TrendRiderPro

@TrendRiderPro1

Swing & position trading. Find the strongest trends. Ride the strongest sectors. Scans for strong stocks. Protect capital. Charts and Trade Ideas

You might like

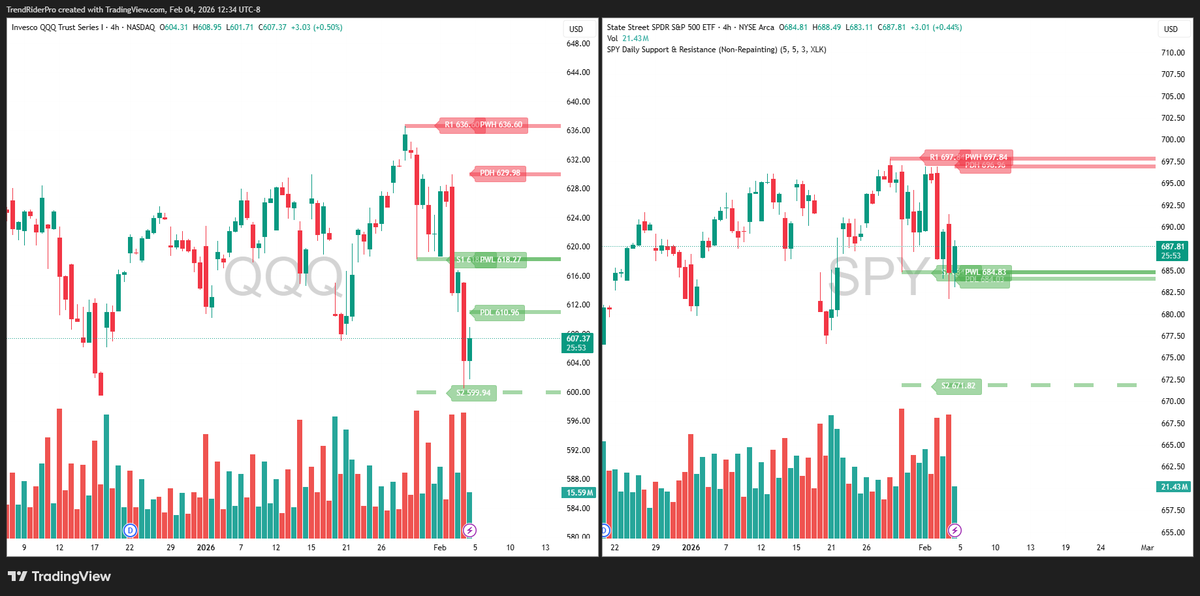

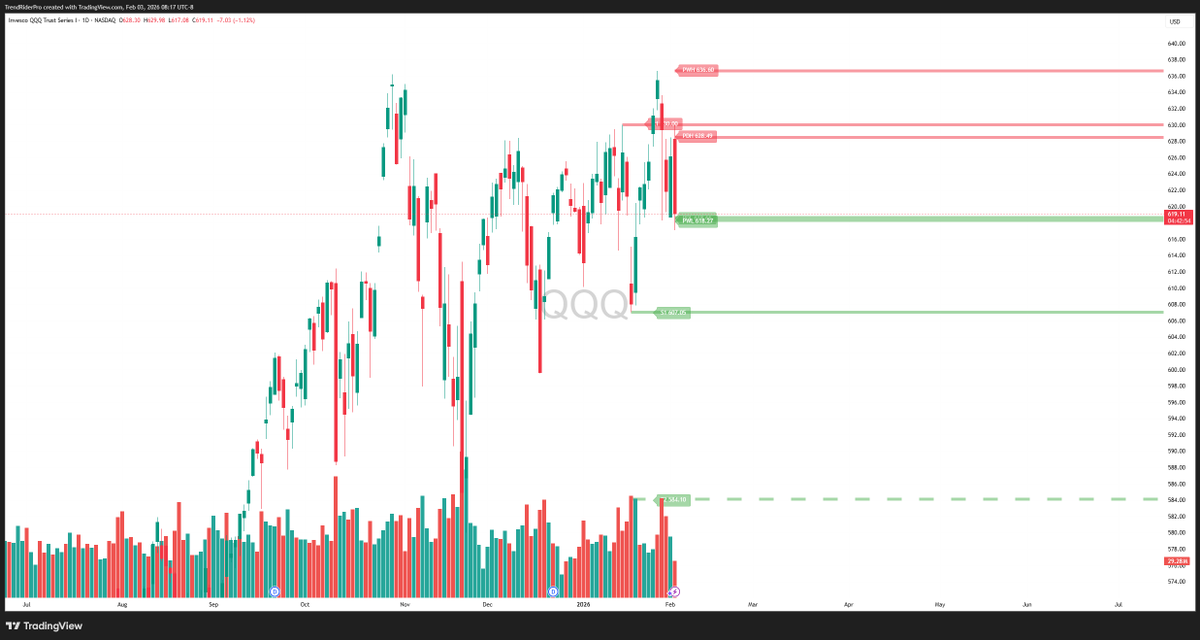

• QQQ broke down sharply and is hovering near prior support, with next downside risk toward the low 600s if the bounce fails. • SPY is also below recent resistance and sitting just above key support (~684–685), showing weaker structure than prior weeks.

• Market was mixed: Big Tech and semiconductors sold off (GOOG, META, NVDA, AMD, AVGO deep red) while AAPL and MSFT held up. • Healthcare and defensives led, driven by a massive surge in LLY, with strength in consumer staples and utilities. • Cyclicals and internet retail…

• Market is selling off broadly, but many major earnings names (UBER, LLY, ABBV, CME, FLEX, etc.) are still in strong technical uptrends, suggesting sector weakness is more sentiment than fundamentals. • Several stocks are pulling back to support ahead of earnings, setting up…

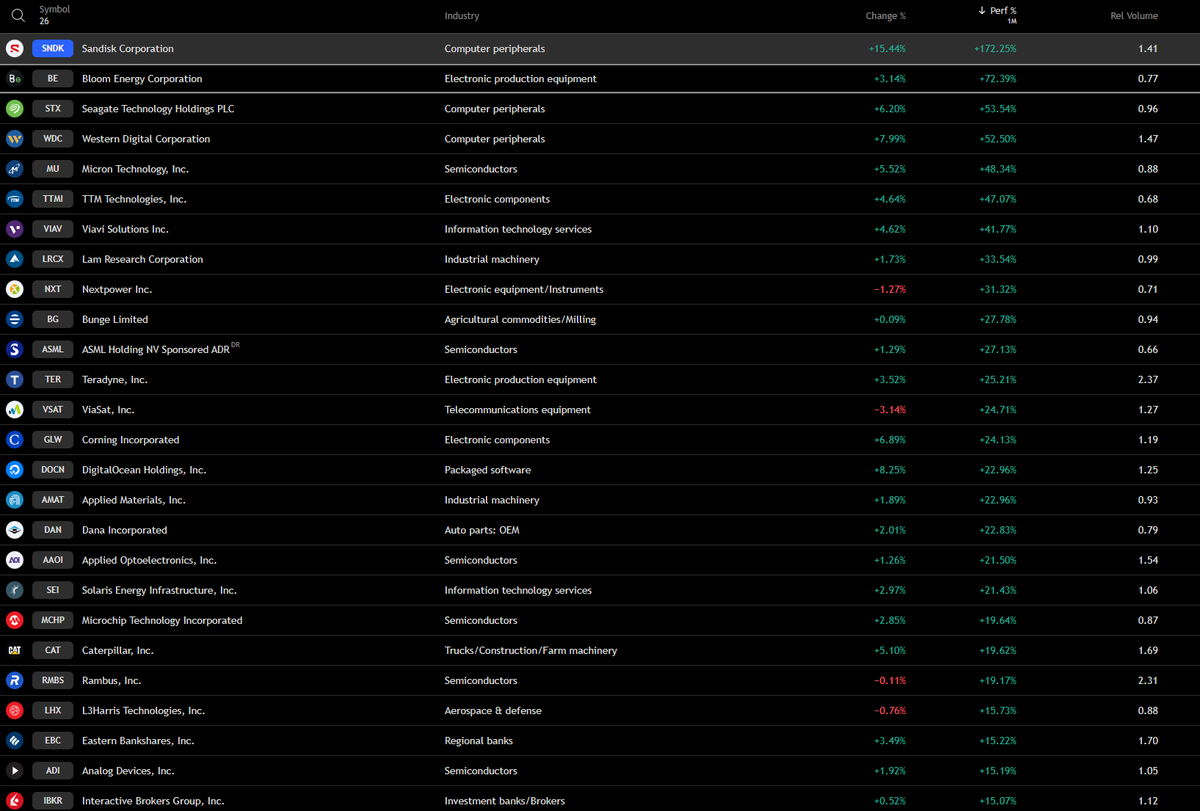

Qullamaggie 1-month biggest gainer in S&P500 and Nasdaq100= high momentum + liquidity + trend + institutional participation. Perfect for breakouts, pullbacks, and continuation trades.

• Tech and semiconductors are leading the selloff (MSFT, NVDA, AVGO, AMZN, META all red), showing risk-off pressure in growth. • Defensive sectors and energy are holding up (XOM, CVX, WMT, COST, KO, PEP), indicating money rotating into safety rather than fully exiting the…

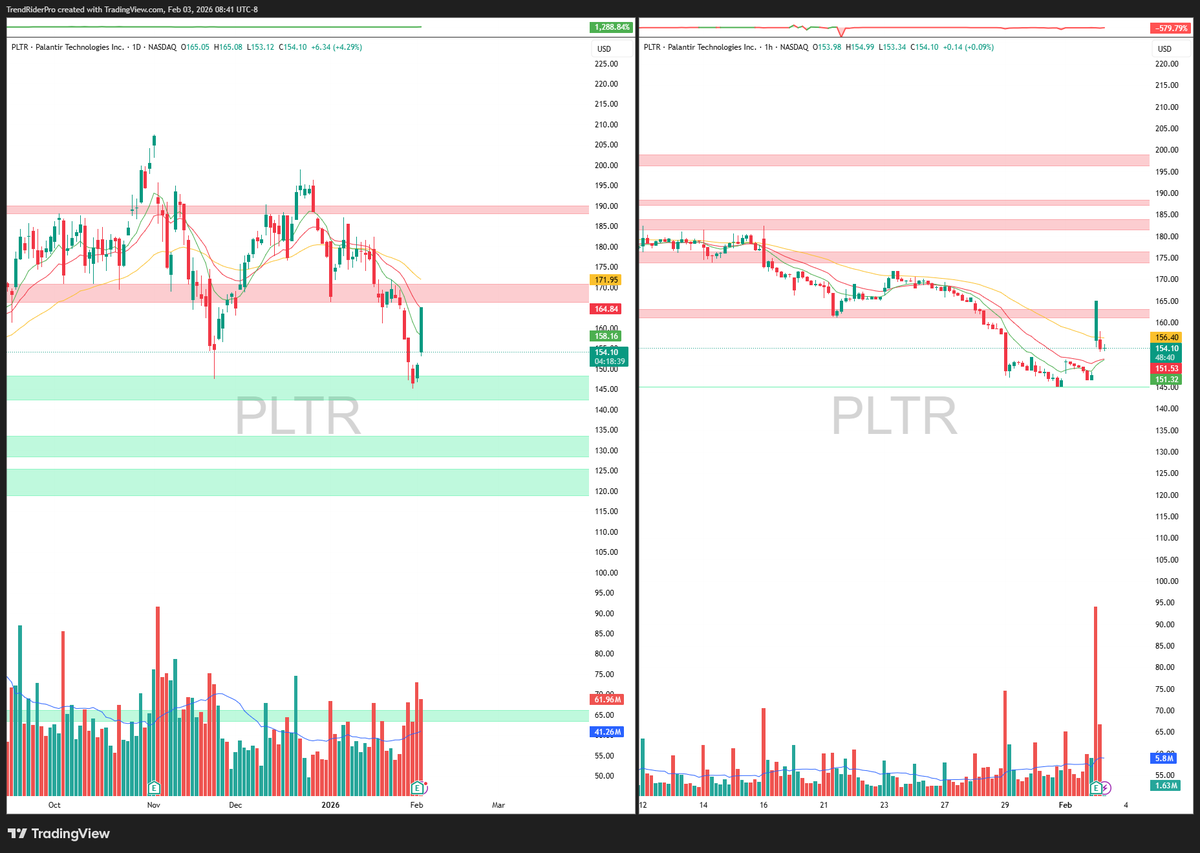

Palantir's latest Q4 2025 earnings were outstanding, delivering 70% YOY revenue growth to $1.41 billion. PLTR is pulling back into a major support zone (~150–155) after failing near the 180–190 resistance band, with trend structure still intact but momentum clearly cooling

• QQQ is pulling back into a key support zone (~618–607) after failing near prior highs around 628–636. • Structure remains range-bound, with volatility expanding and no clean trend continuation yet. • Bulls need a reclaim above ~630 for momentum; a break below ~607 risks a…

👉Market Leaders With Institutional Flow. High-liquidity Momentum Leader Scan. Strong momentum, trading above rising EMAs, priced >$15, $1B+ market cap, and ADR 2.5–10% Trend + Liquidity + Relative Strength

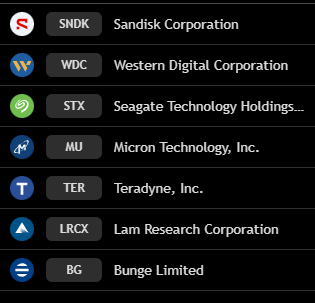

🚀 SNDK just went full parabolic. Price is riding all rising EMAs (5/10/20/50/200) with a steep slope and monster momentum — this is what institutional accumulation looks like.

Qullamaggie 1-month biggest gainer in S&P500 and Nasdaq100= high momentum + liquidity + trend + institutional participation. Perfect for breakouts, pullbacks, and continuation trades.

The most anticipated earnings for the week of February 2, 2026, highlight major tech and growth names: Palantir (Monday), PayPal & AMD (Tuesday), Uber & Alphabet (Wednesday), and Amazon (Thursday/Friday window), alongside others like Lilly, Qualcomm, and Arm. This busy week…

On 1-hour charts (early February 2026): AMZN (~$243.56) remains bullish above key EMAs (10/20/50), support ~$236 after recent pullback. QQQ (~$625-627) is pulling back slightly with bearish EMA signals on some metrics. MSFT (~$427) trades in consolidation below EMA50, with…

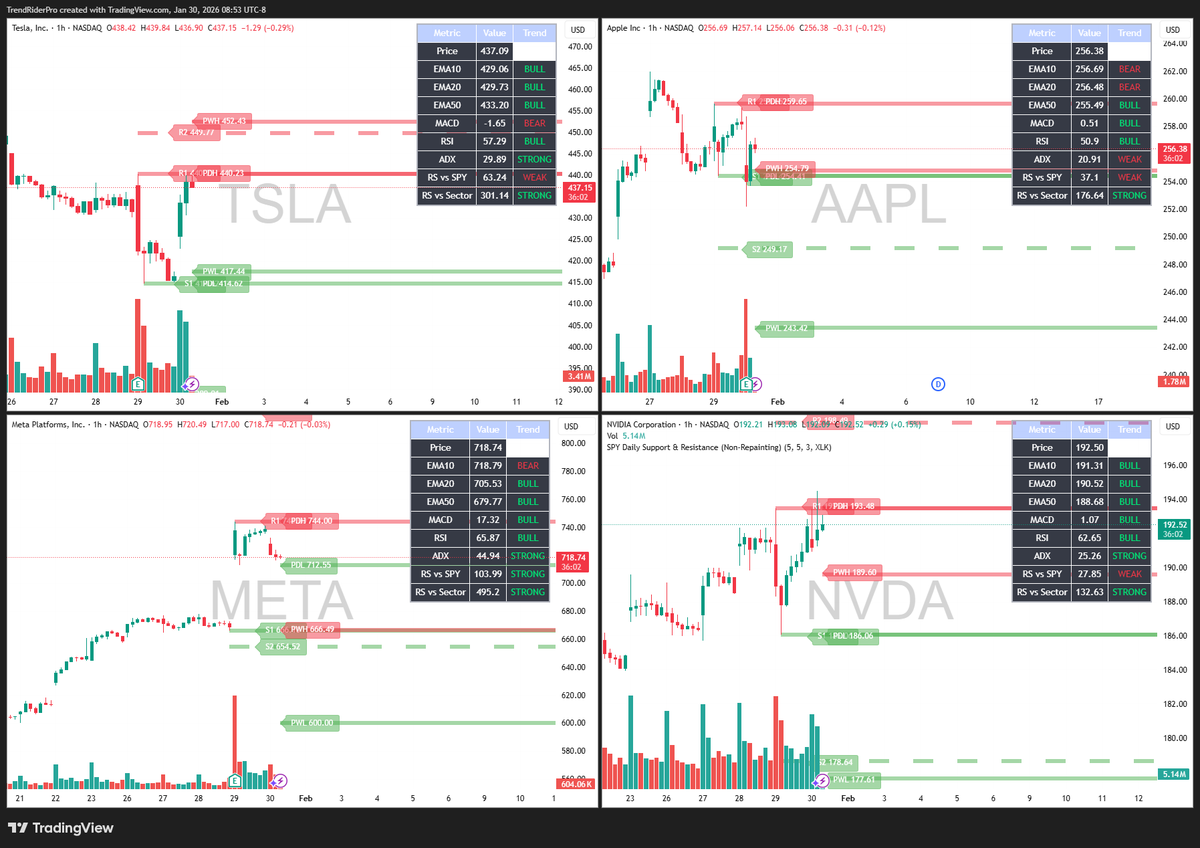

1h time frame (2/2/26): • AAPL and META show the strongest bullish structure (price above key EMAs, MACD bullish, strong sector relative strength). • NVDA is mixed: momentum weakening short-term, but still holding key support with strong sector RS. • TSLA is weakest: below…

• Market is mixed: big tech is split — AAPL, AMZN, GOOG green while MSFT and NVDA are red, showing rotation within tech. • Semiconductors diverge: AMD and MU strong, NVDA weak → selective buying, not broad AI rally. • Energy and Tesla drag, while consumer defensives and…

Multi-symbol 1h charts (Jan 30, 2026): TSLA is in a strong bullish breakout: price above EMAs (all BULL), MACD bullish, strong RS vs Sector (301), . AAPL remains weak/bearish: trading below EMA10/20 (BEAR), RSI neutral but ADX weak, RS vs SPY weak (36.71), price rejected PDH META…

• Heavy earnings week ahead (Feb 2, 2026) with major names like Palantir, PayPal, AMD, Uber, Alphabet, Amazon, Qualcomm, Shell, and Roblox reporting. • High volatility expected across tech, consumer, energy, and healthcare, making this a key catalyst week for the market.

United States Trends

- 1. Panarin N/A

- 2. Wizards N/A

- 3. Drury N/A

- 4. Overwatch N/A

- 5. McCain N/A

- 6. Lonzo N/A

- 7. Chris Paul N/A

- 8. Rangers N/A

- 9. Anthony Davis N/A

- 10. Luka N/A

- 11. Mavs N/A

- 12. Gavin McKenna N/A

- 13. WaPo N/A

- 14. Washington Post N/A

- 15. Greentree N/A

- 16. Trae N/A

- 17. Bezos N/A

- 18. Maxx N/A

- 19. Kings N/A

- 20. Coby N/A

You might like

-

bubbles troubles

bubbles troubles

@BlessTroublPRMR -

Al Lind 🇺🇸

Al Lind 🇺🇸

@AlLind_44 -

Jim Baranello

Jim Baranello

@BaranelloJim -

Collin Bottrell

Collin Bottrell

@CollinBottrell -

Value Investing 1971 💴✍️

Value Investing 1971 💴✍️

@ValueInvest1971 -

Patrick Stöger

Patrick Stöger

@PatrickStger -

Qwarmhie Erick

Qwarmhie Erick

@phreash4114 -

SoCalMike

SoCalMike

@SoCalMike7 -

VALUEGEEK

VALUEGEEK

@bolertax -

Liping Yang

Liping Yang

@yang_lpy1999 -

DCM

DCM

@Dru415 -

Tony

Tony

@elkhuntn

Something went wrong.

Something went wrong.