You might like

LlamaGuard NAV is the first in a suite of risk management solutions that level up our industry for institutional adoption. It’s helping @aave Horizon become THE focal point where TradFi meets DeFi.

Aave Horizon, the largest RWA lending market in DeFi, is upgrading its use of LlamaGuard NAV to leverage the Chainlink Runtime Environment (CRE) for robust pricing and enhanced security. Built in collaboration between Chainlink, @aave, @LlamaRisk, LlamaGuard NAV is purpose-built…

We’re at #SmartCon and we’ll be showcasing #LlamaGuard today, our next-generation oracle solution for scaling RWA adoption in DeFi, built in collaboration with industry leaders @chainlink and @aave. Catch our live presentation today at 10:25 AM at Union Square!

Past week, @aave Horizon TVL reached $370 M with $85 M in net borrows and $207 M in stablecoin supply. GHO market is now active and second-largest among stables. USCC/GHO E-Mode parameters were raised, boosting capital efficiency. Read the full update ↓

In protocols like @aave we have a dual responsibility to protect users from wrongful liquidations and protect protocol solvency. This calls for advancements in oracle design like our work on #LlamaGuard with @chainlink.

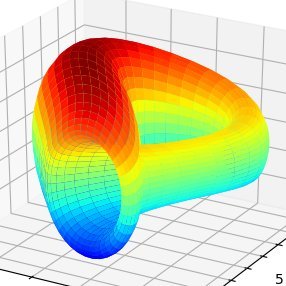

The Oct 10, 2025 market crash showed the significance of pricing strategy. This wasn’t a solvency crisis, it was a pricing failure. We looked at $USDe and the future of risk managed price feeds, powered by @chainlink and #LlamaGuard. Read our full analysis ↓

Less than 2 months after launch, @aave’s Horizon has surpassed $300M in total market size! LlamaRisk is proud to support this milestone, driving the adoption of RWA-backed loans through rigorous due diligence, parameterization, monitoring, and active risk management.

In week 6, @aave Horizon’s TVL surpassed $204M with ~$93.06M in stablecoins. RLUSD and USDC lead, together representing nearly 75% of TVL. @GHO supply sits at 4M after the Facilitator’s deposit. RLUSD & USDC markets remain incentivized. Read our highlights 👇

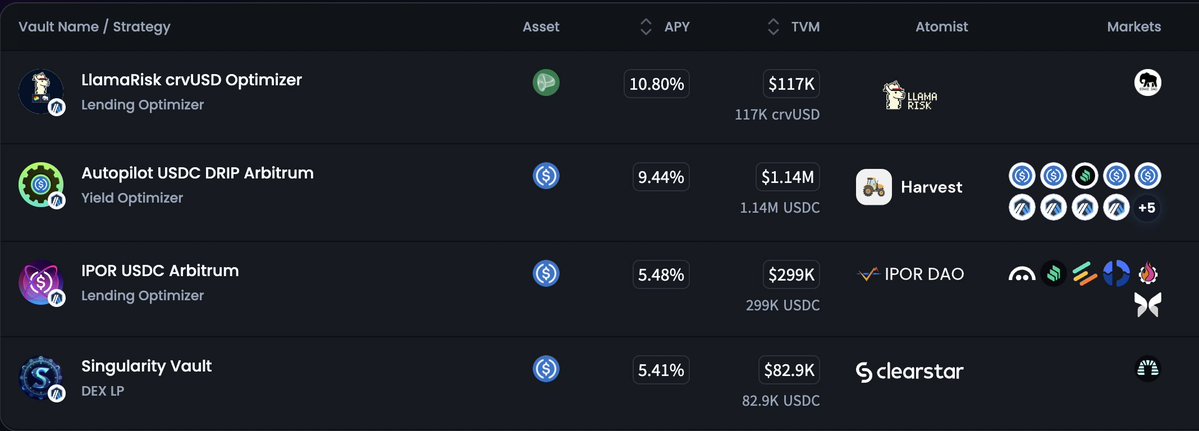

Earn the highest yield on IPOR Fusion Arbitrum in the $crvUSD LlamaLend Optimizer vault. This conservative vault strategy supplies stables to WBTC, WETH, and ARB LlamaLend markets with rewards boosted by @StakeDAOHQ V2 vaults link below👇

Exciting milestone today: @aave Horizon has crossed $200M in net deposits, making it the largest and fastest-growing borrow-lending market for tokenized assets. I expect a significant portion of the $33.5B in RWAs, and the trillions expected to follow, will ultimately find their…

In week 5, @aave Horizon’s TVL topped $176M with ~$77M in stablecoins. RLUSD leads at ~$57.3M. LlamaGuard NAV Oracle is live, adding dynamic bounds for RWAs, and Aave dev toolkit now fully supports Horizon. RLUSD & USDC markets remain incentivized. Read our highlights 👇

$crvUSD peg stability is one of our top priorities. Ways we support the peg: ✅ Stimulate lend market supply sinks in partnerships with @ResupplyFi and @StakeDAOHQ ✅ crvUSD parameterizations that support stability ✅ Detailed risk review and integrations for PegKeeper assets

crvUSD volatility is at ATL while crvUSD supply is around ATH

The first LlamaRisk crvUSD Optimizer Vault on IPOR Fusion is now live on Arbitrum! Big thanks to our partners @CurveFinance, @StakeDAOHQ, and @ipor_io. Curve Finance powers $crvUSD, one of the most trusted stablecoins in DeFi, StakeDAO brings a proven platform for staking and…

Aave Horizon markets have officially upgraded to LlamaGuard NAV! A collaboration with @chainlink and @aave, LlamaGuard NAV introduces dynamic bounds to Horizon’s NAV feeds. This upgrade presents the first phase of risk-managed oracles for tokenized RWAs, reducing friction for…

There seems to be an uncommon opportunity where $scrvUSD is yielding higher than the borrow rate in @CurveFinance $crvUSD mint markets.

The Chainlink Runtime Environment (CRE) is such an incredibly powerful tool for devs and this integration is a great example LlamaGuard NAV is an oracle solution purpose-built to price tokenized RWAs (e.g., money market funds) with sophisticated risk controls, built by…

Introducing LlamaGuard NAV Powered by Chainlink—a dynamic risk-adjusted oracle solution purpose-built for pricing tokenized real-world assets (RWAs), built in collaboration between Chainlink, @LlamaRisk, and @aave. llamarisk.com/research/llama… Built on Chainlink’s proven…

LlamaGuard NAV, built in collaboration with @chainlink and @LlamaRisk, is integrated with Aave Horizon, DeFi's largest RWA lending market. It's a dynamic risk-adjusted oracle for pricing tokenized RWAs, which is essential for attracting institutional users as Horizon scales.

Introducing LlamaGuard NAV Powered by Chainlink—a dynamic risk-adjusted oracle solution purpose-built for pricing tokenized real-world assets (RWAs), built in collaboration between Chainlink, @LlamaRisk, and @aave. llamarisk.com/research/llama… Built on Chainlink’s proven…

Introducing LlamaGuard NAV Powered by Chainlink—a dynamic risk-adjusted oracle solution purpose-built for pricing tokenized real-world assets (RWAs), built in collaboration between Chainlink, @LlamaRisk, and @aave. llamarisk.com/research/llama… Built on Chainlink’s proven…

It's been a long-time dream of mine to build on the @chainlink vision. I'm proud to say that as of today, @LlamaRisk is doing just that with LlamaGuard next-gen oracle solutions. LlamaGuard NAV will be going live on Aave Horizon .soon

Introducing LlamaGuard NAV ⛊ A next-gen oracle for RWAs, built with @chainlink & @aave, is going live in production on Aave Horizon. It delivers dynamic, risk-adjusted NAV feeds with automated safeguards, powering secure and scalable DeFi. Read the full announcement ↓

USDC lenders are currently earning 13% APY (!) on Horizon from Institutional borrowers using RWAs as collateral. Supplying stablecoins is permissionless, while using RWAs as collateral requires onboarding with each issuer.

13% APY for USDC suppliers on @aave's institutional instance, Horizon. Good Friday deal. app.aave.com/reserve-overvi…

The Horizon RWA market hit $80M deposits. Higher.

3 months into @Aave's Umbrella module, the data is compelling! This first-loss layer is a vast improvement on the legacy Safety Module, boosting efficiency, cutting the cost per dollar of coverage from $0.21 to $0.12. Our quants dug into the on-chain data—here's what we found.👇…

United States Trends

- 1. #GMMTV2026 4.19M posts

- 2. Good Tuesday 36.9K posts

- 3. #csm221 N/A

- 4. #OurCosmicClue_Wooyoung 16.6K posts

- 5. MILKLOVE BORN TO SHINE 617K posts

- 6. #tuesdayvibe 2,963 posts

- 7. #NuestraBanderaEsBolívar 2,666 posts

- 8. Mark Kelly 236K posts

- 9. Happy Thanksgiving 17.7K posts

- 10. Alan Dershowitz 4,414 posts

- 11. Taco Tuesday 13K posts

- 12. WILLIAMEST MAGIC VIBES 138K posts

- 13. Mainz Biomed N.V. N/A

- 14. Hegseth 112K posts

- 15. Thankful 49.2K posts

- 16. Praying for Pedro N/A

- 17. University of Minnesota N/A

- 18. Enron 1,966 posts

- 19. Witten N/A

- 20. Frank Gore N/A

You might like

-

Michael Egorov

Michael Egorov

@newmichwill -

C2tP

C2tP

@C2tP -

knows

knows

@evmknows -

LlamaRisk

LlamaRisk

@LlamaRisk -

Alunara

Alunara

@0xAlunara -

WenLLama

WenLLama

@WenLlama -

sam.frax

sam.frax

@samkazemian -

jo

jo

@clwnwrldnjyr -

Concentrator

Concentrator

@0xconcentrator -

Convex Finance

Convex Finance

@ConvexFinance -

crv.mktcap.eth

crv.mktcap.eth

@CurveCap -

dudesahn

dudesahn

@dudesahn -

Panda

Panda

@chonkypandu -

Votium

Votium

@VotiumProtocol -

Diligent Deer

Diligent Deer

@diligentdeer

Something went wrong.

Something went wrong.