The Valuation Desk

@ValuationDesk

Detailed deep dives on compelling businesses, overlooked opportunities, and companies trading below intrinsic value. Not financial advice.

You might like

SharkNinja $SN Part 1 is live. Most companies treat innovation as a function. SharkNinja turned it into a system. An in depth look at how SharkNinja built a repeatable engine for category creation. Read 👇(free) open.substack.com/pub/thevaluati…

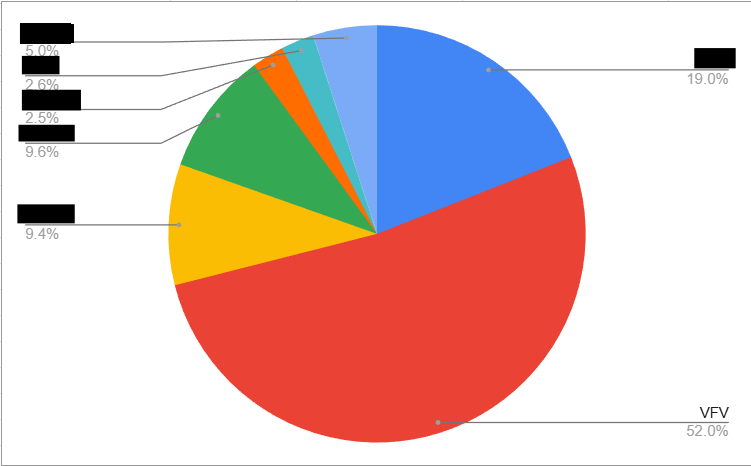

Just over a month since we launched The Valuation Desk, the portfolio is ahead of the S&P 500 by ~130 bps, despite 52% of capital still being held in the index while positions are deployed. Very early days, but an encouraging start, certainly better than the reverse.

Next deep dive is underway. We're heading into the U.S. market for this one. Two multibillion-dollar brands. Relentless innovation. And odds are, one of their products is somewhere in your home. Any guesses?

Part 2 of our deep dive on Mainstreet Equity $MEQ $MEQ.TO is out. We break down the business model and why IFRS NAV understates the long-term upside. An underappreciated real estate compounder. Read 👇 thevaluationdesk1.substack.com/p/mainstreet-e…

The returns speak for themselves, we highly recommend.

Part 1 of our deep dive on Mainstreet Equity $MEQ $MEQ.TO is out. We walk through 26 yrs of public company history, across multiple cycles, to understand how this biz was built and how it achieved >4,000% returns. Part 2 will be out before YE. 👇(free) thevaluationdesk1.substack.com/p/the-real-est…

Our next deep dive will be dropping before the end of the week. Stay tuned.

Zoomd blew up in 22, rebuilt itself in 23, and is now throwing off real cash with a lean cost base. Yet, it trades at 5x earnings and a 20% FCF yield. Our work suggests there’s far more here than the market is pricing in $ZOMD $ZOMD.V $ZMDTF 👇(free) open.substack.com/pub/thevaluati…

Very good write-up on propel. Worth a read if you are into it.

The best thesis I've seen written on $PRL. I really recommend reading it (and the first part) and then understanding how wrong the market is. Long , NFA.

We’ve been working hard and the next deep dive is coming out earlier than planned. Tomorrow, we break down a company that is simply too cheap to ignore. Our estimate puts it at 4x earnings coming out of two years of strong growth in both revenue and profitability. Stay tuned.

$EFN.TO what a great quarter yet again. Element is an incredible compounder that keeps on delivering. This is becoming one of those companies that I just don’t see why I would sell my shares maybe ever. Still priced reasonably IMO.

Funny how the market’s at all-time highs, yet I’m seeing more and more bargains pop up. Non-AI names have been getting hammered lately for no clear reason — feels like the past few weeks have been especially rough.

United States Trends

- 1. Mendoza N/A

- 2. Mendoza N/A

- 3. Indiana N/A

- 4. Carson Beck N/A

- 5. Miami N/A

- 6. #NationalChampionship N/A

- 7. #CFBPlayoff N/A

- 8. Malachi Toney N/A

- 9. Heisman N/A

- 10. Abella Danger N/A

- 11. Natty N/A

- 12. #iufb N/A

- 13. Big Ten N/A

- 14. Michael Irvin N/A

- 15. #NeverDaunted N/A

- 16. Big 10 N/A

- 17. Fletcher N/A

- 18. #CollegeFootballPlayoffs N/A

- 19. Raiders N/A

- 20. Jimmy Butler N/A

You might like

-

Rico

Rico

@csernaggia -

PThome

PThome

@PThome10 -

Leonard Blair

Leonard Blair

@KorrantStocks -

Rhett

Rhett

@Rhett01134143 -

name cannot be blank

name cannot be blank

@pgerry08 -

Robert Sapp

Robert Sapp

@rsapp9472 -

cody cuyle

cody cuyle

@HamburgerRocket -

Seeking Alfalfa

Seeking Alfalfa

@chrisw4415 -

steve dunn

steve dunn

@stephenrdunn -

Buy A Dip

Buy A Dip

@kanyeforPM -

Chadwick

Chadwick

@chaddenheimer -

legend

legend

@maxxlegend5 -

basti

basti

@inflation_hedge -

Nikola Vladak Jr.

Nikola Vladak Jr.

@1999luddite -

Marvin Lapin

Marvin Lapin

@MarvinLapin

Something went wrong.

Something went wrong.