Socialism isn’t wrong because it has compassion. It’s wrong because it doesn’t work.

After Lagarde‘s famous statement that inflation came out of nowhere, isn’t it cute that the ECB is forecasting GDP and inflation till 2026? They don’t even know what will happen next quarter.

Those working from home full-time are 18% less productive than those in the office, per Bloomberg.

• Study hard. • What others think of you is none of your business. • It's OK not to have all the answers. • Experiment, Fail, Learn and Repeat. • Knowledge comes from experience. • Imagination is important. • Do what interests you the most. • Stay curious

Our Inv. Principles 1. Imbalances between the #monetary system & real economy cause the #economic cycle 2. Turning points in the economic cycle come from permutations of #growth, #inflation & #liquidity 3. Systematic, procyclical asset allocation avoids DDs & increases profits

Harvard's CS50's Introduction to Artificial Intelligence with Python. It's also free too: learning.edx.org/course/course-…

'With interest rates now well above zero, the primary causes and conditions of the recent speculative bubble are no longer in place. The persistence of rich valuations here are, in my view, largely the result of psychological anchoring.' hussmanfunds.com/comment/mc2301… by @hussmanjp

I get asked this question a lot, "How much fuel does that bad boy burn" The 9800 runs 2 engines, QSK 60s, each 2000hp. Each engine burns approx. 120 gallons per hour, 2880 gallons per 12 hr. shift or 2 million gals per yr. You cant make #GreenEnergy without a lot of diesel fuel.

The Three Types of Customer Captivity 1) Habit: Frequent purchases of the same brand create tribal allegiance. 2) Switching Costs: If it takes too much time, energy, or money to switch providers. 3) Search Costs: If it takes too long to find an adequate replacement/substitute.

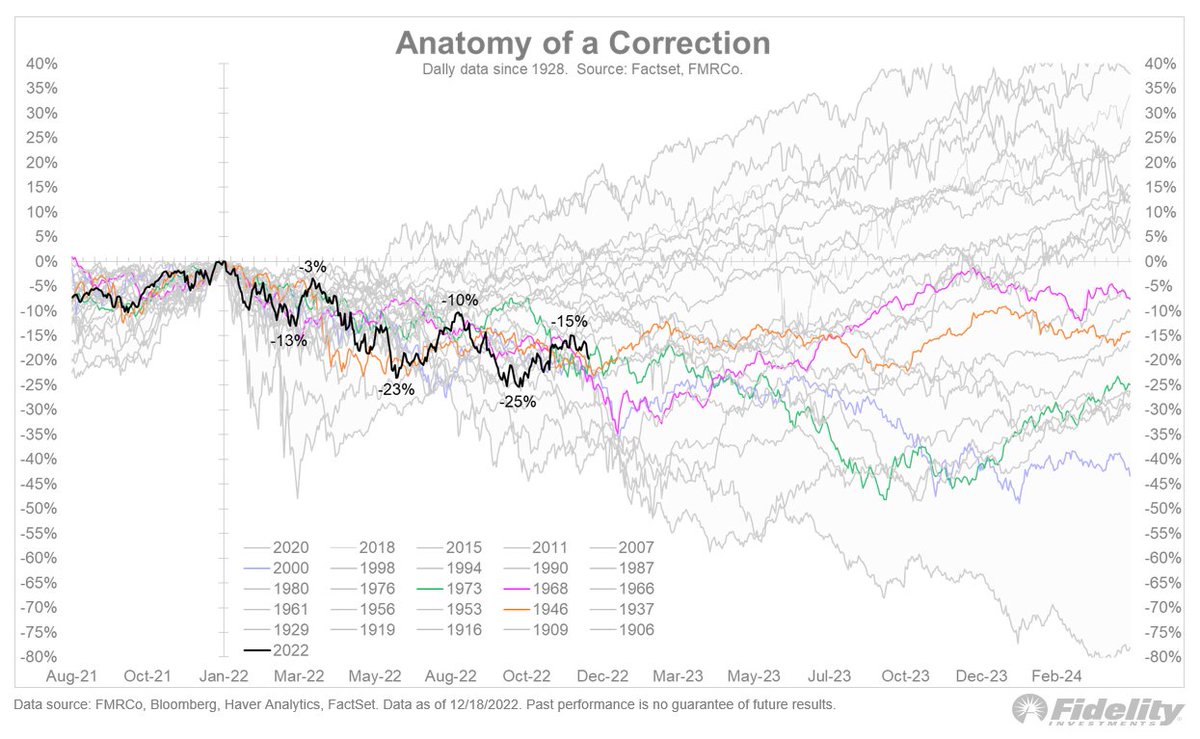

Happy (almost) birthday to the bear market. The claws came out on Jan. 4, 2022.

Just start. Start slow if you have to. Start small if you have to. Start privately if you have to. Just start.

Most women complain they can't find a man that's a 10 out of 10 while they're walking around as a 4 out of 10 themselves.

Here is an idea of how big a trillion is. One million seconds ago was about 11 days ago. One billion seconds ago was 1989. One trillion seconds ago was 30,000 BC. And now you know how much a trillion is.

Imagine getting fucked by her (not literally)

I've spent 22+ years studying Finance with the last 7 as a CFO, and I'll teach you everything you Need to know about a Cash Flow the next 7 minutes:

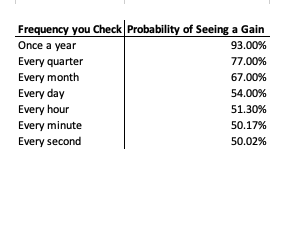

One of my favourite parts of "Fooled by Randomness" by Nassim Taleb was the illustration of how the more frequently you check your portfolio, the higher the chance you'll see a loss. Using a hypothetical portfolio with 15% annual return and 10% standard deviation:

I keep 14 quotes on a piece of paper taped to my wall. These iconic quotes shape how I invest every single day. Here they are. 🧵

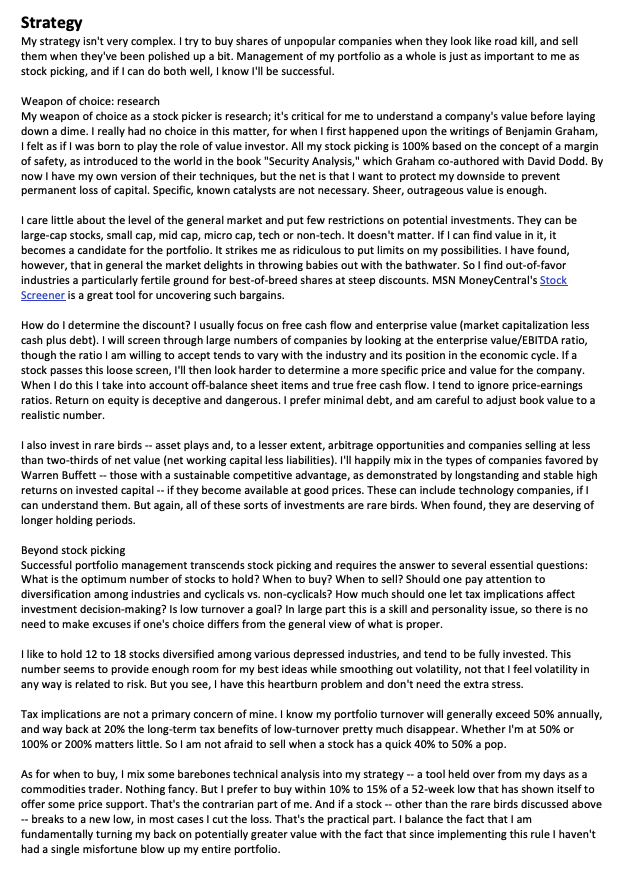

Michael Burry's (@michaeljburry) Investment Strategy One-Pager - Buy roadkill - Sell when roadkill's been polished - Care little about general market - Focus on FCF & Enterprise Value - Invest in Rare Birds - Hold 12-18 Stocks - Buy within 10-15% of 52-week low Love it.

1/ There's a concept known as financial compounding, but most people don't know about intellectual compounding. Buffett and Munger employed this to great effect and to accumulate mental models such that they can make large decisions quickly. Intuition is simply reading a lot.

How to find great companies: -Revenue growth > 5% -Profit growth > 7% -FCF / earnings > 80% -ROIC > 15% -Net debt / FCFF < 5 -Debt/equity < 80%

United States 트렌드

- 1. Baker 34.3K posts

- 2. Packers 31.5K posts

- 3. 49ers 33.4K posts

- 4. #BNBdip N/A

- 5. Bucs 11.1K posts

- 6. Flacco 12.2K posts

- 7. Cowboys 73.9K posts

- 8. Fred Warner 11.1K posts

- 9. Niners 5,391 posts

- 10. Cam Ward 2,933 posts

- 11. Zac Taylor 3,156 posts

- 12. Panthers 75.3K posts

- 13. #FTTB 4,322 posts

- 14. #GoPackGo 4,061 posts

- 15. Titans 24K posts

- 16. Mac Jones 5,836 posts

- 17. Tez Johnson 3,249 posts

- 18. #Bengals 3,229 posts

- 19. Browns 66.3K posts

- 20. #WeAreTheKrewe 2,010 posts

Something went wrong.

Something went wrong.