내가 좋아할 만한 콘텐츠

Check NASDAQ on the Lower Timeframe

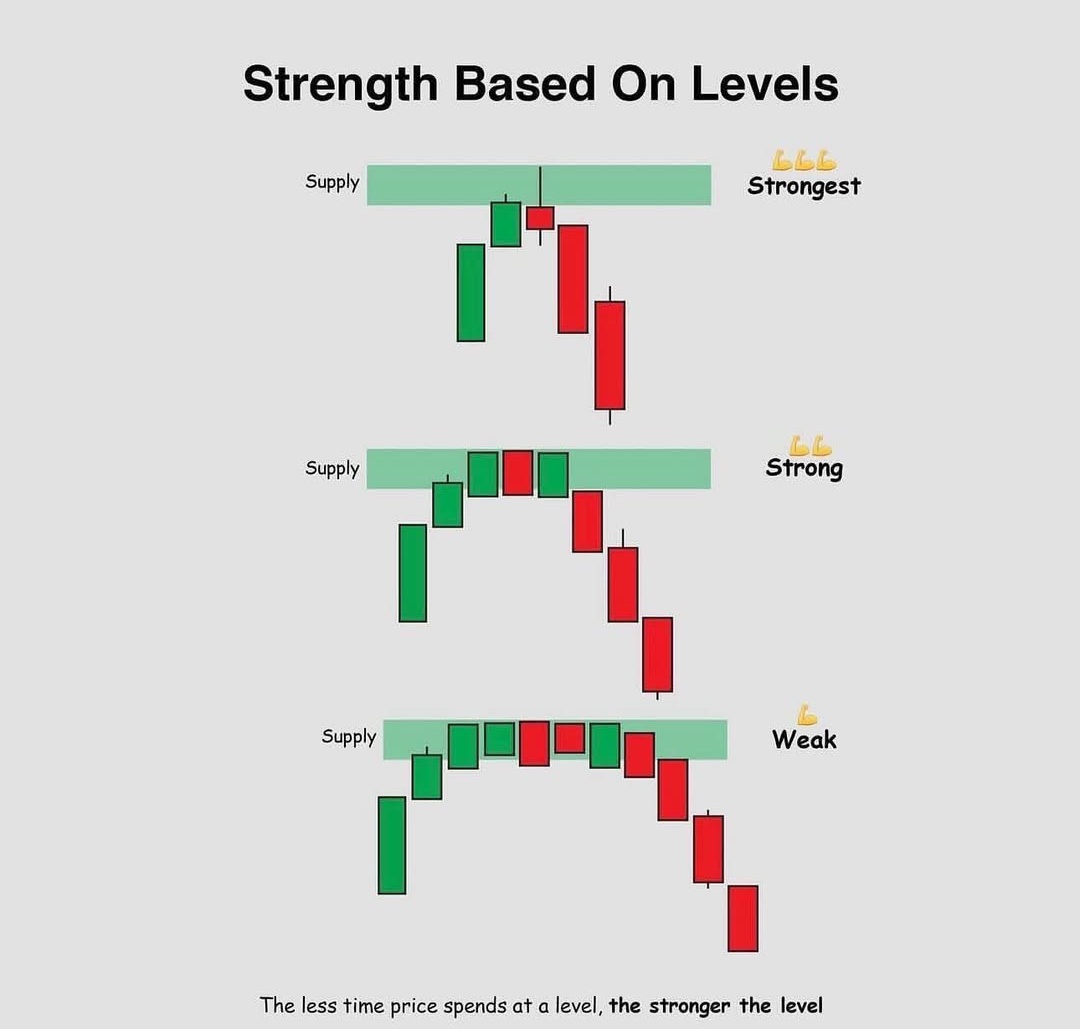

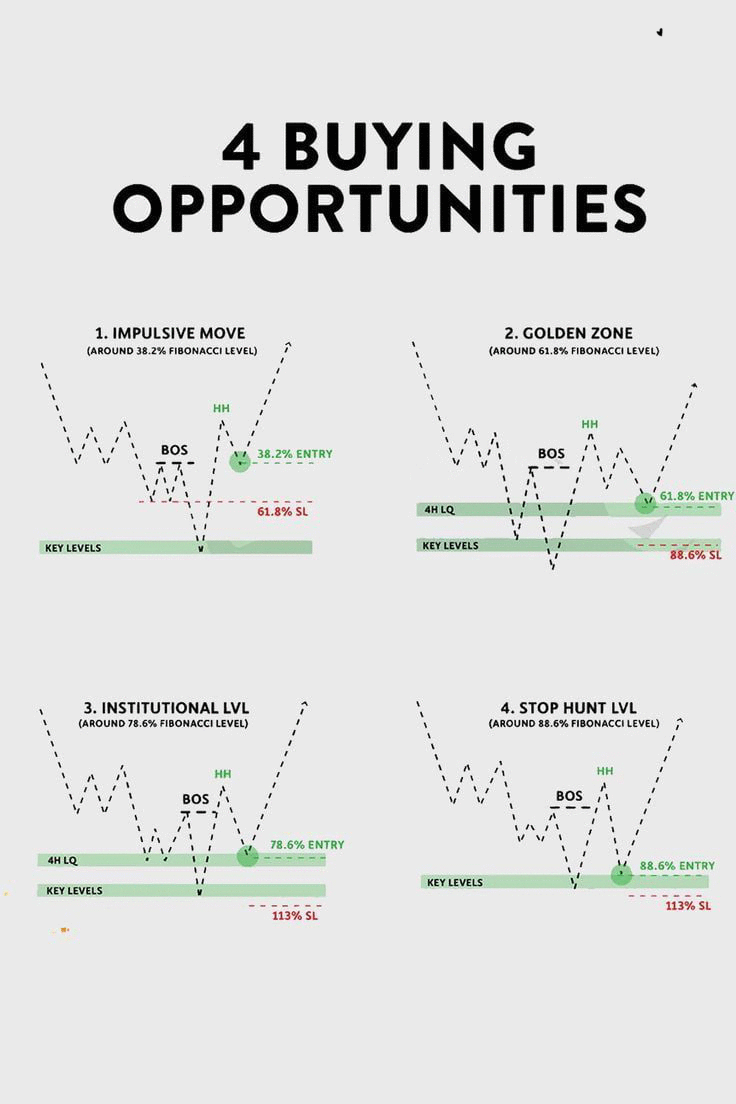

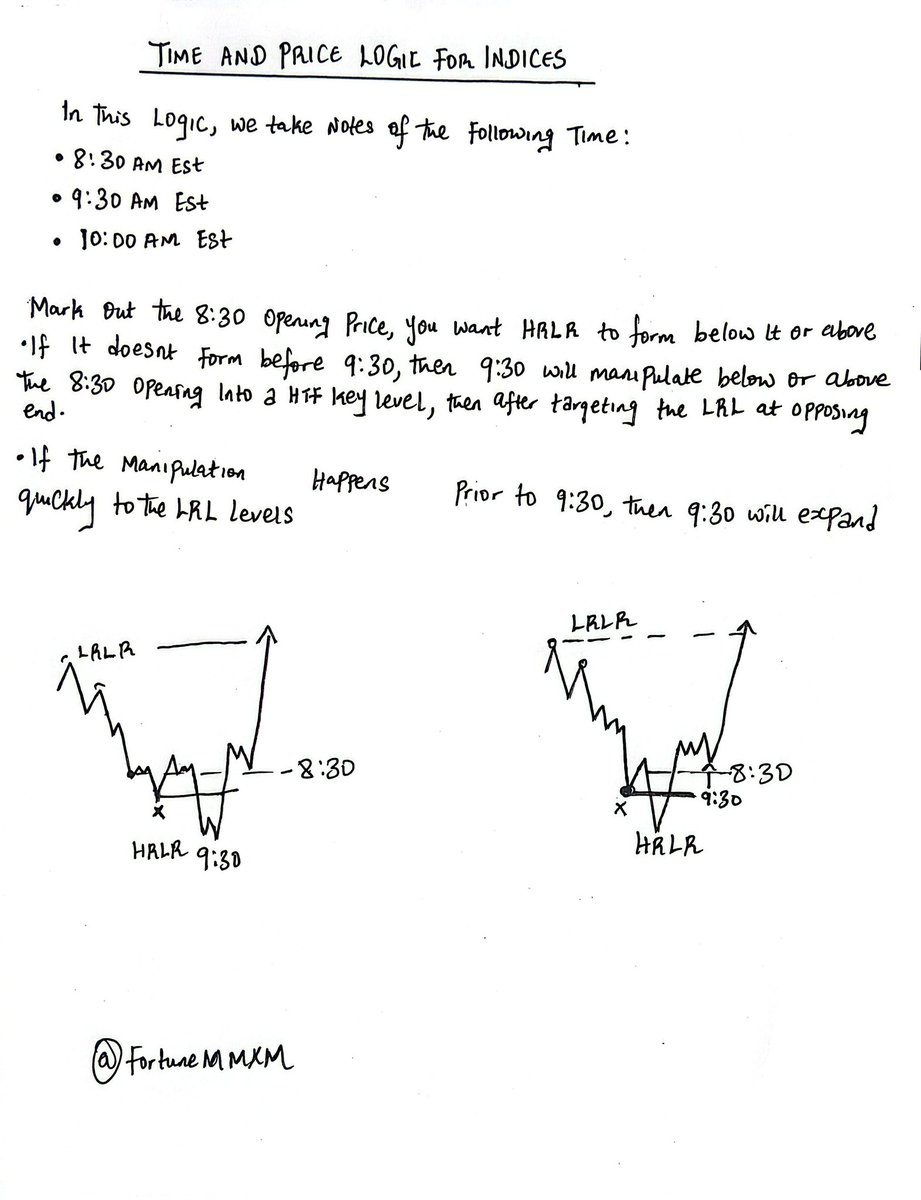

Low Resistance Vs High Resistance Liquidity runs. With Bonus of 9: 30 Manipulation A Thread 🧵:

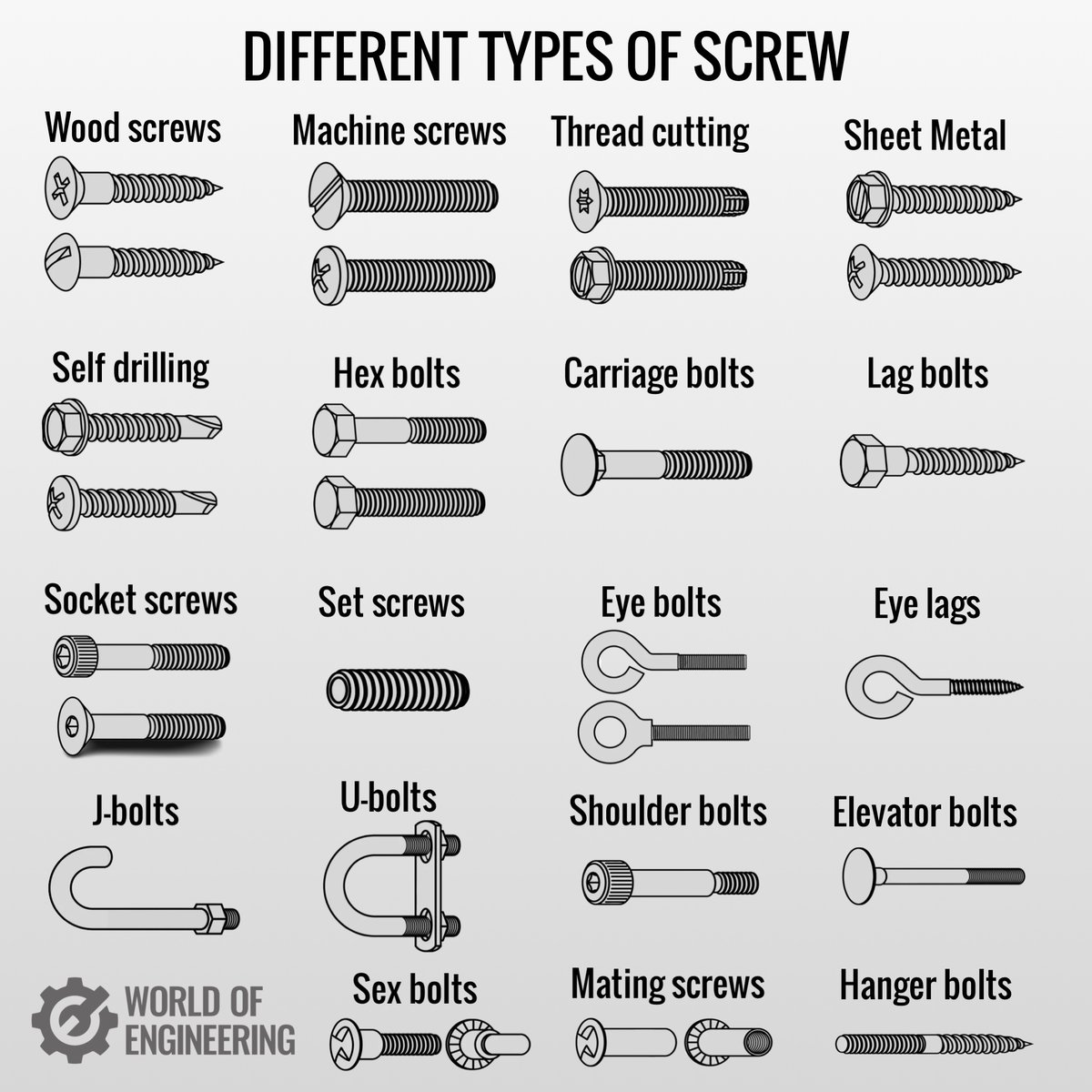

Different types of screw. 1. Wood screws are perhaps the most commonly recognised type of screw. They have a smooth shank and tapered point that make them ideal for penetrating wood. What they’re used for: all types of wood. 2. Machine screws. Blunt ended screws with…

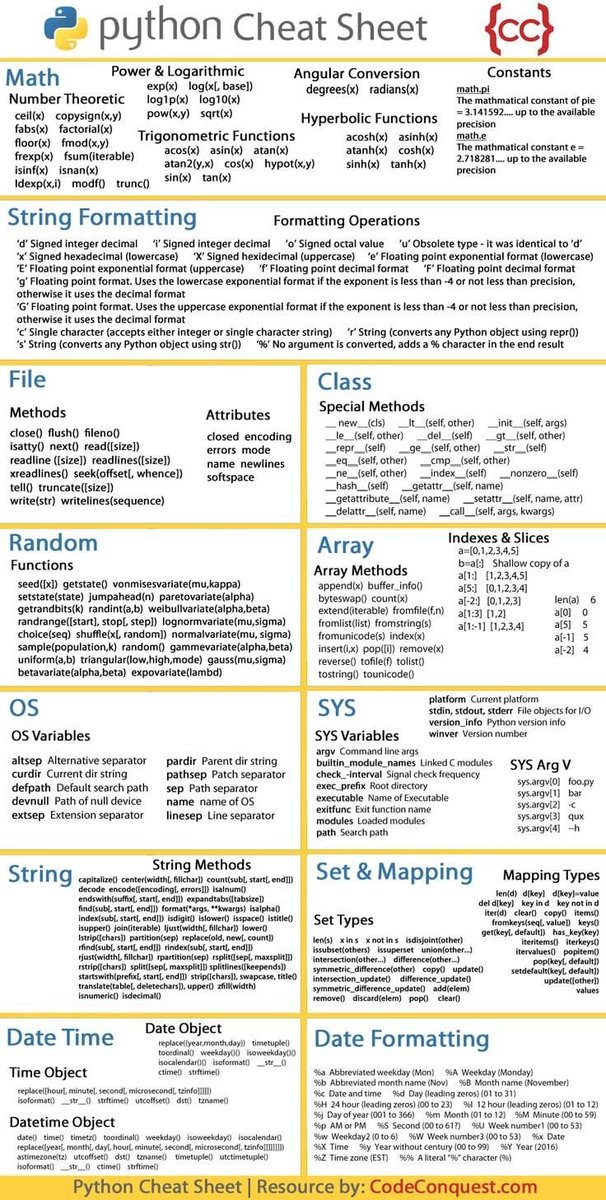

Python Cheat Sheet Source : CodeConquest

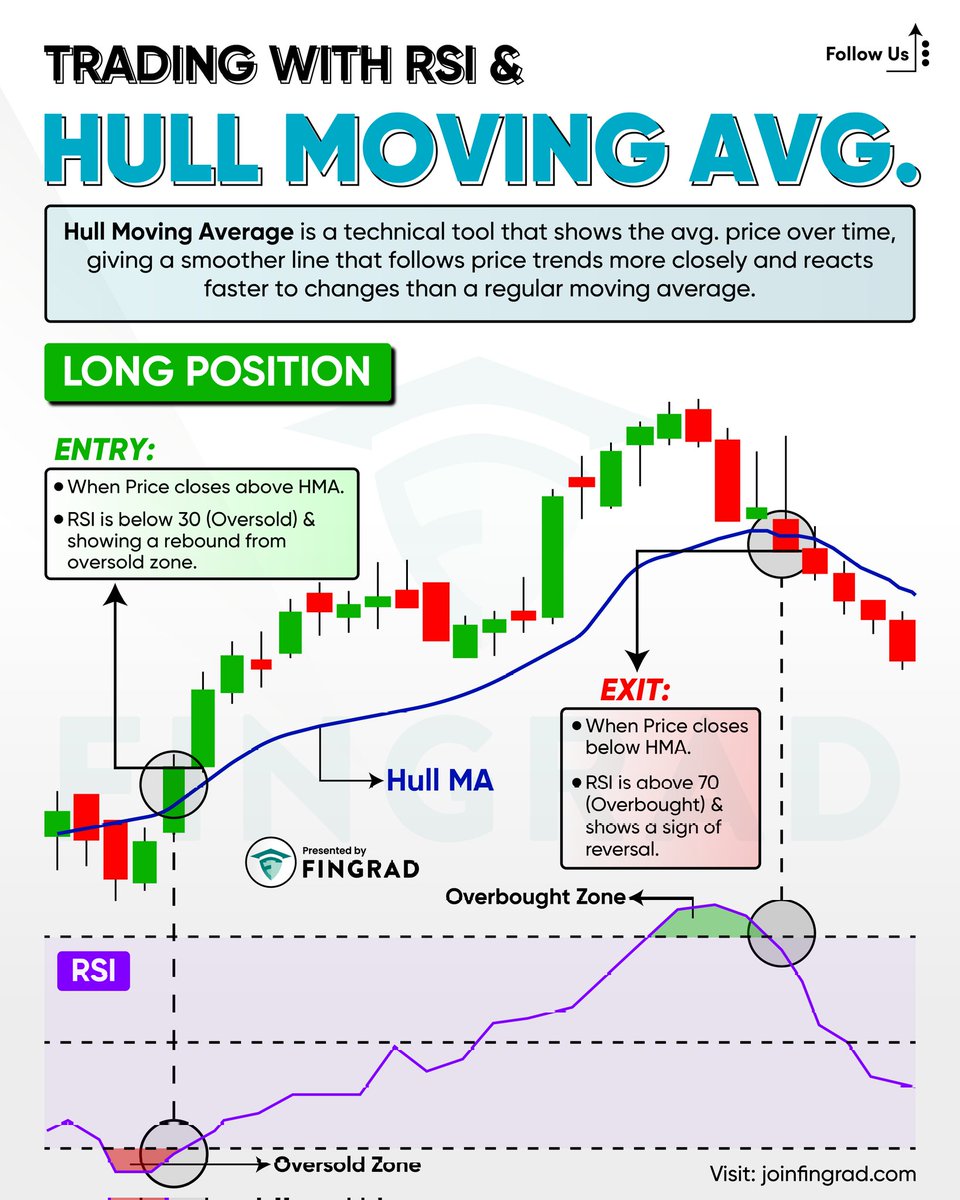

📊 Trading with the Relative Strength Index (RSI) and Hull Moving Average (HMA) combines momentum measurement with a smooth, responsive trend-following tool for better trade timing and confirmation. This approach balances trend following and momentum timing, creating confluence…

Moving Averages: Single & Combined Breakdown Single Moving Averages •5 EMA — Strong Momentum Captures explosive short-term price movement. •13 EMA — Short-Term Trend Great for identifying early trend shifts. •20 EMA — Pullback / Dynamic Support Ideal for buy-on-dip setups in…

In case you are wondering, the answer is no, I did not yet cover my $SPY short.

I shorted $SPY on Wednesday. The long-term trend remains up, but breadth is weakening — fewer stocks above their 50-day lines; a divergence that has been worsening for months. Rate cuts are priced in, and with the Fed hinting at a pause, a pullback looks likely.…

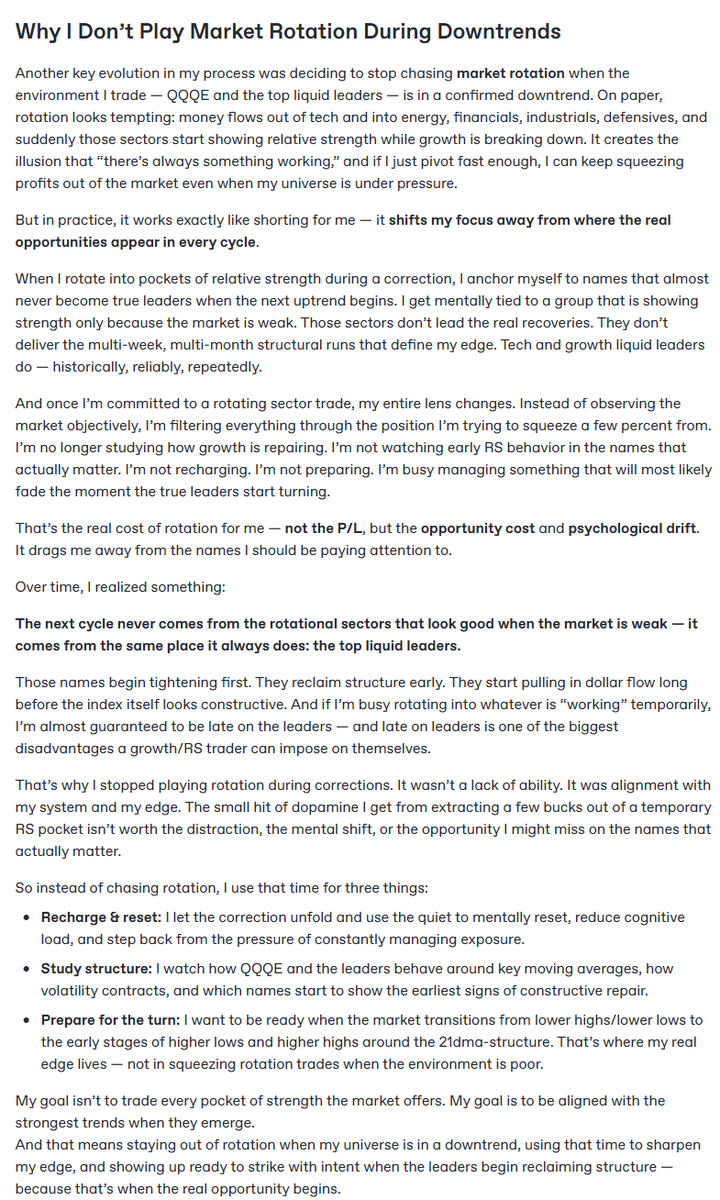

Why I Don’t Play Market Rotation During Downtrends Another key evolution in my process was deciding to stop chasing market rotation when the environment I trade — QQQE and the top liquid leaders — is in a confirmed downtrend. On paper, rotation looks tempting: money flows out of…

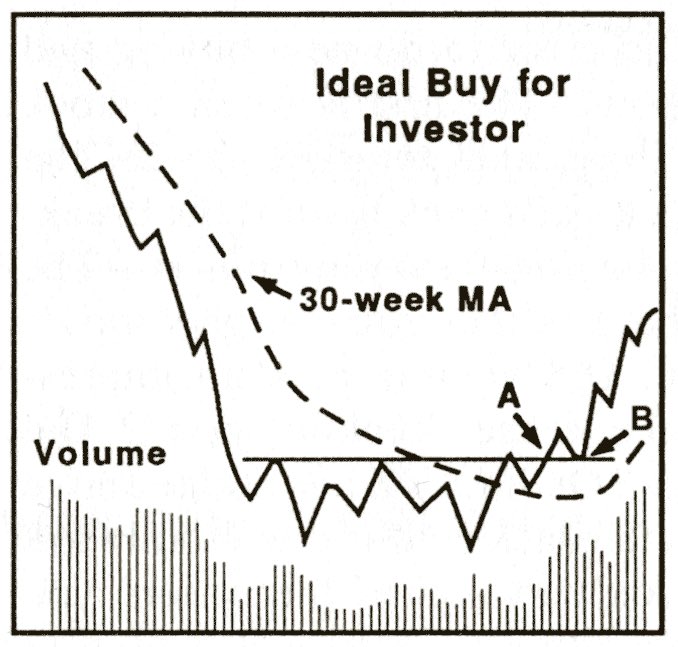

How do you know when a bear market is over? When you start seeing these patterns in the charts 👇

A few TrendFollowing rules taken from W.D. Gann's 1951 book "How to Make Profits Trading in Commodities".

NQ 9:30 Manipulation today..

Low Resistance Vs High Resistance Liquidity runs. With Bonus of 9: 30 Manipulation A Thread 🧵:

Sometimes the best strategy is simple — just wait.

📺 WHY $NVDA ISN’T $PLTR & TWO BEST LOOKING BIG TECH NAMES $NVDA pullback makes its setup ahead of earnings far healthier than $PLTR run into earnings. $AAPL and $GOOGL still show relative strength as the two most constructive big tech charts right now.

The One Thing That Makes Trading Easier (But Nobody Talks About It)

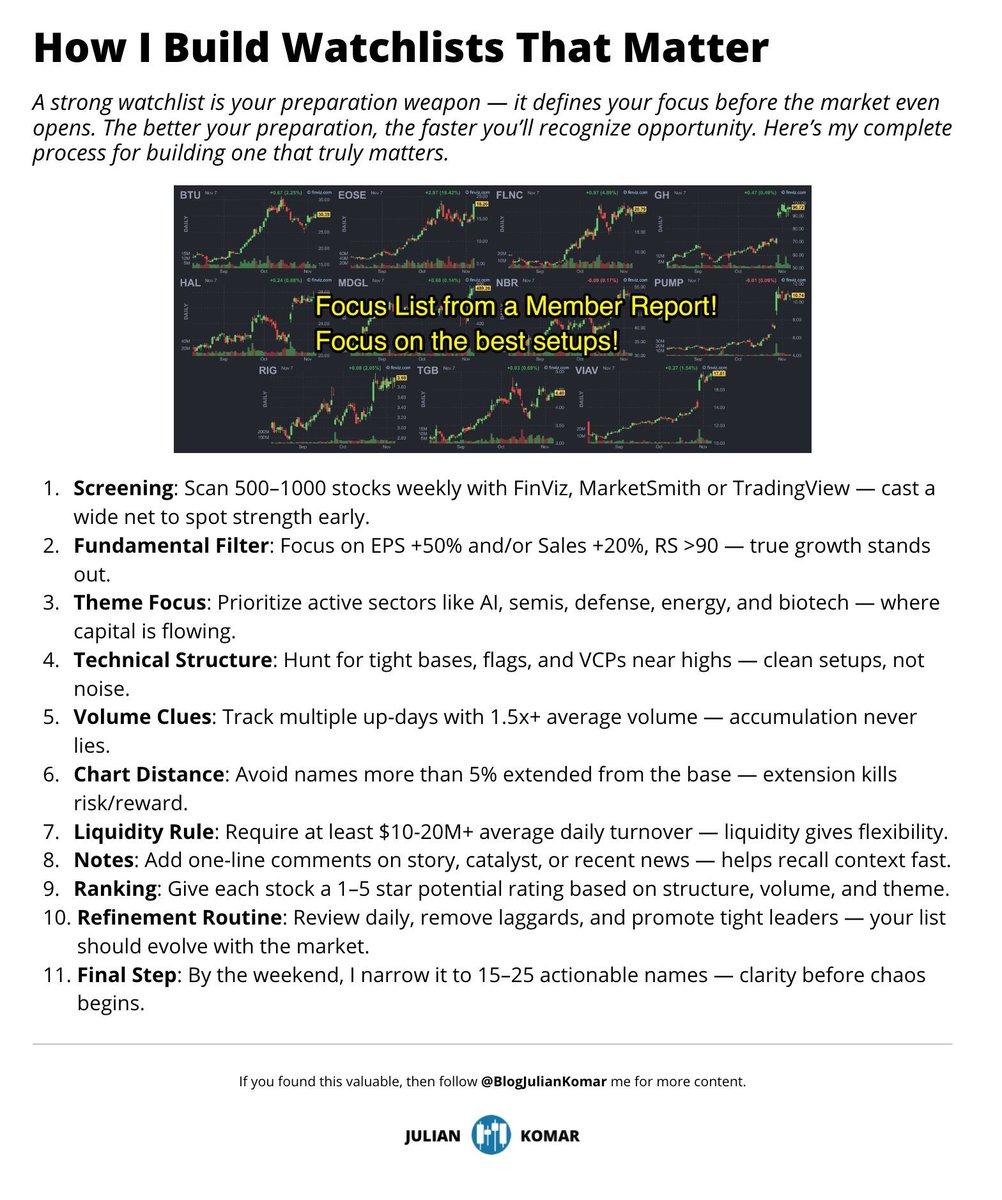

How I Build Watchlists That Matter 👇

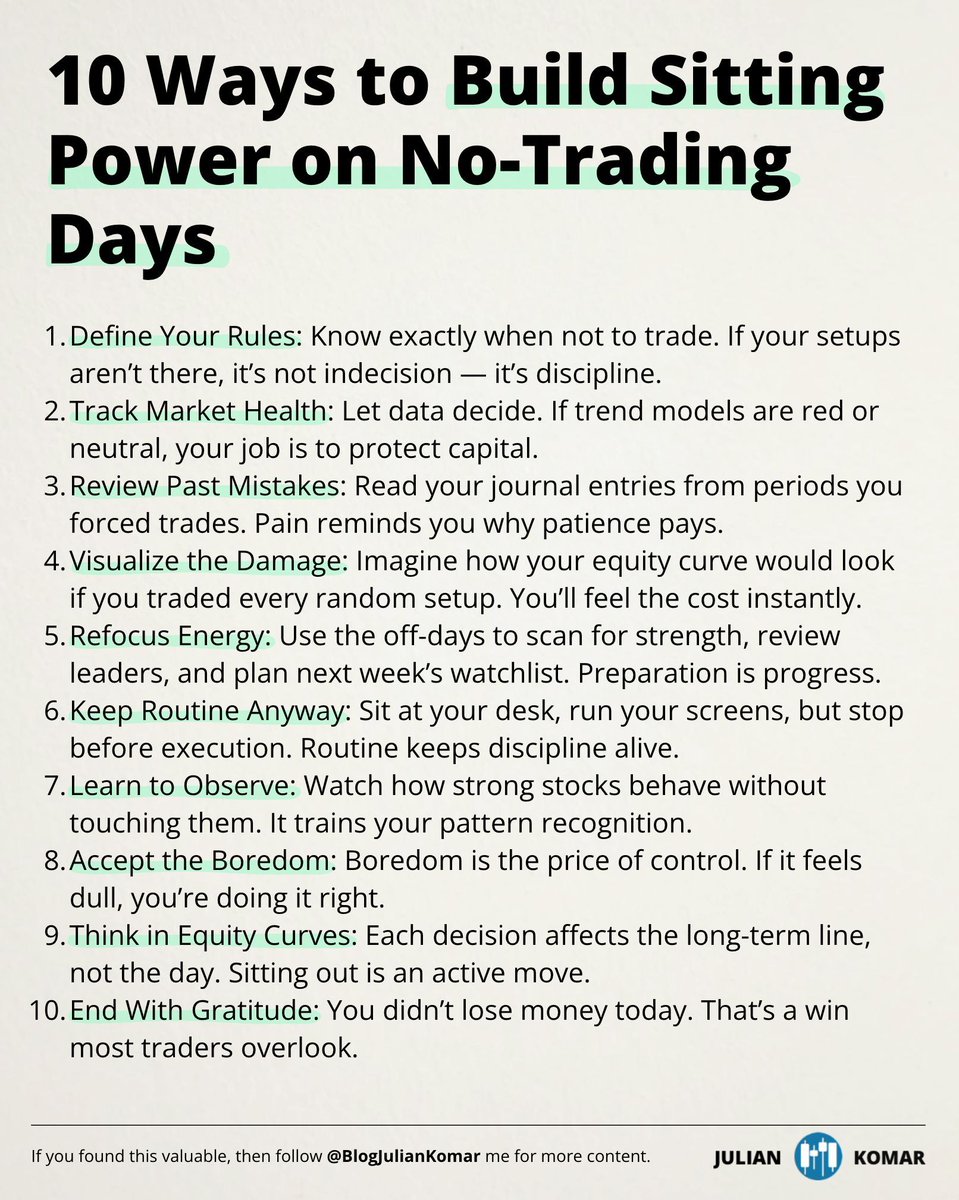

10 Ways to Build Sitting Power on No-Trading Days 👇

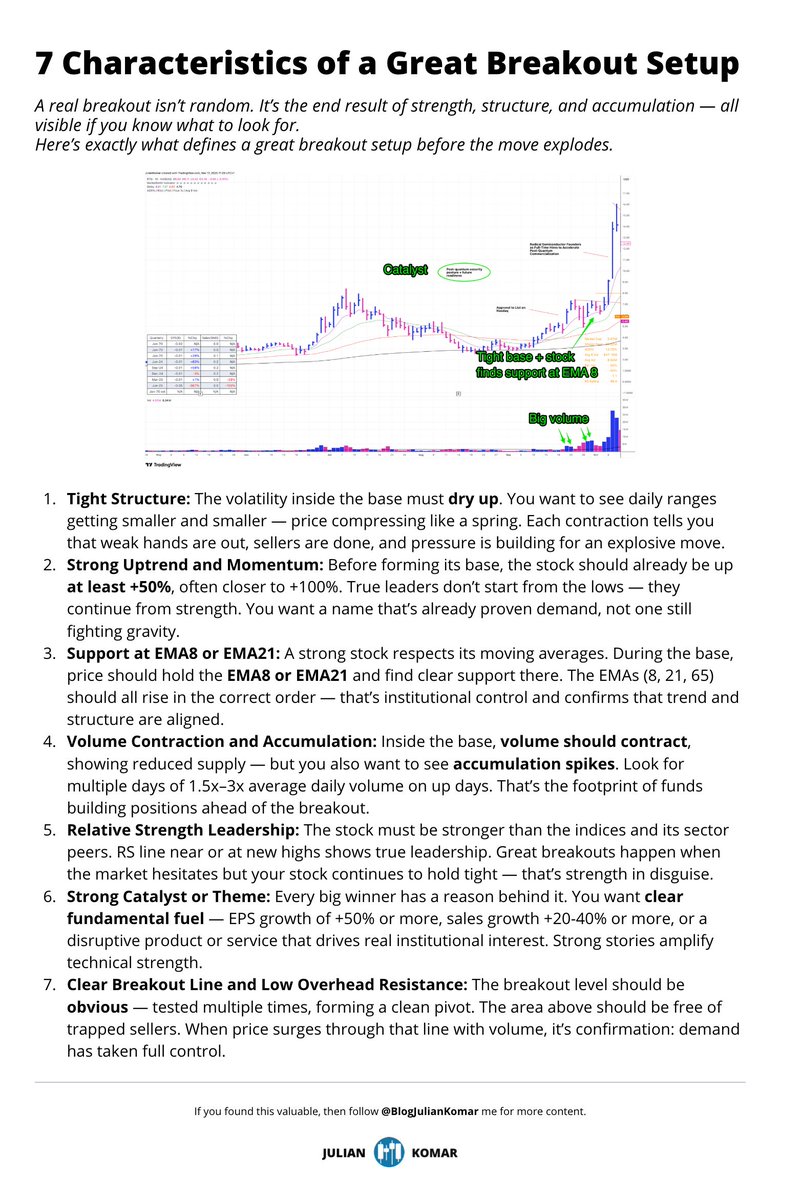

These are the 7 characteristics I want to see before I buy a breakout setup — no exceptions. 💥 👇

United States 트렌드

- 1. #TT_Telegram_sam11adel N/A

- 2. #hazbinhotelseason2 57K posts

- 3. LeBron 87K posts

- 4. Good Wednesday 19.4K posts

- 5. #hazbinhotelspoilers 3,448 posts

- 6. Peggy 19.9K posts

- 7. #DWTS 54.5K posts

- 8. #InternationalMensDay 24.6K posts

- 9. Baxter 2,258 posts

- 10. Kwara 178K posts

- 11. Reaves 8,976 posts

- 12. Dearborn 242K posts

- 13. Patrick Stump N/A

- 14. Whitney 16.5K posts

- 15. Grayson 7,197 posts

- 16. Orioles 7,323 posts

- 17. Jazz 28K posts

- 18. ELAINE 17.6K posts

- 19. Tatum 17.4K posts

- 20. Cory Mills 9,967 posts

Something went wrong.

Something went wrong.