The GP

@TheGenPartner

Select Private Markets news, notes, and thoughts curated for the General Partner community, available to all. Posts by The GP are not financial advice.

Secondaries shops like @Coller_Capital have a unique seat at the table in the Private Markets. On one hand, they're active investors in half-baked vintages. On the other, they must align with both the GP while providing liquidity to selling inst'l nvestors. 2024 Insight thread 🧵

“We did 18.3%” aka “we entered a sh*t ton of CVs at a discount to their last equity rounds and marked them up an average of 18.3% during the available next quarter”.

BREAKING: Apollo Global Management retrned 18.3% for individual investors last year by leaning into single-asset deals that private equity firms aren’t ready to exit..

🚨 Here is the full 42 minutes of my crew and I exposing Minnesota fraud, this might be my most important work yet. We uncovered over $110,000,000 in ONE day. Like it and share it around like wildfire! Its time to hold these corrupt politicians and fraudsters accountable We ALL…

Finally someone explains the idiom.

Legendary investor Howard Marks is flagging early cracks in private credit, warning that the recent bankruptcies may be the first signs of deeper issues ahead. As he puts it, when you see one cockroach, there are usually more. For context, Marks is one of the most respected…

I’m sorry Brad, but if a CEO of one of my holdings spoke to me like that, I wouldn’t be a “Buyer”, I would be a “Seller” of all my shares …

we get it you have a massive L/S trade with openai and google

Private equity firms creating continuation vehicles for assets they marked themselves

DECODING GP STAKES Is GP stakes investing the next frontier in private equity? Sean Ward and Blue Owl Capital are redefining long-term growth with permanent capital. Sean Ward’s path to Blue Owl is far from ordinary. With a blend of Wall Street, PE, and legal experience, he’s…

Lol. Lmao even. We haven't distributed any capital ("but look at your IRR!") and you can't sell your stake unless you write a commit for the next fund. Deeply unserious industry, even more unserious LPs still playing along with this.

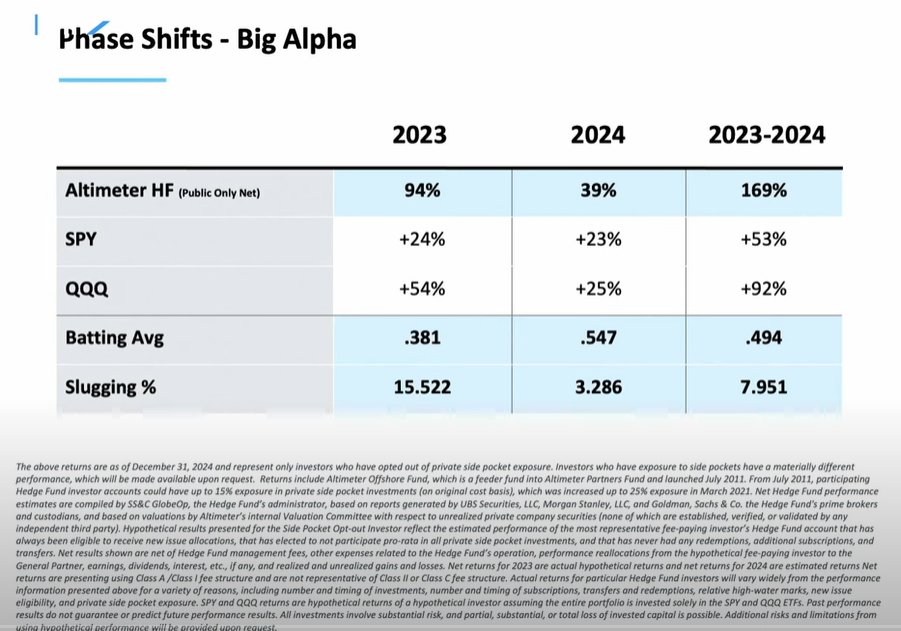

Great returns, but show us the downside capture in 2022. It will make you rethink this performance story.

Altimeter's 2023 and 2024 public equities net returns

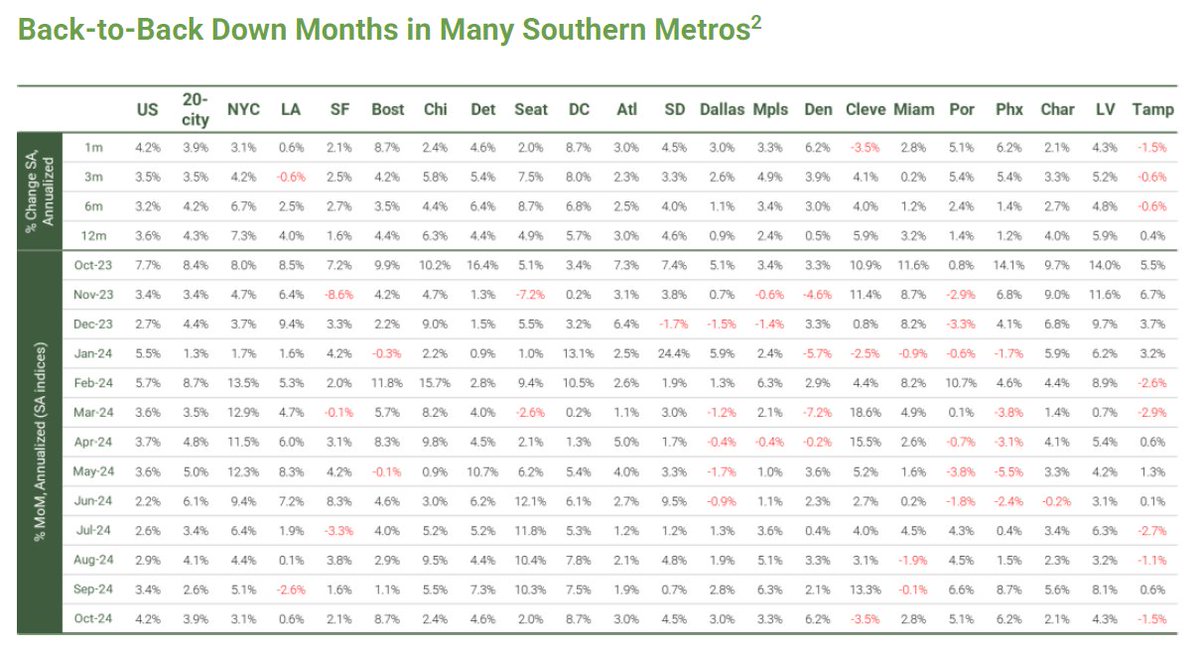

Home Price Appreciation has cooled across the US, and in some cases declined in areas where home values skyrocketed during the COVID-19 crisis

United States Trends

- 1. $MSVP N/A

- 2. National Prayer Breakfast N/A

- 3. Rob Dillingham N/A

- 4. Bulls N/A

- 5. #NintendoDirect N/A

- 6. Leonard Miller N/A

- 7. Good Thursday N/A

- 8. Todd Howard N/A

- 9. Bomberman N/A

- 10. Switch 2 N/A

- 11. Kyoto Xanadu N/A

- 12. Ayo Dosunmu N/A

- 13. Julian Phillips N/A

- 14. Tales of Arise N/A

- 15. Happy Friday Eve N/A

- 16. #SUNGHOONx2026Olympics N/A

- 17. #TorchbearerSUNGHOON N/A

- 18. #성훈x2026동계올림픽 N/A

- 19. Orbitals N/A

- 20. Ford N/A

Something went wrong.

Something went wrong.