ThinkingForward

@ThinkingForwar5

Taking a look at investing concepts, and analysing companies.

你可能會喜歡

ATHs going nowehere? Best way to go about current situation post election- DCA?

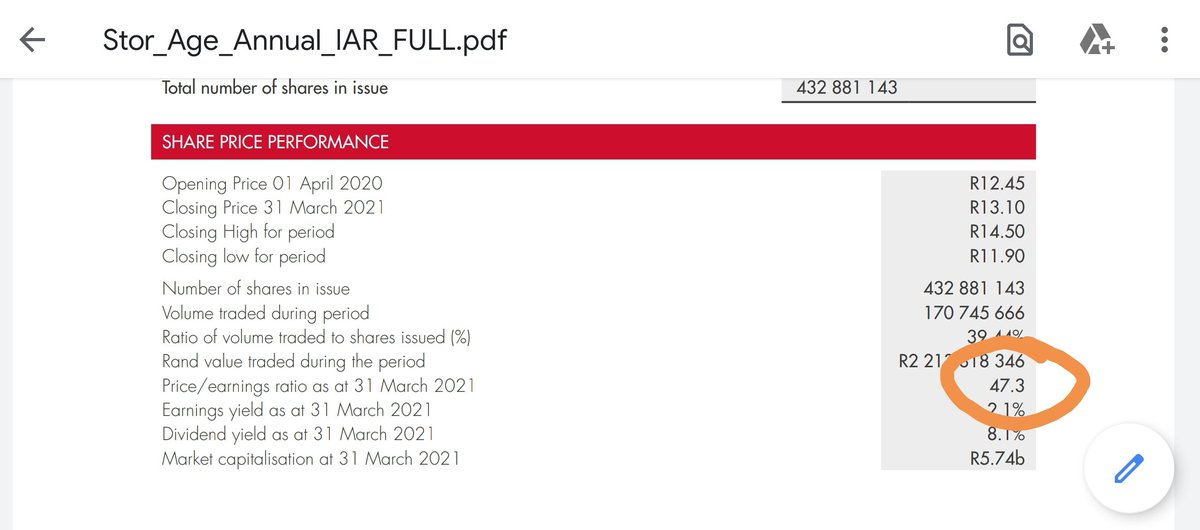

I'm confused, why is Stor-Age's PE ratio according to the Integrated Annual Report 47, if the EPS is around R2 and share price R14? 🤔 Any thoughts, or simply a typo? #JSESSS @financeghost @smalltalkdaily

I definitely would rate Stor-Age as one my top 10 small cap businesses to buy and hold.

"The day you plant the seed is not the day you eat the fruit." - Fabienne Fredrickson

Patience is a tiresome process. This is the not so fun part of #investing. As Paul Samuelson said, it is like watching paint dry. However, when the paint dries, the beauty of the building cannot be hidden. #Patience

In the same way that, the farmer plants the seed and cannot see the growth, the stock investor makes his share purchase and must endure the daily share price movements in the short term. #investing

An investor who is subject to the trend-chasing bias, will more often than not buy a share when its price is high, and then sell when it is low.

Consider all the players in the market. Not everyone has the same reasons for buying and selling.

Time is as important a factor as any when investing. Every person's time horizon is different, and should be considered when setting up their portfolio.

Warren Buffett on diversification (1998)

Big money is not made by selling a stock after 30% gains and try to repeat the process again and again. Reinvestment is not easy. Holding compounding machines, which can provide 15% CAGR over two or three decades is what creates sizeable wealth.

$MCD share price not hurt too much with the disappointing results. Sign that holders of the stock are in it for the long term.

Looking into the big differences between a mining company and the actual commodity. Biggest difference: one is a company and the other is a piece of metal. Not as obvious as you think.

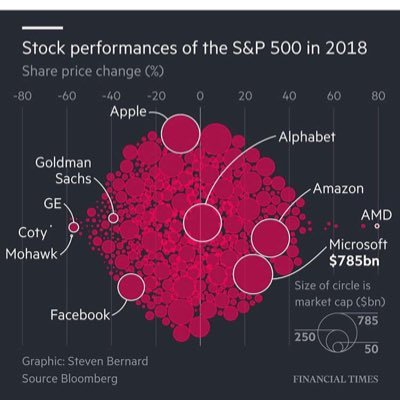

I've been reading up a lot on dividend stocks recently, with the current environment growth (tech) stocks seem overpriced. I'm looking for other areas to out my money to work. #investing #NASDAQ #DividendInvesting

Thoughts on $MCD? 1. Is it a buy/sell? 2. Is it a value/growth buy? 3. Better alternatives?

United States 趨勢

- 1. #AEWFullGear 51.1K posts

- 2. Benavidez 13.7K posts

- 3. Klay 7,623 posts

- 4. Haney 25.7K posts

- 5. LJ Martin N/A

- 6. Mark Briscoe 3,476 posts

- 7. #LasVegasGP 123K posts

- 8. Georgia Tech 6,407 posts

- 9. Terry Smith 2,672 posts

- 10. #AlianzasAAA 3,374 posts

- 11. Lando 67.5K posts

- 12. Utah 21.5K posts

- 13. Kyle Fletcher 2,002 posts

- 14. #OPLive 2,225 posts

- 15. Narduzzi 1,512 posts

- 16. Rhule 2,064 posts

- 17. Nebraska 24.4K posts

- 18. Kris Statlander 2,091 posts

- 19. #LAFC N/A

- 20. Raleek Brown N/A

你可能會喜歡

-

Fred6724 🍥

Fred6724 🍥

@DumbleDax -

CID

CID

@theonecid -

Marc Moeldner

Marc Moeldner

@MarcTheShark83 -

ouɐᴉɹɐɯ

ouɐᴉɹɐɯ

@lawsbymariano -

WilliamNextLvl

WilliamNextLvl

@WilliamNextLev1 -

Sid Jha

Sid Jha

@sidharthajha -

Ero$wole

Ero$wole

@Eroswole_ -

Alex Wheeler

Alex Wheeler

@PlzSaveAmerica -

Centrax Digital South Africa

Centrax Digital South Africa

@icentrax -

Terrific Slouch

Terrific Slouch

@judgebushwood -

Barney

Barney

@goldensnarfblat -

Humphrey

Humphrey

@humphreysu8 -

Savio

Savio

@saviogs50 -

Kyle Barber

Kyle Barber

@Gobarber2 -

Emily Rose

Emily Rose

@noreallyemily

Something went wrong.

Something went wrong.