Venn

@VennTwoSigma

Venn is a factor-based analytics platform designed for asset owners managing multi-asset class portfolios, including those with an alternatives allocation.

You might like

This Venn spotlight focuses on a University hospital system that has about $9 billion in annual revenue & $9 billion in investments & leverages Venn to help support key investment decisions. The Venn subscriber featured in this article was not compen... hubs.ly/Q03htDPL0

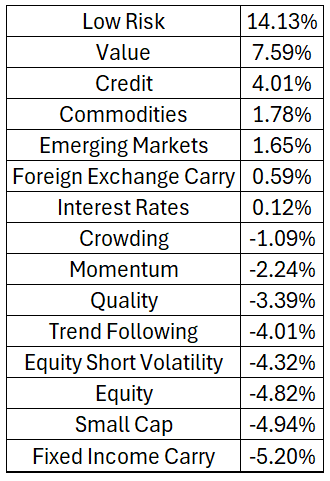

Discover how tariffs and policy shifts since the recent U.S. inauguration have caused divergent factor performance in the U.S. and U.K. Our analysis dives into global and local factors, discussing actionable insights for strategic portfolio construction. hubs.ly/Q03gy6Nt0

Five out of our six Equity Styles registered historically significant performance in February. This implies larger than normal performance swings for institutional investors. Come learn more about the performance of our Equity Styles and... hubs.ly/Q03bTrvd0

January's market was a rollercoaster: from bullish CPI data to the DeepSeek AI shock. We analyze Equity Style performance before, the day of, and after the DeepSeek news rattled markets. hubs.ly/Q035pML-0

Equity Styles were among the best and worst performers in 2024, with other factors also having a standout year. Check out our latest report to analyze calendar year performance through the Two Sigma Factor Lens! hubs.ly/Q0321rWF0

Asset class analysis can be useful to assess the impact of the recent Presidential Election, but the Two Sigma Factor Lens may offer a different and potentially more precise understanding. hubs.ly/Q02_fY3R0

Explore how October's U.S. themes, including the presidential election and rate cut expectations, impacted key factors such as Fixed Income Carry, Interest Rates, Trend Following, and Foreign Currency. hubs.ly/Q02Y3DHH0

September marked the first interest rate cut by the Fed, and it was a big one. Fundamental risk factors reacted, which ultimately matters for investors' portfolios and risk exposures. hubs.ly/Q02SYBWk0

We believe that conducting quantitative analysis is essential for making more informed asset allocation decisions. Read more about how this thinking pertains to Conservative, Moderate, and Aggressive fund categories, and why there is of... hubs.ly/Q02RvKDz0

Join @VennTwoSigma and SimCorp's webinar on Wed, Oct 23rd at 11AM EST. This goes over our research regarding the relationship of Conservative, Moderate, and Aggressive fund categories. hubs.ly/Q02RdcLR0 hubs.ly/Q02Rdf7N0

Discover why Venn’s Foreign Currency factor is crucial for portfolio diversification and risk management in today's market. In this month’s report, we review the methodology and design of this factor, and explore August and historical results. hubs.ly/Q02PQrrR0

Explore how fundamental risk factors performed before and after recent U.S. presidential elections, as well as during different government compositions. hubs.ly/Q02L5Rqh0 See risks here - help.venn.twosigma.com/en/articles/85…

Explore July's performance of the Two Sigma Factor Lens, analyzing macro and style factors, with commentary on tech sector trends and carry dynamics. hubs.ly/Q02KNhRs0 See risks here help.venn.twosigma.com/en/articles/23…

Join us for a Venn Webinar on Wed, July 31st at 11AM EST. The webinar will showcase core workflows such as manager due diligence, unearthing multi-asset portfolio risks, and comparing current and proposed portfolio. RSVP here: hubs.ly/Q02GLmyj0 hubs.ly/Q02GLmxm0

Explore Venn’s new peer group analysis tool, designed to compare investment managers against their peers and understand their performance within the context of a competitive landscape. hubs.ly/Q02zs9QH0

April proved to be an eventful month for markets, with historically significant performance across various Venn factors. In this report, we discuss market themes such as high inflation in the U.S., the weakening Japanese Yen, and continued geopolitical... hubs.ly/Q02wXzF40

In this report we discuss the meaningful performance of three equity style factors: Value, Crowding, and Quality. hubs.ly/Q02sHNKV0

Join us for a Venn and Northern Trust Webinar on Tues, Apr 30th 11AM EST. The webinar will showcase how allocators can conduct sophisticated manager due diligence, unearth holistic multi-asset portfolio risks, and seamlessly conduct familiar workflows. hubs.ly/Q02skgRV0

Read today’s Institutional Investor Opinion piece where Chris Carrano questions whether PE truly offers diversification to long equity and bond markets. Private assets are less liquid than public assets and have additional risks hubs.ly/Q02rZy100

In this piece, we aim to quantify the AI hype by analyzing an AI related equity ETF, including the portion of its excess return driven by its truly unique characteristics. hubs.ly/Q02ptZ0C0

United States Trends

- 1. Steelers 146 B posts

- 2. Aaron Rodgers 40,2 B posts

- 3. Tomlin 34,6 B posts

- 4. DeepNodeAI 67,2 B posts

- 5. CJ Stroud 20,1 B posts

- 6. Arthur Smith 5.945 posts

- 7. #HereWeGo 21,3 B posts

- 8. Christian Kirk 4.193 posts

- 9. #HOUvsPIT 3.884 posts

- 10. #HTownMade 5.053 posts

- 11. Anderson 32,2 B posts

- 12. Nico Collins 3.205 posts

- 13. Jonnu Smith 3.065 posts

- 14. TJ Watt 3.029 posts

- 15. Woody Marks 2.718 posts

- 16. Muth 1.606 posts

- 17. Sheldon Rankins 1.954 posts

- 18. Marvin Lewis 1.086 posts

- 19. DK Metcalf 3.305 posts

- 20. Rooney 5.926 posts

You might like

-

Aven

Aven

@AvenCard -

Senior Helpers Jobs

Senior Helpers Jobs

@JobsHelpers -

Catherine Eckel

Catherine Eckel

@eckelcc -

Ahmed “Yousif”

Ahmed “Yousif”

@Yousif -

Conor L. Myhrvold 🐘

Conor L. Myhrvold 🐘

@conormyhrvold -

Amesite Inc.

Amesite Inc.

@AmesiteInc -

Gabriella Buba-SAINTS OF STORM AND SORROW Out Now

Gabriella Buba-SAINTS OF STORM AND SORROW Out Now

@GabriellaBuba -

BioMedWire

BioMedWire

@BioMedWire -

Aaron Brask, PhD

Aaron Brask, PhD

@aaronbrask -

Catalyit

Catalyit

@Catalyit -

NetworkWire

NetworkWire

@NetworkWireNow

Something went wrong.

Something went wrong.