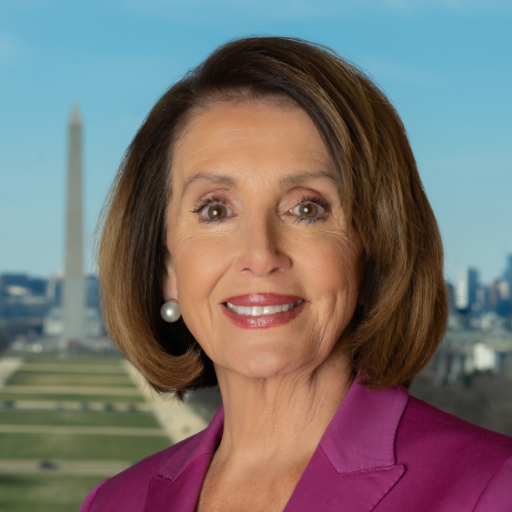

Varnit

@VolumeStack

Left my 9-5 after 10 years! Software engineer turned entrepreneur and trader. Building trading tech. Trade ideas ≠ financial advice. Think wisely!

Bạn có thể thích

$MARA Exactly 5 years ago today (Nov 16, 2020), it started a run from $2.38 to $26.38 by Jan 4, 2021. That's a 10x move in 7 weeks. Currently sitting at $12. Think history could repeat?

$MARA All 5 waves within this triangle look complete now. Per the textbook, it should break out of the triangle and move up next :)

Exactly!

#ETH "Something is coming" Likely Emergency Liquidity incoming. And it will make Crypto SOAR!!! BUT - it will only be for a brief (time-wise) - but massive rally.

$BTC #Bitcoin This Elliott Wave structure is holding well so far and all the fib levels are perfectly aligned.

$BTC $BTCUSD This is my Elliott Wave analysis of #Bitcoin. Notice that wave 4 retraced 61.8% of wave 3 and wave 5 topped around the 4.618 fib extension. And now it's doing an ABC correction within a broadening wedge, which also looks complete to me, unless it becomes a…

$ETH #Ethereum The previous chart I shared had log scale disabled. Here's the log version! A few more points here and there and it should be ready to move up in wave 5. Wave 4 should not enter the territory of wave 1, otherwise this entire setup gets invalidated. So price…

$ETH $Ethereum Technicals aside, let's have some fun. Do you think this creature gets filled with happiness by the end of the month?

$BTC $BTCUSD This is my Elliott Wave analysis of #Bitcoin. Notice that wave 4 retraced 61.8% of wave 3 and wave 5 topped around the 4.618 fib extension. And now it's doing an ABC correction within a broadening wedge, which also looks complete to me, unless it becomes a…

$MARA All 5 waves within this triangle look complete now. Per the textbook, it should break out of the triangle and move up next :)

Just picked up “Elliott Wave Principle” by Frost & Prechter. Time to level up the wave game!

$SHOP Looks like a double top here with RSI showing negative divergence. I'd be cautious as it might pull back to around $125.

$JD That nice looking structure on the weekly I shared earlier got invalidated yesterday. Now, back to basics. This trend line has acted as a solid flip zone over the past couple of years. Let's see if we get a hard bounce from here.

$JD My biggest position! 3,000 shares @ $35.15 + 100 Jan '26 $40 calls @ $2.27 Currently underwater but holding with conviction. Two setups on the weekly both pointing to the same move.. falling wedge breaking out and Elliott Wave triangle finishing up with RSI showing positive…

$UPST Per my analysis, this one's bottomed out. Volume stack should act as fuel to push it higher in the upcoming weeks/months!

If this $ETH Elliott Wave setup plays out as expected, I might launch an Elliott Wave training in the upcoming months. Would you be interested? :)

$ETH #Ethereum Wave 4 has retraced 61.8% of wave 3. Need to hold $3,200 on closing basis for this wave count to stay valid, otherwise it's gonna be screwed.

$BULL These are the fib levels to watch for potential support or reversal zones.

$ETH #Ethereum Wave 4 has retraced 61.8% of wave 3. Need to hold $3,200 on closing basis for this wave count to stay valid, otherwise it's gonna be screwed.

$HIMS This setup is broken now, but lower indicators are oversold and forming positive divergence. They have an event at 9am PST today. Buyback news or some sort of deal might save this, otherwise it could get ugly from here.

United States Xu hướng

- 1. Good Monday 30.8K posts

- 2. Eagles 176K posts

- 3. Goff 19.1K posts

- 4. Lions 81K posts

- 5. #MondayMotivation 28.4K posts

- 6. Dan Campbell 9,578 posts

- 7. #GirlPower N/A

- 8. Jalen 32.9K posts

- 9. House Republicans 29.3K posts

- 10. GM CT 22.1K posts

- 11. #ITWelcomeToDerry 9,304 posts

- 12. Alignerz 209K posts

- 13. Tom Cruise 17.9K posts

- 14. #BaddiesUSA 11.8K posts

- 15. Gibbs 7,485 posts

- 16. AJ Brown 8,114 posts

- 17. #OnePride 5,425 posts

- 18. Adoree Jackson 2,707 posts

- 19. Taxi 16.3K posts

- 20. Nakobe Dean 2,213 posts

Something went wrong.

Something went wrong.