UltraLong

@UltraLong

Private investor from Finland. Started investing in mid 90s. Masters degree from Helsinki University of Technology.

Was dir gefallen könnte

Our top 5 stock positions currently are: Berkshire Hathaway (USA) Nokia (Finland) Metso Outotec (Finland) Verkkokauppa_com (Finland) Siili Solutions (Finland) The backbone of the portfolio is technology (46% allocation): …oughtsofaprivateinvestor.blogspot.com/2022/01/portfo… #investing

I admit: when I beat market (or loose to it) it almost every time has to do with portfolio beta. The stock picking part is about getting a portfolio that you do not have to follow every day or not even every week to sleep well. #investing …oughtsofaprivateinvestor.blogspot.com/2022/01/back-t…

Despite the flight to value, we managed to have the best year ever in terms of absolute gains. In terms of year-on-year growth the year was second best (only second to 2019) at 27,2%. #nokia #BerkshireHathaway #investing …oughtsofaprivateinvestor.blogspot.com/2022/01/happy-…

Portfolio update: Continuing 91% invested in stocks …oughtsofaprivateinvestor.blogspot.com/2021/02/portfo… #investing

Thoughts of the odd year 2020: It turned out to be the best we have had compared to our benchmark investment. At the same time divergence of the performance of stock market from that of the economy at large creates mixed feelings #investing #sijoittaminen …oughtsofaprivateinvestor.blogspot.com/2021/01/2020-o…

New blog post: Portfolio update: Cash position increased. Also start to be "very very long" Berkshire Hathaway. …oughtsofaprivateinvestor.blogspot.com/2020/10/portfo… #investing #berkshirehathaway #metsooutotec #nokia #intel #verkkis

We have sold all of our NVIDIA position and no longer have any positions in the hot dominant technology stocks dubbed as "FANGMAN". …oughtsofaprivateinvestor.blogspot.com/2020/07/last-n…

Berkshire Hathaway (NYSE: BRK.B) back in portfolio for the 3rd time. …oughtsofaprivateinvestor.blogspot.com/2020/03/berksh…

At the moment our top 5 positions in stock market are as follows: 1. Berkshire Hathaway (USA) 2. Nokia (Finland) 3. UPM (Finland) 4. Intel (USA) 5. NVIDIA (USA) Our largest sector allocation continues to be semiconductor industry. …oughtsofaprivateinvestor.blogspot.com/2020/03/change…

I don't believe in timing the market. This includes pledge of not jumping out of market when it starts to look bad. In my latest blog post I'll share what being long in stock market has looked like in our largest broker account lately and my thoughts.. …oughtsofaprivateinvestor.blogspot.com/2020/03/this-i…

Top 5 companies in our portfolio on January 1st were: 1. Apple 2. Western Digital 3. Micron 4. UPM (Finland) 5. NVIDIA The plan for 2020 is to increase weight and number of Finnish corporations at expense of the technology companies listed in the top 5. …oughtsofaprivateinvestor.blogspot.com/2020/01/portfo…

The year 2019 ended up to be the best year we have ever had in stock markets in terms of - yearly gains (+36,2%) - gains relative to our benchmark investment* - passive index investing (+8,6%) - absolute gains 💰 🎉 …oughtsofaprivateinvestor.blogspot.com/2020/01/2019-b…

Increased Nokia position. Last time I wrote after Q1 result that the stock hasn't gone anywhere in 5 years. Now it has, but not to the direction investors wanted. For me, it looked like a decent buying opportunity although this may not be the bottom. …oughtsofaprivateinvestor.blogspot.com/2019/10/increa…

We continue almost fully invested in stocks (~99%). The main theme is "technology and related services" with ~50% of the portfolio allocated to such companies. …oughtsofaprivateinvestor.blogspot.com/2019/08/portfo… #investing #StockMarket #sijoittaminen

Sold Berkshire Hathaway and trimmed down Nokia significantly. Top3 stock positions now: Western Digital, Apple, Micron. New positions: Dell, CVS Health. …oughtsofaprivateinvestor.blogspot.com/2019/08/sold-b… #BerkshireHathaway #Nokia #Apple #WesternDigital #Micron #Dell #CVShealth

In the long run, it's not the profits alone that matter - also cost of holding matters a great deal! Please check out my latest blog post at: …oughtsofaprivateinvestor.blogspot.com/2019/07/cost-c… #investing #ETF

Winner really can't literally take all. A look at history of AT&T and how some of the FAANG may face similar antitrust issues due to dominance and vertical integration. …oughtsofaprivateinvestor.blogspot.com/2019/06/winner… #antitrust #Amazon #Google #apple #Nokia

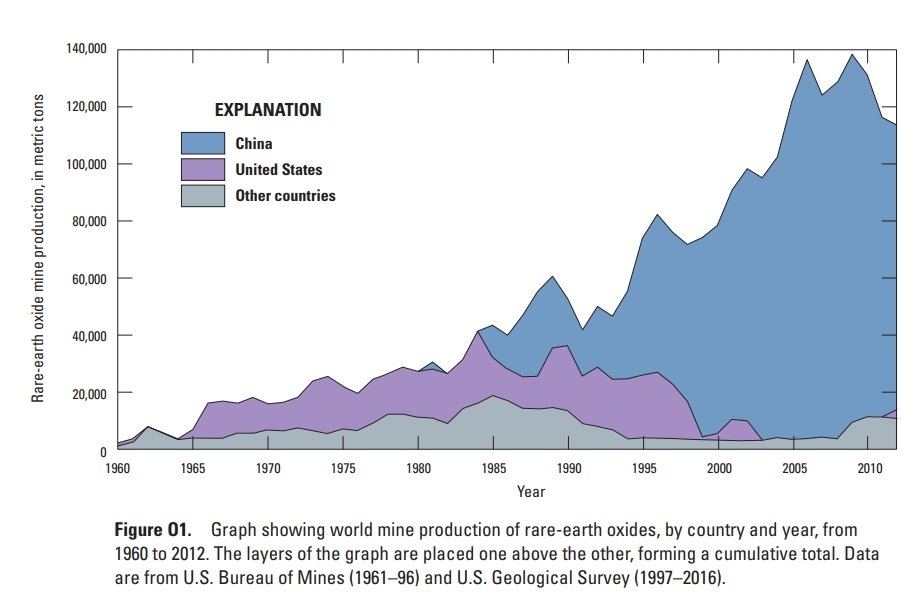

China #RareEarth dominance. China's share of "heavy" #REE (i.e. the most critical of the rare earths) is likely even more impressive as many mines outside tilted towards "light" REE. Source: pubs.er.usgs.gov/publication/pp… #tradewar #SupplyChain #USChinaTradeWar #ChinaUS

U.S is more dependent on China in #RareEarths than the figure 80% (China's share of imports) suggests. Some of remaining 20% also originate from China. Also, the Ion-adsorption clay deposits in southern China are the world’s primary sources of the heavy #REE (HREE). #tradewar

Not all #RareEarths are equal. Some are far more important than the others. U.S Mountain Pass mine is heavily tiltled towards "light" #REE whereas "heavy" REEs are much more critical. More in my old post: …oughtsofaprivateinvestor.blogspot.com/2011/02/critic… #ChinaUS #ChinaTariffs #TradeWars #SupplyChain

United States Trends

- 1. Epstein N/A

- 2. Jay Z N/A

- 3. Pusha N/A

- 4. Iron Lung N/A

- 5. #OPLive N/A

- 6. Marina N/A

- 7. Izzo N/A

- 8. Podz N/A

- 9. Mariah N/A

- 10. Bill Gates N/A

- 11. #questpit N/A

- 12. #VERZUZ N/A

- 13. Pistons N/A

- 14. Michael Watts N/A

- 15. #DragRace N/A

- 16. $Accelerando N/A

- 17. Hield N/A

- 18. Hanoi Jane N/A

- 19. SANTA FROST WARM SIGN N/A

- 20. Jokic N/A

Was dir gefallen könnte

Something went wrong.

Something went wrong.