WhiteWatersCapital

@WWCrobots

Unique algorithmic trading system for investors. Our pride: advanced risk management system for medium-term investments. #trading #investment

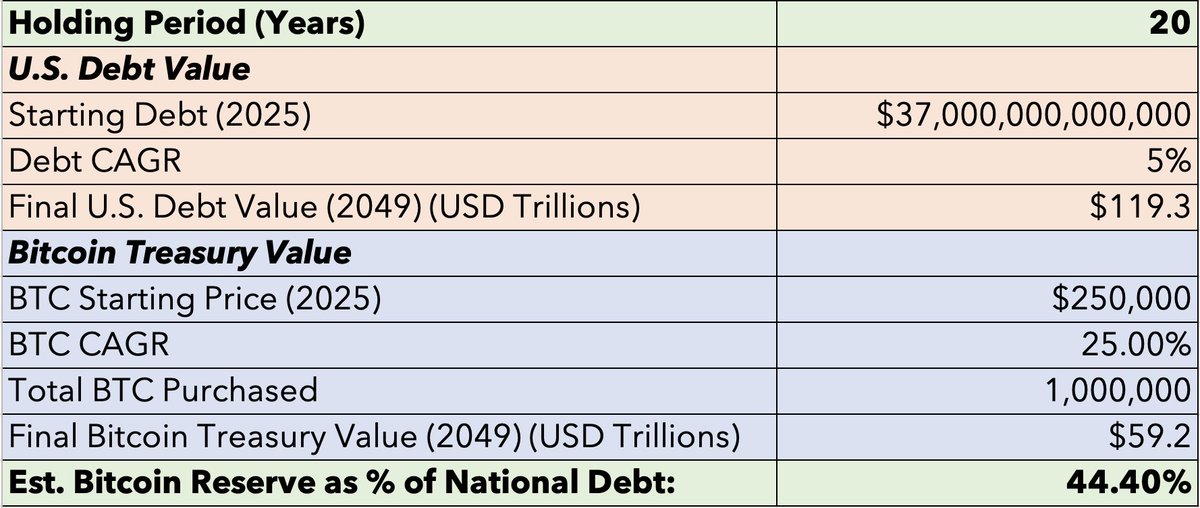

If the U.S. Treasury were to acquire 1 million BTC over the next five years, with an expected annual growth rate of 25%, projections indicate that by 2050, the U.S. could cover approximately 44% of its national debt. #Bitcoin #HedgeFund #Cryptocurrency #Finance #EconomicFuture

If history repeats itself on 'December 16' like in 2016 and 2020, BTC will skyrocket into the stratosphere from here!

🚀 Market Update: This year’s flat BTC and ETH conditions may seem confusing, but it’s a setup for future volatility. Our trading system thrived through August, emerging from drawdown as seasoned clients increase capital in anticipation of the next trend. 💪📈 #Crypto #Trading

📊 August Results Update from WhiteWaters Capital! 🚀 We're thrilled to announce that August has turned out to be the second most profitable month of the year for us!

d: 8 trades, +15.2% profit Total client gain: +4.93%. We've focused on high volatility, but BTC's decreasing volatility poses challenges. Always optimizing for client success! 💹 #Crypto #Trading #FinTech

One of the algorithms went long on Bitcoin on May 17, 2024, at $65,400. It closed the first half of the position at $66,547. The stop loss for the second half of the position is set at $64,580.4. The profit from the first half of the position has offset the potential risks.

At the moment, the market is range-bound, so algorithms are hardly entering trades. For example, there were 47 trades in February, but only 15 in April. However, there is no direct correlation between the number of trades and the account's profitability.

The key point is that over a 5-year period, our approach allows to outperform simple holding of the underlying asset by 10 times.

Position volatility -91% vs. our <11% drawdown in 2 years. Downside: robots captured only +10% in 50% Bitcoin surge. #trading #investment

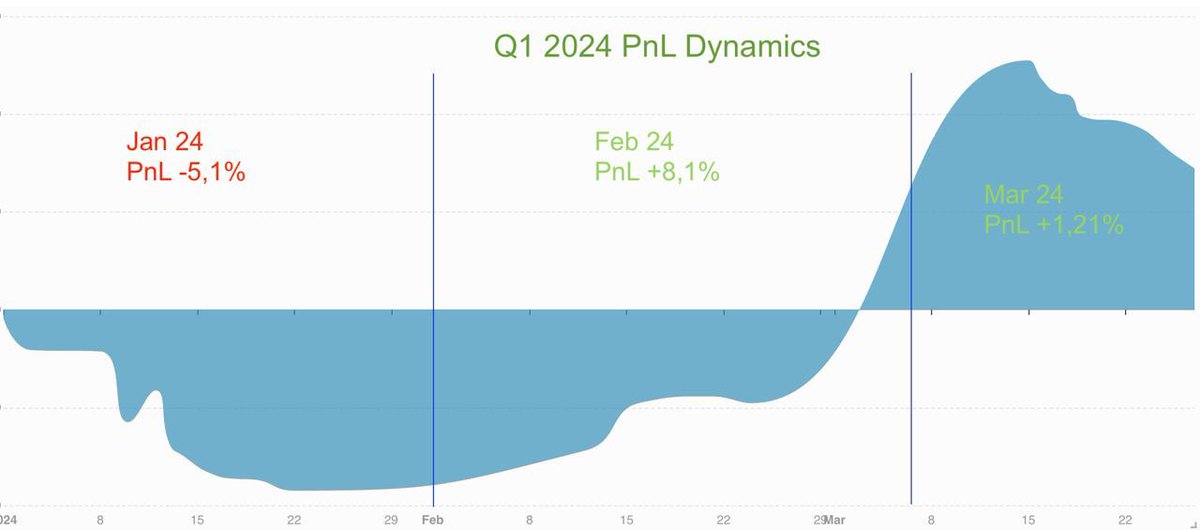

Continuing from previous post: January: Sideways market led to -5.1% drawdown. February: Strong trend resulted in +8.1% gain. March: Another sideways trend, closed at +1.21%. Our goal: long-term profitability with controlled risk. Short-term system won't outperform simple holding

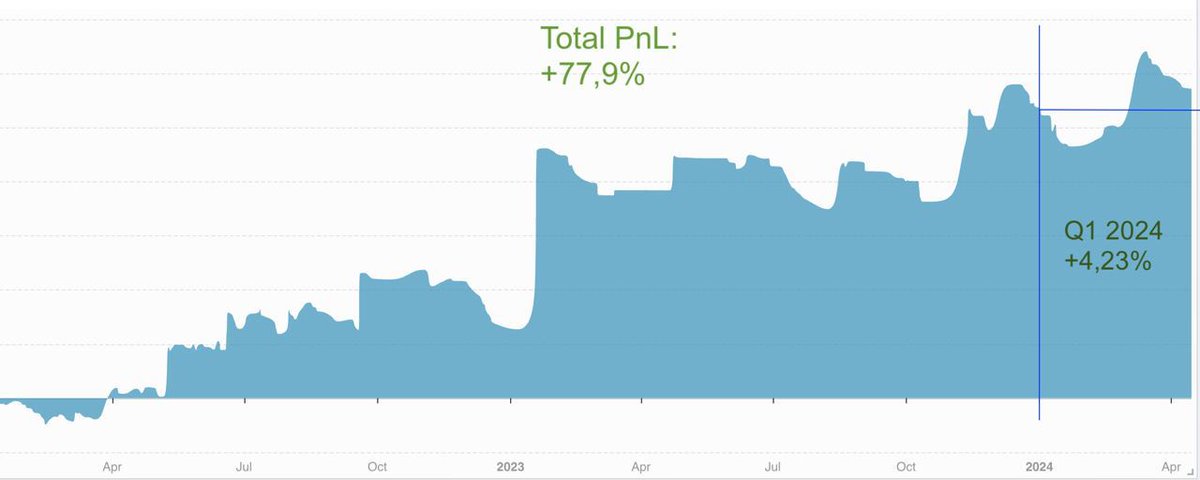

Hello everyone! We are thrilled to share the results of our hard work over the past years. For the entire period from January 2022 to the end of the first quarter of 2024: +77.9% For the 1st quarter of 2024: +4.23%

United States Trends

- 1. Belichick N/A

- 2. Staged N/A

- 3. Nebraska N/A

- 4. Michigan N/A

- 5. #WWENXT N/A

- 6. Bill Polian N/A

- 7. Hall of Fame N/A

- 8. Ilhan Omar N/A

- 9. #WonderMan N/A

- 10. Palat N/A

- 11. Brady N/A

- 12. Paul George N/A

- 13. #iubb N/A

- 14. Rutgers N/A

- 15. #DelcyLaVozDeLaPaz N/A

- 16. Jared McCain N/A

- 17. Steve Perry N/A

- 18. J Cole N/A

- 19. Spygate N/A

- 20. Tillis N/A

Something went wrong.

Something went wrong.