你可能會喜歡

For starters its all about how well things are running...I'm willing to get more aggressive when I'm seeing the ball. So started a pos as you pointed out with stop at lod that day...then doubled up the next day when it took out the prior day high and I was going to close all of…

Kristjan Kullamägi @Qullamaggie CAGR 2013-2019 is 268% One of the best performers during the market craze of the past years. Here are resources I used to study his work, please add any other resources you have in the comments below! Resources: 1: 12.31.21 and 01.03.22:…

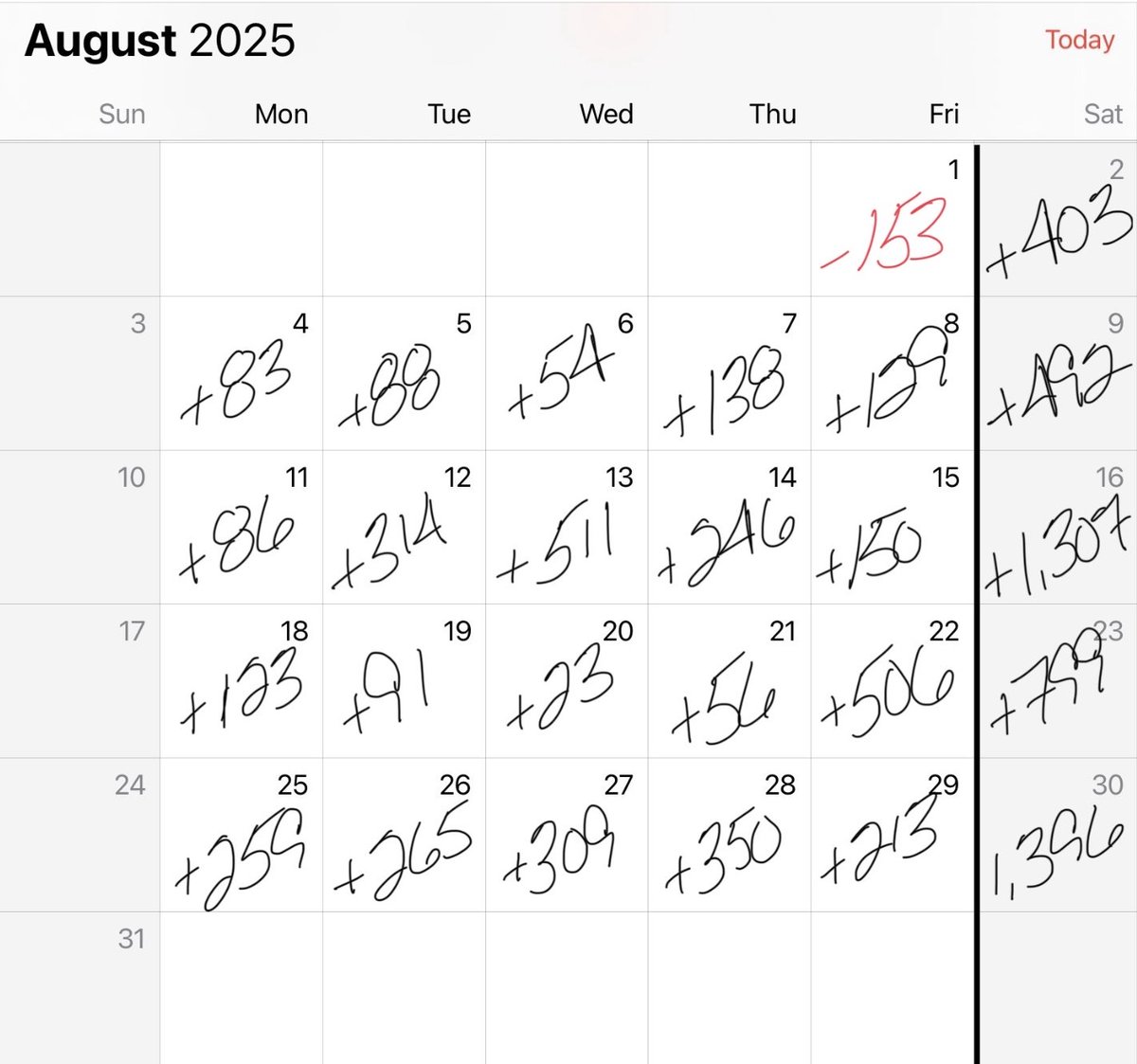

First net negative reading since 8/01. That rebounded quickly after just that one negative day. Will see if this can rebound or if it starts a string of negative readings.

Chalk up another classic loss for me here...(in reality more of a net breakeven based on the earlier trade) but a couple notable things. 1. A trade failing doesn't mean much to me and I had a pretty decent line here as I've gotten some traction and this has good liquidity and…

Well talked about this a few times but a couple things this is a good example of: 1. Sometimes the best position to buy is the one you already own. 2. If I already own something and want to add I always ask myself...'if I didn't own it would I buy it here'...if the answer is…

Trading doesn’t just test your strategy. It amplifies who you already are. 👉If you’re even slightly impatient in everyday life, sit in front of a live market and watch what happens… That mild impatience turns into overtrading. Jumping in too fast. Adding to positions that…

New video out! If you’ve ever wanted to understand how @Qullamaggie spots the hottest themes & sectors — and turns them into huge trades — this one’s for you youtube.com/watch?v=bZsZhN…

youtube.com

YouTube

9 Figure Trader Shows How To Find The Hottest Themes (Qullamaggie)

Historically, September is the weakest month for the NASDAQ and equities more broadly, which is visible in the cycle model dipping into late September/early October. After that, cycle work points to a recovery into year-end, consistent with the “election-year rally” tendency. The…

Signs of a top or a bottom:

THERE CAN BE NO GROWTH WITHOUT SUFFERING I was reflecting on this opening quote and it immediately made me think of trading. We all naturally seek to avoid suffering, but in trading (and life), it is the struggles that lead to the most growth. Every drawdown, slump, or big loss…

Learn, live, and love the rules.

The nature of the relationship you have with yourself is at the epicentre of everything you do. If this relationship is healthy, balanced, respectful, trusted, then you are likely to be more comfortable in situations of uncertainty, complexity, challenge. If this relationship…

AUGUST U.S. 🇺🇸 INFLATION DATA: CPI 2.9% YoY, (Est. 2.9%) CPI 0.4% MoM, (Est. 0.3%) Core CPI 3.1% YoY, (Est. 3.1%) Core CPI 0.3% MoM, (Est. 0.3%)

Do you really know how to read the tape or do you just like technical analysis? Weekly CMR video now live! TRADING 101: THE SECRET TO READING THE TAPE youtu.be/X7JCrDBX3cg?si…

youtube.com

YouTube

TRADING 101: THE SECRET TO READING THE TAPE

This week on the Investing with IBD podcast: @MarkRitchie_II is back to help us try and make sense of the current rally. Live 2PM Pacific/5PM Eastern on September 3 Watch Here: 👇 youtube.com/live/-w86LYBJq…

youtube.com

YouTube

Here’s How To Respond To The Evolving Rally | Investing with IBD

We just posted @TheOneLanceB 's excellent presentation on why more information is not the path to success in trading and what to do instead. This is an important video for all traders to watch. Watch it here 👇 youtu.be/qz7avJJvnyI

youtube.com

YouTube

Stop Learning, Start Winning: Lance Breitstein’s Deep Work Strategy...

“Let’s say you have a system that makes 100 trades a year. It has an expectancy of 0.7R, meaning on average you should make 70R each year. Well, if you risk 1% on each trade, you should come close to making 100% per year with compounding. And 0.7R per year with a 100-trade system…

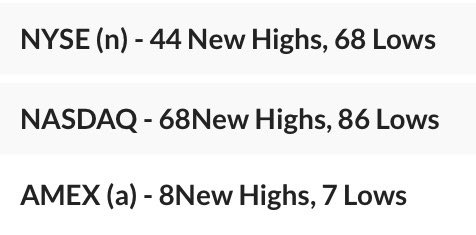

AUG25 the net 52 week New High/Low (IBD #s) differential. Every picture tells a story and this one always reflects the general health of the market - its been doing it for over 80 years. This is now 19 straight net positive weeks in a row. That’s what a market at or near all time…

The less attached you are to the money, and the more committed you are to honestly observing yourself, the more money you’ll make. That's a key aspect of what "Process over Outcomes" actually means.

AlphaMind Podcast Episode 150 🎙️ Mark Minervini: From Humble Beginnings to Mark Wizard and Trading Legend 🎧Podcast: bit.ly/Minervini_PC 📺YouTube: bit.ly/Minervini_YT

youtube.com

YouTube

#150 Mark Minervini: From Humble Beginnings to Mark Wizard and...

Mondays carry two forces for traders: 1) Pent-up excitement for a fresh week 2 The shadow of last week’s wins or losses Both can cloud your judgment. The market doesn’t care what you hope for or fear. It only offers what’s here right now. Trade this moment, not last week’s…

United States 趨勢

- 1. Branch 36.7K posts

- 2. Chiefs 111K posts

- 3. Red Cross 49.7K posts

- 4. Exceeded 5,982 posts

- 5. Mahomes 34.6K posts

- 6. Binance DEX 5,168 posts

- 7. #njkopw 5,025 posts

- 8. #LaGranjaVIP 81.9K posts

- 9. Air Force One 55.9K posts

- 10. Rod Wave 1,606 posts

- 11. #TNABoundForGlory 59.1K posts

- 12. #LoveCabin 1,358 posts

- 13. Tel Aviv 58.8K posts

- 14. Alon Ohel 15.7K posts

- 15. Bryce Miller 4,593 posts

- 16. Omri Miran 15.3K posts

- 17. Eitan Mor 14.9K posts

- 18. LaPorta 12.1K posts

- 19. Matan Angrest 14.4K posts

- 20. Goff 13.9K posts

你可能會喜歡

-

Cory Mitchell, CMT

Cory Mitchell, CMT

@corymitc -

Nathan Bancroft

Nathan Bancroft

@n_bancroft2 -

Peter Robbins

Peter Robbins

@prrobbins -

Ross Haber

Ross Haber

@RossHaber_ -

TML Trader

TML Trader

@TMLTrader -

Shahid Saleem

Shahid Saleem

@SSalim0002 -

Roy Mattox

Roy Mattox

@RoyLMattox -

Ameet Rai

Ameet Rai

@AmeetRai_ -

Oliver Kell

Oliver Kell

@OliverKell_ -

Leif Soreide

Leif Soreide

@LeifSoreide -

Julian Komar 🚨 Market Update Premium

Julian Komar 🚨 Market Update Premium

@BlogJulianKomar -

Coach Mak | Know Your Money

Coach Mak | Know Your Money

@WealthCoachMak -

James Roppel

James Roppel

@Upticken -

Dr. Eric Wish

Dr. Eric Wish

@WishingWealth -

KIER MCDONOUGH

KIER MCDONOUGH

@KIERMCD

Something went wrong.

Something went wrong.