MikeG

@ZenCryptoLab

Liquidity-first framework for crypto market cycles. Context, timing, and risk - interpreted through human judgment and experience.

Most crypto losses come from reacting to noise rather than understanding risk conditions. I focus on liquidity regimes and how they shape timing, risk, and market behavior across cycles. Some nuance omitted from the timeline intentionally.

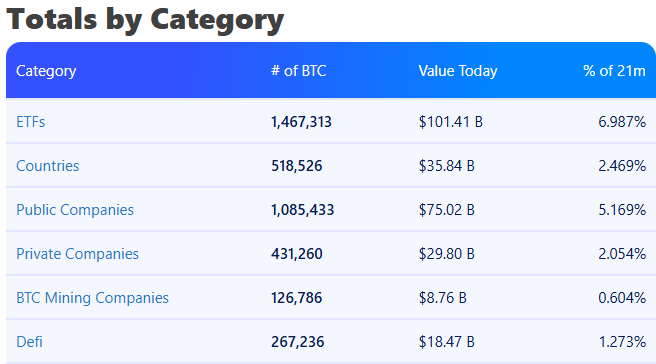

The supply holder stats below highlight an important consideration… This is not your Grandad’s crypto market anymore. Changing conditions require a change in thinking about risk and a change in decision making criteria. Traditional assumptions do not apply.

Nobody's talking about this: ~14% of Bitcoin's entire supply is now in institutional hands. - ETFs: 7% - Corporates: 5% - Governments: 2.5% source @BitboBTC

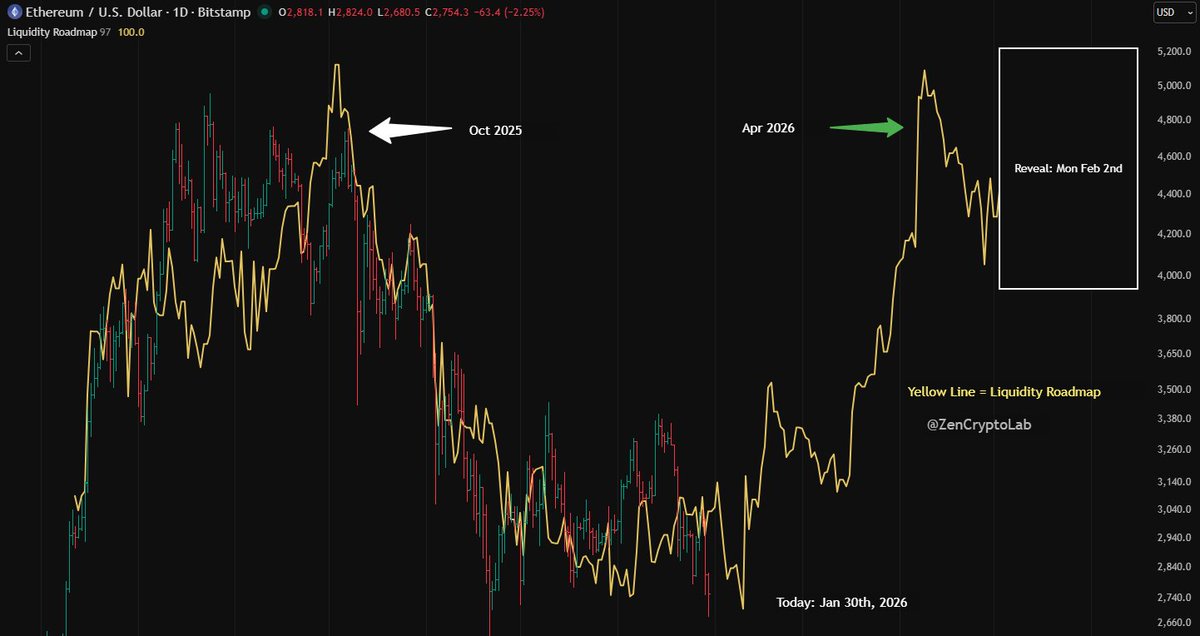

WEEKLY UPDATE: Liquidity Roadmap Update In the video I shared this weekend, I go through recent price action and near-term nuance. The leading edge of the liquidity roadmap is revealed ahead of the usual Monday update in this video.

This is the second video in a short series where I’m sharing how I think through liquidity conditions and frame my decisions around participating in crypto markets (Bitcoin and Ethereum focused). If the last few weeks have felt harder to interpret than usual, this is about…

Price is going to lure some people in this morning. This price action is unfolding as liquidity conditions suggest and what I reviewed in yesterday’s video.

This is the second video in a short series where I’m sharing how I think through liquidity conditions and frame my decisions around participating in crypto markets (Bitcoin and Ethereum focused). If the last few weeks have felt harder to interpret than usual, this is about…

WEEK-END WRAP UP: The market is sitting within a contraction range ahead of a potential expansion pivot. The magnitude of this week’s price action, coming on the heels of a recent dislocation, suggests forces beyond routine volatility are influencing behavior during this…

I’ll be sharing another video soon, covering nuance and liquidity cycle concepts I go through privately. The crypto market is on edge with recent price action and financial markets in general are on high alert given geopolitical uncertainty. I’ll touch on these topics and my…

Sometimes the investment or trading edge you have prevents you from losing capital, not just building it. The liquidity roadmap can help minimize risk in crypto. Please share if this has helped you and spread the word.

Monitor the liquidity roadmap long enough and you’ll start to notice that all of the explanations for market movements in crypto are largely narrative and noise. There are circumstances where those external factors matter, I’ve referenced them regarding last week’s price action…

It is somewhat amusing how a large portion of CT berates the Fed for printing money but is both dependent on them to pump their bags and hates on them when they take a tight money stance. See things as they are.

WEEKLY UPDATE: 3 Month Outlook 🔍Current Phase: price has dislocated from liquidity conditions ahead of the near term contraction to expansion pivot zone. I've pointed out a prior price dislocation during the last geopolitical conflict in June 2025 in the chart below.…

I highlighted in a recent video that the liquidity contraction in the roadmap would initiate between that day and the same time next week. Today is about the midpoint of that window. I am operating under the view that current market conditions are not dominated by that…

Some elements of the selloff in crypto right now was in the cards - driven by liquidity conditions - known in advance. Geopolitical issues are not helping. Follow the liquidity roadmap. Stop getting kicked in the crotch.

This video provides context on how I’m framing current liquidity conditions and associated risks as conditions shift in the near term. It reflects the type of nuance and timing context I typically work through privately when markets are in transition. NOTE - There's one outcome…

WEEK-END WRAP UP: This week highlights elevated noise as markets are reacting to geopolitical uncertainties and US policy choices. While price action could be interpreted as an early arrival of the expected liquidity contraction ahead of a February expansion, confirmation…

I go over the following key concepts for tracking liquidity in crypto markets in yesterday’s video below. Here are the key concepts: 1. Lags and delays 2. Signatures 3. Cycle resets 4. Shocks and dislocations

This video provides context on how I’m framing current liquidity conditions and associated risks as conditions shift in the near term. It reflects the type of nuance and timing context I typically work through privately when markets are in transition. NOTE - There's one outcome…

This video provides context on how I’m framing current liquidity conditions and associated risks as conditions shift in the near term. It reflects the type of nuance and timing context I typically work through privately when markets are in transition. NOTE - There's one outcome…

I’ll be sharing a video over the next day, schedule permitting, that covers nuance I don’t typically address in short-form posts. It’s a continuation of how I frame recent liquidity conditions and changes leading into February.

WEEKLY UPDATE: 3 Month Outlook 🔍Current Phase: Current price movement is looking like an early arrival of the February pivot. While anything is possible in markets, I caution this interpretation at this point. See quoted post below. 🔭Next Swing: The leading edge reflects a…

For those following the Liquidity Roadmap, the market's response over the last 5 plus days, including the sell off today certainly looks like the signature of the contraction prior to the February expansion implied by liquidity conditions. CAUTION - if this scenario turns out…

For those following the Liquidity Roadmap, the market's response over the last 5 plus days, including the sell off today certainly looks like the signature of the contraction prior to the February expansion implied by liquidity conditions. CAUTION - if this scenario turns out…

United States Trends

- 1. El Paso N/A

- 2. #njnbg N/A

- 3. Jake Lee N/A

- 4. Rio Rico N/A

- 5. Wemby N/A

- 6. #njpw N/A

- 7. Carlos Palazuelos N/A

- 8. Nancy Guthrie N/A

- 9. Tumbler Ridge N/A

- 10. Thomas Frank N/A

- 11. Bronny N/A

- 12. Mizuki N/A

- 13. British Columbia N/A

- 14. Dahyun N/A

- 15. Pacers N/A

- 16. Tucson N/A

- 17. #OlandriaxYSLBeauty N/A

- 18. Flour N/A

- 19. Spring Festival N/A

- 20. #T20WorldCup N/A

Something went wrong.

Something went wrong.