WhatCanIMakeToday

@WhatCanIMT

GME DD & Market Reform

Thank you @SECGov for processing the retail investor petition to close a RegSHO loophole exempting broker/dealers from delivery obligations when a seller fraudulently sells securities, lies about delivering and fails to deliver. We hope to see a rule change proposal soon!…

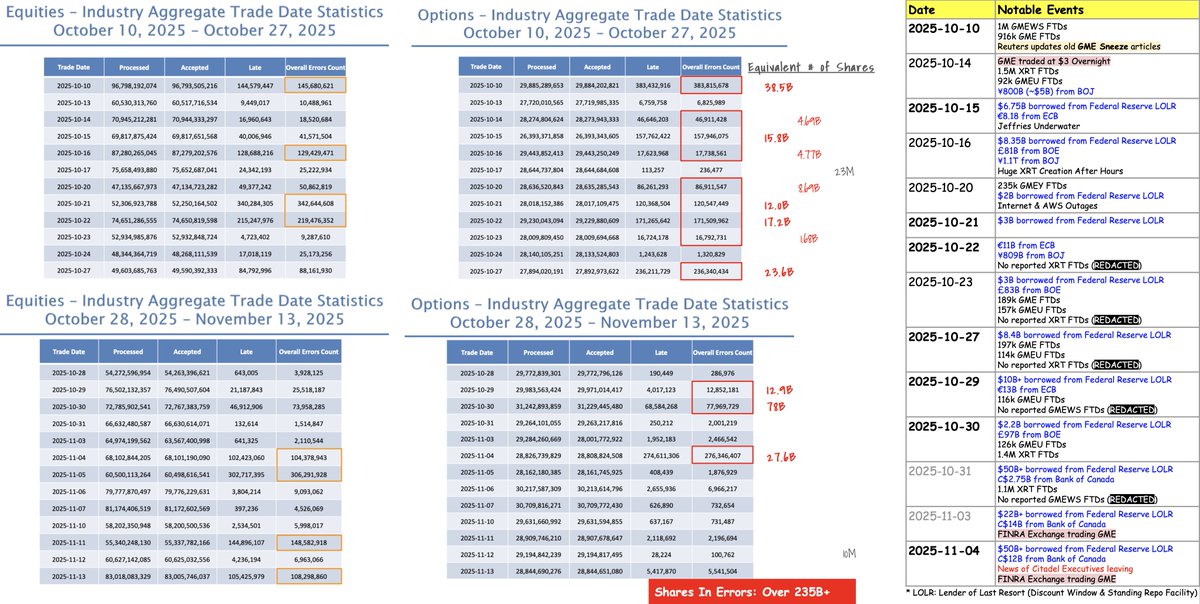

Over 160 billion shares affected by CAT Errors last month with more than half the month having billions of shares in errors per day. 🤡 Correlating those extreme error days with notable events tells a story about $GME, an idiosyncratic systemic risk. A story of FTDs, MSM…

$GME It looks like investors are trying to bypass off exchange internalization (FINRA) by placing buy orders above NBBO ask, which are then, probably illegally, filled off exchange, instead of routing them to the exchanges. The penalty for breaking rules is less than the cost…

BOJ 🇯🇵 lent ¥241B ($1.5B) last night. A drop of grease to keep the system going while Japan pushed through ¥21T ($135B) stimulus package.

Normally the BOE🇬🇧 would have published their Short Term Open Market Operations today, but 🦗 Did the BOE finally stop supporting insolvent financial institutions? Or did they just stop reporting their support to do it in secret?

Wait... this math gets worse. ECB did a 7-day operation today for $40M which leaves only $20M excess cash without Central Bank assistance from 🇯🇵🇪🇺 Wall St might be drowning without Central Bank help

🤔$6.52B Fed Reverse Repo today (basically "excess" cash to generate risk free interest). BOJ injected ¥1,017B (~$6.46B) last night of which ¥961B ($6.11B) from JGB purchases. Did BOJ provide $GME shorts with $6.46B in life support to park with the Fed? <$60M liquidity left?

🤔$6.52B Fed Reverse Repo today (basically "excess" cash to generate risk free interest). BOJ injected ¥1,017B (~$6.46B) last night of which ¥961B ($6.11B) from JGB purchases. Did BOJ provide $GME shorts with $6.46B in life support to park with the Fed? <$60M liquidity left?

‼️ $GME DISCOUNTS TODAY below $20 ‼️ Per last ER, GameStop had $8.7B in Cash+Equivalents plus 4710 BTC ($420M at $90k ea) = $9.1B assets ($20.34 per share) $19.99 is quite clearly a discount off of just the assets

BOJ 🇯🇵 injected a bit over ¥1T (~$6.5B) again. The last time the BOJ breached the ¥1T level was Oct 28; not even a month ago. $GME Shorts can't last a month without Central Bank intervention

What’s the point of a US Dept of Labor jobs report when there are no jobs? Duh!

BREAKING: The U.S. Department of Labor announces it is officially cancelling the October jobs report. Now why would they do that I wonder? 🤔😏

I think. Therefore I am invested in $GME

No borrowing from the Lender of Last Resort this morning. But that could be because banks are so broke they can't even qualify to borrow from the Lender of Last Resort (per Bloomberg) reddit.com/r/Superstonk/c…

€11.53B from the ECB 🇪🇺 today ⬆️ €1.68B from €9.85B last week

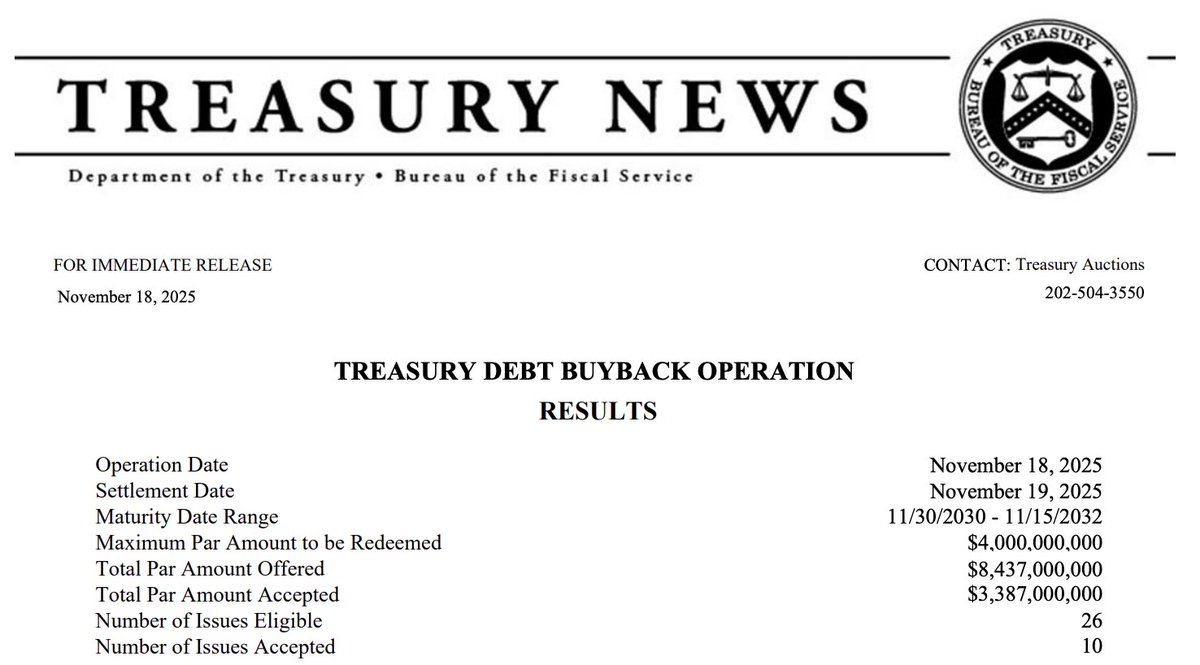

US Treasury bought back $3.4B in debt ... WHILE $8.4B WAS OFFERED 2.5x more was offered begging to be bought back

Today is a $GME squeeze day. Can’t go higher and can’t go lower. Better a rock and a hard place. 😈

GameStop with the extremely rare 0.00% day. You cannot make this up. $GME

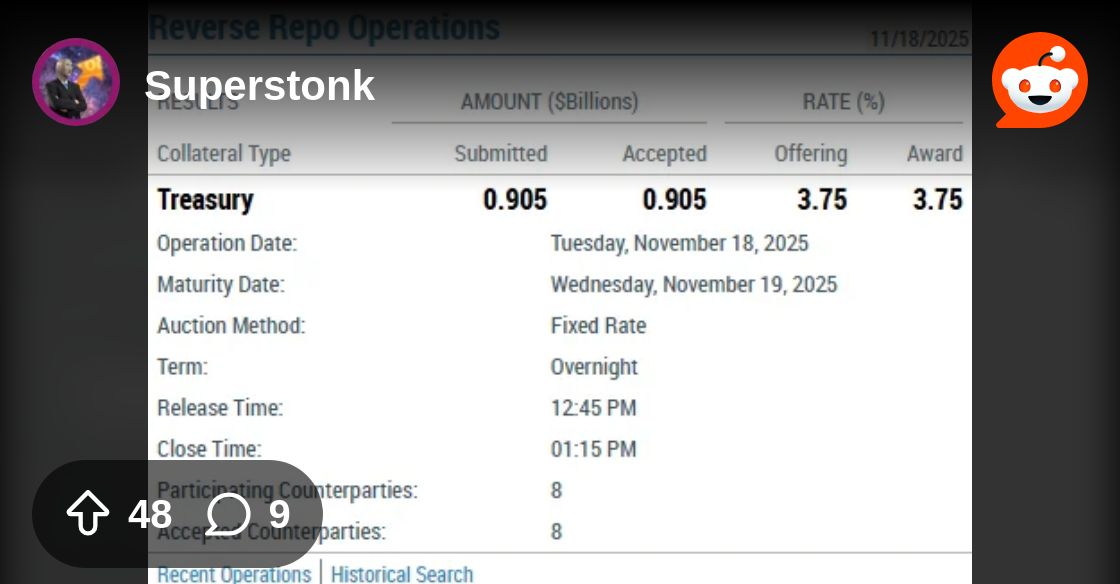

We got a new low on the Overnight Reverse Repo below $1B!!! Only $905M in reserves parked with the Fed! reddit.com/r/Superstonk/s…

GME FTD Spikes are now directly correlated with Federal Reserve Lender of Last Resort Borrowing reddit.com/r/Superstonk/c… And strange things happen at C35 with another computer outage when settlements are due... Wall St version of the dog ate my homework? reddit.com/r/Superstonk/c…

United States Trends

- 1. #BaddiesUSA 48.3K posts

- 2. Rams 27.4K posts

- 3. Cowboys 96.1K posts

- 4. Eagles 136K posts

- 5. Scotty 8,599 posts

- 6. #TROLLBOY 1,639 posts

- 7. Chip Kelly 7,548 posts

- 8. Stafford 13.2K posts

- 9. Bucs 11.8K posts

- 10. Baker 20.2K posts

- 11. Raiders 64.3K posts

- 12. #RHOP 10.3K posts

- 13. Stacey 29.1K posts

- 14. #ITWelcomeToDerry 12.6K posts

- 15. Teddy Bridgewater 1,140 posts

- 16. Todd Bowles 1,887 posts

- 17. Ahna 5,648 posts

- 18. Pickens 31.4K posts

- 19. Shedeur 126K posts

- 20. DOGE 154K posts

Something went wrong.

Something went wrong.