Fascinating reflection of the British media that an article gets written about the "£100,000 tax trap" at least every week. The median wage is £36k. Never has an issue which effects so few people been given so much press coverage.

Higher earners are rejecting raises, working fewer hours and making huge pension contributions to avoid what has become known as the "£100,000 trap". Sky's @bradley_jyoung investigates ⬇️ Money blog 🔗 trib.al/H3XpifZ

"A £1 payrise could cost you tens of thousands of pounds". Apart from that the chances it could cost *me* that is actually nil, isn't it? Or the vast majority of the rest of your viewers.

I'm pro sorting this out just so we no longer have to hear quotes from extremely high earners telling us they're "not well off people" ever again.

Fully deserve some of the dunking for being unclear/flippant here. Yes, this is an issue. Yes, it's *also* infuriating that we get a story on this (and "HENRYs") every single week.

To the several people trying to frame £100k as not very much money (or as some kind of middle class wage), I think you might need to consider that you might've lost a little sense of perspective.

The framing of these stories is always "people who are objective well-off in the context of the UK are actually struggling when you think about it", which is both untrue and distasteful.

Yes, it's a negative consequence if someone turns down hours they would otherwise be willing to work for tax reasons. But the idea that these people aren't vastly more comfortable than the majority of people in the UK is silly.

Errr mate have you heard of Farmers and Private schools? Most of the middle class is now affected by the £100k theshold one way or another. The median wage is brought down by students, part timers and the semi retired. A very large number of households will end up with at…

You do understand that the median wage might be a bit higher if the disincentive to earn more didn't exist right? The people you're referring to pay roughly ~30% of all income tax, surely them paying more because they earn more is a good thing?

The median person isn't a high-end heart surgeon, specialist anaesthetist, electrical grid operator, or air traffic controller either, but if those people work fewer hours to cut their salary, it can harm us all.

Here’s the fault in your thinking: one of the reason GP services are so poor is that a lot of GPs limit their hours *precisely because* of the £100k tax trap. We’ve never had so many GPs, but also never so many that are ‘part-time’

It's a cascading problem based on crap tax brackets. If you have student loans and the temerity to have children... Over £100k and your marginal rate can be over 90%. Over £60k and your marginal rate can be around 70% or higher as you lose Child Benefit. Over £50k and you're…

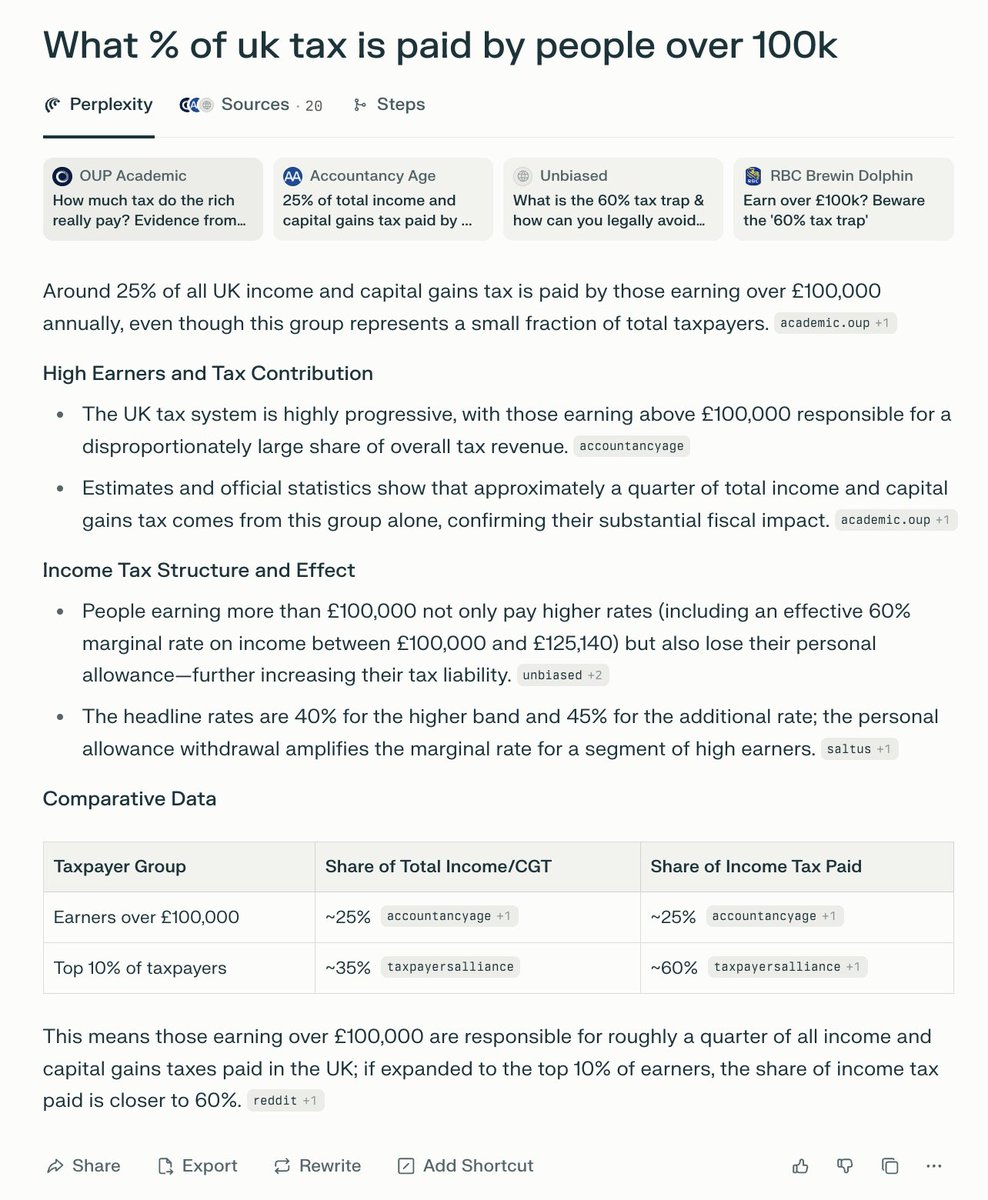

It seems a petty relevant group to me. 25% of income tax and capital gains.

It actually affects people on lower incomes even more. The £100k cut-off stunts growth and productivity. If more people moved past that point, the country would grow faster, tax revenues would rise, and public services would benefit. The world isn’t zero-sum, one person doing…

OK now do the disincentives associated with statutory minimum wage rising faster than median wage and see how far that gets you.

If your tax system is so onerous that it prompts the most productive people in the country (in growth and tax payments) to slam on the breaks to avoidhitting a tax threshold you've got a big problem. It hobbles investment, hits the tax rake and it punishes success and ambition.…

People on £36k don't make a positive tax contribution. We need to look after those who do.

What's the impact on the tax take and public services? it's huge

Fancy being trapped by £100,000, certainly many would and in the reduced working hours and an ability to make huge pension contributions. Lets roll it out for the many.

MPs’ basic salaries are now £93,904. There might be a change of view when they exceed £100,000 and MPs see 60% of the increase swallowed up by tax.

Except it does affect you! It affects you when your NHS doctor goes part time to avoid the trap and you have to wait longer for an appointment. Or when the judge hearing the case of the person who mugged you goes part time so you have to wait years for justice. It affects…

4% are LGBT yet we hear about them every single day in our media

This affects everyone who lives off the labour of those earning over £100k

Not everyone will be on £100k but everyone benefit from the higher tax those few pays

Missing the point. @grok can you summarise the total percentage of UK income tax paid by those earning over £100k

It’s rage bait + generates the web traffic. And that’s what pays the media outlet’s bills innit.

Perhaps it’s because the top 10% of earners contribute 60% of all the income tax revenue. Bottom 50% of earners contribute around 20%. Discouraging people from trying to earn more money or move past the £100k threshold is counter productive.

"Never has an issue which effects so few people been given so much press coverage." % of Brits: - Earn £90k+: ~6% - Identify as Muslim: ~6% - Unemployed: ~5% - Are LGBT: ~4% - Homeless: ~0.5% - Have familial ties to Palestine: ~0.1% You could go on; this is how press works.

why are you addicted to our country being poor the median wage being £36k should be a source of huge national embarrassment not a way for you to score nonsensical political points

Politics of envy masquerading as egalitarianism. Good job mate, lets disincentivize our high-agency, high-output achievers who want to start families. People like you are a great example how our younger cohorts are miserable and ambitionless. Crab bucket mindset

Don't complain about not being able to get a GP appointment at 8am in the morning or spending ages sat on an NHS waiting list for an operation then. The tax arrangements at that level are throttling your county in ways, it seems, many of you don't realise.

"Never has an issue which effects so few people been given so much press coverage" You sure about that?

The higher rate taxpayers account for a significant chunk of all tax revenue. Them choosing to work less has a disproportionate effect on the amount of revenue raised

You say so few...it is as a percentage but still around 2.8m people

Tom, firstly I would say that I hugely respect you, and the content you and your team create. This is a genuine issue. It creates massive perverse incentives for the salaried middle class, which have a negative impact on everyone. 1/n

United States Trends

- 1. Diane Keaton 142K posts

- 2. Mateer 7,423 posts

- 3. #UFCRio 14K posts

- 4. Annie Hall 32.6K posts

- 5. Oregon 54.4K posts

- 6. #iufb 3,465 posts

- 7. Indiana 26.7K posts

- 8. Bama 16.5K posts

- 9. Sark 3,347 posts

- 10. Tim Banks N/A

- 11. Norvell 5,797 posts

- 12. Baby Boom 3,009 posts

- 13. Petrino 2,360 posts

- 14. Raiola 1,231 posts

- 15. Mizzou 13.5K posts

- 16. Mendoza 14.9K posts

- 17. Stein 3,638 posts

- 18. First Wives Club 10.2K posts

- 19. Father of the Bride 9,983 posts

- 20. Cignetti 2,513 posts

Something went wrong.

Something went wrong.