adityagite🌊🥑

@ad_git

Product @0xfluid; Tinkering @Instadapp; @BlocSocIITR; @summerofbitcoin’ 22 ; prev @0xPolygon, @0xppl_, @labs_orbit; alum @iitroorkee

คุณอาจชื่นชอบ

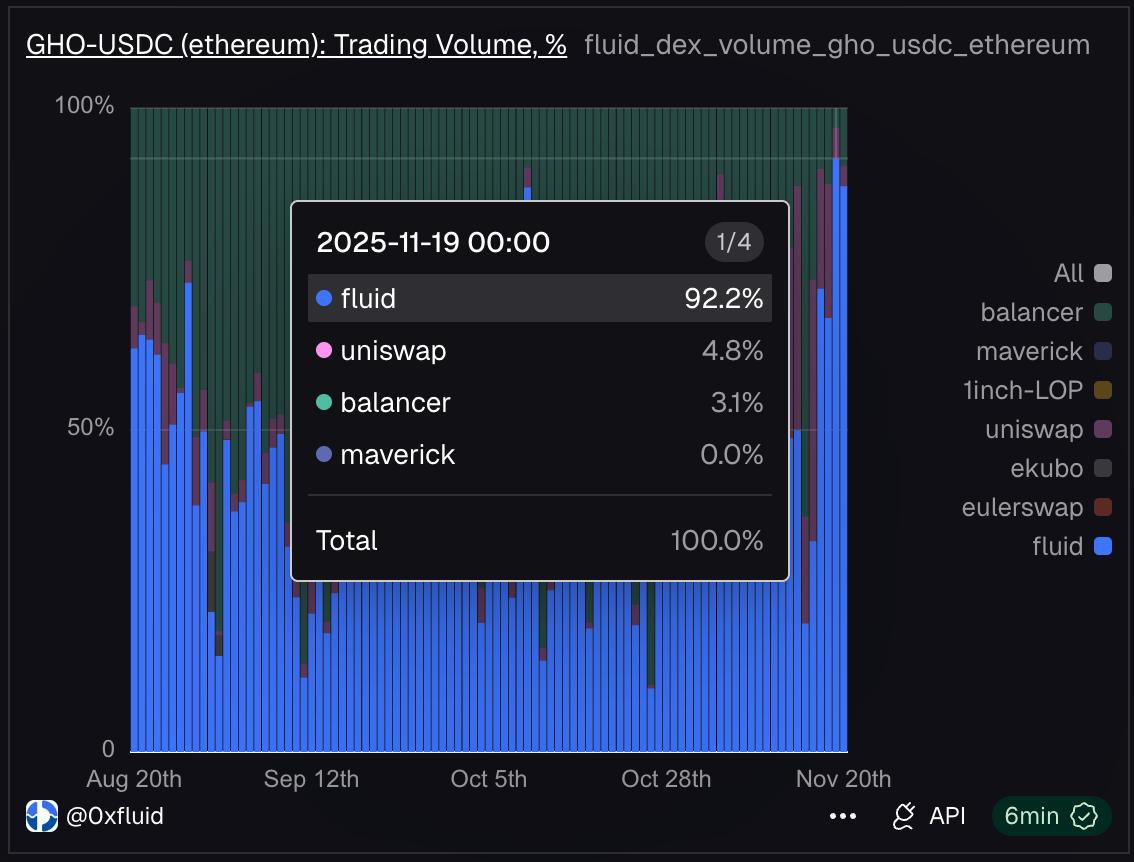

92.2% of all GHO-USDC trading volume is now routed through @0xfluid Up from 40% just a few weeks ago. /fluid 🌊

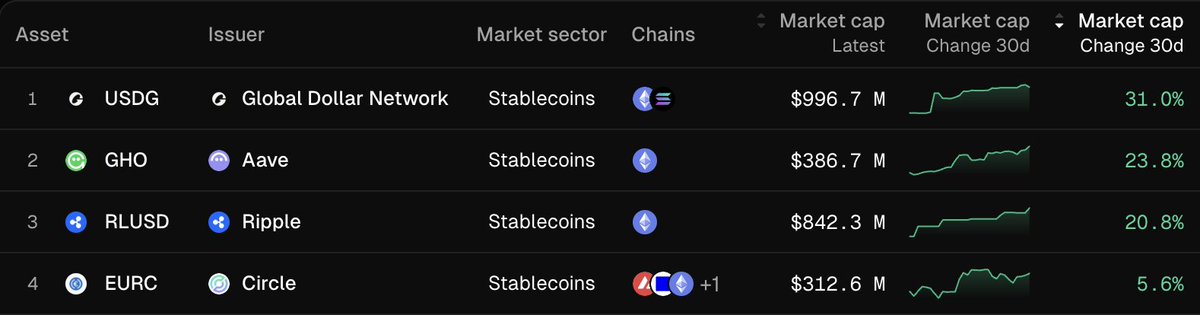

Fastest growing stablecoins in the $100M-$1B supply range: 1. USDG by @global_dollar 2. GHO by @aave 3. RLUSD by @Ripple 4. EURC by @circle A common denominator for all 4 is that they have a deployment on @ethereum.

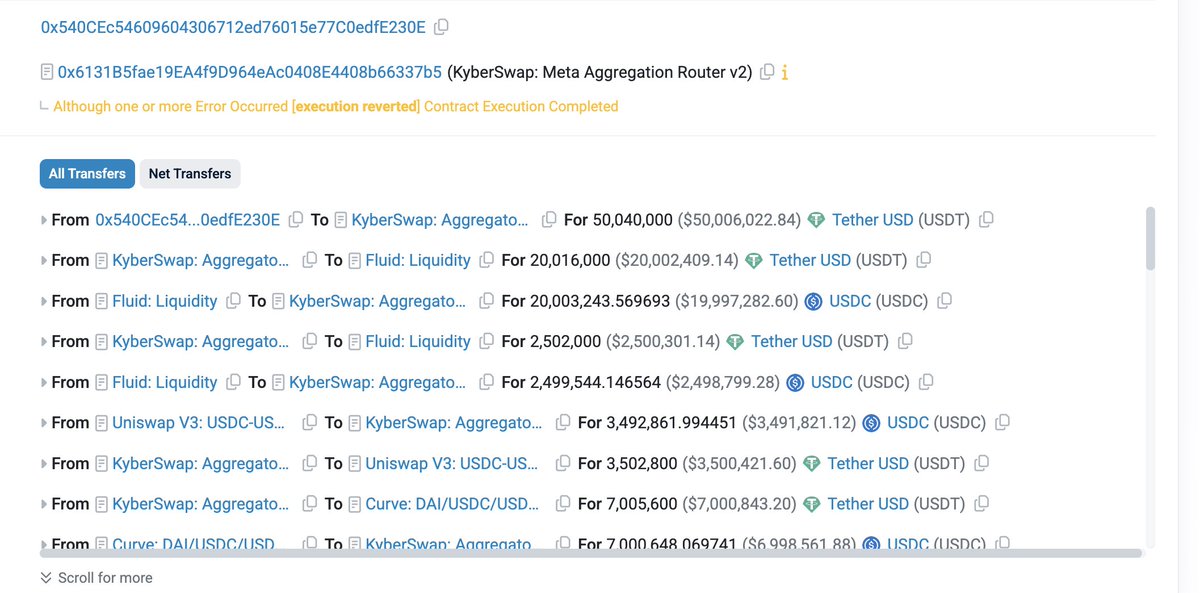

Someone did a $50M trade of USDC to USDT on @KyberNetwork and $28M routed from @0xfluid. Entirely of this trade went through our smart debt pool allowing users to earn on their debt. 🌊🌊🌊🌊🌊

Kyber handled 50M in a single tx, the whole process took only 5s. This is the beauty that TradFi never comes close. On the other note, @0xfluid liquidity handled 28M by itself in this trade, amazing.

met the cto of one of the fluid auditors (top 3 auditor imo) told me he put half of his personal networth in fluid after he reviewed the code there’s no bigger vote of confidence than an auditor putting perosnal money into your protocol

We just landed in the beautiful city of Buenos Aires! 🇦🇷 Its going to be a huge week for Fluid: multiple talks, panels and a booth (with merch 👀) during @EFDevcon, @arbitrum, @stable_summit, @ethconomics, @eigencloud and @MetaMask events. 🗓️ Wednesday, Nov 19 ▪️11:15–11:45am…

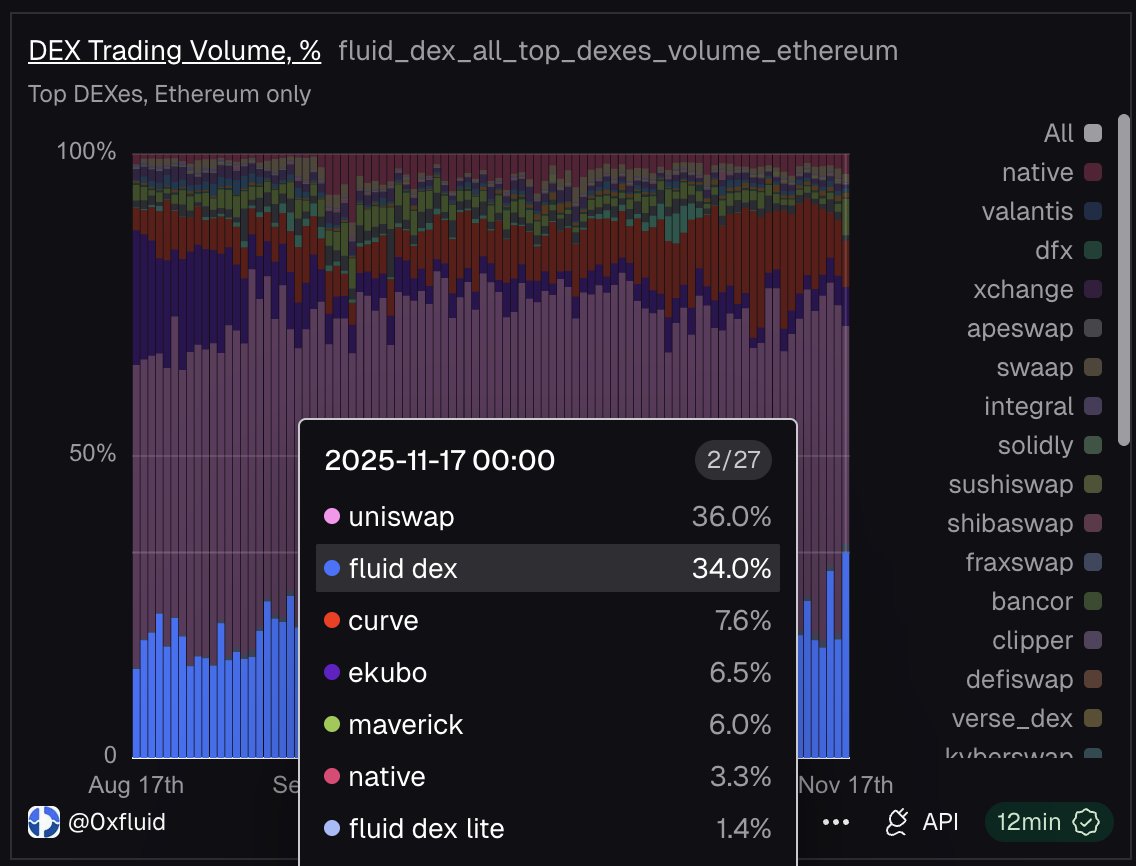

If you made any swaps on Ethereum in the last 30 days using any aggregator, there’s a 1-in-3 chance your trade was routed through @0xfluid. Let. That. Sink. In. /fluid 🌊

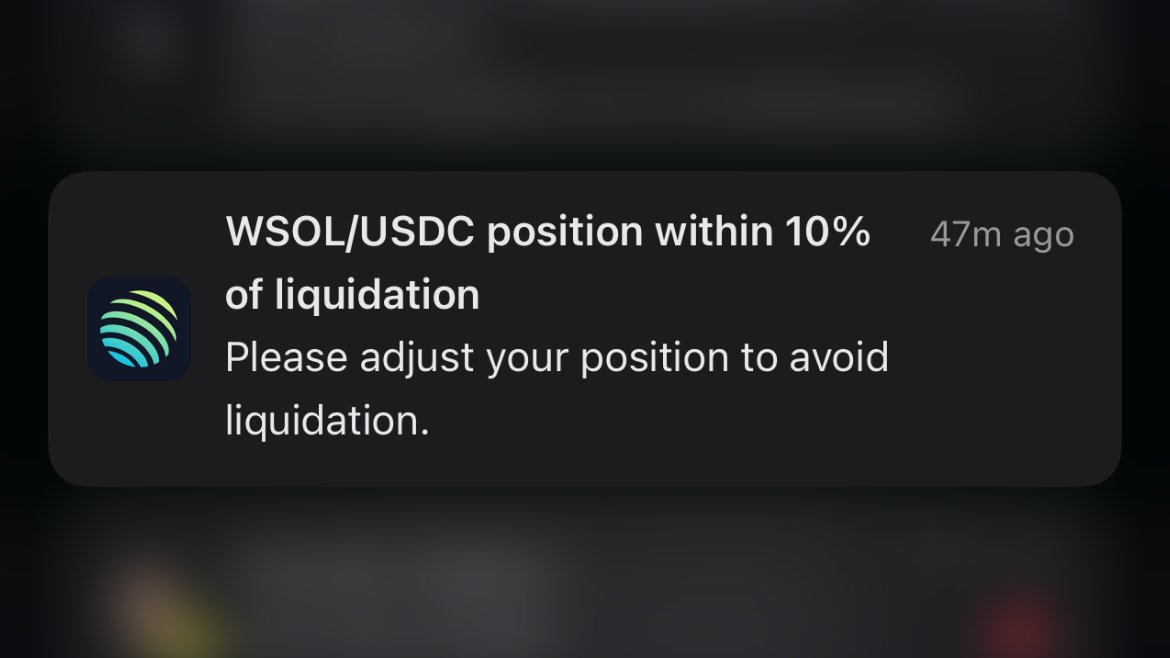

liquidation warnings are coming to @jup_mobile very soon hopefully, you never get this notification. but if you're near liquidation, we want you to know so you can top-up and stay safe. jupiter lend is better for borrowers 🫡

Catch us at DeFi Today event at the main venue @EFDevcon on November 21st at 2:30pm Alpha drop on Fluid DEX v2 with @DeFi_Made_Here 👀🌊

Jupiter Lend is better and safer for borrowers. 1⃣ Our groundbreaking liquidation engine is so efficient that our penalties are only 0.1% — 10x lower than the nearest competitor. We only bring your position back to a point of health, instead of blindly removing massive chunks…

i can't keep my silence anymore - i feel compelled to expose this honeypot that @jup_lend issued

I have spent most of my professional career studying how diseases progress, with the best scientific minds at IISc, Bangalore. In most cases, the body shows some signals before the disease takes shape. These signals can either be in your lab reports, or can be an anomaly in your…

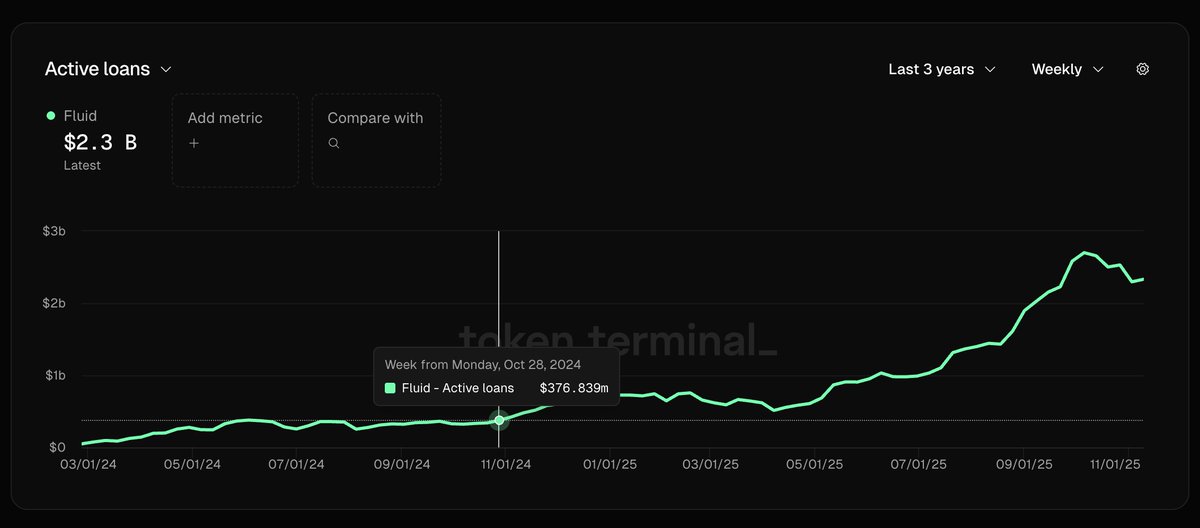

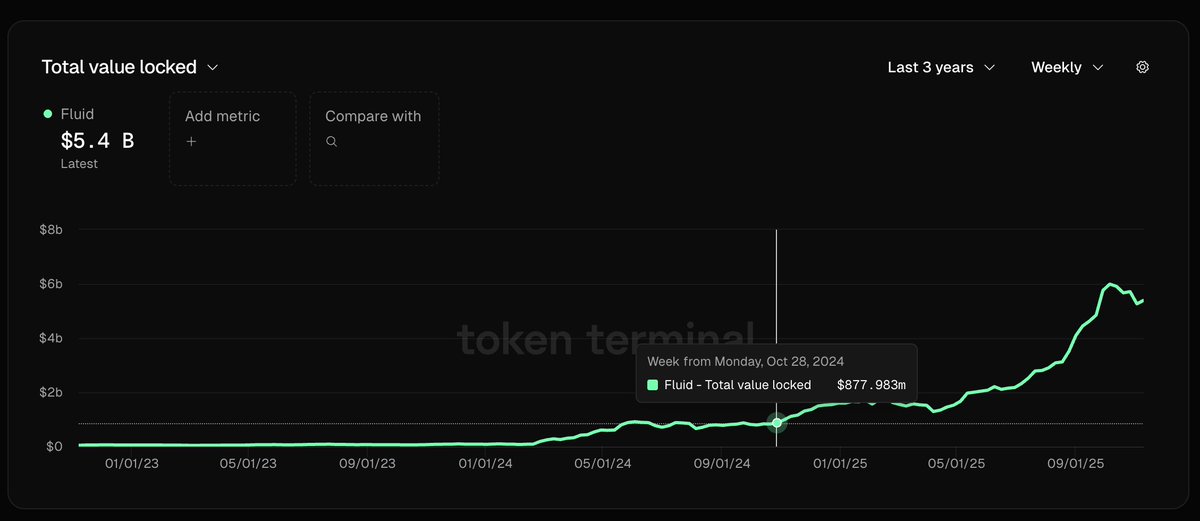

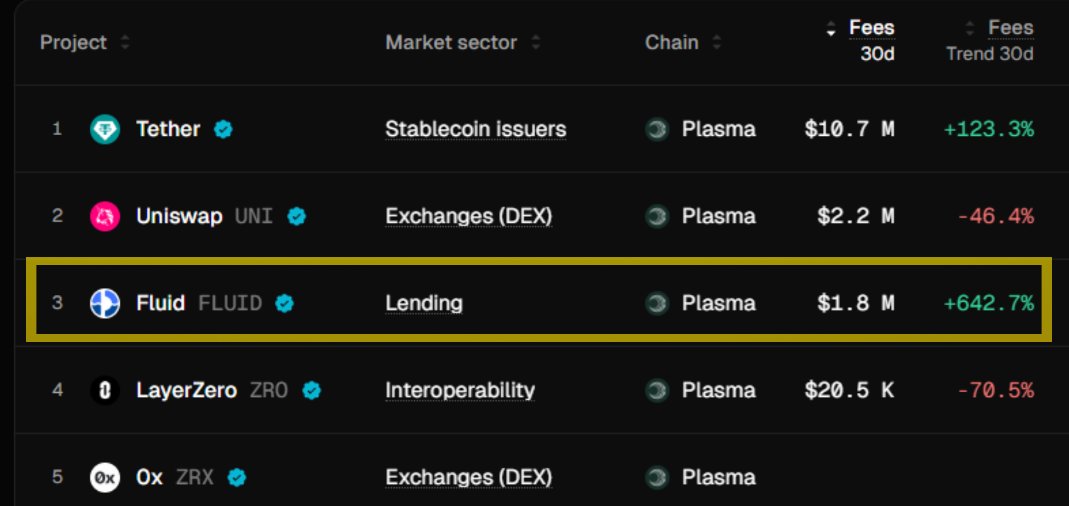

the most under discussed growth story in all of crypto since Fluid DEX launch just over 1 year ago: - active loans have grown from $376m to $2.3b (+511%) - TVL has grown from $877m to $5.4b (+515%) i can't wait to see what the future holds for this protocol

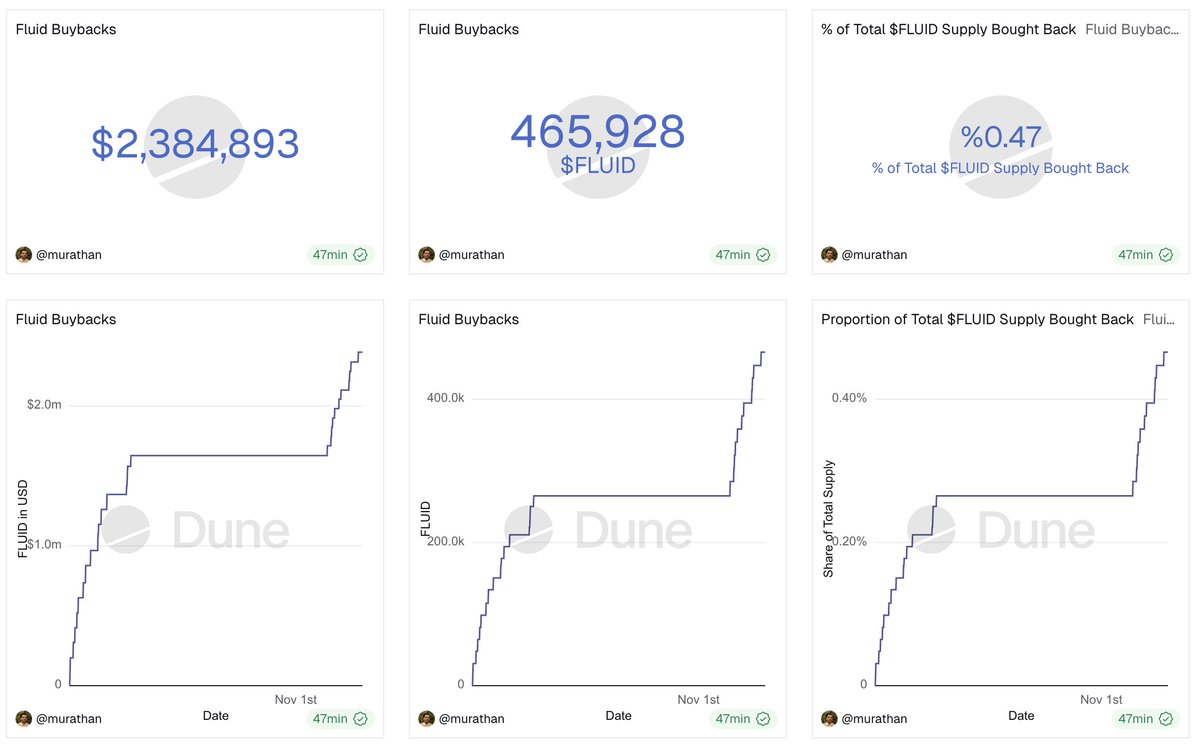

0.47% of total supply is bought back in just ~40 days of revenue buybacks. This does not include revenue from @jup_lend yet.

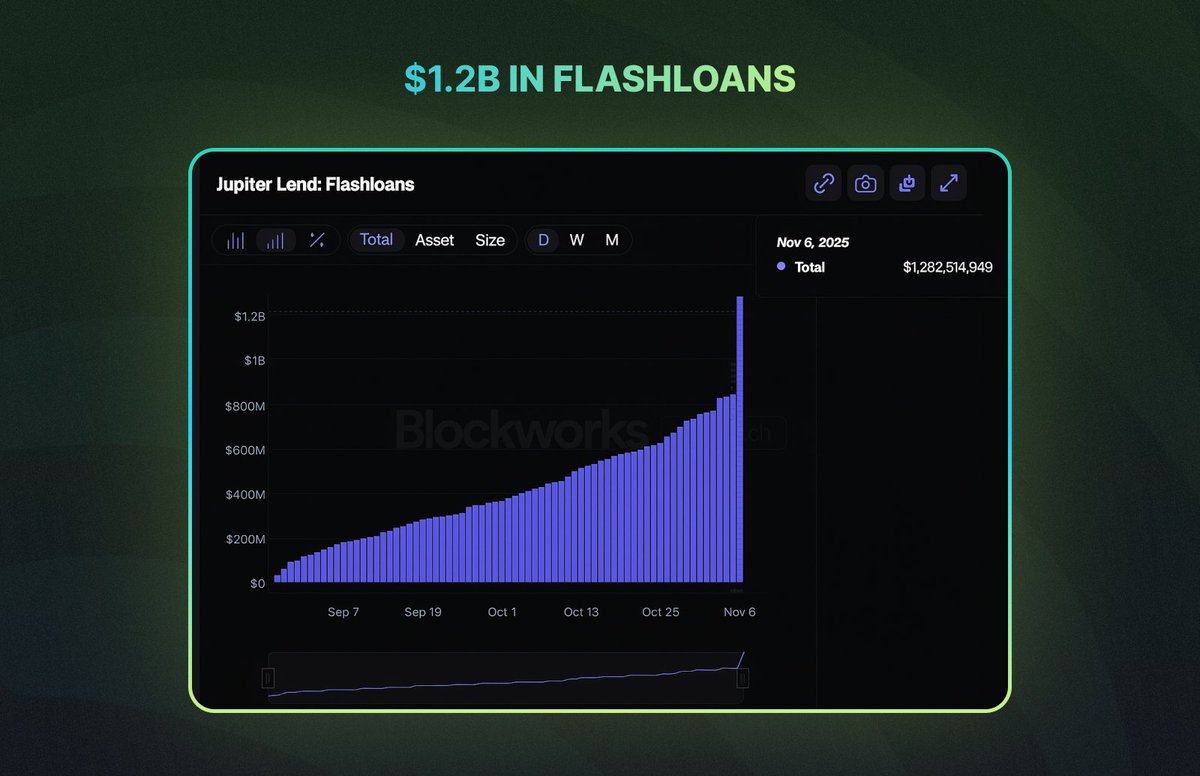

BREAKING: Jupiter Lend has processed over $1.2B in flashloan volume in the last 3 months. Lend looking good here. P.S: Unlike other protocols, we have 0 flashloan fees 📷

One invaluable feature of @0xfluid (except the brilliant engineering team, which has been shipping for 7 years) is that users and funds can use it across both Ethereum and Solana (@jup_lend) and have the same experience. No other protocol in DeFi has an equivalent across 2 major…

guys you're literally earning ~6-10% apy for holding a Jup Lend Stablecoin (e.g. jlUSDC, jlUSDS) which can easily be swapped via Market or Limit Orders easily. but hey, if you hate money, just hold naked stables.

Earn yield while you trade 🤝 @jup_lend Earn is now integrated directly into Jupiter routing – meaning you can swap in/out of any yield-bearing assets (denominated as jl like jlUSDC) in one click. No slippage. No added swap fees. Instant access to stablecoin yield.

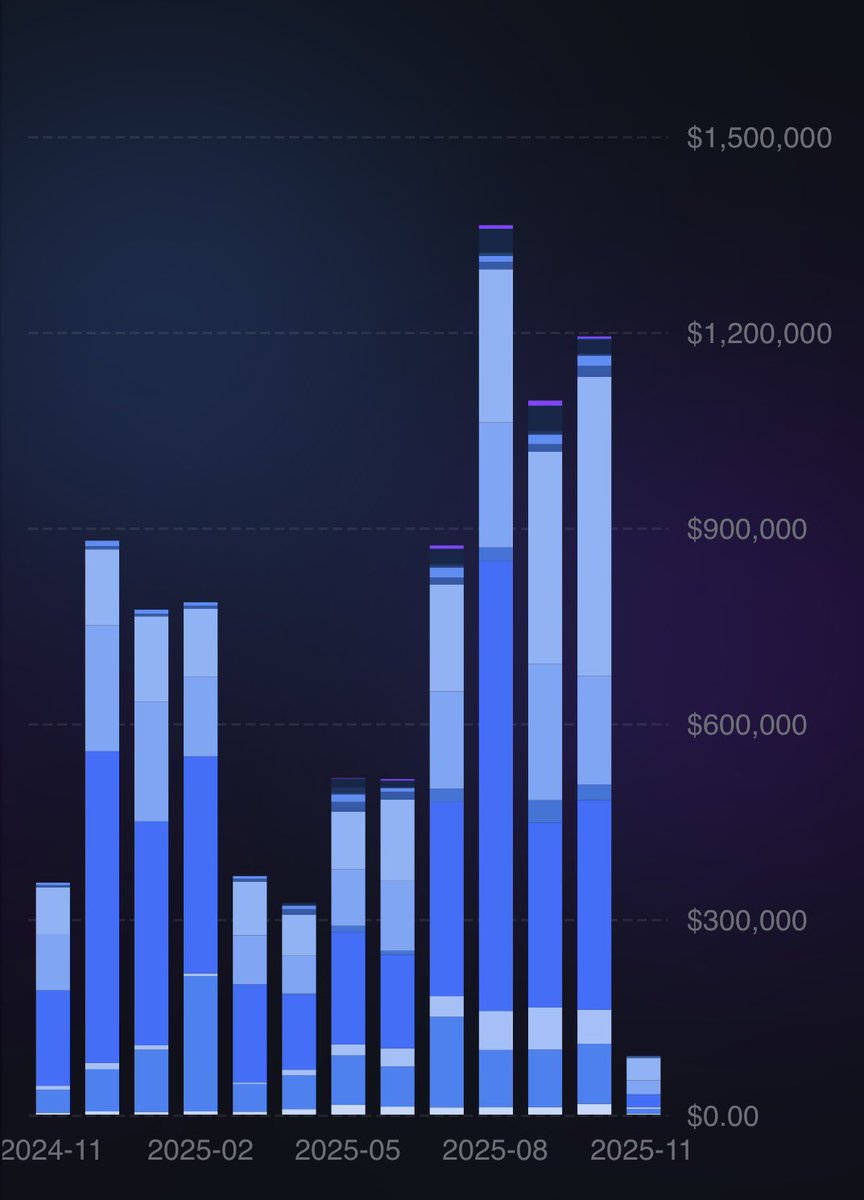

.@0xfluid pulled in $1.2M revenue last month, and buybacks kick off tomorrow! * chart excludes Jup Lend revenue (~$300K in Oct, 50% goes to Fluid). /fluid 🌊

Assets from @maplefinance on Fluid have surpassed $500M across all chains 🌊🥞 Together, Maple + Fluid are bridging institutions and DeFi capital efficiency, a step closer to a connected onchain financial system. Fluid connects top assets like syrupUSDC and syrupUSDT to deep,…

BREAKING: $6 million dollars in Earned interest. Jupiter is for everyone.

United States เทรนด์

- 1. Josh Allen 16K posts

- 2. Texans 32.4K posts

- 3. Bills 128K posts

- 4. #MissUniverse 171K posts

- 5. Maxey 6,451 posts

- 6. Will Anderson 4,511 posts

- 7. Ray Davis 2,106 posts

- 8. #TNFonPrime 2,171 posts

- 9. Costa de Marfil 11.5K posts

- 10. Shakir 4,393 posts

- 11. Achilles 3,839 posts

- 12. Christian Kirk 3,139 posts

- 13. James Cook 4,995 posts

- 14. Taron Johnson N/A

- 15. Woody Marks 2,741 posts

- 16. Ryan Rollins 1,131 posts

- 17. Nico Collins 1,716 posts

- 18. Adrian Hill N/A

- 19. Sedition 260K posts

- 20. #BUFvsHOU 2,342 posts

คุณอาจชื่นชอบ

-

prady

prady

@prady_v -

VK

VK

@0xVK__ -

Blockchain Society IIT Roorkee

Blockchain Society IIT Roorkee

@BlocSocIITR -

Kaushik kumar

Kaushik kumar

@kauku_shikmar -

Kautuk | Conscious Engines

Kautuk | Conscious Engines

@Kautukkundan -

CB

CB

@0xSeeVK -

eth_sign | Lucidly

eth_sign | Lucidly

@eth_sign -

Darpit Rangari | pnp.exchange

Darpit Rangari | pnp.exchange

@proxima424 -

Aditya Kalsaria

Aditya Kalsaria

@AdityaKalsaria -

Ishan

Ishan

@iishann14 -

rajat

rajat

@cro0k_ed -

Ashis 👨💻🏗

Ashis 👨💻🏗

@akp111_eth -

shriya

shriya

@0xShriya -

lomna 🧢

lomna 🧢

@AlmostAnmol -

PROBOT

PROBOT

@pr0b0t1sc00l

Something went wrong.

Something went wrong.