Tran Trading Lab

@TranTradingLab

Markets move on Liquidity + Positioning. Risk rules + entry filters (daily) — lose less, last longer. Weekly Switchboard. TG-EN↓ TG-KR↓ Edu—NFA.

Start here 👇 Markets move on Liquidity + Positioning. What you’ll get from this account: • Risk rules + entry filters (daily) → lose less, last longer • Weekly Switchboard (Base/Alt/Tail + triggers) • Clean charts: structure → liquidations → absorption TG-EN ↓ | TG-KR…

Be honest: after a sudden flush you usually… A) Panic sell B) Revenge trade C) Freeze D) Follow a written plan Vote + reply with ONE rule that would move you from A/B/C → D.

오늘 플랜은 딱 이거예요 (노-에고): 1.스윕(유동성) 구간 확인 2.브레이크 & 리테스트 확인되면 진입 고려 3.무효화 깨지면 즉시 종료 “맞추기”가 아니라 틀릴 때 빨리 나가기.

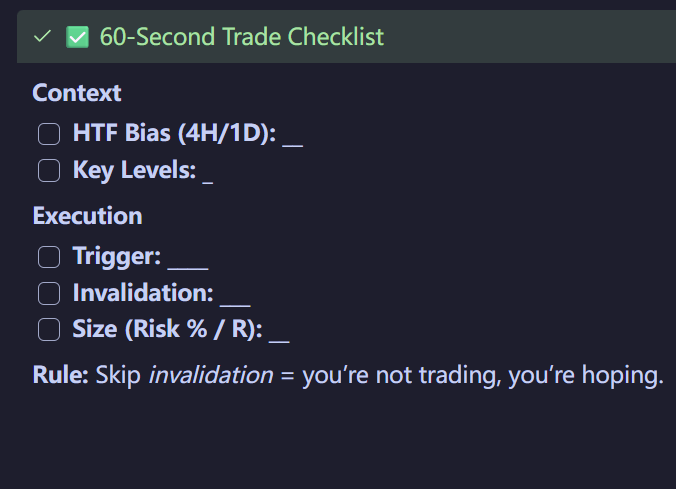

My 60-second checklist: ☐HTF bias ☐Key levels ☐Trigger ☐Invalidation ☐Size Skip invalidation = you’re not trading, you’re hoping.

Today’s plan (no ego): 1.Identify the liquidity sweep zone 2.Wait for break + retest (or failure) 3.Invalidation is the line that makes me wrong If price violates invalidation, I’m out—no “maybe”.

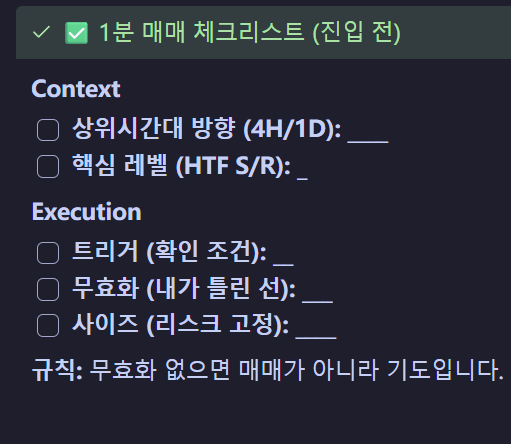

1분 매매 체크리스트 ✅ ☐상위시간대 방향(4H/1D) ☐핵심 레벨(HTF S/R) ☐트리거(확인 조건) ☐무효화(내가 틀린 선) ☐사이즈(리스크 고정) 무효화 없으면 매매가 아니라 기도입니다.

오늘은 전형적인 유동성 싹쓸이 → 리클레임 흐름입니다. 저는 예측 안 해요. 시나리오만 준비합니다. 상승: 리클레임 유지 → HH/HL 이어지면 롱 우세 하락: 리클레임 실패 + 레벨 이탈 = 리스크오프 확인은 가격이 해줍니다.

BTC did a classic flush → reclaim session. My map today: 1.Bull case: hold reclaimed levels, accept higher 2.highs/lows Bear case: rejection + loss of reclaim = risk-off I’m not predicting. I’m waiting for confirmation + sizing small.

If you only remember one thing: Markets don’t move because of stories. They move because of forced flows. Positioning → Liquidations → Absorption → Repositioning. I post daily notes from a liquidity/flow lens. Follow if you want the “why” behind the candle. #BTC #Macro…

개미의 7단계 (실화) 125k BTC: “지금 사면 천재” 115k: “이건 신의 선물” 105k: “마지막 털기” 95k: “여기 강지지” 85k: “건강한 조정” 75k: “그래서 리스크 관리가 중요합니다 여러분…” 우리 다 겪어봤죠? 😭 (전 그래서 규칙만 남깁니다) #BTC #코인 #투자밈

Which kills PnL more? (Be honest) A) Over-leverage B) Moving stops C) Revenge trading D) Not taking profits E) Following “calls” Reply with your letter + why. I’ll share my fix for the top answer. #TradingPsychology #Crypto

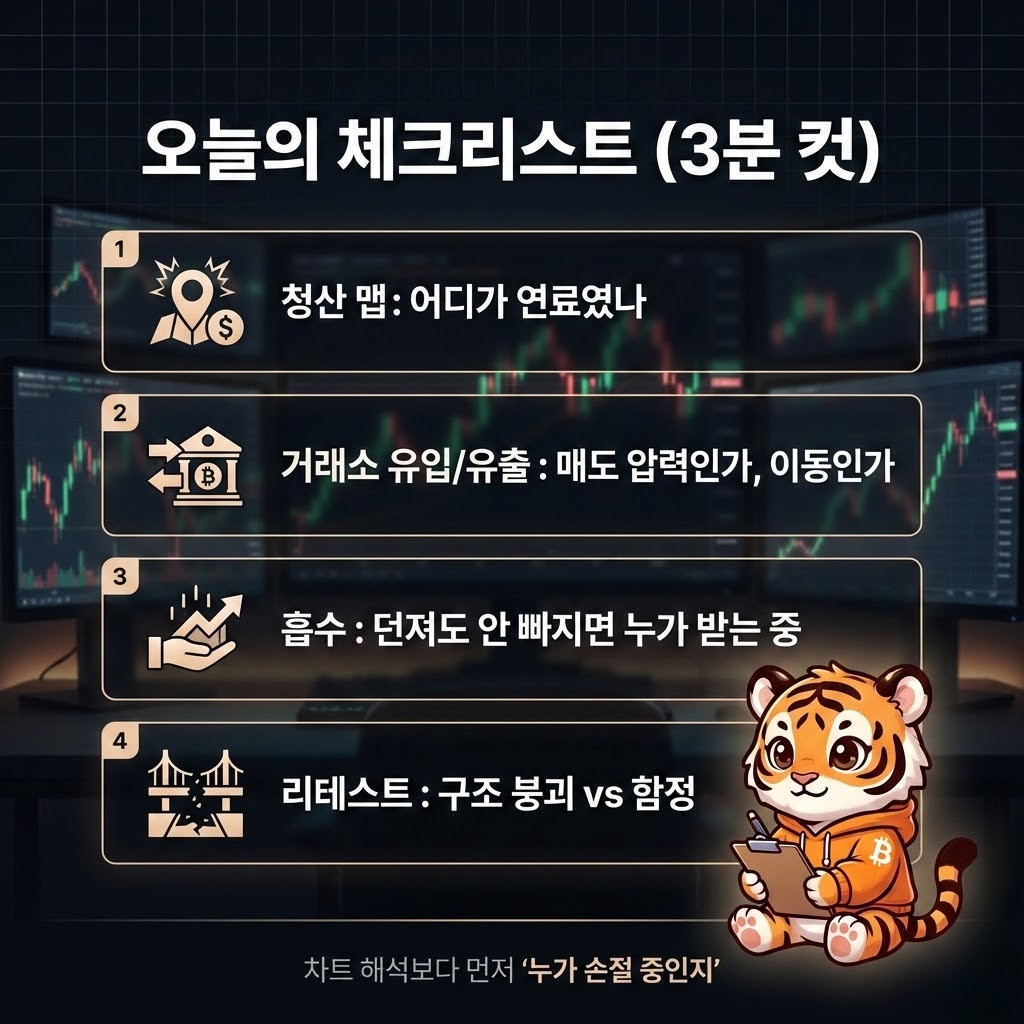

오늘의 체크리스트 (3분 컷) ✅ 가격이 급락/급등했을 때, 난 이 4개만 봅니다: 1.청산 맵: 어디가 ‘연료’였나 2.거래소 유입/유출: 매도 압력인가, 이동인가 3.흡수: 던져도 안 빠지면 누가 받는 중 4.리테스트 실패/성공: 구조가 깨졌나, 함정이었나 차트 “해석”보다 먼저 누가 돈을 잃고…

Hot take: Most traders don’t lose to the market. They lose to their own size. If you feel “certain”, you’re probably too big. Rules I don’t break: ●risk small ●cut faster than ego ●survive to trade the next setup Solvency > bravado. #Trading #RiskManagement #BTC

United States Trends

- 1. #PAKvNED N/A

- 2. #River N/A

- 3. #STARDOM N/A

- 4. Olympics N/A

- 5. Babar N/A

- 6. #AISxADaywithPerthSanta N/A

- 7. PERTHSANTA AIS MELODY N/A

- 8. #SmackDown N/A

- 9. NDSU N/A

- 10. Hunter Hess N/A

- 11. St. John N/A

- 12. UConn N/A

- 13. Raheem N/A

- 14. Athena N/A

- 15. Andrea Bocelli N/A

- 16. Mountain West N/A

- 17. Malik Monk N/A

- 18. Jordynne N/A

- 19. Scoot N/A

- 20. Metallica N/A

Something went wrong.

Something went wrong.