Nevill Shah @ Fundastick®

@ThinkFundastick

Active investor | Stock ideas | Wealth creation through equities

You might like

Valuation spectrum 0 - 5 x PE > Value trap 5 - 10x PE > Beaten down value 10-15x PE > Under-valued 15-20x PE > Attractively valued 20-25x PE > Fairly valued 25-35x PE > Highly valued 35-50x PE > Over-valued 50-100x PE > Crazily valued 100+ x PE > Insanely valued

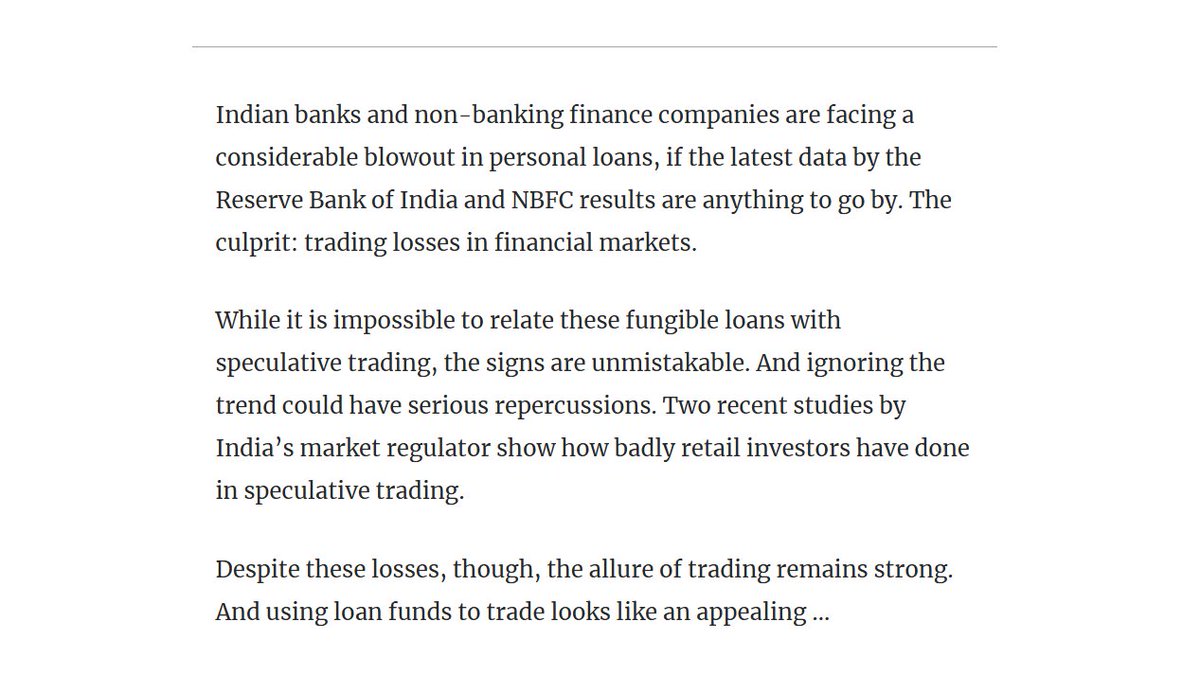

While only speculative trading F&O is mentioned here, another unnoticed area is gaming/betting apps - cricket games, sports betting, online card games to mention a few #RBI

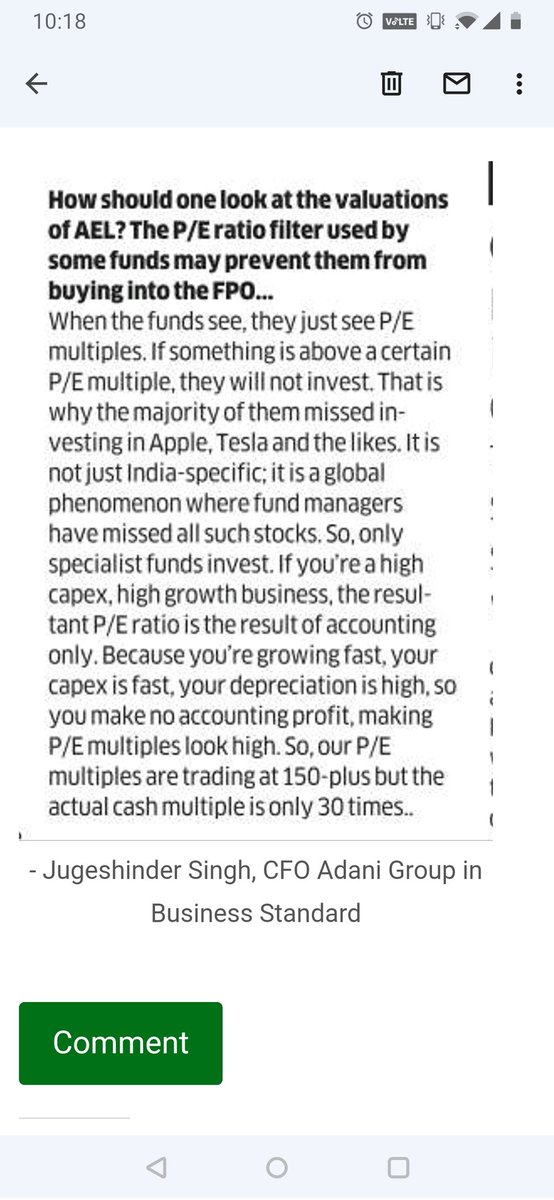

Typical brain-washing of the ignorants Selling down institutional fund managers in a retail-read newspaper. Being a CFO he doesn't tell that you shouldn't look at 'Operating cash flow' but you should look at 'Free Cash Flow' = OCF - capex #StockMarketindia #ADANIENT

Within one week Alibaba sold its stake in Zomato Fosun mulling to sell stake in Gland Pharma Now Softbank to sell stake in Policy Bazaar #indianstockmarket

State discoms cooking their books by capitalizing costs as assets. This is the recipe for lower power tariffs. If these were to be charged to P&L, then discoms would have to hike their tariffs to stay profitable. Power hikes possible in future. theprint.in/economy/state-…

theprint.in

State discoms have a ‘trick’ to put off payments, avoid tariff hikes. Now, Modi govt wants it gone

In its letter to states & UTs, power ministry says large regulatory assets created by SERCs without specifying mandatory trajectory for their recovery is in contravention of law.

No better and recent example than the Covid crash of March 2020

"Assuming you have the requisite capital and nerve, the big and relatively easy money in investing is made when prices are low, pessimism is widespread and investors are fleeing from risk." — Howard Marks

While lending is evergreen, not every lending venture is gold

2018 Bandhan Bk IPO at 375 Current 239 2016 Rbl bank ipo at 225 current 135 2016 Pnb housing ipo 775 current 450 Root cause: hyper and reckless growth Who next?

A nice case example why ESG frameworks matter for conducting risk analysis for a business/industry moneycontrol.com/news/photos/in…

The IMF economist warns of further pressure on emerging/developing market currencies (his worst-case scenario of 1% global GDP growth carries a 10-15% probability) moneycontrol.com/news/business/…

moneycontrol.com

Worst is yet to come, warns IMF's top economist Pierre-Olivier Gourinchas

Gourinchas has also said it will be best if central banks of emerging and developing countries let their exchange rates adjust and conserve foreign exchange reserves for when conditions worsen

This is a cycle and it keeps repeating The only concern is the ability of every country to withstand the downward pressure on its currency. And this ability comes from how much reserves it built during the good times.

Short-term disruptions (in stock prices) only and only provide an opportunity to buy something for the longer term. Sometimes even facilitating the start of high compounding. (Obviously given that the long-term story is intact & that numbers support the conviction) #investing

insights.massifcap.com/blog/political… A very nice article on assessing "political risks". This could be very helpful for conducting macro-analysis. #equity #investing #investingtips #stockmarkets

Thats a very useful industry insight. Brokerage stocks could see some operational pressure.

Starting this October 7th, every first Friday of the month, all brokerages must transfer unused funds back to the customer's bank account as part of the new account settlement (AS) process. I guess it will be more than Rs 25,000 crores across the industry. 1/8

moneycontrol.com/news/business/… Before signing the mediclaim forms, please check the 'eligible room rent' Your entire claim could get pro-rated downwards based on 'the room rent you pay' vs 'the room rent you are eligible for' #financialplanning #healthinsurance #healthcare

moneycontrol.com

Room rent limit in health insurance plan: The devil’s in the detail

The cap on room rent plays the biggest role in deciding the actual amount your insurer pays to settle your hospital bills.

United States Trends

- 1. Good Thursday N/A

- 2. #هشتاقك_بسعر_مميزز_ち481682θ1 N/A

- 3. Happy Friday Eve N/A

- 4. #DareYouToDeathEP7 N/A

- 5. #thursdaymorning N/A

- 6. Kuminga N/A

- 7. #ThursdayMotivation N/A

- 8. Porzingis N/A

- 9. WaPo N/A

- 10. Ford Foundation N/A

- 11. Warriors N/A

- 12. Dalen Terry N/A

- 13. Kwara N/A

- 14. Yabu N/A

- 15. Stoutland N/A

- 16. Cristiano Ronaldo N/A

- 17. Thandeka N/A

- 18. Glorilla N/A

- 19. Guthrie N/A

- 20. Izzo N/A

You might like

-

Unknown man

Unknown man

@jay_himachal -

Nevill Shah

Nevill Shah

@Nevillshah -

jinal sheth

jinal sheth

@sheth_jinal -

Parikshit Shahani

Parikshit Shahani

@pshahani1 -

Reluctant Workaholic

Reluctant Workaholic

@amanagarwal -

Aman Agrawal

Aman Agrawal

@agraman95 -

VJ

VJ

@Market_SniperVJ -

Navid Virani

Navid Virani

@nvirani888 -

wolf_🐺

wolf_🐺

@vats238 -

Chetan Gindodia

Chetan Gindodia

@chetan_gindodia -

Market Maverick

Market Maverick

@market_is_life -

Sathya

Sathya

@Sathyasrinika -

Pramod

Pramod

@Pramodbr_78

Something went wrong.

Something went wrong.