.

@biancoresear_h

Macro investment research at http://biancoresearch.com Our total return index is at http://biancoadvisors.com The ETF WTBN tracks our Index. biancoresearch.eth

你可能会喜欢

Discussed in the interview below. --- How many jobs does the US economy need to make, the so-called breakeven rate? Given that immigration drives population growth, and it might be negative for the first time in a Century, an argument can be made that the breakeven rate is…

MacroVoices @ErikSTownsend & @PatrickCeresna welcome, Jim Bianco @biancoresearch. They discuss, whether a fed rate cut is even a good idea, inflation risks, the unobvious relationship between the jobs report and the southern border, why cutting short term rates could actually…

Mid-year update We review the performance of the Bianco Research Total Return Index and the ETF that tracks it, the WisdomTree Bianco Fund (WTBN). Also, the fair value of bonds and why Trump's demand that the Fed cut rates can lead to higher LT yields. biancoadvisors.com/2025-mid-year-…

Cook refusing to leave puts the Fed in a difficult position. If they allow her to continue with her duties as Fed Governor, starting this morning, and the courts find that the President does have the authority to fire her, even if it's months later during an appeal, anything she…

Just received this statement from Lisa Cook, via her attorney: "President Trump purported to fire me 'for cause' when no cause exists under the law, and he has no authority to do so. I will not resign. I will continue to carry out my duties to help the American economy as I have…

Why is Trump firing Lisa Cook? It may be bigger than you think. A little-known fact is that all twelve Federal Reserve District Bank presidents serve five-year terms. They end in February of years ending in “1” and “6.” So, February 2021, February 2026, February 2031, and so on.…

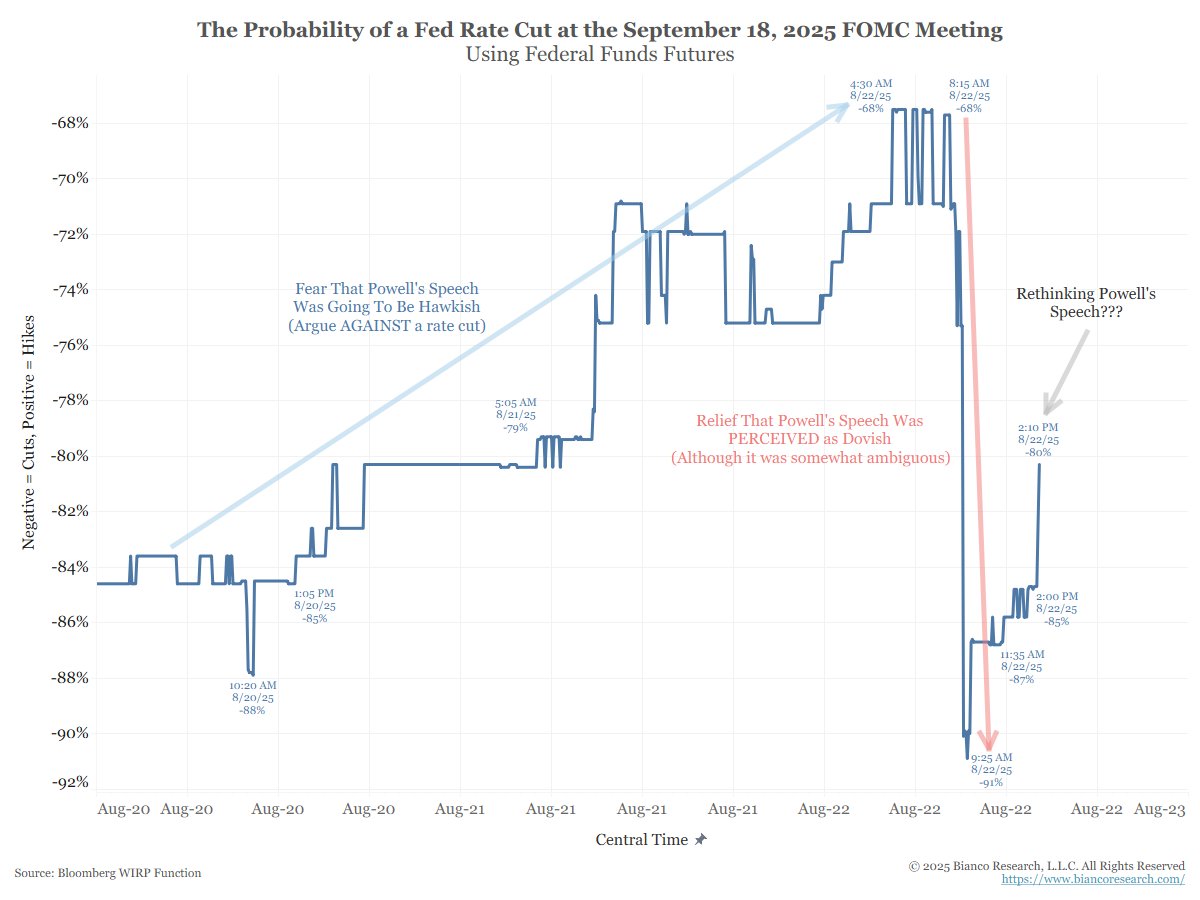

Maxi screaming into the ether

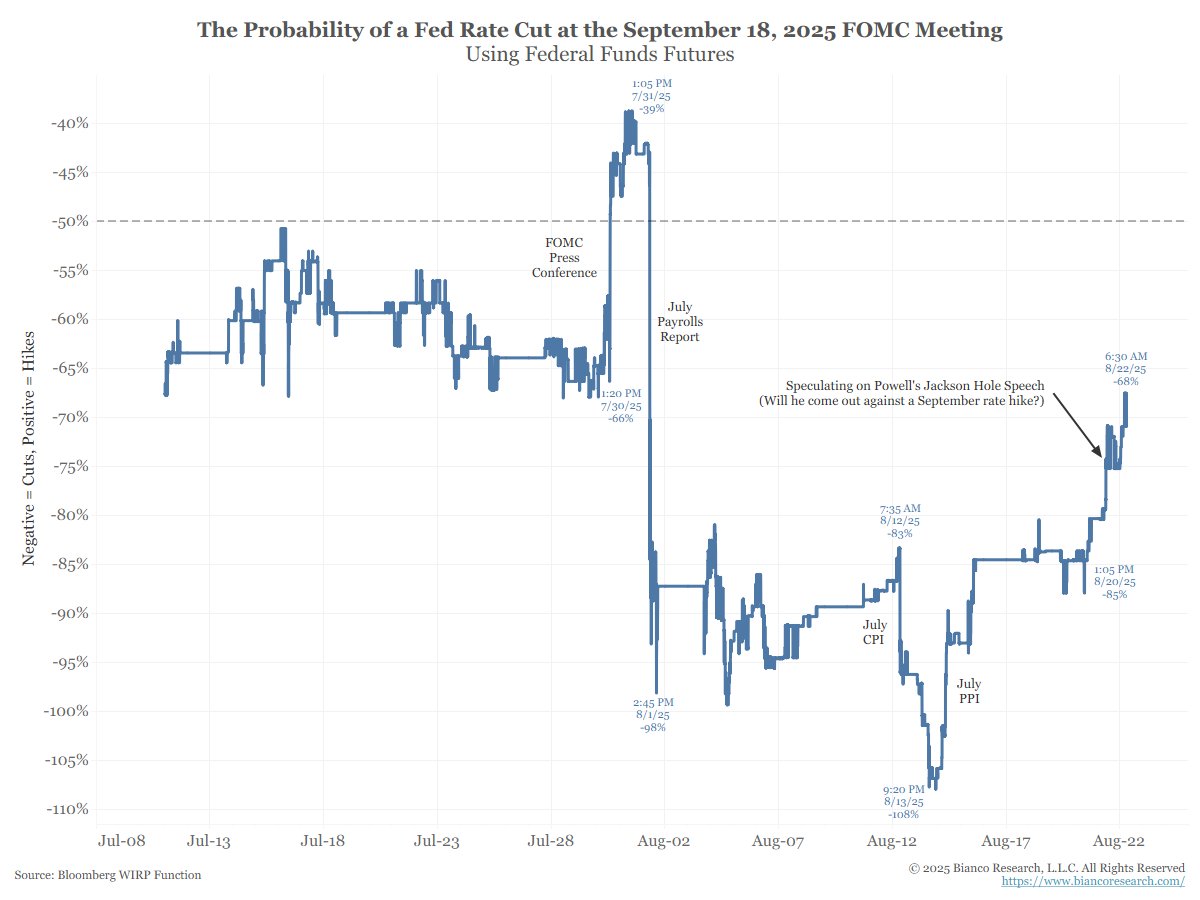

1/2 Reading the opinions of many professionals about Powell's speech yields little consensus. There seems to be as many interpretations as people I read. In other words, it was a somewhat ambiguous speech; Powell was unclear about what he wanted to do next month. This…

2/2 To paraphrase Miracle Max in The Princess Bride, a September rate cut is mostly a done deal, but that means it's also slightly not a done deal.

I agree with this

Post Jackson Hole interest rate markets suggest 3% fed funds bottom in mid-2027. If so then 4% 10 year is a possibility. Still with trillions in supply ahead, 4% is hard to imagine. Stay mildly bearish with expected range of 4.15-4.45 over next few months. Current 4.25% yield is…

Trump posted this on Truth Social about an hour ago

Fear of Powell coming out against a September rate cut continues to grow. --- Note: the odds are still more than 50% for a cut, so it is still priced in. But the trend is toward more, not less, uncertainty. Speech at 10 AM ET ... two hours from now

Zervos trading to be the next Fed Chairman took a hit in the last 36 hours, going from 18% on Tuesday, August 19th (and in second place behind Waller!) to 8% earlier today, a loss of more than 50%. I've been reliably told that MIGHT have something to do with the repost below.

One Fed Chairman on his way out, the other on his way in???

Weak-Kneed About Powell's Speech Tomorrow? (That he will push back about a rate cut) --- Note that the probability of a rate cut is still 70%, so it is still greater than 50%. It was 88% yesterday.

Most econ stats are surveys. Falling response rates are reducing accuracy, resulting in larger revisions. Gov't surveys, such as those conducted by the BLS, request personal information. Now, Fed scammers are doing the same (below). We need a new way to measure the economy.

Did you get an unsolicited call from the Federal Reserve? Do not provide any personal financial information to the caller. It’s a scam! For more information about how to protect you, your family, and friends, visit federalreserve.gov

And don't think for a minute that the public can distinguish between a Fed scammer and a legitimate BLS survey. Hang up on all of them.

We have been told that if the central bank cuts are not “too late,” long term rates fall, including mortgage rates. It did not happen in the US a year ago when the Fed cut and it’s not happening now in the UK (or throughout Europe). FYI, the Bank of England cut rates last week.

BOND MARKET ALERT 30 yr cost of UK Govt debt soaring Despite 5 base rate cuts by BofE This should not be happening I’ve been warning about this for months Markets realised growth is flat, debts too high

The last 125 bps of bank rate cuts by the BoE have seen the 10-year Gilt rise 87 bps. Cutting rates is NOT lower long rates!

Home prices have been 🚀 for years. The problem is not mortgage rates, it's inventory (not enough). Cut rates and home sellers raise prices, and monthly payments remain unchanged. The affordability problem remains. Greedy boomer homeowners get richer. How to fix…

Jim - the flaw in your rates to stay higher for longer is the OER has been overly weighted and lagging in the CPI calculation. So much extra housing inventory sits waiting for lower rates. No way house prices can go up until the months of supply drop substantially.

United States 趋势

- 1. D’Angelo 267K posts

- 2. Brown Sugar 19.8K posts

- 3. #PortfolioDay 14.5K posts

- 4. Young Republicans 11.1K posts

- 5. Pentagon 102K posts

- 6. Drew Struzan 25.7K posts

- 7. Politico 154K posts

- 8. Black Messiah 10.1K posts

- 9. Big 12 13.1K posts

- 10. Scream 5 N/A

- 11. Voodoo 20.3K posts

- 12. Jeff Albert N/A

- 13. Soybeans 4,295 posts

- 14. Venables 3,384 posts

- 15. Merino 11.5K posts

- 16. VPNs 1,361 posts

- 17. Happy Birthday Charlie 142K posts

- 18. Baldwin 20.1K posts

- 19. How Does It Feel 8,877 posts

- 20. First Presidency 2,105 posts

你可能会喜欢

Something went wrong.

Something went wrong.