bitvpr

@bitvpr

for research purposes only

Bill Gates is in El Salvador meeting with Bukele and you're still selling bitcoin

In other systems debt grows or kills you, with nirvana/samsara value grows around the debt

I’ve been going through Nirvana’s docs the past few days and honestly… I think a lot of people are sleeping on what @nirvana_fi just shipped. With Samsara now live, Nirvana isn’t just launching another DeFi product. They’re introducing a new way for teams to run decentralized…

Getting day 1 exposure to the samsara og markets is going to look like a cheat code in 6 months, these should be easy long term holds

Today, $navETH will launch on Samsara! 19:00 UTC. Be early.

you can almost hear the rotation: metals got their victory lap, now the attention span of global capital is sprinting straight into crypto

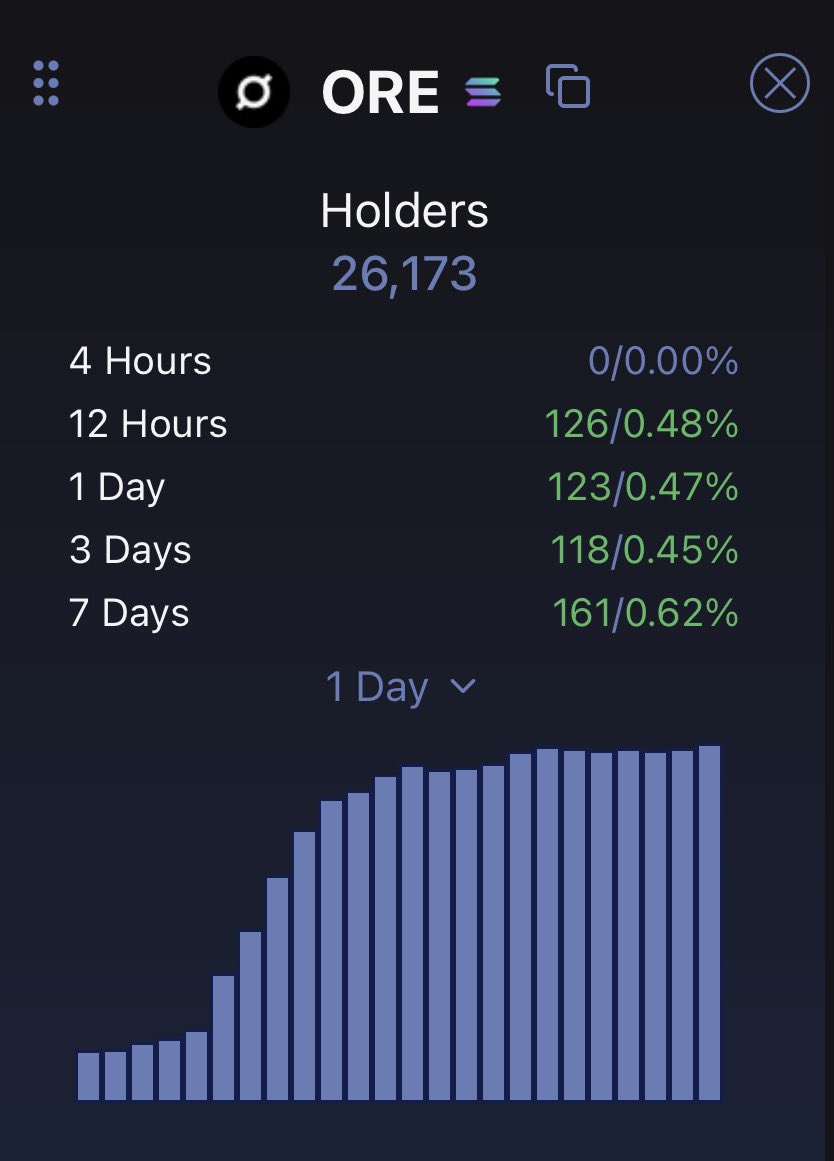

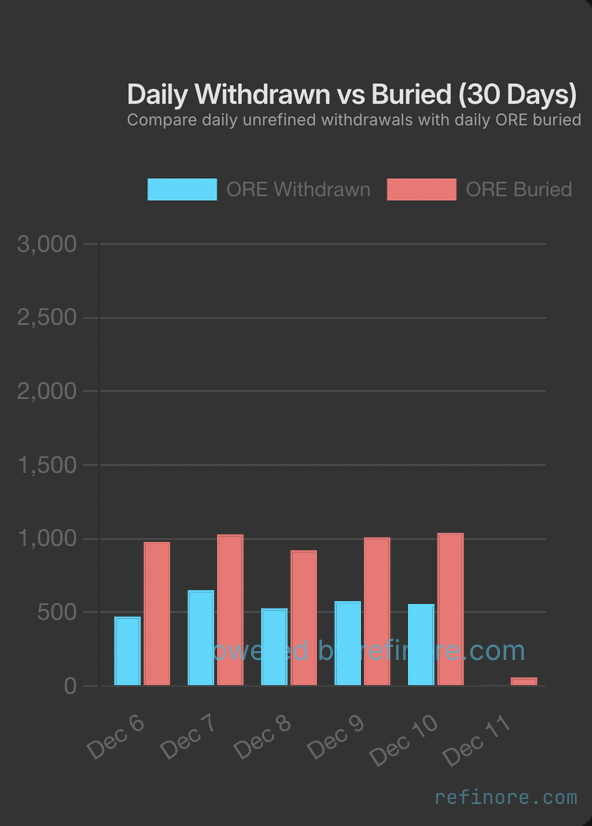

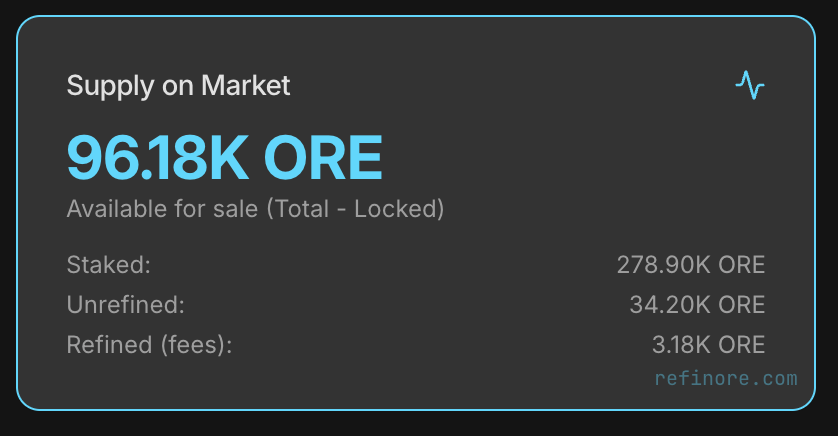

Even when $ORE mining slows the net burn keeps stacking. Five days of supply shrink. At this pace of -500 per day the market supply evaporates in 6 months

Everyone will finally understand the $ORE store of value idea when the circulating supply drops below 50K. At that point scarcity stops being theoretical

Peters gold bar

GOLD CANNOT PROVE IT IS GOLD Yesterday in Dubai, Peter Schiff held a gold bar on stage. CZ asked one question: “Is it real?” Schiff’s answer: “I don’t know.” The London Bullion Market Association confirms there is only one method to verify gold with 100% certainty: fire…

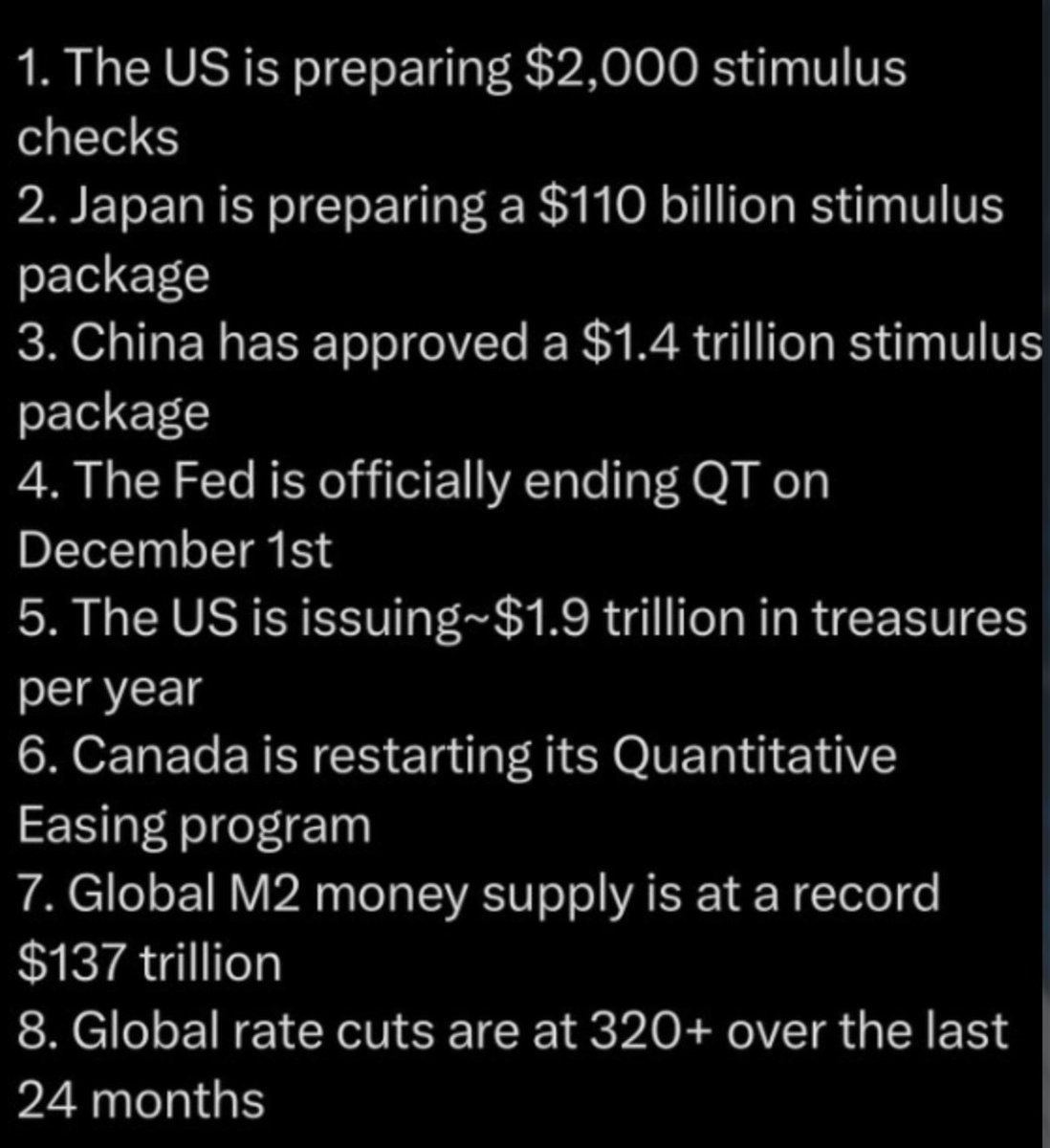

4 year cycles vs quantitive easing QE periods 2011-2014, 2020-2022 QT periods 2017-2019, 2022-present Bitcoin and hard assets went up in the last QT period and now you think they’re going to go down in a QE period?

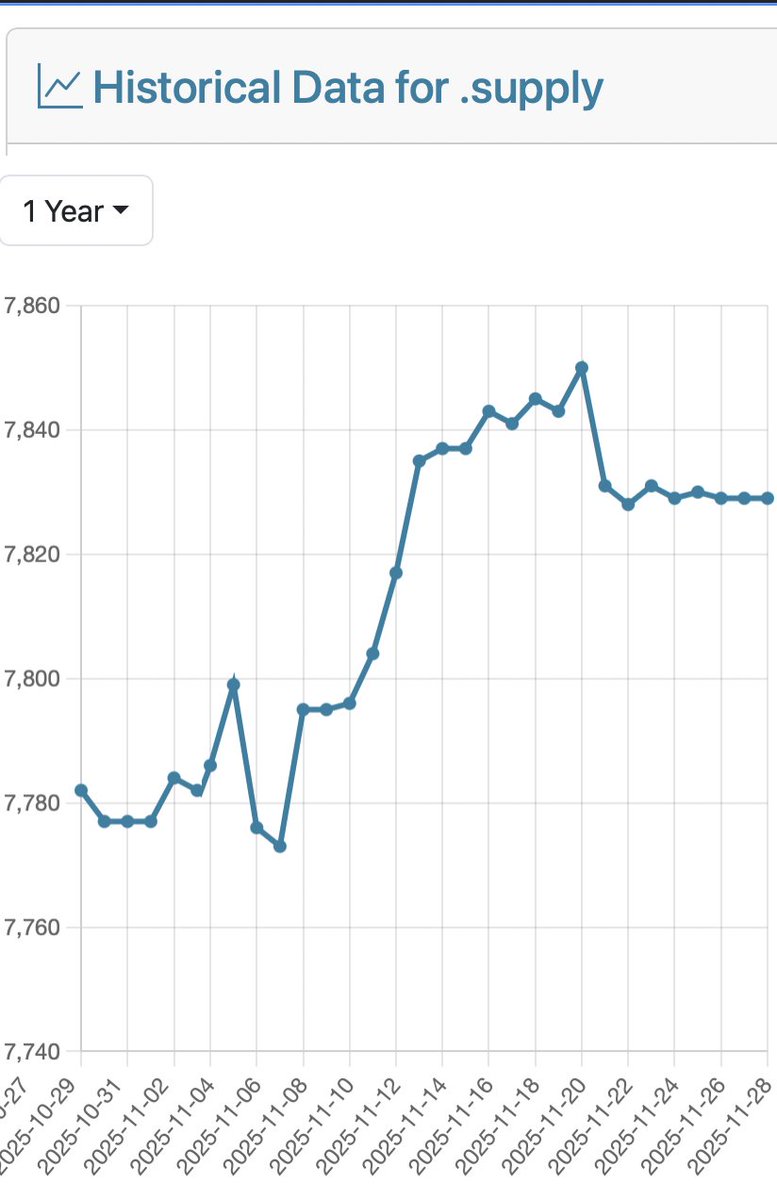

The large increase of new .supply domains registered since $ORE ore.supply took off resembles when pumpfun launched and spawned a ton of hybrid .fun sites. None of the derivatives endured, pumpfun’s moat was being first

Monad couldn't have launched in market sentiment conditions worse than these. Being able to buy at presale levels when everyones risk appetite has never been lower is probably going to turn out to be a good move

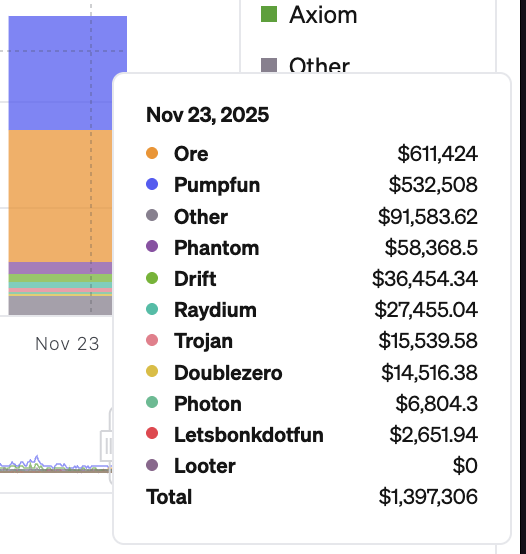

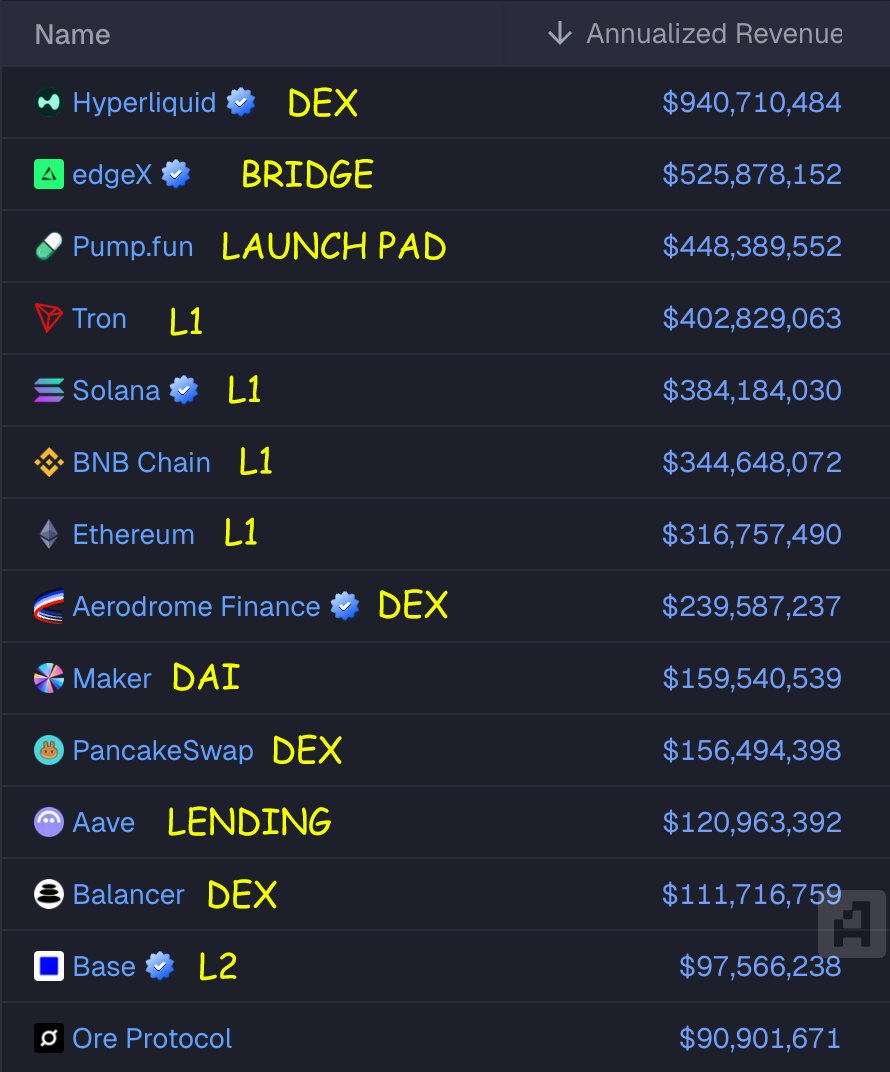

$ORE has overtaken pumpfun for daily revenue for the first time

It makes no sense to weigh Burry’s comments on AI as if he has domain depth. He is a data driven investor with a medical background, not a systems engineer. The AI trade is deeply tied to the underlying architecture, if you want real insight you listen to the builders not the…

Nvidia emailed a memo to Wall Street sell side analysts to push back on my arguments. I stand by my analysis. Obviously, the full analysis does not fit in a tweet. I will release on my timeline. The first post in The Heretic’s Guide to AI’s Stars “Supply-Side Gluttony” is up…

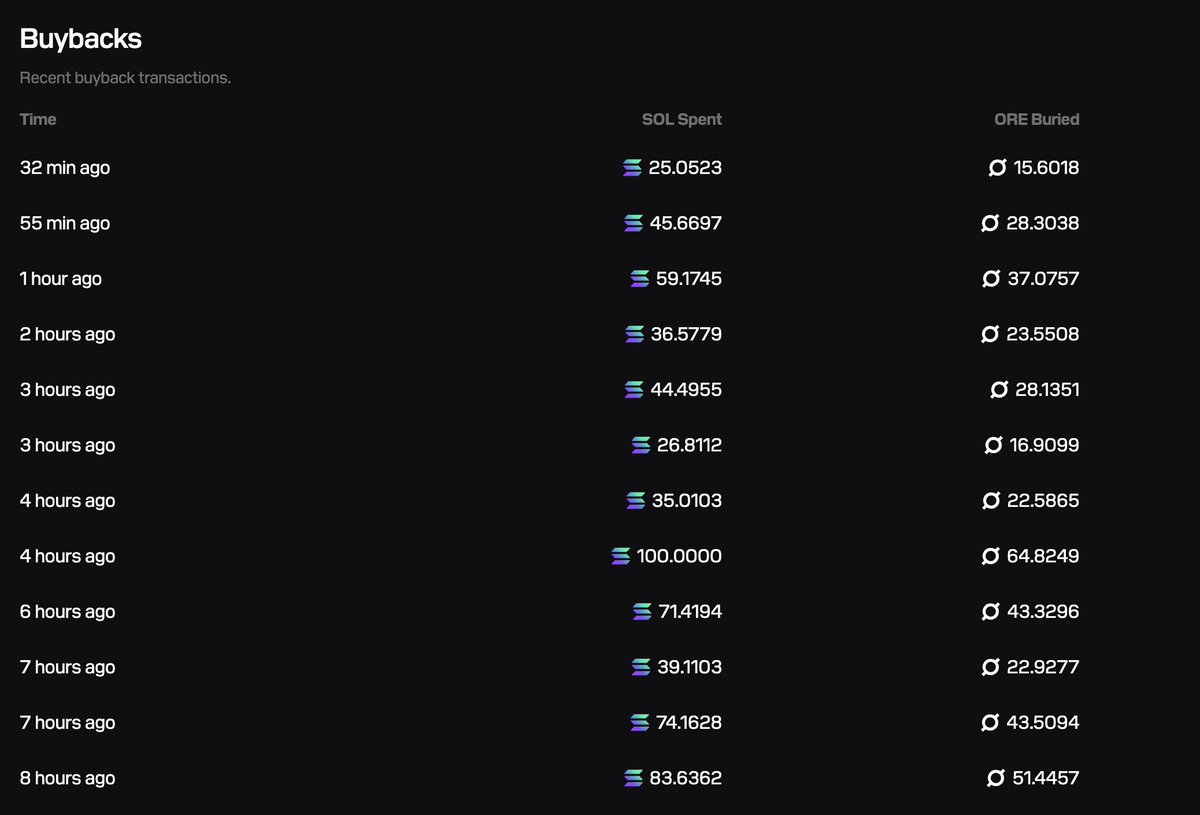

When a network expands at a steady compounding rate and the system applies continuous buyback pressure, the long term vector becomes clear. Participation climbs and supply gets absorbed. There is really only one path forward.

$ORE has the kind of supply mechanics that sneak up on people. Everyone stares at charts while the float quietly disappears. One day the market wakes up and realises the valuation should be far higher than anyone was prepared for

If you actually run the math on the buy and burn loop for $ORE you see the curve steepen fast. Most are pricing it like a static asset when the supply reflexivity is doing all the heavy lifting

If you sell your bitcoin you settle in dollars. If you understand where dollars are heading you see why that is not the win people think it is

kind of wild that after just one month $ORE is already a top 15 revenue engine in the entire industry. and it’s not an exchange, settlement layer or infra crypto has spent a decade praying for a protocol that prints because users genuinely want to be there. turns out when you…

$ORE price nukes? Don’t care. The only question that matters is: did the apes leave? Turns out they didn’t. Even after a full capitulation candle, people are still glued to the machine. That’s real product market fit in crypto terms, stickiness. The one thing you can’t…

The $ORE chart without the last 10 volatile days Strip out the blow off wicks, the panic buys and sells and the underlying structure looks completely different Early stage assets don’t die from volatility. This is a chart that is absorbing the initial inertia, repricing, and…

Massive buying opportunity on $ORE. Don’t bet against degeneracy. Pumpfun, prediction markets, perps, sports betting, meme tokens = same primitive. “Degenerate flow” is a truth oracle with a dopamine UI. It’s where culture meets price discovery. You might not like it, but…

United States Trends

- 1. Giannis N/A

- 2. Sinner N/A

- 3. #SmackDown N/A

- 4. Trans N/A

- 5. Adam 22 N/A

- 6. Bucks N/A

- 7. #DragRace N/A

- 8. Gigi N/A

- 9. Jason Luv N/A

- 10. #OPLive N/A

- 11. Kuzma N/A

- 12. #PersonaLive N/A

- 13. Attitude Era N/A

- 14. Pacers N/A

- 15. Dabo N/A

- 16. Spizzirri N/A

- 17. Aaron Gordon N/A

- 18. Antarctica N/A

- 19. #ZuffaBoxing01 N/A

- 20. WILLIAMEST ECHO IN SG N/A

Something went wrong.

Something went wrong.