value add viktor

@ViktorValue

stashing things to come back to later

You might like

There has to be something wrong with you if you drive a $90,000 vehicle but won’t pay the $6 express Lane.

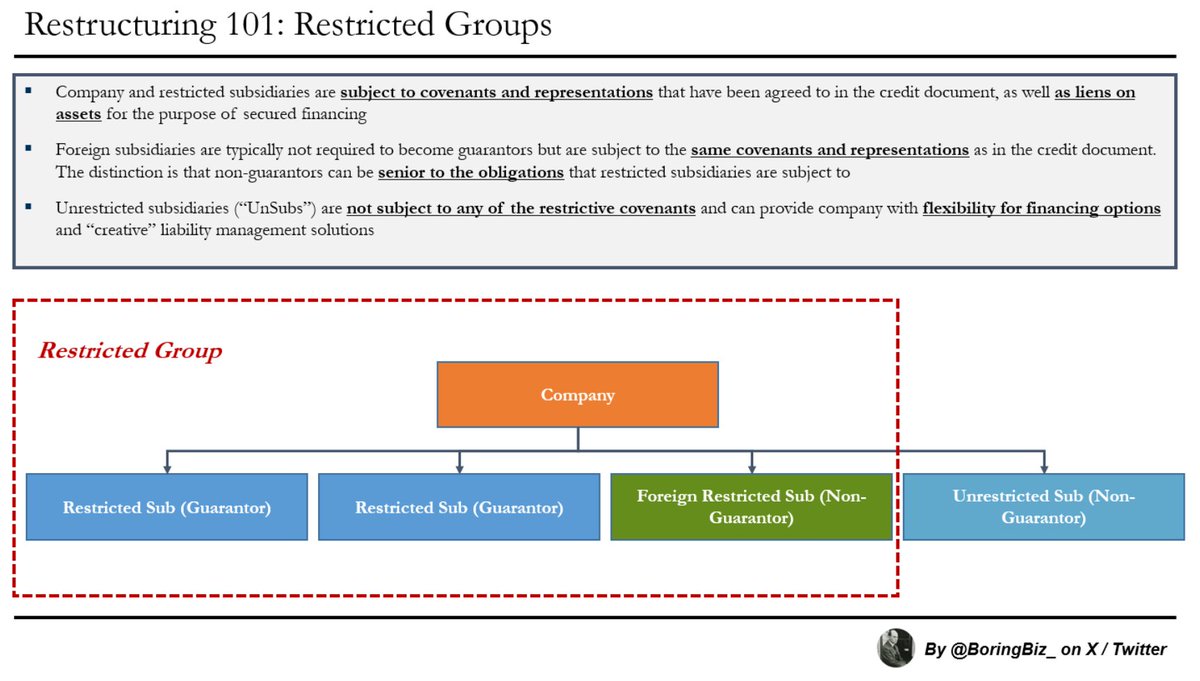

If you are interested in working in restructuring investment banking or distressed investing, this thread is for you A collection of my restructuring, credit doc and liability management primers 🧵 1/ Restructuring 101: Restricted Subsidiaries

There are many factors to consider when deciding whether to invest your money with someone. One critical question that few people ask—but that reveals a lot—is this: How much money does this person profit if I lose money with them?

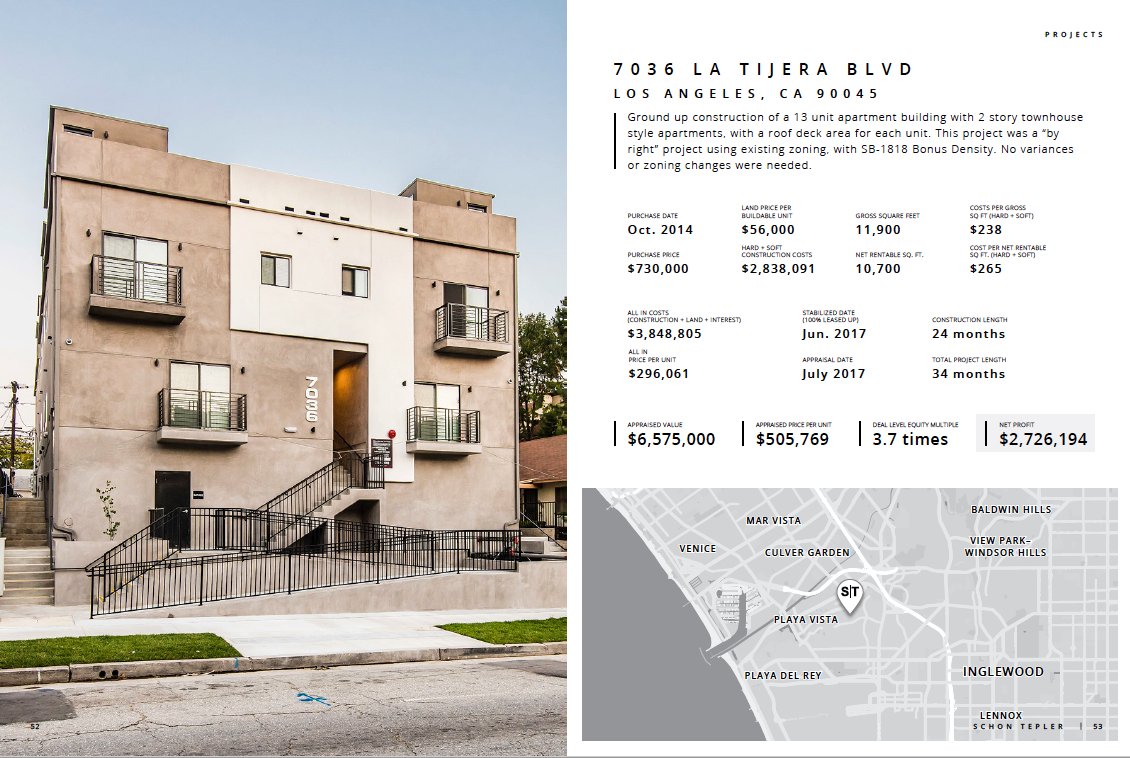

FEEs in Real Estate Typical Development Fees I have seen on ground-up MF development are: - 3% of the total cost; OR - 4-5% of hard and soft costs; OR - 5% of hard costs Prop Management Fee is 2.5-3% on institutional deals 👇

Amortization is an insurance policy for the lender that’s sold as an insurance policy for the borrower. For a responsible borrower, IO is always superior.

there’s always someone who knows how a building operates. usually it’s someone underpaid and isn’t on the cap table (manager/engineer/superintendent). foreclosing lenders need to find these people, promote+overpay them to prevent their assets from going to waste.

Not getting the exact outcomes you want in real estate deals leads to experience. Record the lessons; don't let them go to waste. Have "Business Lessons" and "Life Lessons" notebooks/checklists. Same lessons will keep coming until the lesson is learned (with variations)...

How you know you've made it: You get to stop doing business with assholes. No asshole clients. No asshole partners. No asshole investors. In the early days, when you're hungry, you have to do what you have to do. Bend over backwards for customers. Deal with disrespectful…

What is the most ideal CoGP structure for a younger GP to negotiate when moving up to doing institutional deals? IMO this is the IDEAL: - 90/10 co-investment with your CoGP from day one - 90/10 cost-overruns with CoGP - 50/50 on the promote

Jon Gray is worth $5.5 billion dollars In 30+ years of experience at Blackstone, he has grown from analyst to president of the largest real estate owner in the world 11 lessons from Blackstone's Jon Gray you should read:

Sam Zell is worth $5.2 billion dollars Known as the Grave Dancer, he has amassed a large part of his fortune during financial downturns He has shared his secrets to success in his book "Am I Being Too Subtle" Here are 10 lessons every investor should read:

If you want to up-level, consider subscribing to Fundrise, CrowdStreet, and RealtyMogul- three crowdfunding platforms offering insight into GP operators, LLC agreements, and presentations. Keep everything.

there are institutional-level JV docs that state that returns will be calculated per "excel's XIRR function". the fact that this has made its way into partnership language gives you a sense for the kinds of awful things people at the highest echelon of our industry spend (1/2)

Pro tip: How to upgrade the facade of your project to make it more appealing on a budget. One of the top local developers in Los Angeles gave my partner and me advice: "Spend $10 a foot more on the facade; it's worth it."

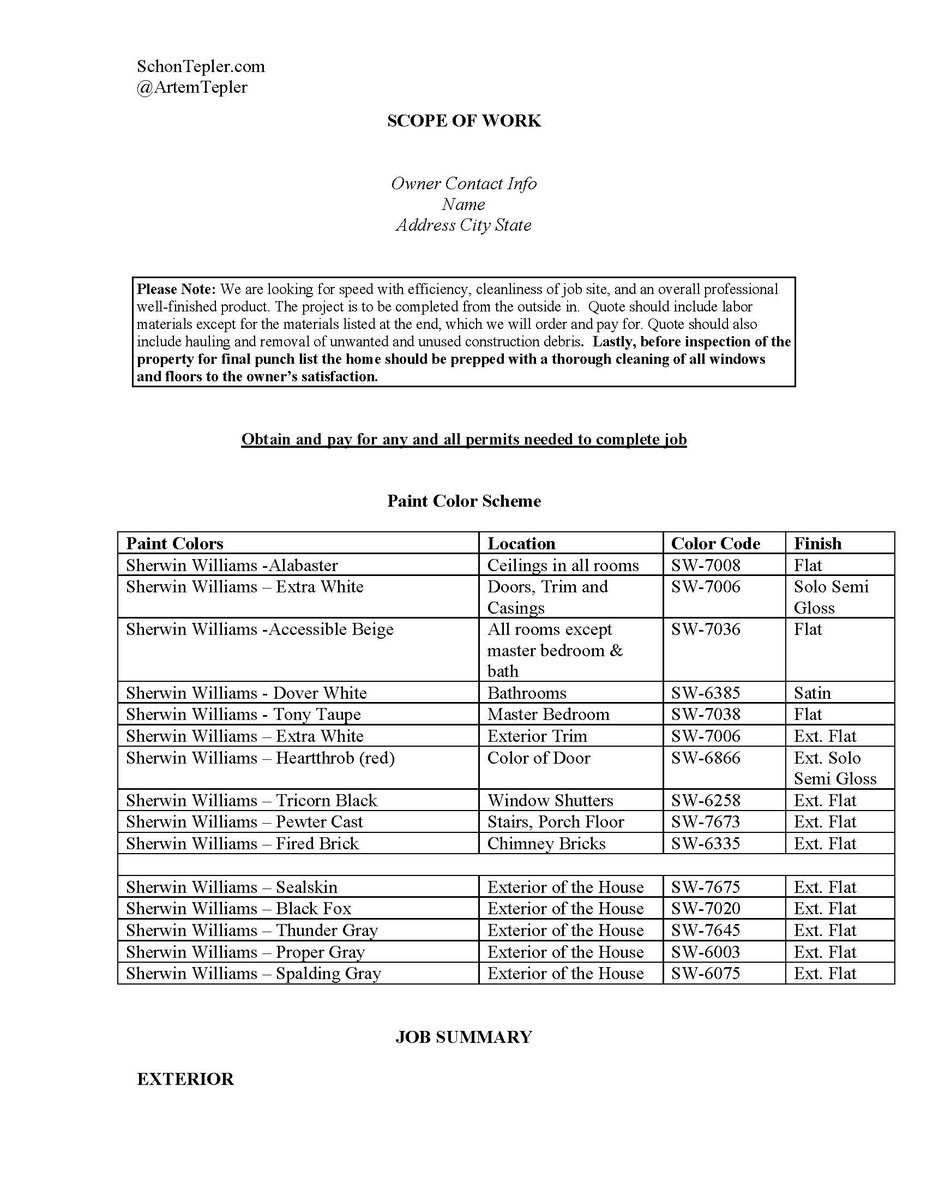

Rehabbing an Apartment or a House (Scope of Work Attached) Here are the steps to rehabbing a house or an apartment building: 1. Have a comprehensive scope of work to bid out to different GCs (attached, delete what's not needed)

When are people going to realize that, unless you have a value-add strategy, real estate investing is mostly just an interest rate play

You'd be surprised how much money is lost on a closing statement... Best advice I have received: Assume nothing, question everything Any war stories of losing/catching big errors on closing statments?

To protect their downside, they - Buy supply constrained real estate They don’t over leverage They try to buy at or below replacement cost They extend their debt early when possible They blend and extend existing leases constantly They only focus on one asset class

Mental note - make friends with estate attorneys.

United States Trends

- 1. Lakers N/A

- 2. Luka N/A

- 3. Clippers N/A

- 4. #TheTraitorsUS N/A

- 5. Colton N/A

- 6. Kawhi N/A

- 7. Vando N/A

- 8. Ayton N/A

- 9. Paolini N/A

- 10. #TNAiMPACT N/A

- 11. #criticalrolespoilers N/A

- 12. Iva Jovic N/A

- 13. #thepitt N/A

- 14. Harden N/A

- 15. Draymond N/A

- 16. Autopilot N/A

- 17. Zubac N/A

- 18. #LakeShow N/A

- 19. Maki N/A

- 20. Marcus Smart N/A

You might like

-

Roy Donnelly

Roy Donnelly

@roymdonnelly -

Thomas

Thomas

@thomasainvest -

The Schillne Retail Team

The Schillne Retail Team

@schillneretail -

Morgan Treaster

Morgan Treaster

@OKCriskguy -

CRE_Appraiser

CRE_Appraiser

@CreAppraiser -

Rob DuBroc

Rob DuBroc

@rob_dubroc -

nc

nc

@NCarm8 -

Justin Mullen

Justin Mullen

@JustinMullenCRE -

Anthony Le Grande

Anthony Le Grande

@MrLeGrande1 -

Jesse Shemesh

Jesse Shemesh

@JSPointAcq -

Rachael Jones

Rachael Jones

@clover_cap -

Josh Kantor

Josh Kantor

@JoshuaKantor

Something went wrong.

Something went wrong.