Ken Rumberger, CPA

@Trinity_Tax

Trinity Tax, a Certified Public Accounting Firm that takes the Stress out of Your Success by handling your Tax and Accounting Needs while you run Your Business.

You might like

Deadline Reminder ‼️ Individual 1040 Extensions are due October 15th. Ken Rumberger, CPA 727-375-1040 #Taxes #TaxDeadlines

Happy Thanksgiving from all of us at Trinity Tax Service. Wishing everyone a happy and heartfelt Thanksgiving filled with family and friends ❤🍂

We don’t know them all, but we owe them all ❤️🇺🇸 This #VeteransDay, we honor those who served.

🚨This week the IRS announced that the amount individuals can contribute to their 401(k) plans in 2022 has increased to $20,500, up from $19,500 for 2021 and 2020. Read the full release at: irs.gov/newsroom/irs-a…

Deadline Reminder ‼️ Do you have employees? The IRS requires you to file Form 941 to report the amounts of federal #incometaxes and other #payrolltaxes you have been withholding from your employees. Submit the forms by: October 31st

Understand how selling your home may affect your tax return. Here’s what to consider when selling a house: go.usa.gov/x6KAE #IRS #TaxTip

Are your tax documents and financial information protected in case of a natural disaster strikes? Get #HurricaneStrong with #IRS tips: go.usa.gov/xHpEN

If you got a tax filing extension, you can still get help to meet the Oct. 15 #IRS deadline. go.usa.gov/xMBWX

Have you created your #IRS Online Account? From your account, you can access tax records, view balances and notices, make payments, and approve and electronically sign Tax Information Authorization requests made by your #taxprofessional. bit.ly/3EWYreN

Our regularly updated newsletter provides timely articles to help you achieve your financial goals. Stay up to date and subscribe at: bit.ly/3m7pICC

Our regularly updated newsletter provides timely articles to help you achieve your financial goals. Stay up to date and subscribe at: bit.ly/3m7pICC

#IRS will not email you asking you to provide or verify financial information to obtain the monthly #ChildTaxCredit payments. Stay alert and learn to recognize a phishing scam: irs.gov/phishing

#TaxPros: The #IRS website can help you get the information you need to help your clients. Visit go.usa.gov/xAF32

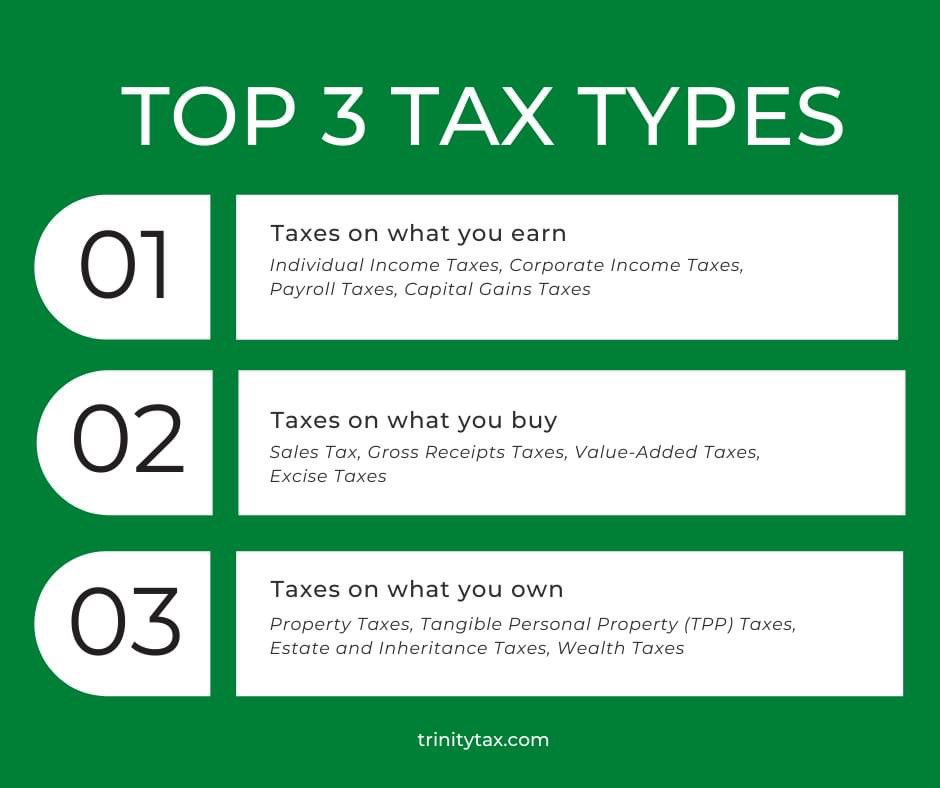

Do you know the differences between the 3 basic tax types? Read here: bit.ly/3tbNAYV Ken Rumberger, CPA | (727) 375-1040 | trinitytax.com #taxes #IncomeTaxReturn #corporatetax

Avoid long hold times on the telephone. Use the #IRS online tools and get answers to many common tax questions at irs.gov/help

ICYMI: Businesses can claim 100% of their food or beverage expenses paid to restaurants between Jan. 1, 2021 and Dec. 31, 2022. See more #IRS information on guidelines at: go.usa.gov/xHgy8

United States Trends

- 1. Good Friday N/A

- 2. #KawasakiHeavenlyWord N/A

- 3. RED Friday N/A

- 4. Hire Americans N/A

- 5. #23Ene N/A

- 6. Lakers N/A

- 7. Luka N/A

- 8. Ari Lennox N/A

- 9. Clippers N/A

- 10. Autopilot N/A

- 11. #TheTraitorsUS N/A

- 12. Maki N/A

- 13. Jim Jones N/A

- 14. Kawhi N/A

- 15. #VolunteerLife N/A

- 16. Colton N/A

- 17. Uncle Ted N/A

- 18. Ted Nugent N/A

- 19. #PetLove N/A

- 20. Lagos N/A

You might like

Something went wrong.

Something went wrong.