Economic Highlights

@YieldKernel

News, analysis and research in economics/finance/business.

You might like

"Although applying a lower discount rate in a DCF raises the valuation, it assumes that cash flows are unchanged. Naturally, this is a flawed assumption and explains why there is no strong relationship between interest rates and equity multiples."

Tariffs past, present and future. With Doug Irwin on.ft.com/4jm4rC2

New CEPR Discussion Paper - DP19538 Fiscal Management of Aggregate Demand: The Effectiveness of Labor #Tax Credits Axelle Ferriere @AxelleFerriere @sciencespo @ScPoResearch @CNRS, Gaston Navarro @gmnavarro @federalreserve ow.ly/kkGq50TzQ8e #CEPR_MEF #CEPR_MG #economics

Silver hits 12-year high, chasing gold's record-breaking rally msn.com/en-us/money/ma…

In the July issue, "The Evolution of Technological Substitution in Low-Wage Labor Markets" by Daniel Aaronson and Brian J. Phelan zurl.co/6XcZ

An analysis of 185 C-level job specs showed that a significant percentage are poorly designed. Learn why the poor design of C-suite jobs can block executives from succeeding in their roles: mitsmr.com/3FWAzc9

The trailing 12-month P/E ratio for $SPX of 17.6 is below the 5-year average (22.8) and below the 10-year average (20.4). #earnings, #earningsinsight, bit.ly/3se9xqT

Demand swings keep retailers 'guessing' on inventory buff.ly/3ynDxDq

Where inflation is and is not...

Quasi-maximum likelihood estimation of break point in high-dimensional factor models ift.tt/VCabZLu #econometrics #timeseries

Stocks pared their gains and Treasury yields rose after the Fed said it will raise its benchmark interest rate. Here's a look at market reaction, in four charts. on.wsj.com/3MVXjfB

#SuperBowl is one of the biggest spending and earning events of the year! Here's what that means 👇 trib.al/7HKcbHD

The U.S. rate of inflation climbed again in January to 7.5% and stayed at a 40-year high, CPI shows. Upward pressure on consumer prices is unlikely to relent soon. Puts more pressure on the Federal Reserve to act. marketwatch.com/story/coming-u…

Experts cannot agree on how to measure #systemic #risk, with researchers having proposed a plethora of #indicators. B Hartwig @ecb, C Meinerding, Y S. Schüler @bundesbank proposes an analytical approach designed to lend structure to this plethora ow.ly/jo2T50HzfzF

Our Latest World Survey: The global economic recovery looks fragile at the start of 2022. economy.com/business-confi… #omicron #economy #inflation #businessconfidence

"The top 10 most-popular value ETFs hauled in $11.2 billion in the past three months." @LaraCrigger has the insights for 2022, read more: bit.ly/3rAZNWP

It’s raining records at Merrill Lynch; earnings show the firm posted new highs last year on numbers ranging from revenue to assets and net new ultra-high-net-worth clients bit.ly/3tPksZT @InvestmentNews @BDNEWSGUY

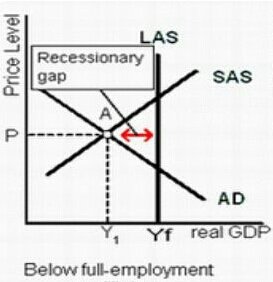

ECONOMY WATCH: U.S. economy slowed in December from rapid growth. ISM services index falls to 62% from record 69%. Labor & supply shortages still a big headache. Higher prices - inflation - also a problem. Omicron effect limited in December. Expect a bit worse in January ...

In 2022, consumers will continue to spend on home improvement as they've done since the pandemic began. That will boost retailers Home Depot and Lowe's. on.barrons.com/3sL41xp

U.S. Credit Outlook: Implications of Higher Interest Rates. economy.com/economicview/a… #interestrates #creditcards #credit #delinquency

United States Trends

- 1. #2025MAMAVOTE 1.37M posts

- 2. #KonamiWorldSeriesSweepstakes N/A

- 3. Tyla 15.5K posts

- 4. Fetterman 67K posts

- 5. No Kings 147K posts

- 6. Deport Harry Sisson 24.9K posts

- 7. Somalia 30.2K posts

- 8. Miguel Vick N/A

- 9. #SpiritDay 1,275 posts

- 10. Dave Dombrowski N/A

- 11. Andrade 6,504 posts

- 12. GTreasury 3,647 posts

- 13. #thursdayvibes 3,681 posts

- 14. Mila 17.5K posts

- 15. Ninja Gaiden 25.2K posts

- 16. #WorldFoodDay 36.2K posts

- 17. Yung Miami N/A

- 18. Jennifer Welch 7,785 posts

- 19. Starting 5 7,666 posts

- 20. Turkey Leg Hut N/A

Something went wrong.

Something went wrong.