Antonio Linares

@alc2022

Early and long term $AMD, $TSLA, $PLTR, $SPOT, $HIMS, $DUOL investor. This is not financial advice and is my ONLY account. Please do your own research.

คุณอาจชื่นชอบ

I’m an early and long term $AMD, $TSLA, $PLTR, $SPOT, $HIMS, $DUOL investor. My incentives on this platform are to make the best investments possible in public, so more people want to buy my course to learn the mental framework behind my picks.

I took courses on Udacity, but customer service wasn’t great towards the end. I’m unaware of the current state of the service.

The best investment you can do today is buy a world class AI course online and get very familiar with the technology. I did 3 courses back to back years ago. I dedicated 1.5 years to the endeavor. Has paid incredible dividends.

Education and healthcare are still in the 15th century. $DUOL and $HIMS are going to change this and very quickly.

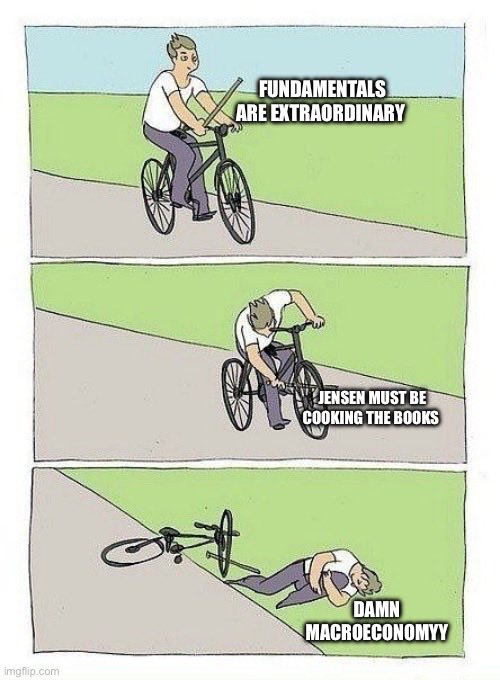

The reason macro investors don’t make more than a few good calls in their life is every situation is different. Conversely, all extraordinary companies are fundamentally the same. They just deliver more value to customers per $ spent.

Until the market understands that proprietary data is the moat of the 21st century, this sort of price action will tend to be a prevalent thing. After all this time, the market still doesn’t quite understand $AMZN CapEx cycles…

If $HIMS hits $10… unlikely though. I really like their new yearly subscription model

The $DUOL situation today is as if $HIMS traded at $10 because ChatGPT will cure all sickness

If anything, strength training, tennis, wine and peptides.

And avoid ladies, liquor and leverage.

The recipe is simple, but not easy: 1. Bet on the world’s best founder/operators early. 2. Do not sell.

The recipe is simple, but not easy: 1. Bet on the world’s best founder/operators early. 2. Do not sell.

Me: “I’m confident $DUOL will execute”. Meanwhile the $DUOL team:

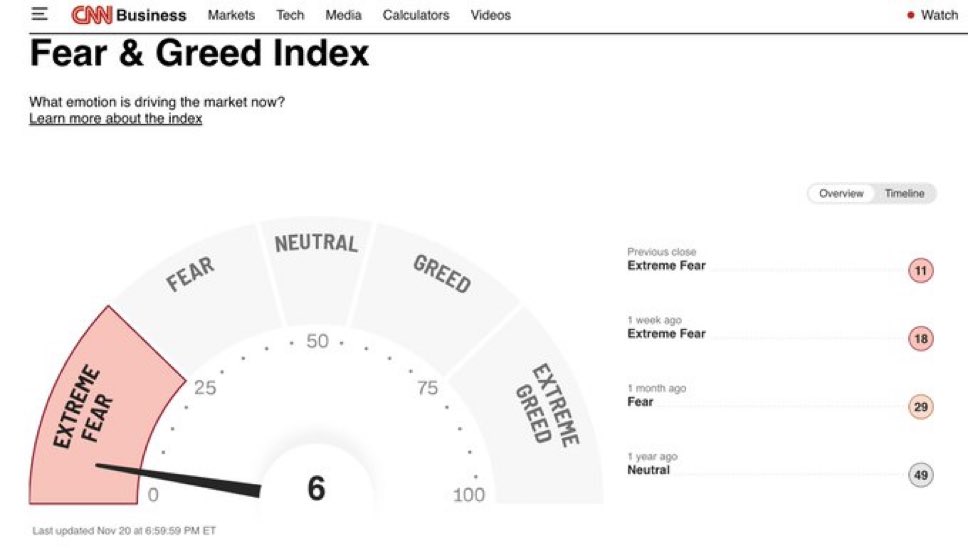

An in depth analysis of $AMZN, $META, $PLTR, $AMD, $MSFT Q3 earnings reveals more compute continues to equate to more intelligence and thus, incremental value delivered to end customers. The market is freaking out because fundamentals are impossibly good. I remain long AI.

In 2021, people were buying plots of land in the Metaverse next to Travis Scott. Today, fundamentals are so good investors are panicking. Two different approaches to the markets.

The reason I’m much wealthier today than in 2022 is that I bet big on two companies back then: $PLTR and $SPOT. These two stocks are up a lot because their respective FCF/share is up a lot. That’s all that matters.

If bear comments trigger you, it’s because you don’t actually have a conviction.

Instead of watching $HIMS and $DUOL drop another 80%, you can spend the afternoon watching my free masterclass. As an $AMD shareholder for the past 11 years, I've seen the stock drop violently many times. But being focused on fundamentals has delivered me a 50X investment.…

The point of investing is making a lot more money in 5-10 years. Weekly, monthly price action is irrelevant. People barely remember panics.

United States เทรนด์

- 1. Mamdani 287K posts

- 2. Kandi 4,872 posts

- 3. Mama Joyce 1,351 posts

- 4. #ItsGoodToBeRight N/A

- 5. #HMGxBO7Sweeps 1,508 posts

- 6. Brandon Aiyuk 1,074 posts

- 7. Egg Bowl 2,207 posts

- 8. Chance Moore N/A

- 9. #BY9sweepstakes N/A

- 10. #RHOA 1,803 posts

- 11. Adolis Garcia 1,992 posts

- 12. Putin 210K posts

- 13. #AleMeRepresenta N/A

- 14. Richie Saunders N/A

- 15. Khalifa 45.4K posts

- 16. Wisconsin 8,470 posts

- 17. El Bombi N/A

- 18. Joshua 41.5K posts

- 19. Nolan Jones N/A

- 20. Kiffin 11.1K posts

คุณอาจชื่นชอบ

-

Giuliano

Giuliano

@Giuliano_Mana -

Palantir Daily

Palantir Daily

@DailyPalantir -

Arny Trezzi

Arny Trezzi

@arny_trezzi -

Long Equity

Long Equity

@long_equity -

Quartr

Quartr

@Quartr_App -

Thomas Chua

Thomas Chua

@SteadyCompound -

Convequity

Convequity

@convequity -

Idea Hive

Idea Hive

@ideahive -

Stock Market Nerd

Stock Market Nerd

@StockMarketNerd -

Heavy Moat Investments

Heavy Moat Investments

@stonkmetal -

Brad Kaellner

Brad Kaellner

@bkaellner -

Finding Compounders

Finding Compounders

@F_Compounders -

Leandro

Leandro

@Invesquotes -

Finding Moats Investment Research

Finding Moats Investment Research

@Finding_Moats -

SVN Capital

SVN Capital

@SvnCapital

Something went wrong.

Something went wrong.