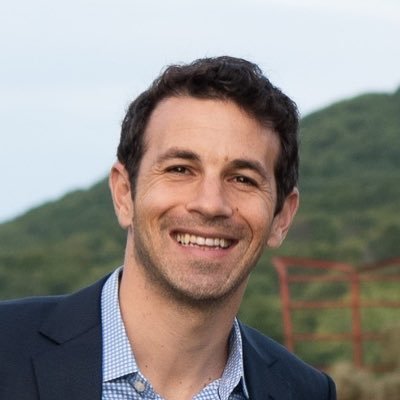

Chad Kusserow

@VetTechTrader

25+ year career tech investor/hedge fund manager. Fundamental alpha generation and absolute returns, driven by my self-developed R/R system and a touch of TA.

Może Ci się spodobać

Even though I won’t be posting here any longer, I’ll still be actively using the platform for all the great real time tech information that is abundantly available, and I look forward to running into some of you at future investor conferences - take care and good luck!

It’s been a good run here, but sometimes lines cross at the proper time & opportunity knocks, but that also means I’ll no longer be posting here; thanks to all those I’ve had positive interactions with; hope I’ve helped a few along the way make a few bucks & improve their process

More GPU $$s

I don't think Goolsbee said anything new- mkt rallying on hope for a stripped down CR...

What's a 100 point bounce amongst friends from premkt lows-...getting the early flush key- then slightly better PCE and now hope for a ST stopgap CR to save Christmas- now they better deliver- or else...

Yep - chatter of ST stopgap bill- what I figured...

My guess is they come up with a super stripped down shorter term CR in order to at least keep the Govt open- prob won't solve much but also at least not ruin Christmas for people

Global flows now day trading ha

US equity funds saw biggest net outflows in 15 years ahead of Fed decision reuters.com/markets/us/us-…

80bp bounce off the premkt lows- from the PCE- struggle all day will be hypersensitivity to any flow of progress toward meeting more towards the middle on this CR- bad from market perspective ST but nec if people really want some LT reform progress in DC

Japan back into jawbone mode

Japan's government 'alarmed' by recent forex moves, top officials say - Reuters ooc.bz/l/51394

Record inflows gushing into the US after an already big year just in time for this CR drama- pretty toxic setup- has been plenty of signs of very frothy stuff past sev weeks

Type of premkt flush was hoping we were going to have yesterday to get some stink bids hit- $SPY 5745 (100dma) logical area for very oversold support- premkt low was 5777, or 60bps away- no one knows how this CR plays but cld very likely only get figured out over the weekend

$NKE said a few times the headwinds from these actions to reposition Direct, inventories and merch reshuffle will be more impactful in q4 than q3

Mentioned this before- hate how $NKE guides- think they like the opacity to allow for upside but just creates so much unnecessary volatility

$NKE just continuing process of getting out of the failed Direct strategy and discounting- just a matter of when enough is enough vs. death by a bunch of cuts - knew when saw invs vs. revs prob an issue- still tough to gauge in Q&A if this is final big cut

$NKE guiding q3 revs ~5% light as blow out invs; GMs guided ~250bps lower than where street is (mentioned this in preview), SGA down slightly yoy- eps somewhere in neighborhood of .42 vs. .80 est(though incls some restructuring charges - haven't broken out yet)

$NKE saying invs higher than they would like, esp Direct and will take actions there-obv means forward guide will take a bit of a divot vs. prior 2H up vs. 1H

United States Trendy

- 1. Good Sunday 55.9K posts

- 2. Stockton 27.3K posts

- 3. #ViratKohli 40.4K posts

- 4. #BNewEraBirthdayConcert 1.03M posts

- 5. Auburn 41.4K posts

- 6. #INDvSA 64.6K posts

- 7. Bama 30.1K posts

- 8. Duke 33.3K posts

- 9. Ole Miss 39K posts

- 10. #JimmySeaFanconD2 286K posts

- 11. PERTHSANTA LUMINOUS SKIN 335K posts

- 12. BECKY BIRTHDAY CONCERT 957K posts

- 13. #NIVEASkinGlowxPerthSanta 387K posts

- 14. Notre Dame 26.2K posts

- 15. Miami 141K posts

- 16. Lane Kiffin 49.2K posts

- 17. Ewing 1,379 posts

- 18. Stanford 10.2K posts

- 19. Austin Theory 5,538 posts

- 20. Japan Cup 11.7K posts

Może Ci się spodobać

-

Jamin Ball

Jamin Ball

@jaminball -

Fred Liu

Fred Liu

@HaydenCapital -

DaRazor

DaRazor

@akramsrazor -

TrumpGrift Capital🇺🇦

TrumpGrift Capital🇺🇦

@Crussian17 -

Upslope Capital

Upslope Capital

@UpslopeCapital -

Newmoon Capital

Newmoon Capital

@NewmoonCap -

Software Stack Investing

Software Stack Investing

@StackInvesting -

Deep Sail Capital

Deep Sail Capital

@DeepSailCapital -

Shortsighted Capital

Shortsighted Capital

@ShortSightedCap -

Alex Morris (TSOH Investment Research)

Alex Morris (TSOH Investment Research)

@TSOH_Investing -

Hemingway Capital

Hemingway Capital

@lfg_cap -

Matthew Cochrane

Matthew Cochrane

@TheMattCochrane -

Jerry Capital

Jerry Capital

@JerryCap -

Andy 🍕🏔️

Andy 🍕🏔️

@bizalmanac -

Chris Sommers

Chris Sommers

@ChrisSommers79

Something went wrong.

Something went wrong.