🚨 GUJARAT HIGH COURT ISSUES NOTICE ON 180-DAY ITC REVERSAL RULE 1️⃣ The Gujarat High Court has issued notice to the Union Govt & State tax authorities on a petition challenging the constitutional validity of the 2nd & 3rd provisos to Section 16(2) of the CGST Act — the clauses…

Days are not far when rikshaw wala will ask for extra charges for reels, like extra fees for NRIs in zoo.

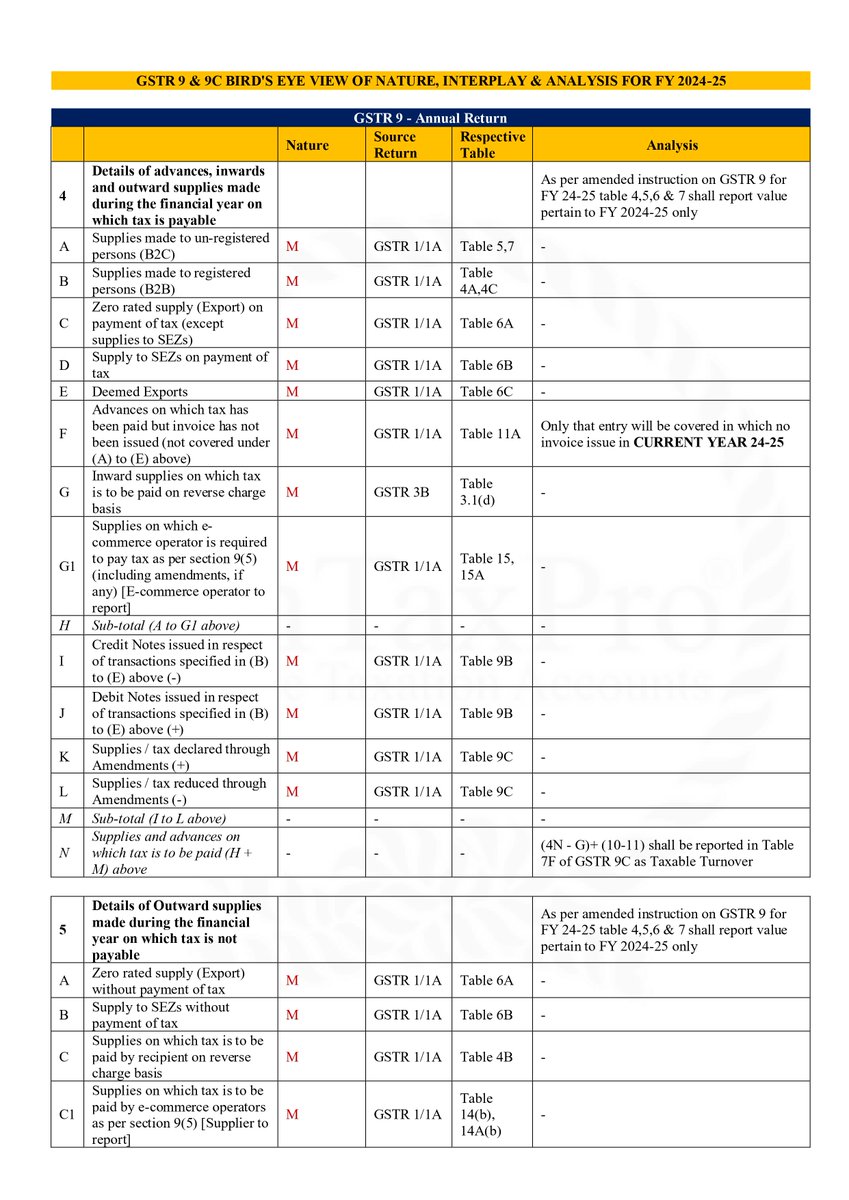

Reporting of Sale, Purchase and RCM Transactions in GSTR 9 for the year 2024-25 Due Date to file is 31/12/2025 #GST #TaxationUpdates

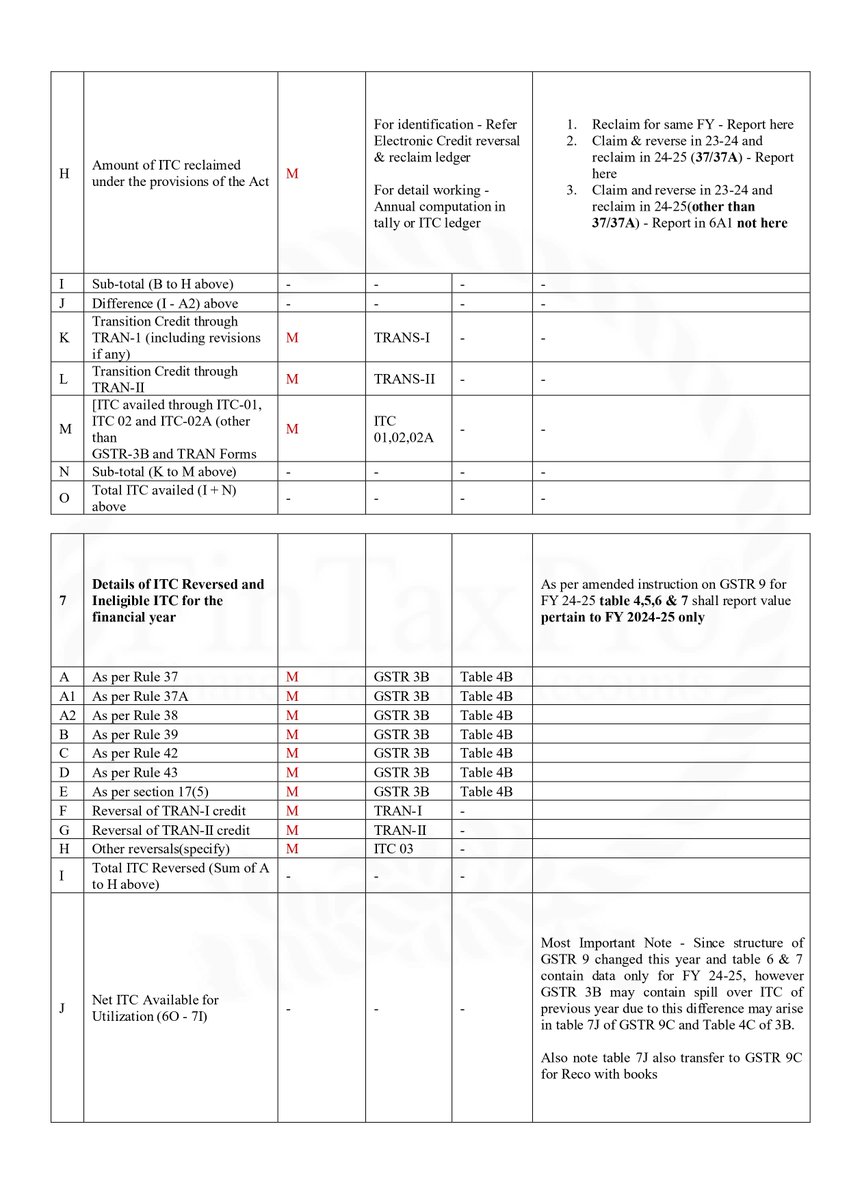

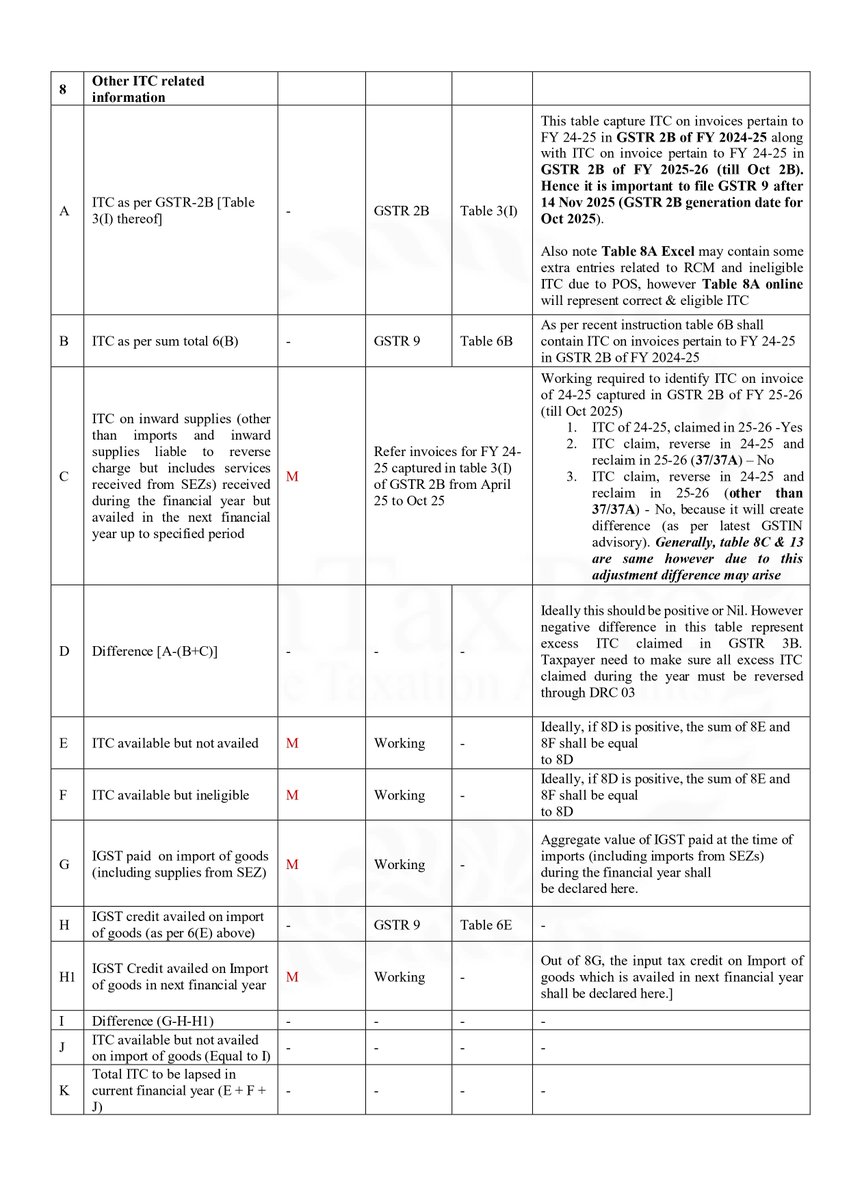

Table 8A of GSTR 9 for FY 2024-25 capture the details of documents / records pertaining to FY 2024-25 appearing in GSTR 2B. Therefore, Table 8A of GSTR 9 will include all the inward supplies pertaining to FY 2024-25 appearing in GSTR 2B of FY 2024-25 and will 1. Also include…

🛡️ CAAS Stands for Professional Dignity and Privilege 🛡️ The Chartered Accountants Association, Surat (CAAS) today made a representation to the Commissioner of Police, Surat, highlighting the unjust treatment of a member Chartered Accountant during an ongoing Economic Offence…

Here is the link of short, easy and crisp discussion on GSTR-9 (Also covering 24-25 changes) Important topic can be directly access at: 7:30 Mins - Brief about all tables 24:13 Mins - Table wise changes for ITC reporting and 2B Comparison in table 8 30:00 Mins - Reporting of…

Table 6A1 of GSTR 9 for FY 2024-25 capture the ITC of preceding FY (2023-24) claimed by the recipient in the current FY (2024-25) till the specified time period and it is also included in Table 6A of GSTR 9 for FY 2024-25. However, any ITC pertaining to FY 2023-24 or any other…

🚨GSTR9/9C🚨 This 1-hour session by @DEEPKORADIA , hosted by @akhilpachori serves as perfect practical refresher for starting your GSTR-9/9C this season! Covers the workflow we followed last year+all new table-wise & conceptual changes #TaxTalkies youtube.com/live/BLkuKZAjS…

Whether exemption under section 11 or 10(23C) can be denied during intimation under section 143(1) solely because Form 10B or 10BB was filed belatedly, even though the forms were eventually furnished and were available with the Assessing Officer? Saraswati Devi Educational and…

🚨 Major Changes in GSTR 9 & 9C for FY 2024-25! Comment GSTR 9 and i will dm you all notes for FY 2024-25 This year, GSTR 9 & 9C come with several conceptual and reporting changes — and to simplify your understanding, here’s a bird’s-eye view covering three key aspects: 🔹…

Supreme Court protects Practicing Chartered Accountant : Held that merely issuing Form 15CB under the Income-Tax Act does not amount to abetment of money laundering. In this case, a Chartered Accountant had issued Form 15CB for remittances related to import of goods, as required…

100% of Balance Sheets in our office were signed and certifed in accordance with ICAI Guidance Note of Non-Corporates. 🥂 It was hard but we are definitely more prepared for the next tax audit seasons! What about you all ? 🫡

GSTR-9 - So many issues solved for this year, but few of them are yet to be addressed! (Then finally we consultant can move forward to better issues - other than GSTR-9!) Here are the things solved in this year: - Table 8 has been solved once and for all, there wont be any…

9th Anniversary of Demonetisation and still more than 50% of the taxpayers cases are stuck in appeals waiting and seeking for justice and opportunity of being heard while their bank accounts stay frozen.

CA Sarthak Ahuja has sharply argued that CA degree is losing its value. What’s your opinion? Listen carefully before you pass your comment on it!

Dear All, We are excited to announce the launch of The Tax Talkies, a new YouTube channel dedicated to GST and Income Tax discussions. We are inaugurating our channel with an essential live session on the "Practical Aspects of GSTR-9/9C for FY 2024-25." Join us for our debut…

From January 2026, E-Diary of Articleship will be launched by Board of Studies Article need to enter all the details of the Articleship Work done and Stipends received As announced by @ruwatiaofficial ji, Chairman, BOS (Operation) #ICAI

GSTR-9 & GSTR-9C: Mandatory vs Optional Tables for FY 2024-25 ✅A must-have chart for GST Annual Compliance!! 📤 Share within your team for smoother compliance 🗓️ Stay tuned — I’ll be sharing conceptual - practical GSTR9 & 9C tips soon on @DEEPKORADIA ! 📌Bookmark it! (1/3)

The Extension can be understood as follows: - Income Tax Audit filing due date further extended to 10th November from 31st October - Audit Income Tax Return due date extended to 10th December from 31st October - No Extension for Transfer Pricing Matters

CA’s looking at FAQ’s for UDIN after generating UDIN for almost 50-100% of TAR’s #ICAi

United States 趋势

- 1. Cloudflare 239K posts

- 2. Gemini 3 36.3K posts

- 3. Saudi 172K posts

- 4. #NXXT2Run N/A

- 5. Jamal Khashoggi 12K posts

- 6. Salman 52.1K posts

- 7. Piggy 83.8K posts

- 8. Robinhood 4,872 posts

- 9. #AcousticPianoCollection 1,409 posts

- 10. #UNBarbie 1,896 posts

- 11. #UnitedNationsBarbie 2,936 posts

- 12. Merch 67.5K posts

- 13. Pat Bev 1,209 posts

- 14. Olivia Dean 4,605 posts

- 15. #LaSayoSeQuedóGuindando 2,424 posts

- 16. Mary Bruce N/A

- 17. CAIR 31.7K posts

- 18. Kevin Brown N/A

- 19. Antigravity 4,461 posts

- 20. Taco Tuesday 16.4K posts

Something went wrong.

Something went wrong.