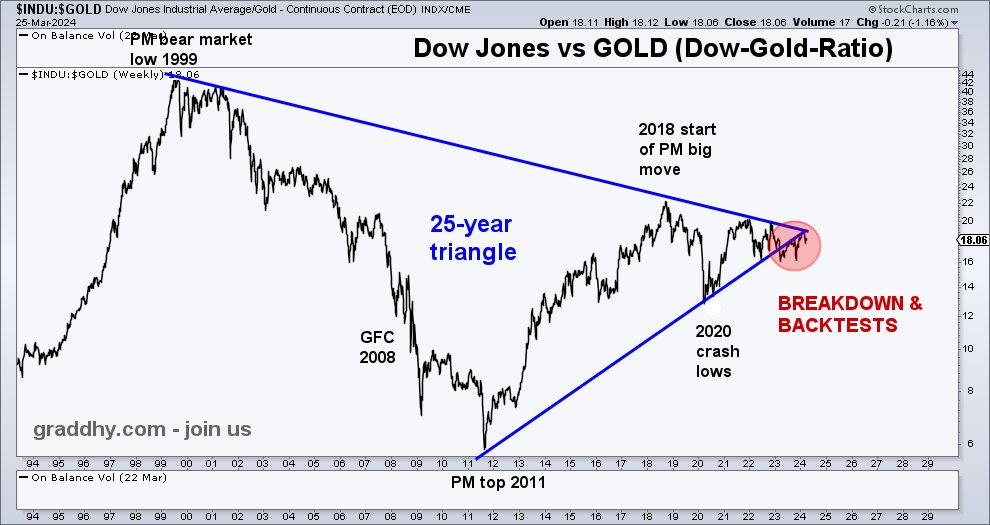

At the time, many were focused on the gold vs SPX to break out. But, the Dow-to-Gold-ratio below showed much earlier what was happening. And, note that the Dow-to-Gold-ratio backtested the blue 25 year apex from below, while gold made its mega breakout above $2100 level (which…

Posted that the Dow-to-Gold ratio had broken down below its 25-year triangle, and that gold was about to break out. It did. Very important chart for the next macro trend. Institutions - wake up! #gold is now set to outperform general stock market. So it begins. #commodities

THE BITCOIN DEATH CROSS HAS JUST FLASHED!

Sell your BTC and get into the precious metals sector.. still early Few understand

United States เทรนด์

- 1. #AEWFullGear 20.1K posts

- 2. Haney 19.8K posts

- 3. Georgia Tech 4,418 posts

- 4. #RiyadhSeason 15.7K posts

- 5. #TheRingIV 8,176 posts

- 6. Darby 4,064 posts

- 7. Brian Norman 5,692 posts

- 8. Utah 20K posts

- 9. #Boxing 8,069 posts

- 10. Bandido 32.2K posts

- 11. Mason 39.7K posts

- 12. Matt Rhule N/A

- 13. Nebraska 21.2K posts

- 14. #Svengoolie 1,274 posts

- 15. Brodido 1,446 posts

- 16. Syracuse 9,291 posts

- 17. Eddie Hearn N/A

- 18. Heupel N/A

- 19. Haynes King N/A

- 20. Okada 10K posts

Something went wrong.

Something went wrong.