Stock Traders Weekly

@TopStockSetups

Stock Traders Weekly helps you to identify the best time to trade the best setups.

🔹A Gift for Longer-Term Investors 💰 🔹Ignore the Noise—Keep It Simple 🟢

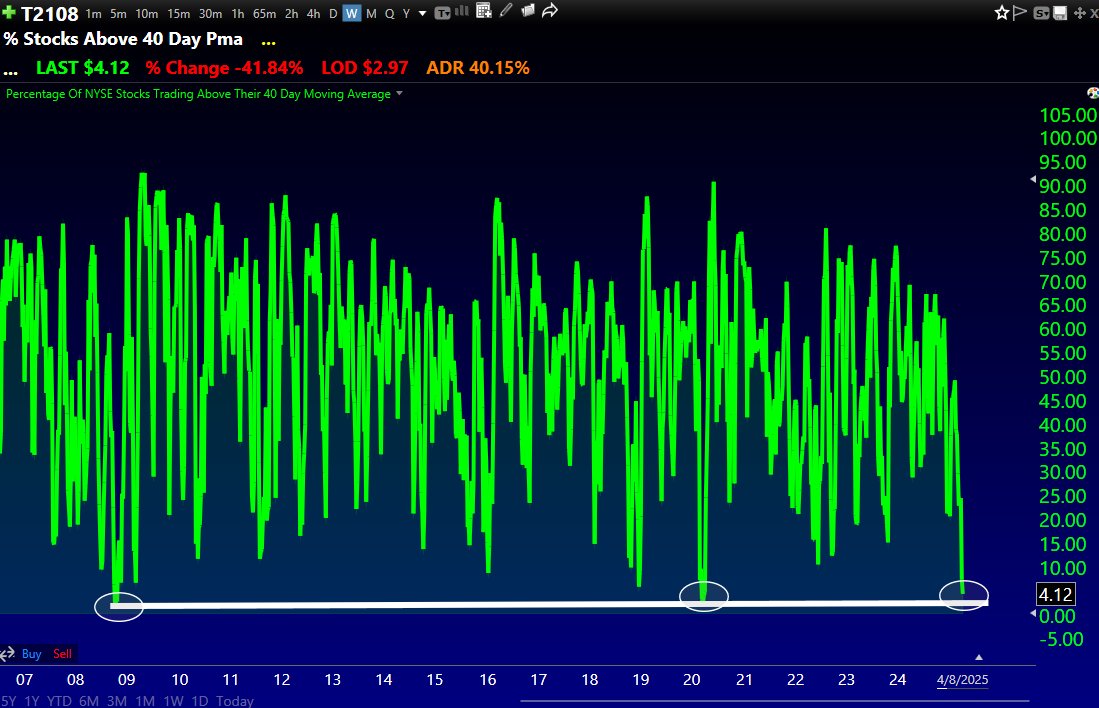

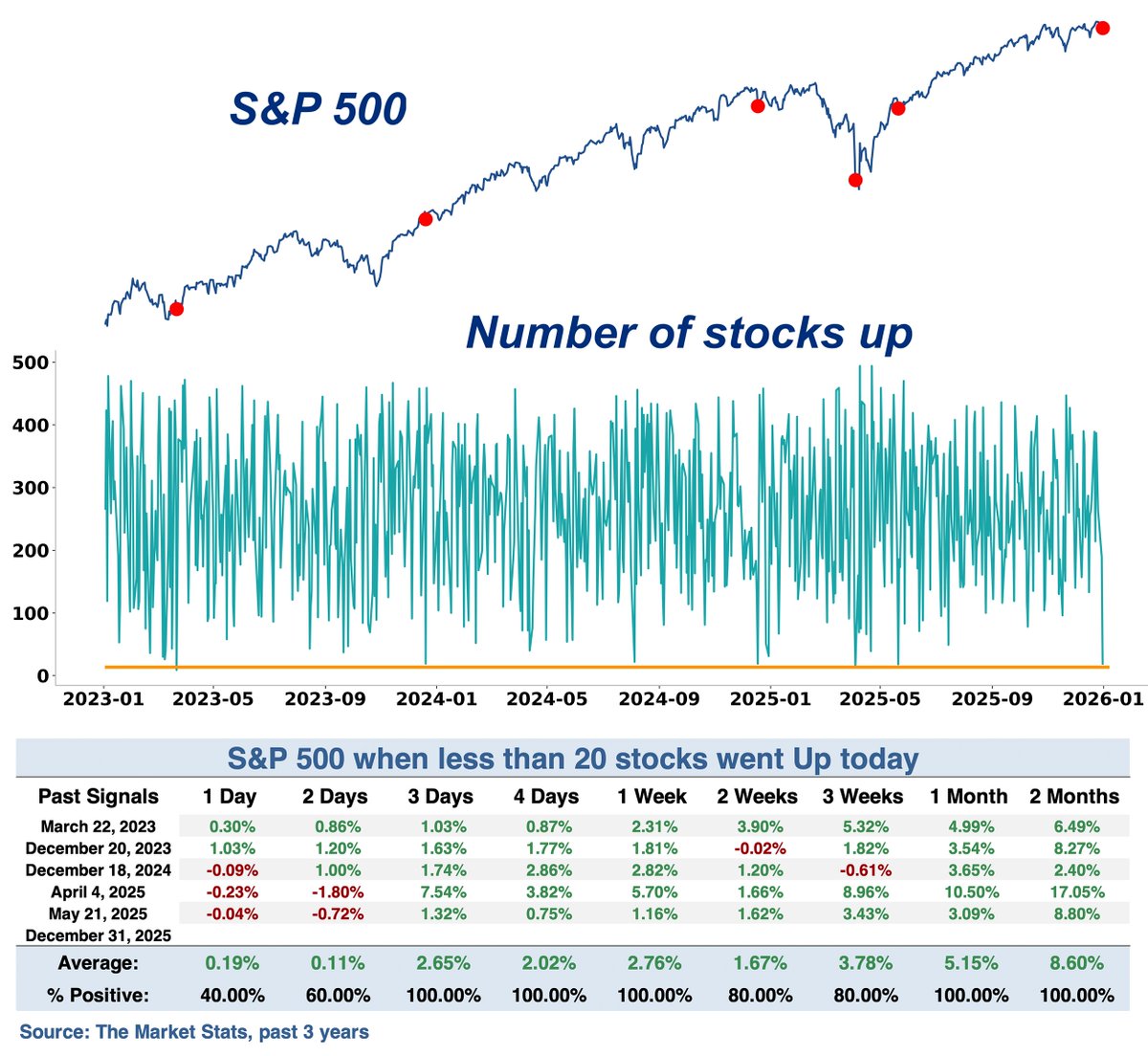

The S&P 500 had fewer than 20 stocks go up today This happened 5 other times in the past 3 years. Each instance saw $SPX rally in the next 2-5 days

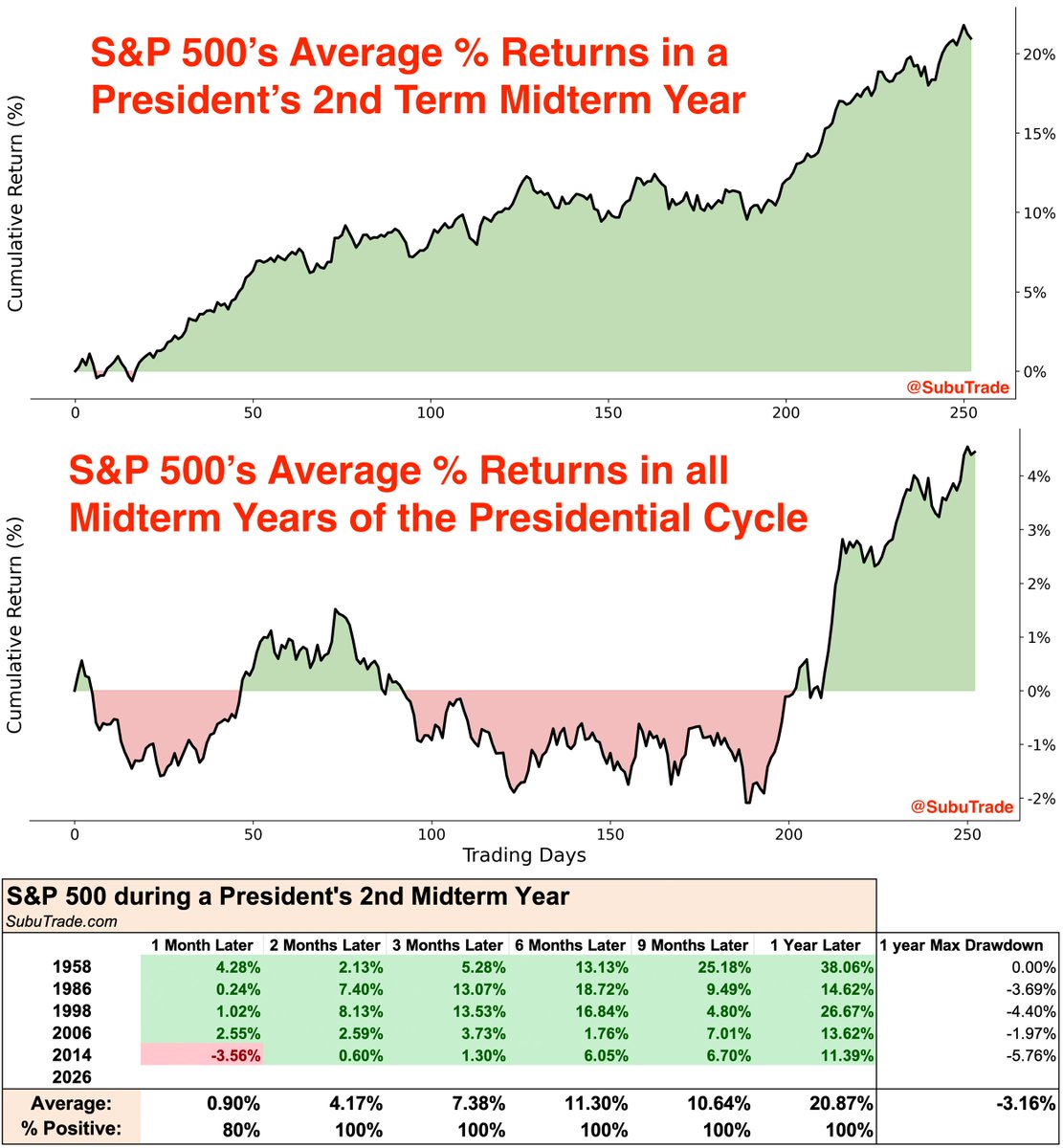

2026 is a Midterm Year of the Presidential Cycle. It's generally the weakest year of the Presidential Cycle. But Midterm Years are quite bullish under 2nd Term Presidents (e.g. Trump in 2026). $SPX was up each time a year later, average gain +20% h/t @RyanDetrick

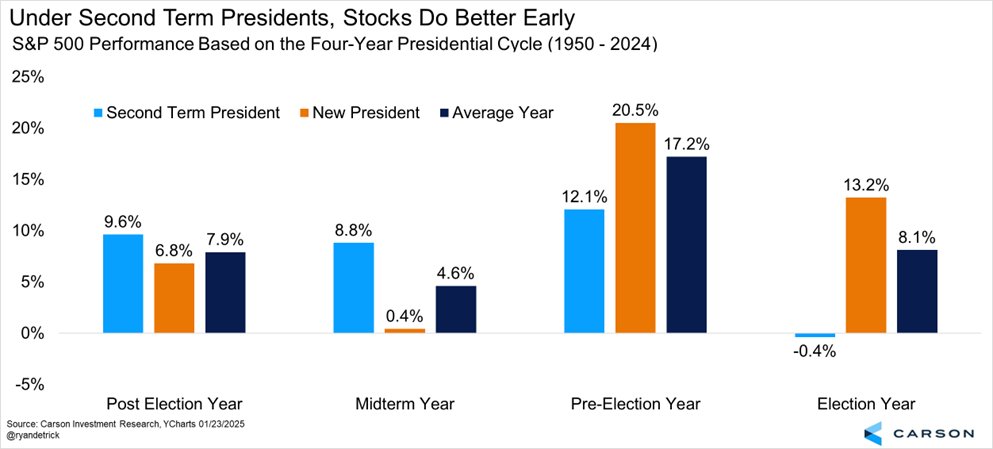

Yes, midterm years tend to be weak, but they actually do much better under a second-term President. In fact, early in a second-term (post-election years and midterms) do better. It is later in the term things don't do as well and first-term Presidents see the better returns.

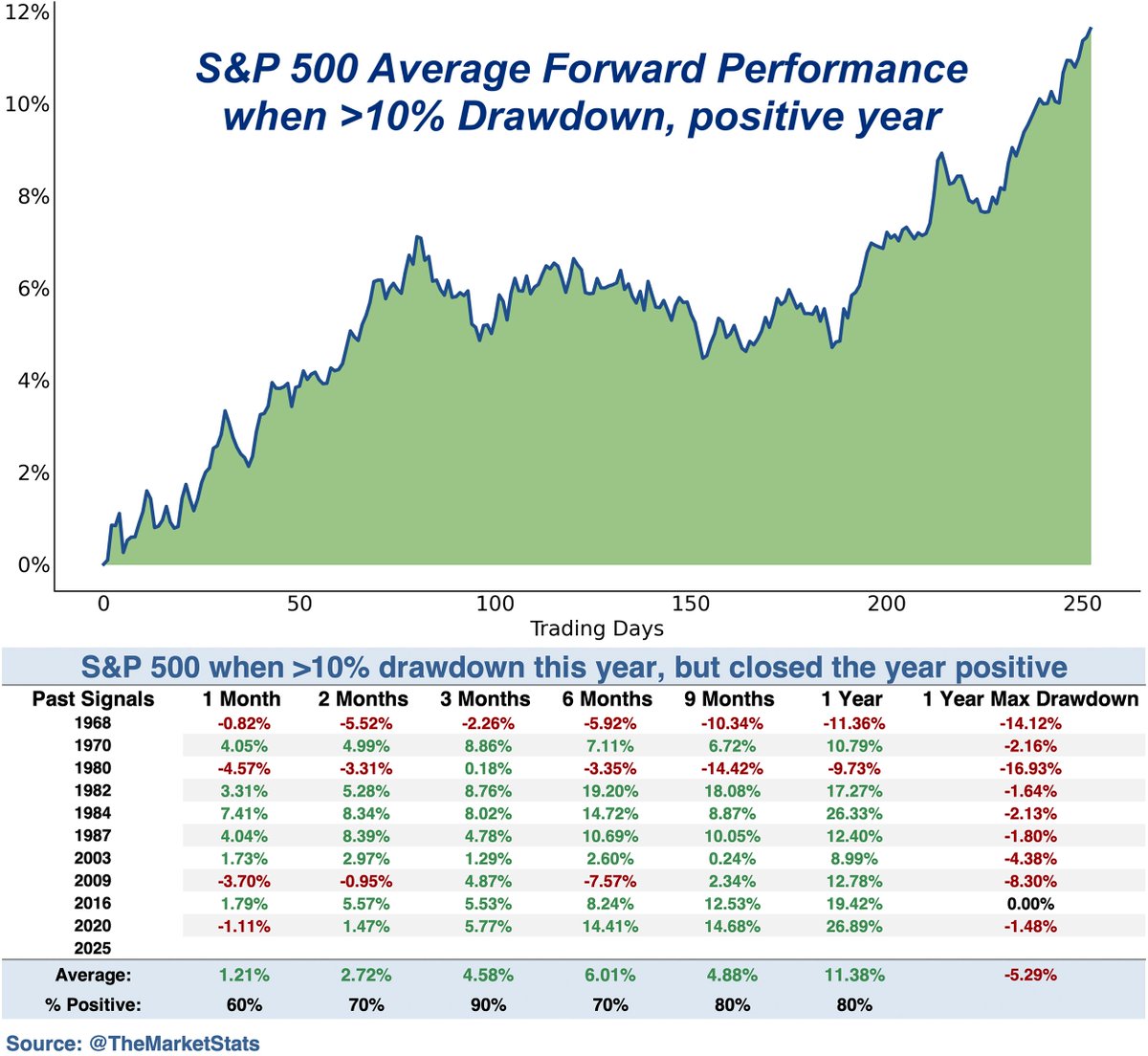

The S&P 500 had a 10%+ drawdown this year, yet is on track to finish the year positive In past instances, $SPX rallied 9 out of 10 times over the next 3 months, with an average gain of 4.5% The maximum drawdown over the next year was -5.2%

No major breakouts in $SPX or $NDX while Tech/Semis are in a consolidation phase. $XLK $SMH setting up bullish ascending triangle patterns which usually lead to new highs, bigger breakouts at index level. But when is the question? Accumulate when you can, not when you have to.…

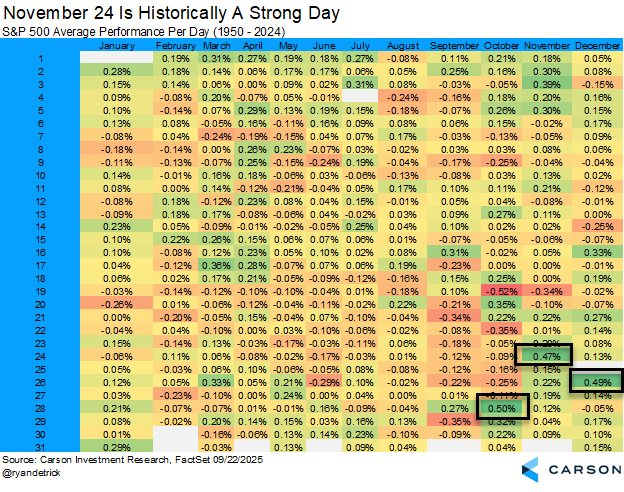

Markets are closed tomorrow, but December 26th is the 2nd best day of the year Since 1950, the S&P 500 is up an average of 0.49% on December 26th Chart from @RyanDetrick

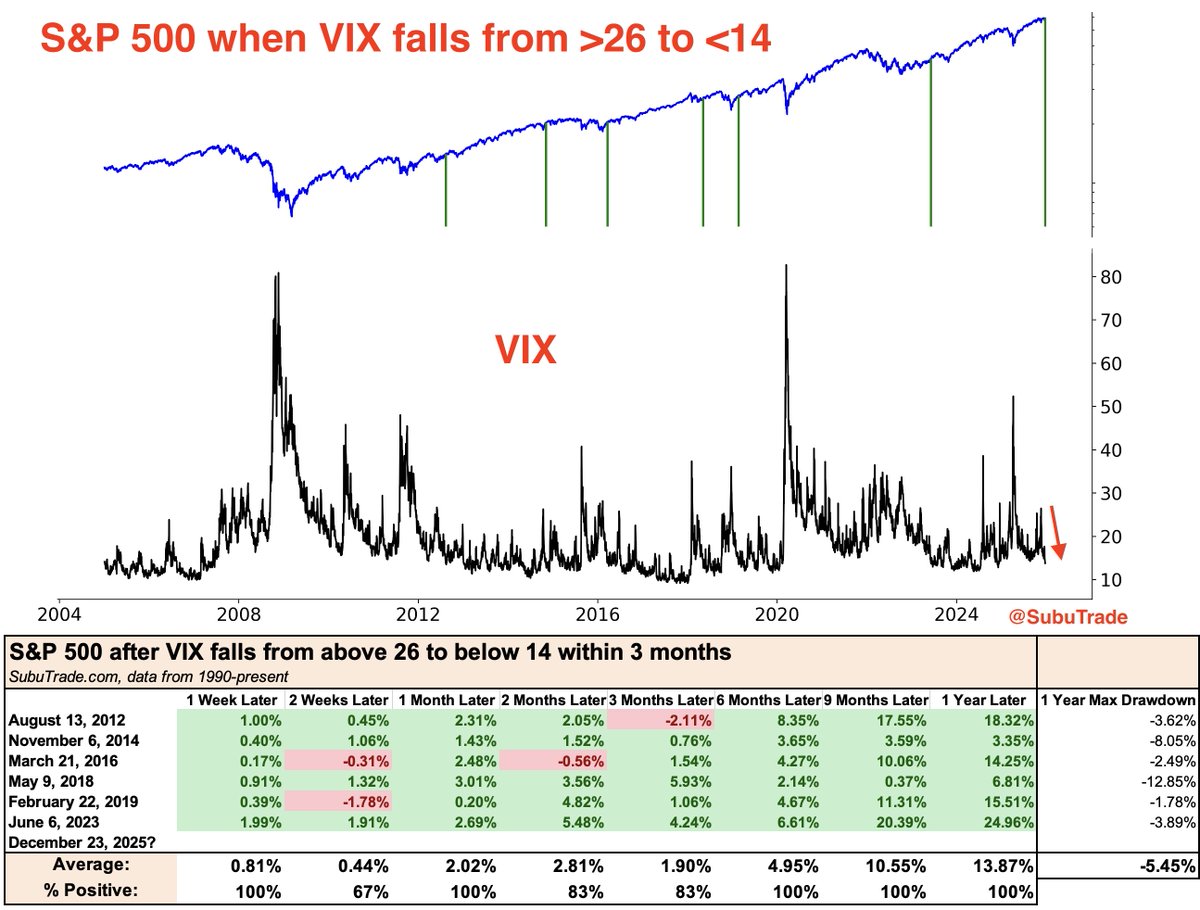

$VIX is below 14 today. Just last month it was above 26. When $VIX falls this fast, $SPX was higher every time 1 week and 1 month later. Santa Claus is coming to town?

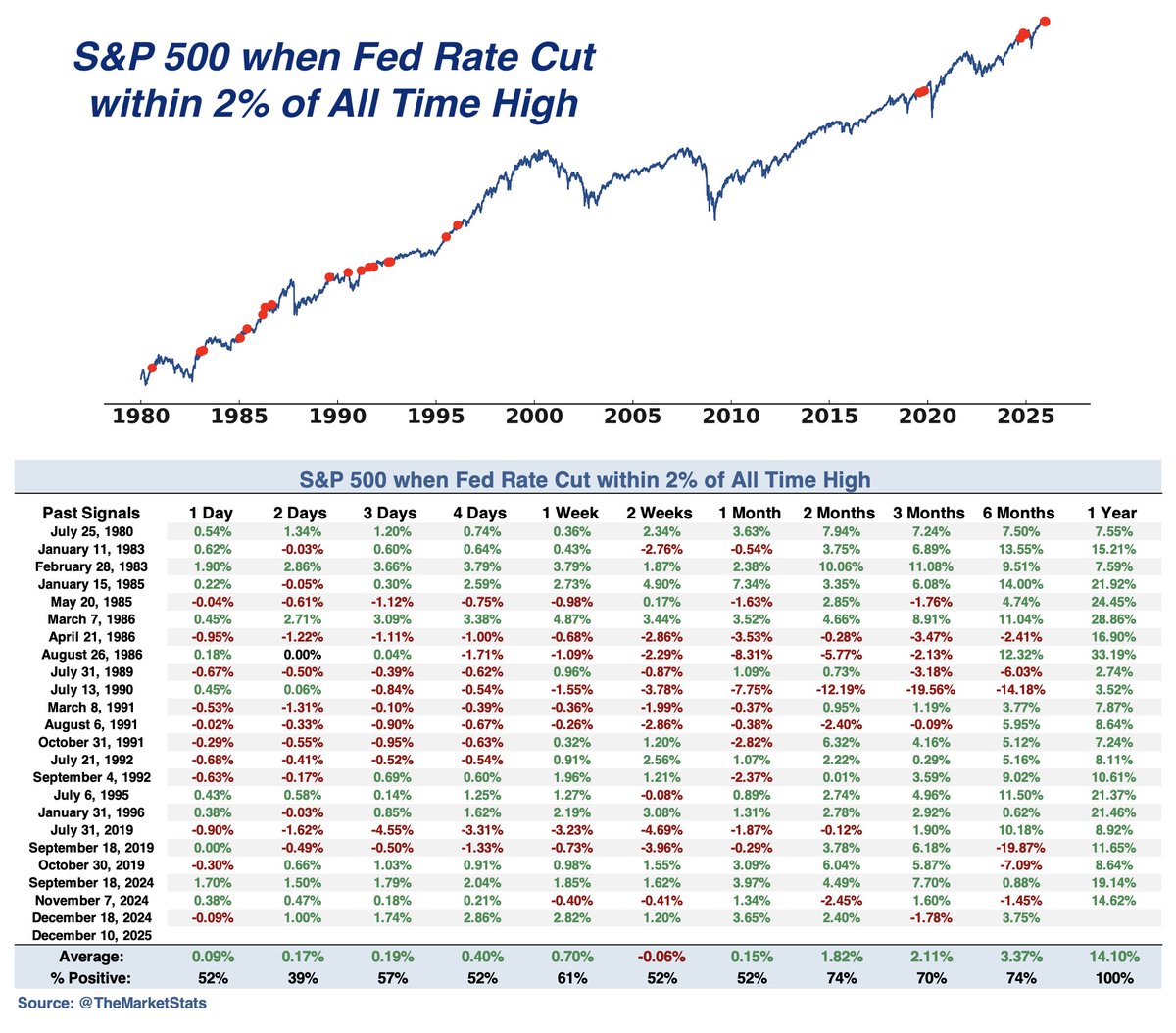

$SPX is less than 2% from an All Time High heading into today's expected Fed rate cut In the past, this combination saw remarkably strong forward returns: $SPX was up 100% of the time, 1 year later h/t @RyanDetrick

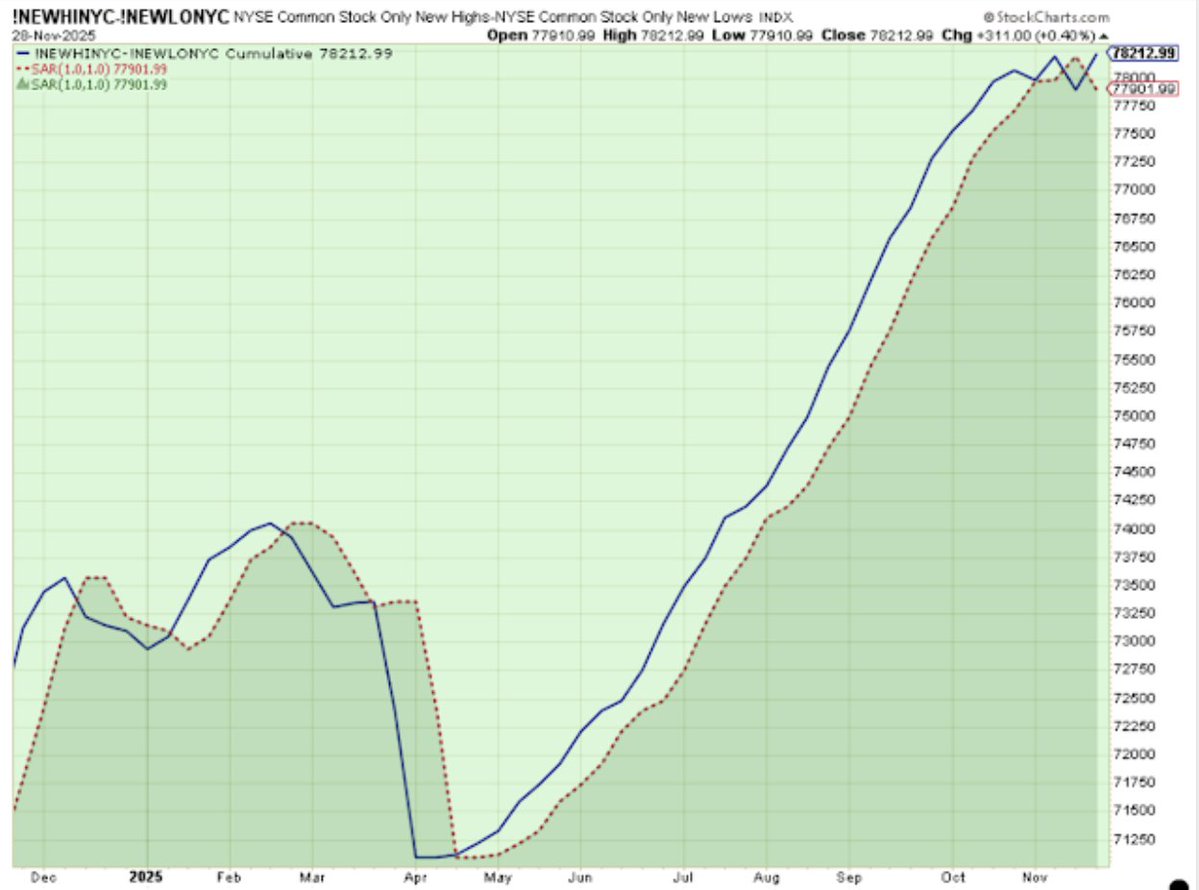

Have not seen a pattern like this in NYSE Cumulative Net New Highs in 2025, but when blue is above red, no matter how quickly the recovery, it is a BUY signal. -5% pullback being evidenced as market mistake and your opportunity? $SPX $NYA $ES_F $SPY $QQQ $NDX $RUT $META $TSLA…

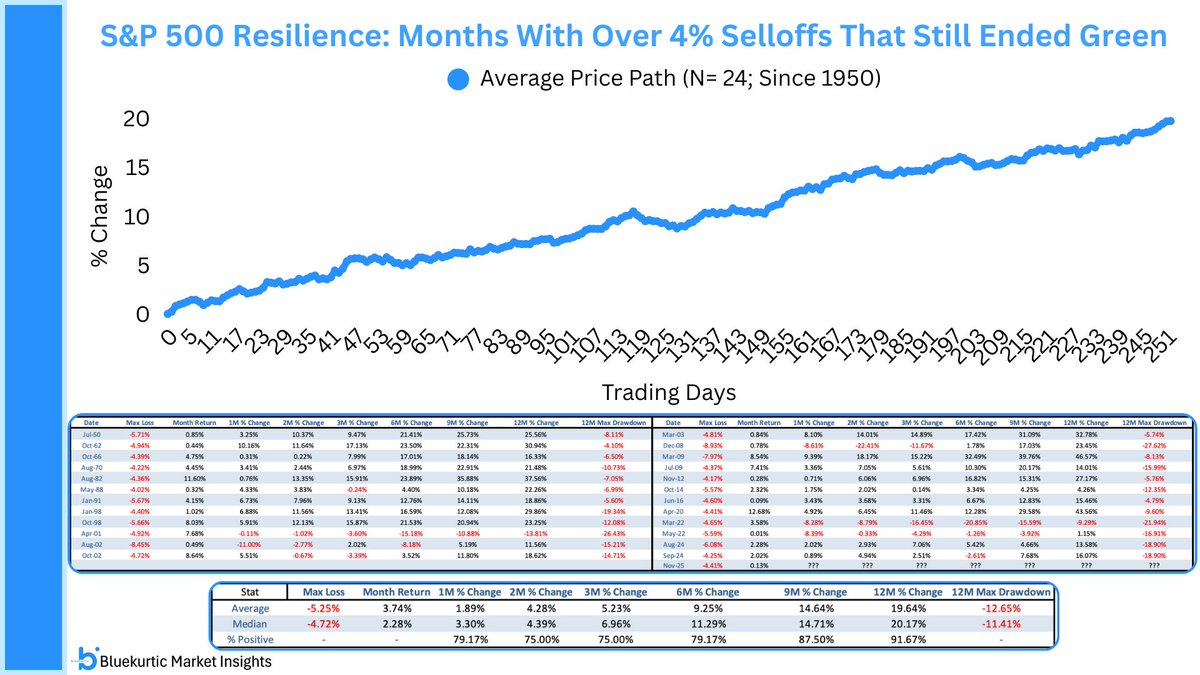

November saw a 4%+ intramonth drop in the S&P 500, yet still finished positive. Since 1950, only 24 other months saw a 4%+ drop and still ended positive. 12 months later, the market was higher 91.7% of the time, with an average max drawdown of 12.7%. Points to a good year ahead!

Nice follow through after Friday's bounce. The early October lows holding is a big level. Coupled with huge volume overall and put volume last Thursday, good chance the lows are in. After a 38% rally, a 6% give back is simply normal and healthy. It was needed to increase…

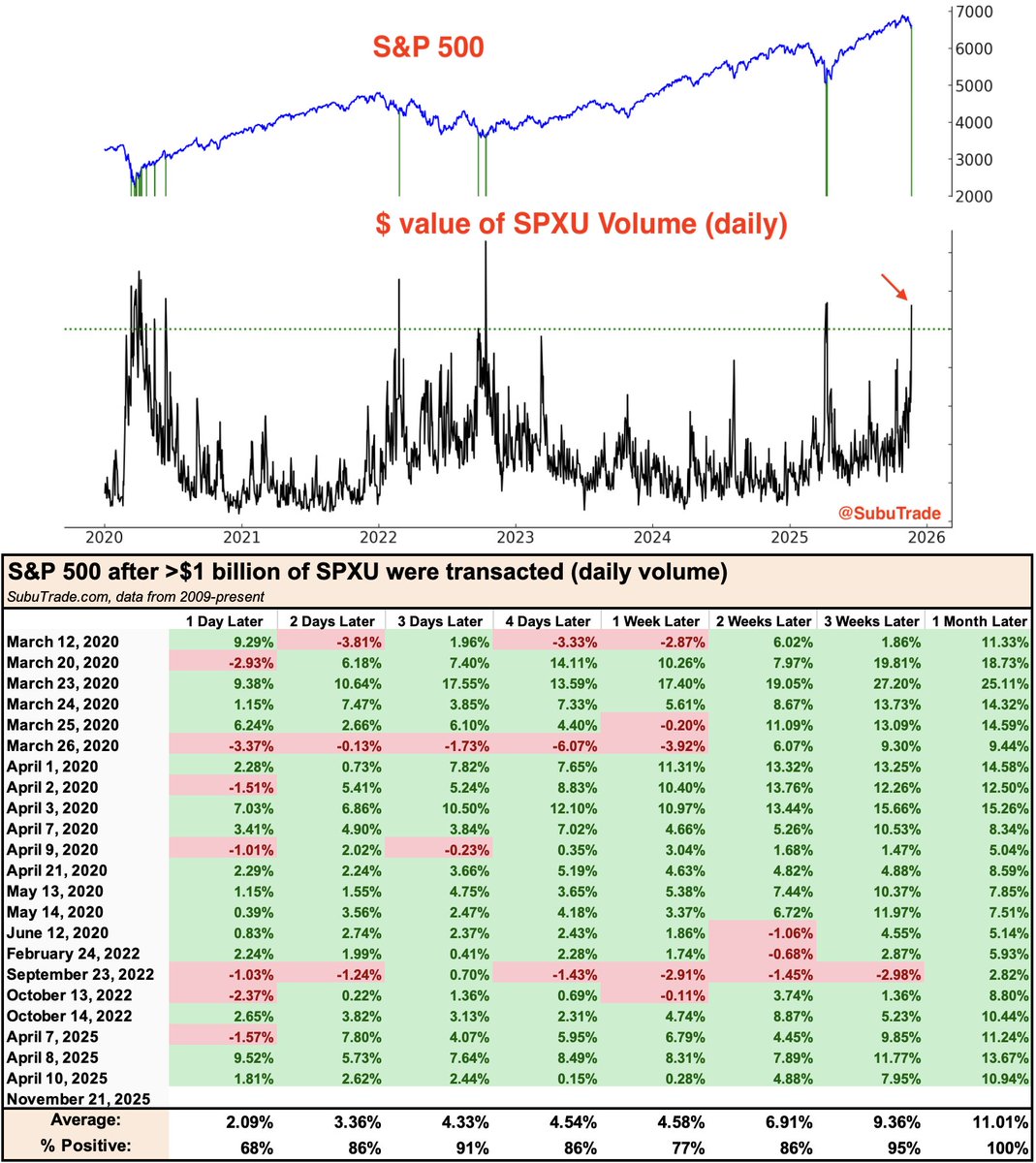

Huge bets against $SPX? On Friday, more than $1 billion of $SPXU were transacted. (SPXU is -3x short S&P 500 ETF) Past spikes marked major bottoms: 1. COVID bottom 2. 2022 bear market's first wave bottom 3. October 2022 (bear market bottom) 4. April 2025 (Liberation Day…

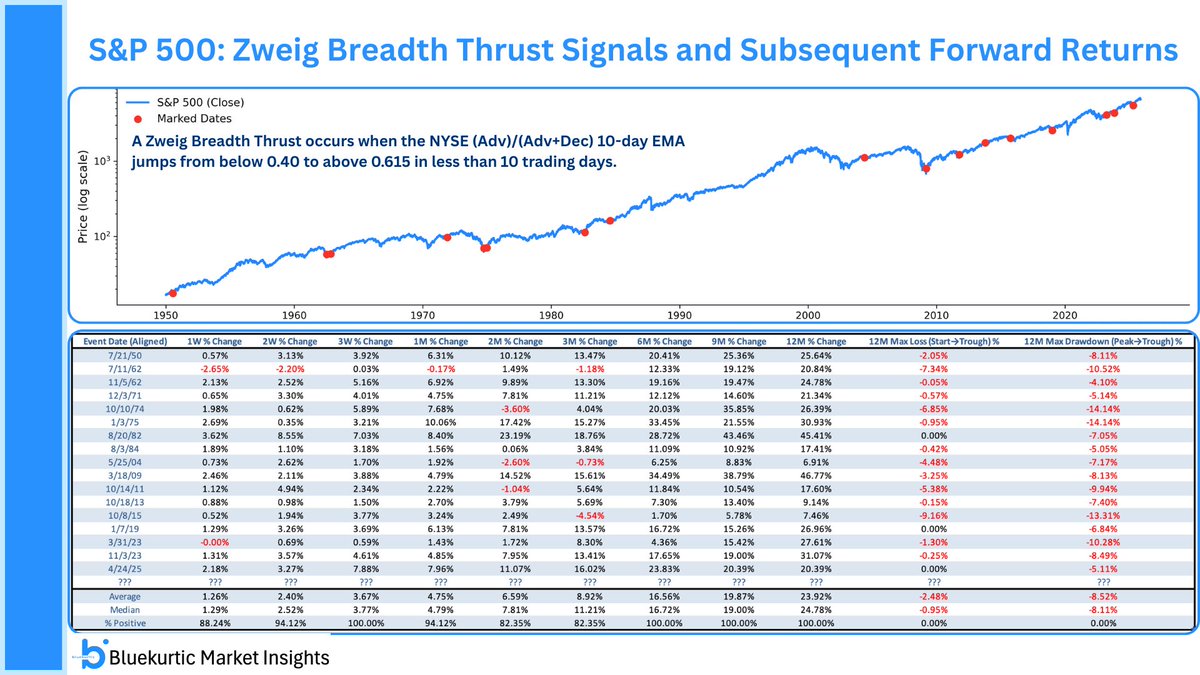

Zweig Breadth Thrust fell below 0.40 on 11/20. If it surges to 0.61+ within 10 days, it would trigger a rare ZBT signal. Such fast breadth expansions in the market led to 100% positive 12-month stock returns with an average max loss of just 2.5% and drawdown of 8.5%.

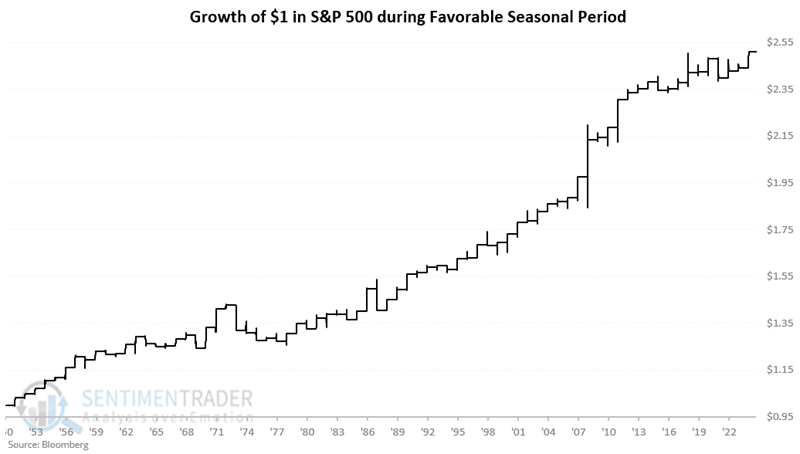

A reliable seasonal window is approaching. Late November and early December have delivered steady gains for decades. • The period covers the last six trading days of November and the first three of December • The S&P 500 has risen in twenty four of the last twenty six years •…

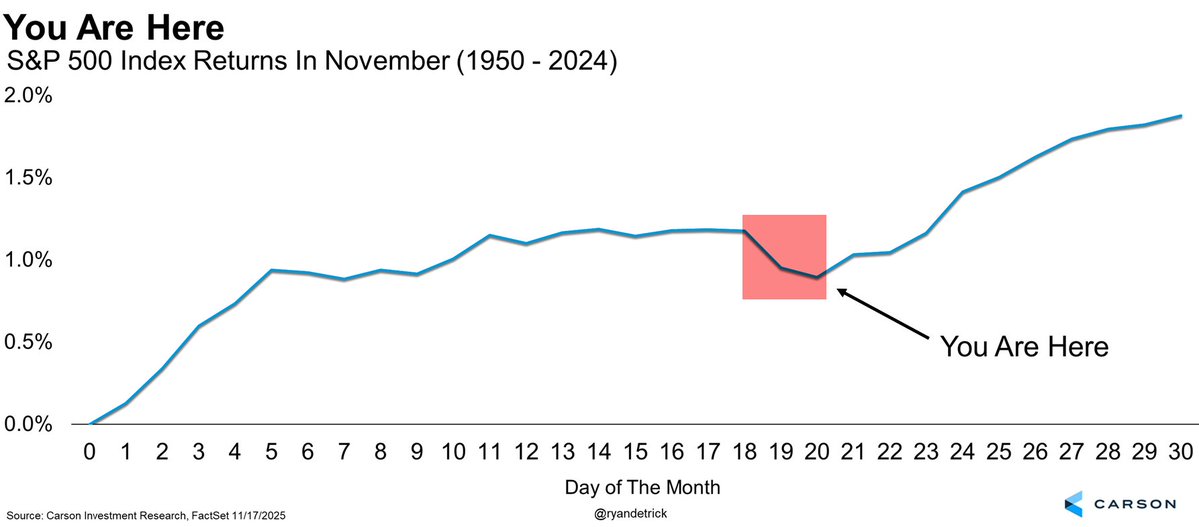

November historically bottoms on November 20th before the seasonal late month rally. What is more interesting is one the weaker parts of the year is Nov 18-20. Looks to have played out this year, now will the rally?

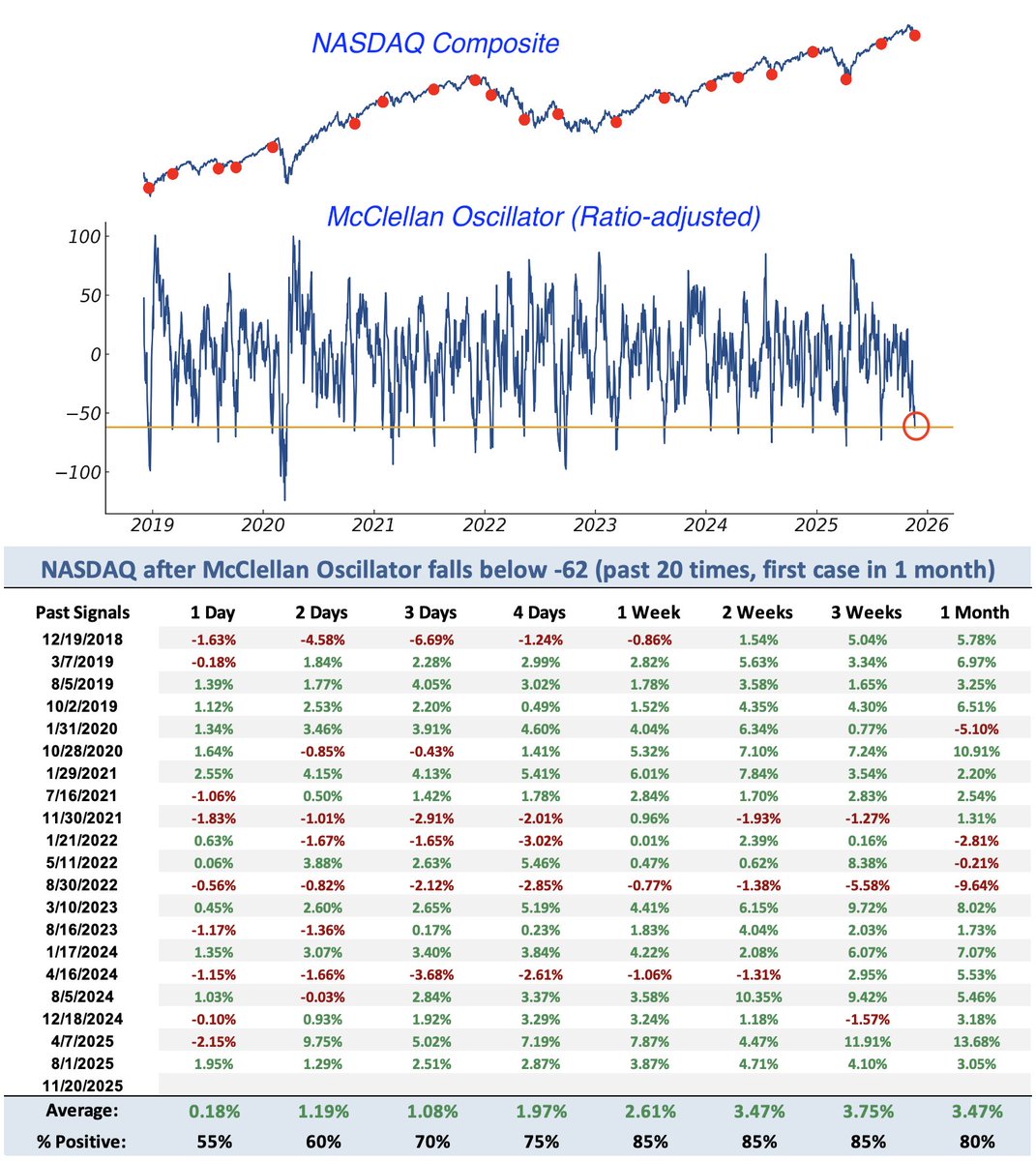

Oversold Breadth? NASDAQ's McClellan Oscillator fell to -62 today The last 20 times this happened, NASDAQ rallied 85% of the time 1 week later H/T @ConnorJBates_

Good eye! NASDAQ after McClellan Volume Oscillator falls below -112

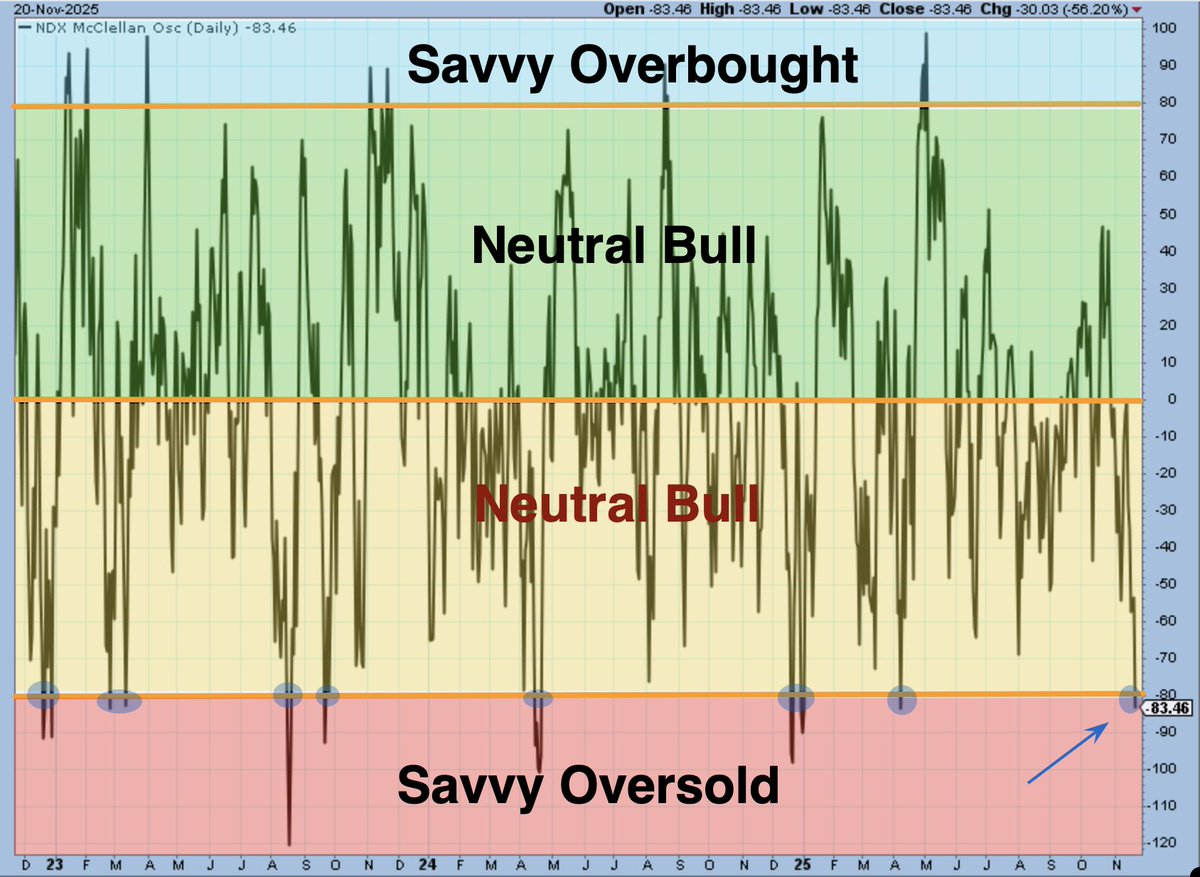

The 1st major oversold condition has been met with Nasdaq McClellan Oscillator having breached -80 threshold. Confirmed with -30 Bullish Percent Index Each time during the bull market it has bounced within 4 trading days and averaged ~4.5% gain over forward 1-month. $SPX $NDX…

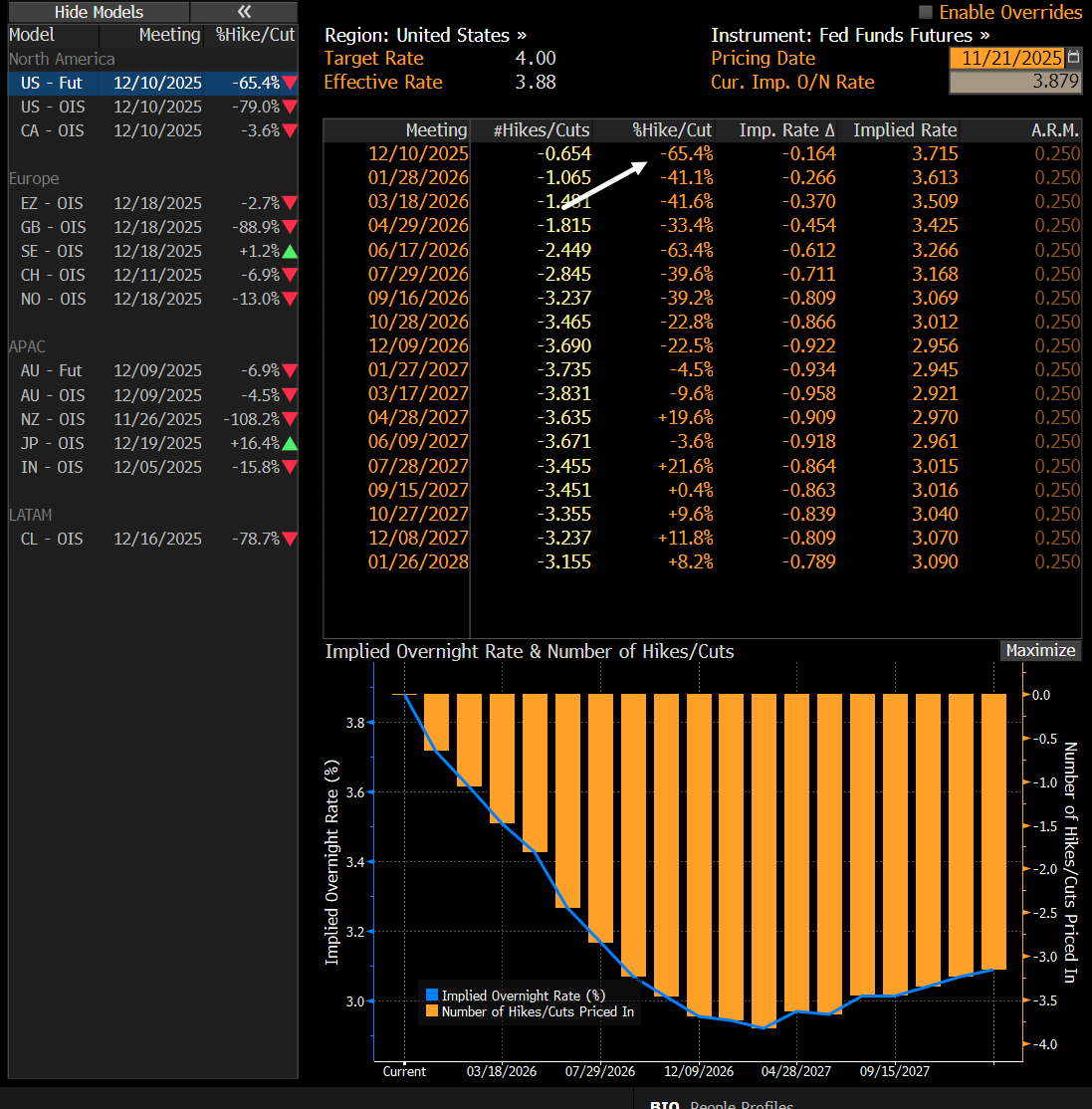

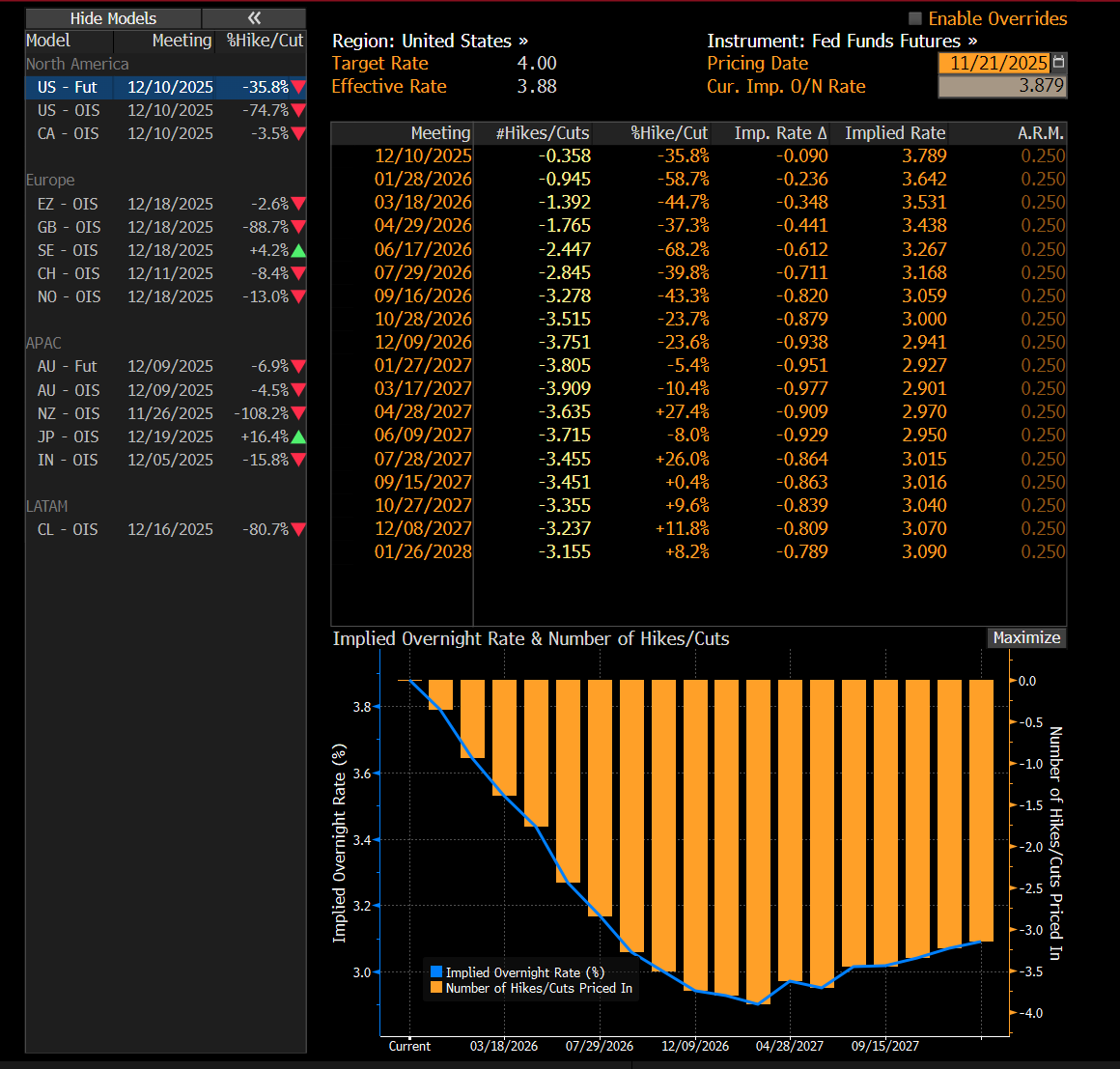

Fed Fund Futures jump to a 65% chance of a rate cut Dec10th from a 36% just an hour ago after Fed's Williams comments that's a rather big change.

Fed Fund Futures at 36% of a Dec cut

*FED'S WILLIAMS STILL SEES ROOM FOR A NEAR-TERM RATE CUT

The S&P 500 streak without a -5% pullback ended yesterday at 145 days. $SPX $ES_F $SPY $NDX $QQQ $IWM $NYA $VIX $VOO

United States Trends

- 1. #HardRockBet 4.255 posts

- 2. Dalot 19 B posts

- 3. Go Birds 12,6 B posts

- 4. Go Bills 13,4 B posts

- 5. #BillsMafia 7.657 posts

- 6. #FlyEaglesFly 5.463 posts

- 7. Good Sunday 84,8 B posts

- 8. Jaguars 11 B posts

- 9. Tapper 29,2 B posts

- 10. #DUUUVAL 2.186 posts

- 11. LaFleur 58 B posts

- 12. Bills ML N/A

- 13. #SundayFunday 2.257 posts

- 14. Walker Little N/A

- 15. Homan 26,4 B posts

- 16. Bregman 35,9 B posts

- 17. Gillie N/A

- 18. Red Sox 3.961 posts

- 19. Havertz 15,9 B posts

- 20. Jags ML N/A

Something went wrong.

Something went wrong.