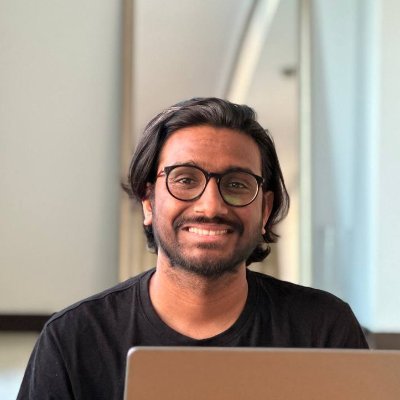

adityagite🌊🥑

@ad_git

Product @0xfluid; Tinkering @Instadapp; @BlocSocIITR; @summerofbitcoin’ 22 ; prev @0xPolygon, @0xppl_, @labs_orbit; alum @iitroorkee

abyss

Tham gia vào Tháng 5 2021

Bạn có thể thích

United States Xu hướng

- 1. Tulane 10.7K posts

- 2. #SmackDown 32.1K posts

- 3. Gunther 20.3K posts

- 4. North Texas 6,887 posts

- 5. #ROHFinalBattle 15.6K posts

- 6. Anthony Davis 1,741 posts

- 7. #OPLive 2,578 posts

- 8. LA Knight 10.3K posts

- 9. Cocona 32.7K posts

- 10. #TNAFinalResolution 6,063 posts

- 11. Athena 9,578 posts

- 12. UNLV 3,723 posts

- 13. Boise State 2,704 posts

- 14. Kennesaw State 3,533 posts

- 15. Mark Pope 3,141 posts

- 16. Persephone 2,609 posts

- 17. #OPNation 1,038 posts

- 18. Trouba N/A

- 19. Jimmy Rogers 2,437 posts

- 20. Wes Miller N/A

Bạn có thể thích

-

prady

prady

@prady_v -

VK

VK

@0xVK__ -

Blockchain Society IIT Roorkee

Blockchain Society IIT Roorkee

@BlocSocIITR -

Kaushik kumar

Kaushik kumar

@kauku_shikmar -

Kautuk | Conscious Engines

Kautuk | Conscious Engines

@Kautukkundan -

CB @IBW🚀

CB @IBW🚀

@0xSeeVK -

eth_sign | Lucidly

eth_sign | Lucidly

@eth_sign -

Darpit Rangari | pnp.exchange

Darpit Rangari | pnp.exchange

@proxima424 -

Aditya Kalsaria

Aditya Kalsaria

@AdityaKalsaria -

Ishan

Ishan

@iishann14 -

rajat

rajat

@cro0k_ed -

Ashis 👨💻🏗

Ashis 👨💻🏗

@akp111_eth -

shriya

shriya

@0xShriya -

lomna 🧢

lomna 🧢

@AlmostAnmol -

PROBOT

PROBOT

@pr0b0t1sc00l

Loading...

Something went wrong.

Something went wrong.