Bruce Macdonald

@bmacd36

#MSOGang

You might like

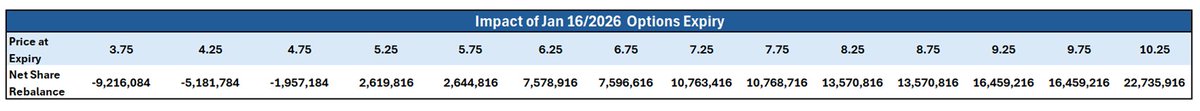

OPTIONS IMPACT VISUALIZED Let’s put some numbers to the concept. Here is the rebalance impact at various MSOS levels based on current Jan 16 open interest. The assumption here is that options are “delta hedged” and that those deltas will be zero or one at expiry depending on the…

Even if volume hits an all-time record, the math doesn't work. The liability (23M shares) is simply too large relative to the physical capacity of this stock (Max historical volume ~44M). They would need to be the buyer of every other share traded on a record-breaking day just to…

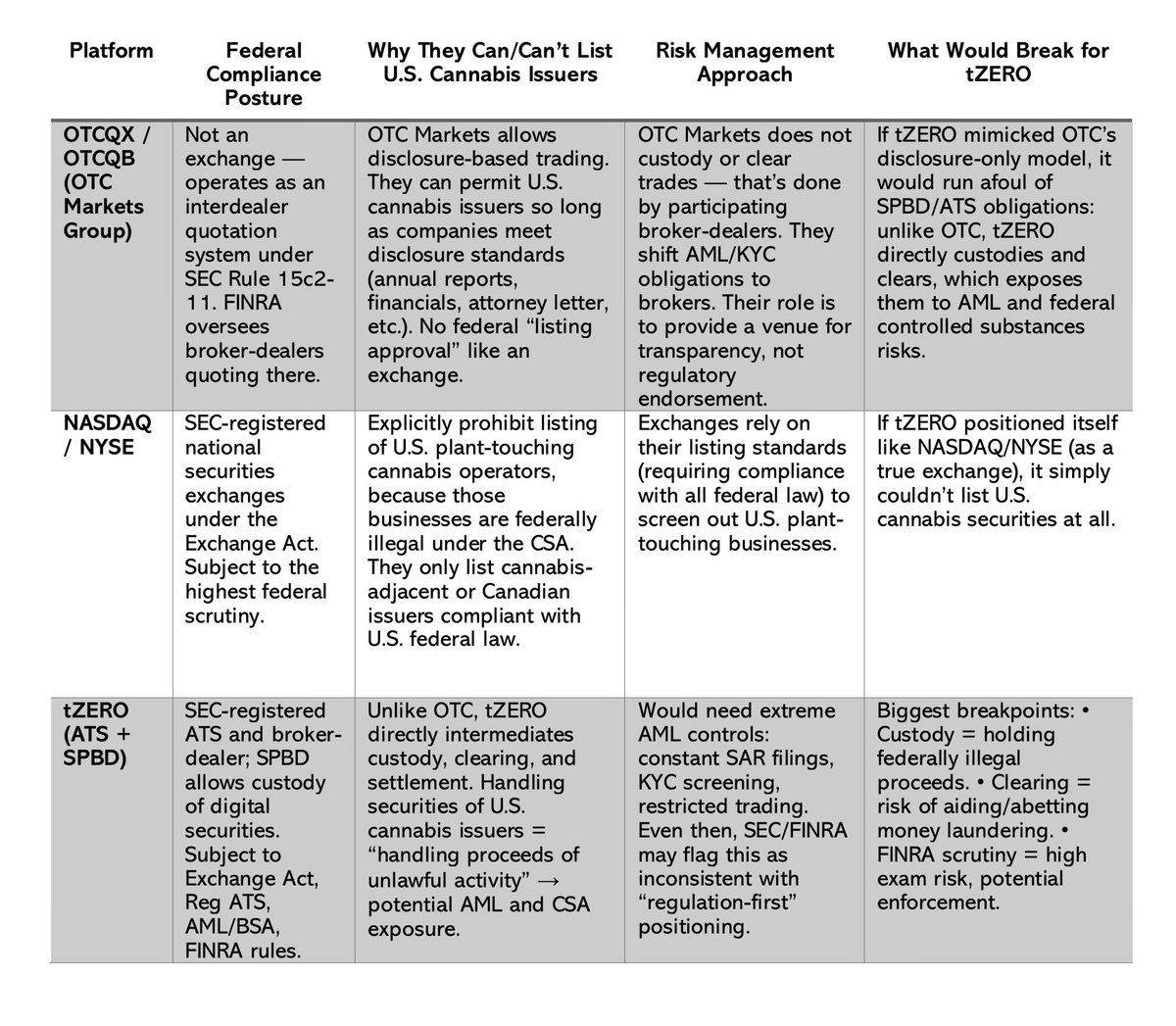

I was posed an interesting question around potential alternative solutions to the cannabis custody crisis (@tZERO). Unfortunately as you can see below, there is no easy way out without reform. I was reminded of things that I think we take for granted in how our sector functions…

@marcuslemonis @AlderLaneEggs @todd_harrison @bmacd36 @tZERO Gents, if only there were a platform to be the base layer for the impending growth of the next great American growth industry - cannabis healthcare? Or would it be same issues as currently exist, (compliance!)? Cheers J

The cannabis sector’s echo chamber seems slow to learn. As a $GTBIF shareholder, I invested based on its strong fundamentals. But fundamentals alone don’t drive price action - especially when key players thwart liquidity inflows into the name. Fact: Since June, $MSOS has boosted…

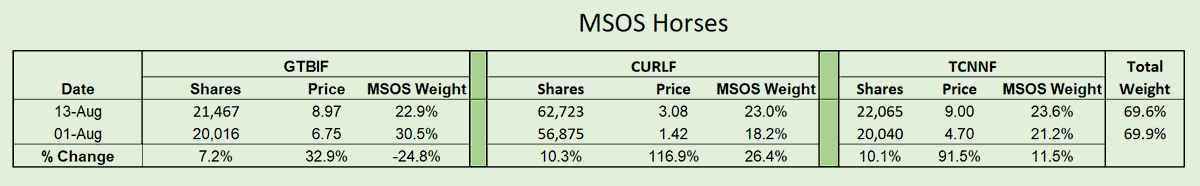

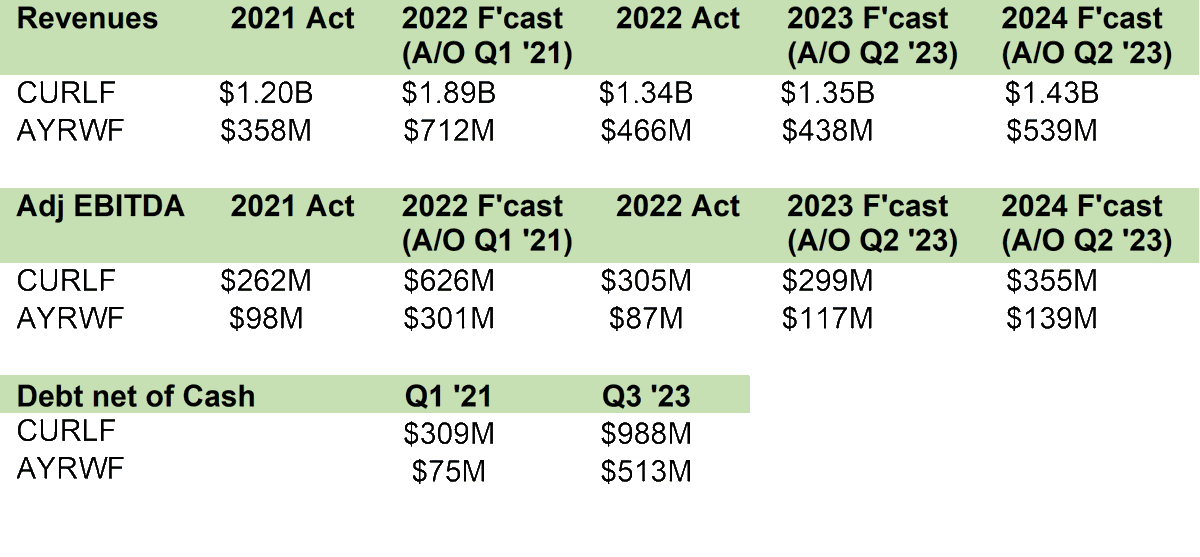

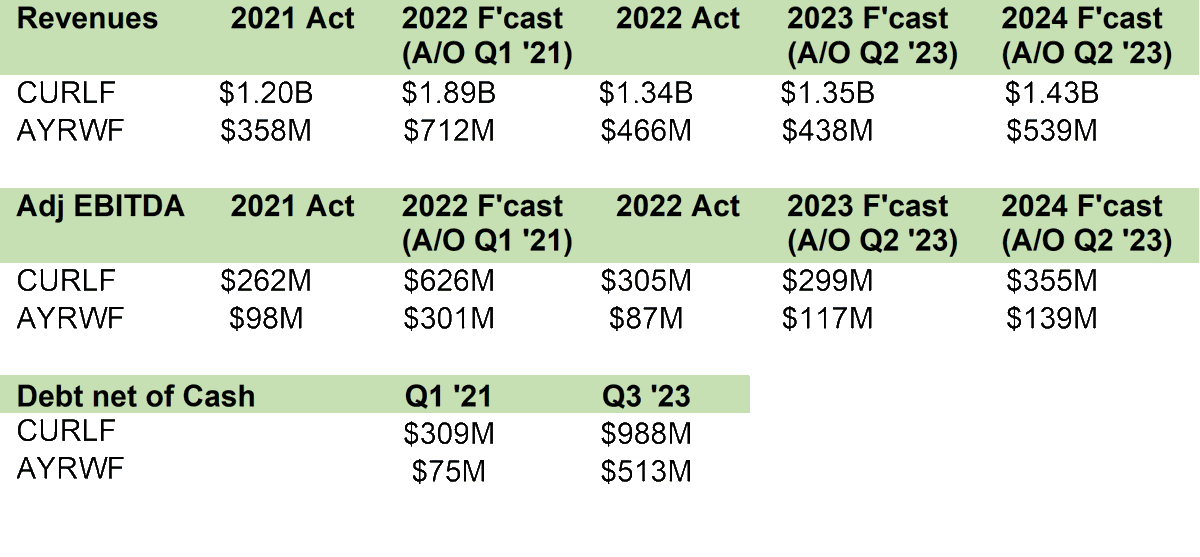

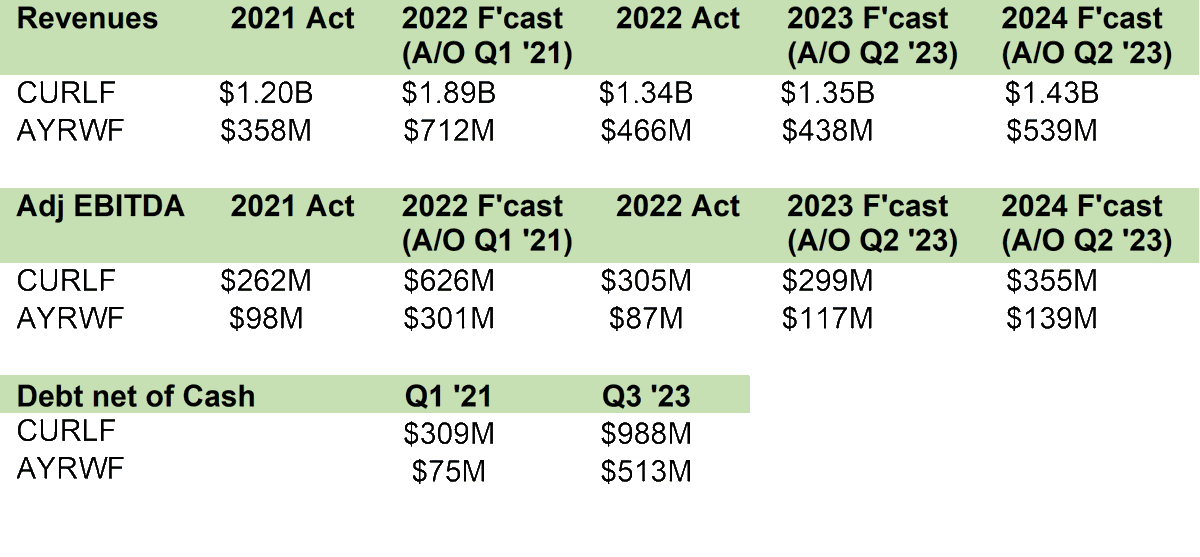

The three lead names within $MSOS traded rank with $TCNNF becoming the top holding at 23.6%, $CURLF remaining in second at 23.0% and $GTBIF dropping to third at 22.9%. Below is the updated scorecard. Whether you believe in correlation or causation, today we saw $MSOS pour $3.0M…

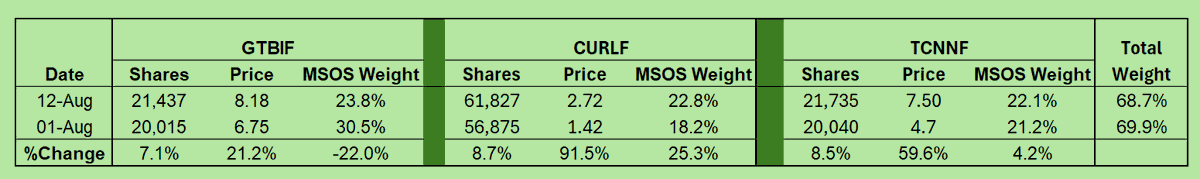

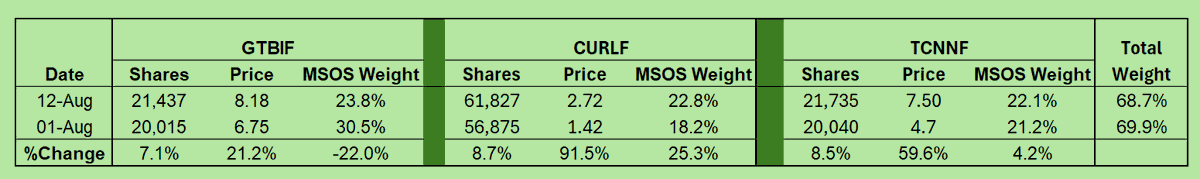

The recent shifts in $MSOS weightings are worth a closer look. On August 1, $GTBIF dominated with a 30.5% weighting, leading second-place $TCNNF by over 9 points. Just seven trading days later, the picture is quite different. $GTBIF's weighting has plunged by 22% to 23.8%, while…

The recent shifts in $MSOS weightings are worth a closer look. On August 1, $GTBIF dominated with a 30.5% weighting, leading second-place $TCNNF by over 9 points. Just seven trading days later, the picture is quite different. $GTBIF's weighting has plunged by 22% to 23.8%, while…

Who would have thought $CURLF would be a sliver away from $GTBIF as top portfolio weighted stock? $msos

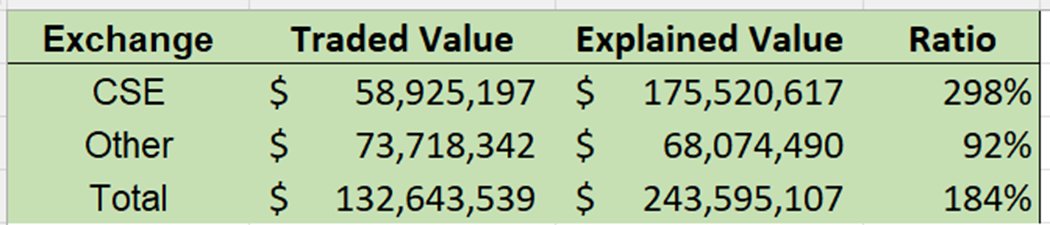

Today highlighted the impact of custody challenges in the U.S. cannabis sector. Within the MSOS ETF, three companies - $CURLF, $TSNDF, and $VFF – have been able to structure to avoid custody issues, which has also enabled their listing on the TSX or Nasdaq. Their trading…

Almost at 6M volume on TSX. This is the much-delayed benefit of what $CURLF & $TSNDF did when they uplisted. TSX custody didn't really matter much during a falling knife environment but it matters now when interest comes back to the space on such big, gamechanging headlines.

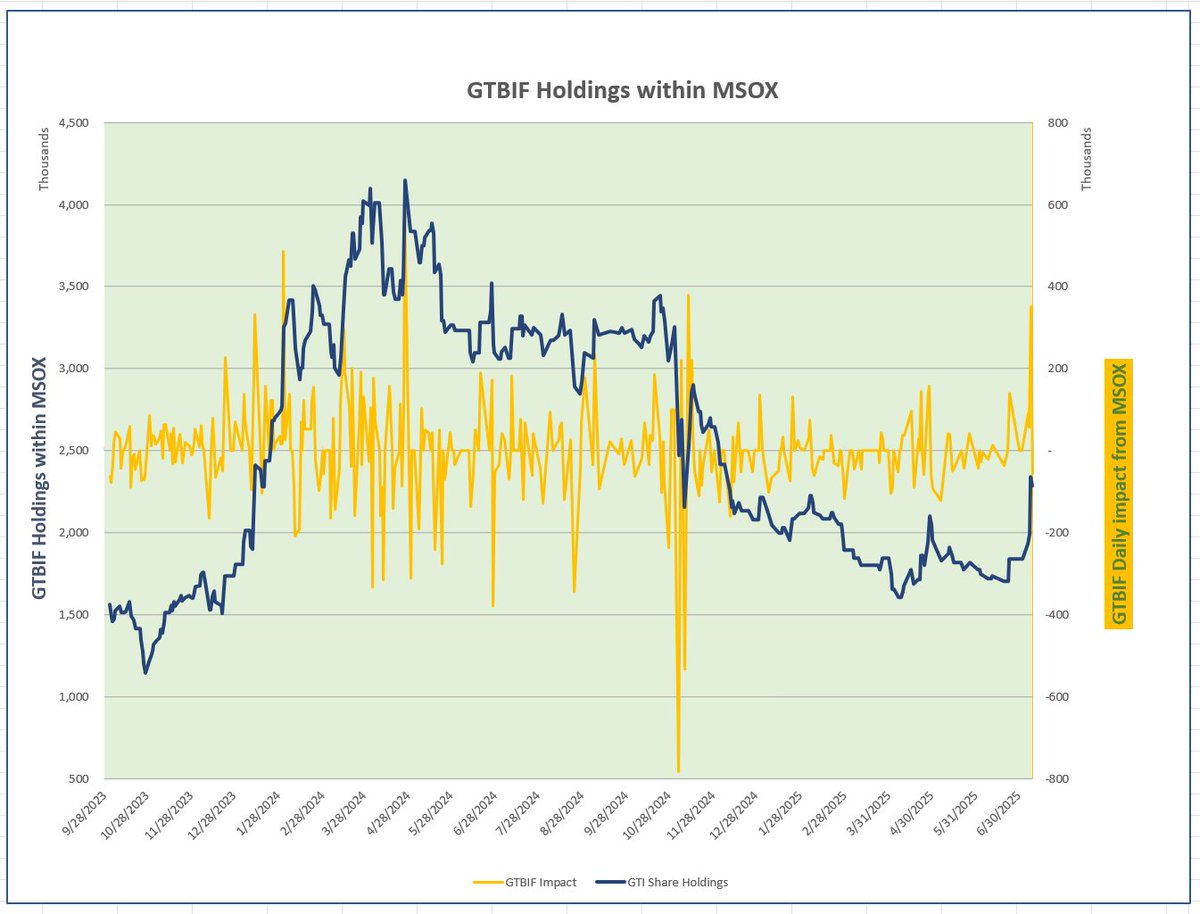

Fun Fact - Even after today's redemption, $MSOX has added 1.0 million shares of $GTBIF to its representative holdings since July 4th. A net of $6.95 million flowed into $GTBIF over this last month from $MSOX making the weighted average purchase price ~$6.86 per share. Over this…

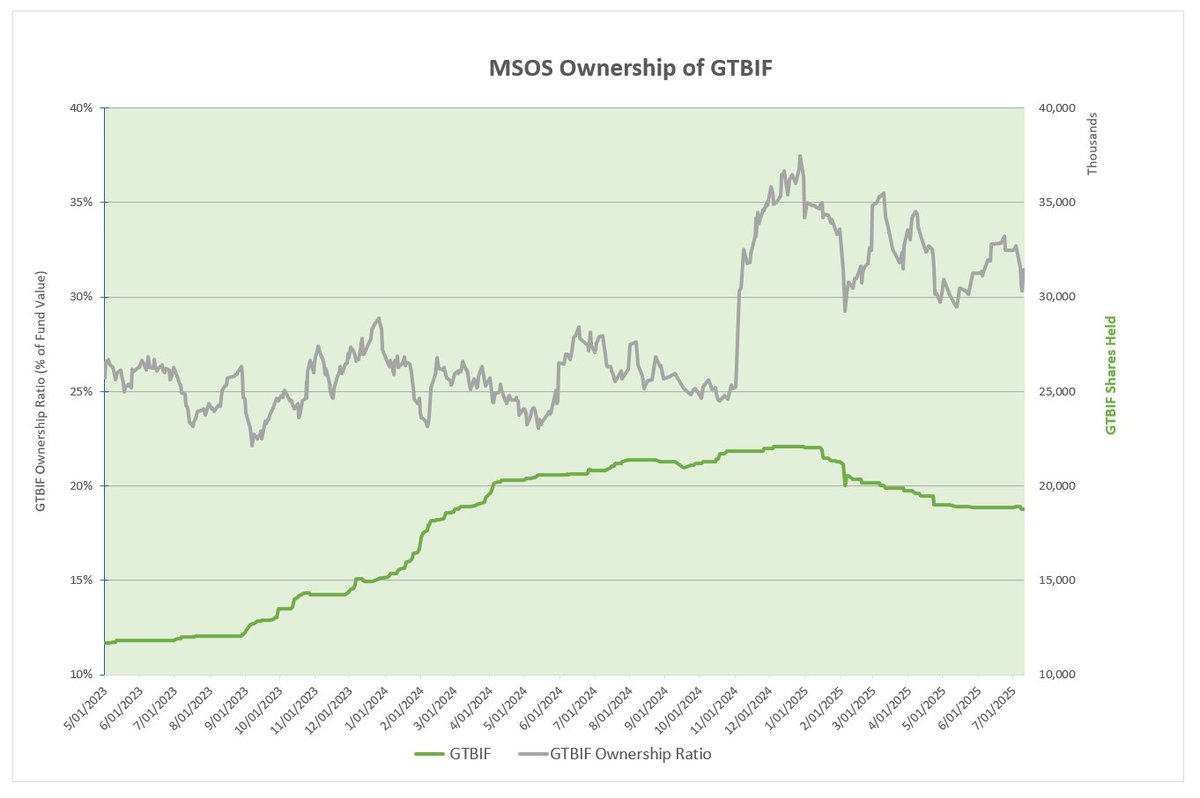

MSOS as a managed ETF means you are betting on both the horse and the jockey. The chart below shows 2 years of concentration of $GTBIF within the $MSOS portfolio. As you can see, @InvestinginCan1 built the fund position through the back half of ’23 and throughout ’24 to maintain…

Further to yesterday's discussion, let’s examine the $MSOX story with some detail. You can’t say something is good or bad if you don’t know why. MSOX is a leveraged ETF which is designed to amplify the daily returns of the $MSOS basket of stocks by a factor of 2x. While this…

These questions looked fun for a weekend data mining project. My fav is Q1 - Does $MSOS help or harm but lets dispense with the others first. #3 - I would guess that there are 6-10 AP's registered with 3 being active (only Dan really knows) but it doesn't matter. These guys…

"...AP will have shorted underlying names against the purchase of the ETF shares..." 1. Does this harm the underlying companies? 2. Could they do this if MSOS didn't exist? (**Currently**) <-- most interested in this one. 3. How many APs & can they conspire together?

Why not just think of $MSOS as an alternative custody mechanism. That is the main driver that has made it such a big part of the traded cannabis ecosystem. Shareholders make or break companies not by where they keep their shares, but rather based on rewarding or penalizing…

Ben - "You keep using that word (derivatives). I do not think it means what you think it means" - Princess Bride. There are four types of derivatives (options, forwards, futures and swaps). Buffett was not referencing anything like (cannabis) swaps in his quote- he was…

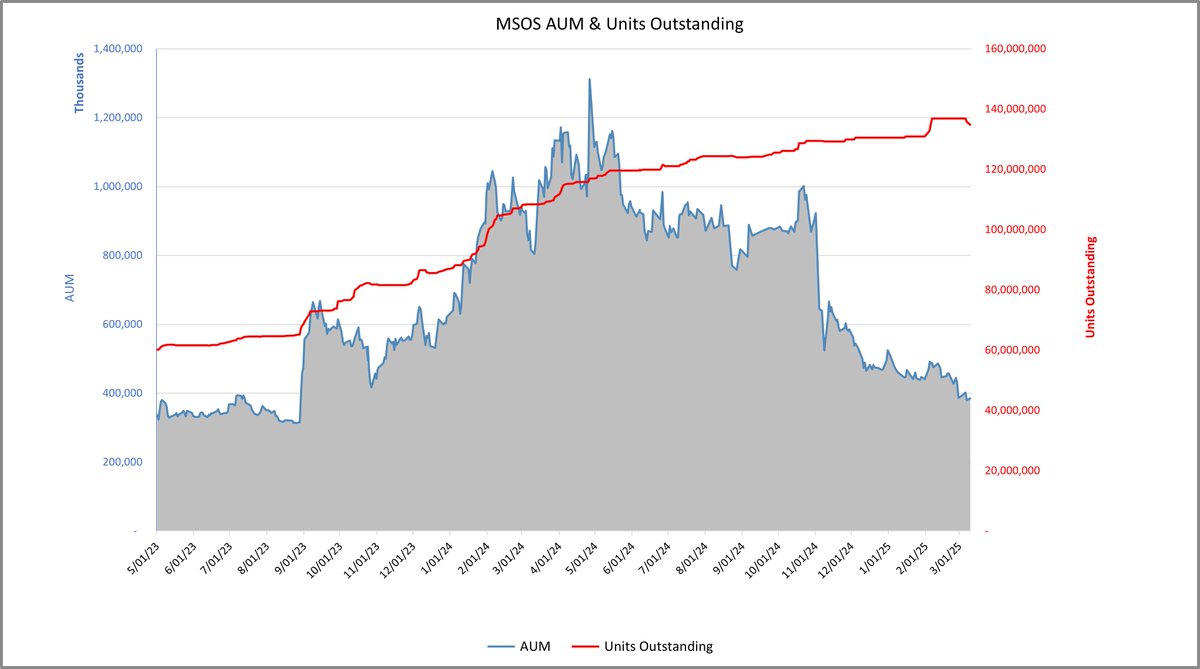

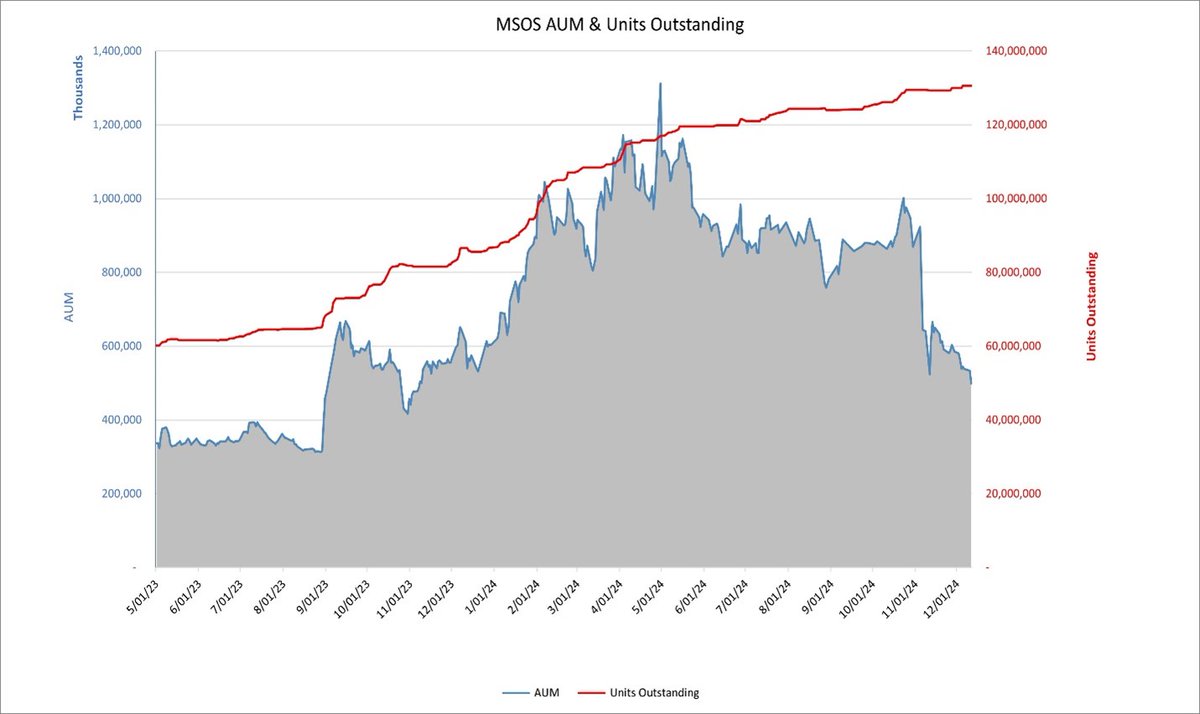

There is a different dynamic in $MSOS trading these days. It is a pattern we haven’t seen since SAFE failed to be included in the NDAA in Dec of 2022. We are seeing what appears to be a controlled liquidation of a significant position in MSOS by one of their shareholders. The…

The fundamental mechanics surrounding MSOS are getting lost in the noise as people look for scapegoats for an underperforming sector. Many relevant questions have been tabled around leverage, derivatives, redemptions, arbitrage dynamics etc. which I will address, but bottom line…

Leverage ticks higher: 12.81/474.18 =0.027 Zero management. Zero explanation.

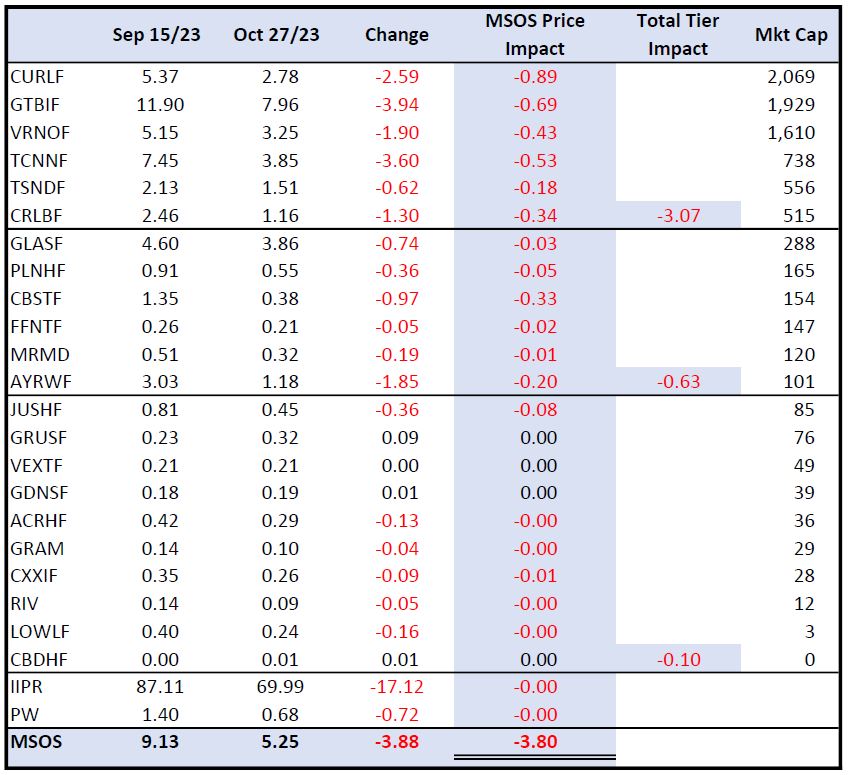

With the recent $MSOS price action, I am again seeing conspiracy theories on root cause. Let’s de-myth with facts. $MSOS is a reflection of its underlyings – full stop. The movement in $MSOS can be fully explained in terms of its holdings and vice versa. The table below breaks…

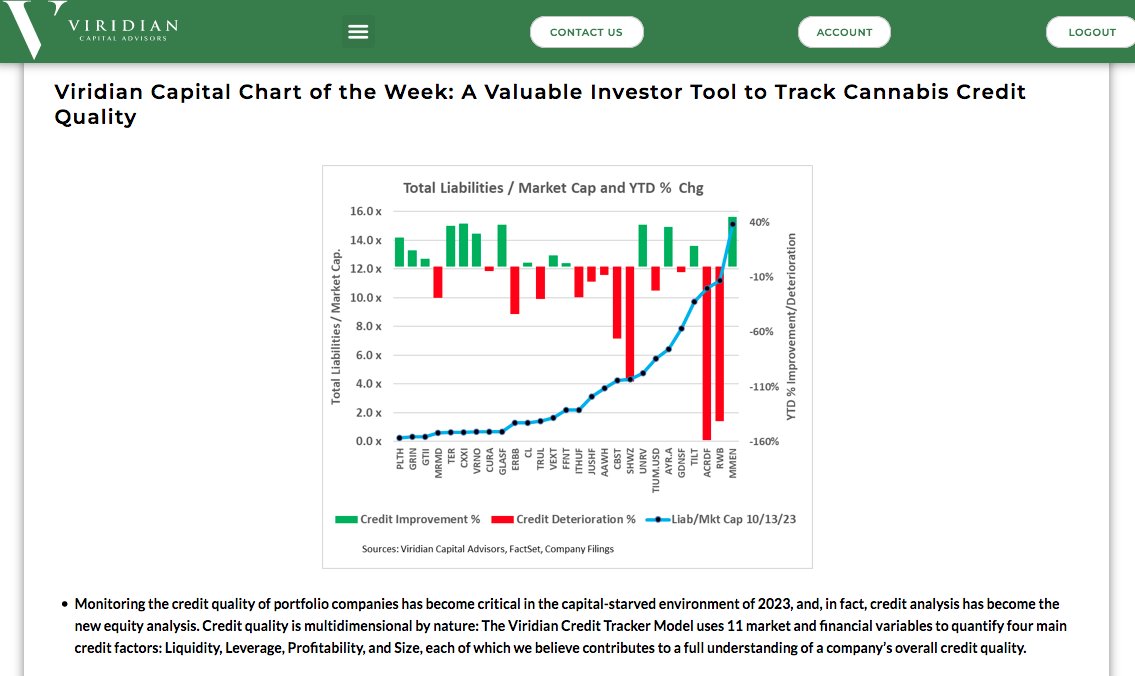

1/ Viridian Chart of the Week: A Valuable Tool to Track Cannabis Credit Quality "Monitoring the credit quality...has become critical in the capital-starved environment of 2023...We believe the best single number that an investor can calculate is Total Liabilities/Market Cap."

An interesting development with the SEC finally turning the lights on in the securities lending space. Rules appear to include monthly reporting of short activity over $10M by funds which will be anonymized and shared publicly 20 days later. Stock borrow activity will be made…

I was asked about $MSOS Short Interest (SI). Shorts are slippery topic. It is not always easy to get to the root cause and potential effects. A 20+% SI is indeed large. I can think of 4 likely drivers for the $MSOS SI. (Spoiler alert – choose E – All of the above). Let’s break…

I was asked about $MSOS Short Interest (SI). Shorts are slippery topic. It is not always easy to get to the root cause and potential effects. A 20+% SI is indeed large. I can think of 4 likely drivers for the $MSOS SI. (Spoiler alert – choose E – All of the above). Let’s break…

Just because people dream up a conspiracy doesn’t make it so. Let’s dig into the realities of $MSOS. Markets have two things - fundamentals and mechanics. Let’s start with mechanics. $MSOS is like any other ETF with two exceptions – it can’t directly hold all of its underlyings…

Just because people dream up a conspiracy doesn’t make it so. Let’s dig into the realities of $MSOS. Markets have two things - fundamentals and mechanics. Let’s start with mechanics. $MSOS is like any other ETF with two exceptions – it can’t directly hold all of its underlyings…

Just because people dream up a conspiracy doesn’t make it so. Let’s dig into the realities of $MSOS. Markets have two things - fundamentals and mechanics. Let’s start with mechanics. $MSOS is like any other ETF with two exceptions – it can’t directly hold all of its underlyings…

United States Trends

- 1. McDermott N/A

- 2. Beane N/A

- 3. #MLKDay N/A

- 4. Dr. Martin Luther King Jr. N/A

- 5. Don Lemon N/A

- 6. Dr. King N/A

- 7. Daboll N/A

- 8. Joe Brady N/A

- 9. Pegula N/A

- 10. Happy MLK N/A

- 11. Buffalo N/A

- 12. Dolly N/A

- 13. Nobel Peace Prize N/A

- 14. Norway N/A

- 15. FACE Act N/A

- 16. MLK Jr. N/A

- 17. #MondayMotivation N/A

- 18. 25th Amendment N/A

- 19. Christians N/A

- 20. NYSE N/A

You might like

-

Aaron Miles

Aaron Miles

@_AaronMiles_ -

Revelations Partners, LP

Revelations Partners, LP

@RevelationsLP -

George Archos

George Archos

@GeorgeArchos -

Sammy Dorf

Sammy Dorf

@SammyDorf -

Jason J. Schilling

Jason J. Schilling

@RealSchill -

budflight

budflight

@budflight -

Scott R. Grossman

Scott R. Grossman

@srg444 -

$hompz

$hompz

@shompzilla -

Christopher Norman

Christopher Norman

@cnormanlaw -

Mackenzie P

Mackenzie P

@mpadvisorshares -

Ben Munchin

Ben Munchin

@Wheatonabix -

Jerry Derevyanny

Jerry Derevyanny

@JDerevyanny -

Boris Jordan

Boris Jordan

@Boris_Jordan -

Carl Roger 🇨🇦🇸🇪

Carl Roger 🇨🇦🇸🇪

@nbeaullsten -

Brady Cobb

Brady Cobb

@BCobblaw

Something went wrong.

Something went wrong.