chartspoop

@chartspoop

do not treat my yaps as financial advice

You might like

My trading journey as a Singaporean from a strict Chinese family We were taught: study hard → good job → never touch stocks (“It’s gambling. Your luck will run out one day”). Family members got burned before. Stocks were forbidden. But with my STEM background, the market is…

talked to a guy who's been trading 23 years and manages $40M asked him what separates traders who survive from traders who blow up his answer surprised me it wasn't strategy. it wasn't discipline. it wasn't psychology. "bet sizing. that's it. that's the whole game." here's…

So satisfying

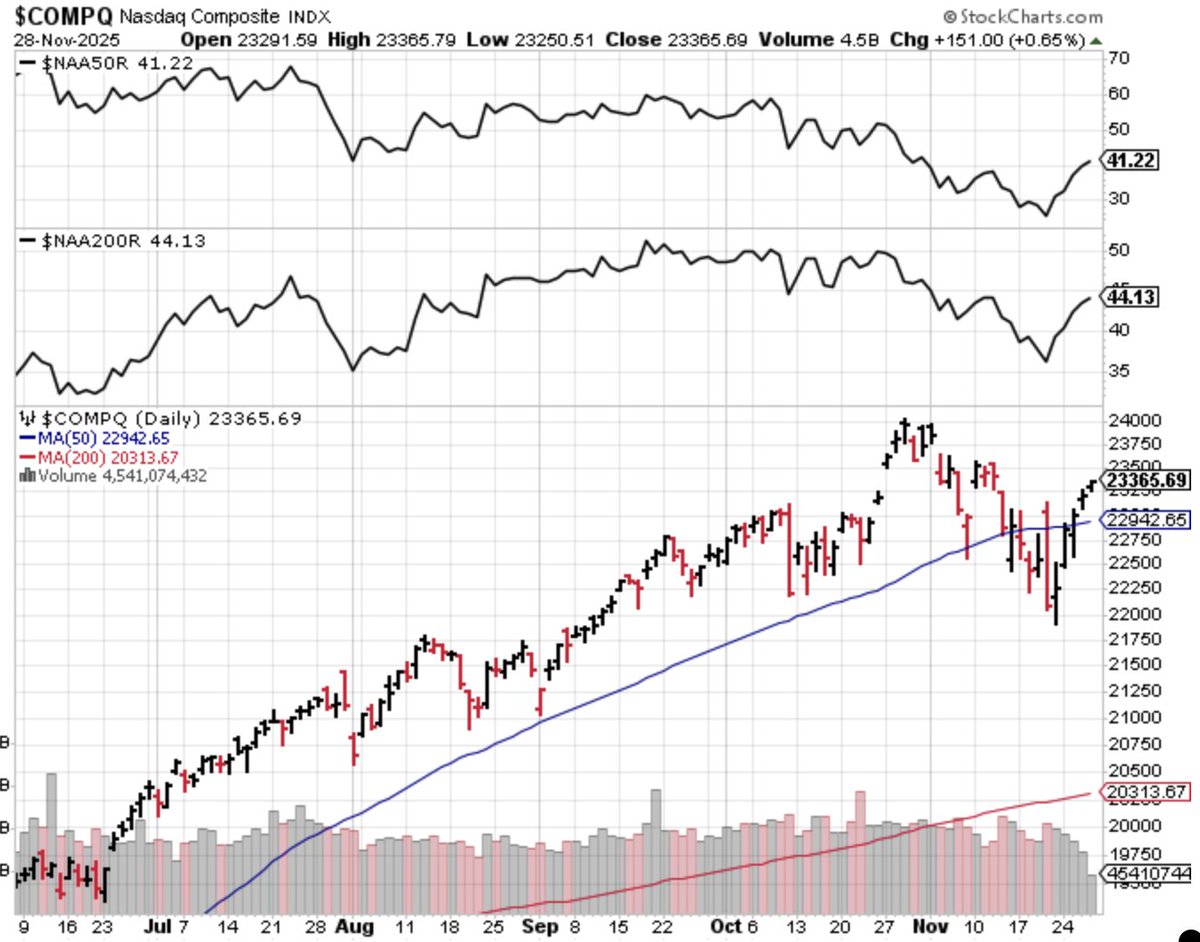

$ORCL $AVGO already showing that amazing earnings are being sold into. AI/semi theme is temporarily down. $TSLA exhibited strength on friday when everything is going down. In times like this, i'll typically stay out of the market. However, weed stocks seem too tempting. $MSOS…

Loving the look of retail stocks - hot off the boom from $AEO $VSCO, $LULU and $CROX looking to join in next week. $DNUT looks pretty too.... too much donuts so people have to buy more clothes? win-win!

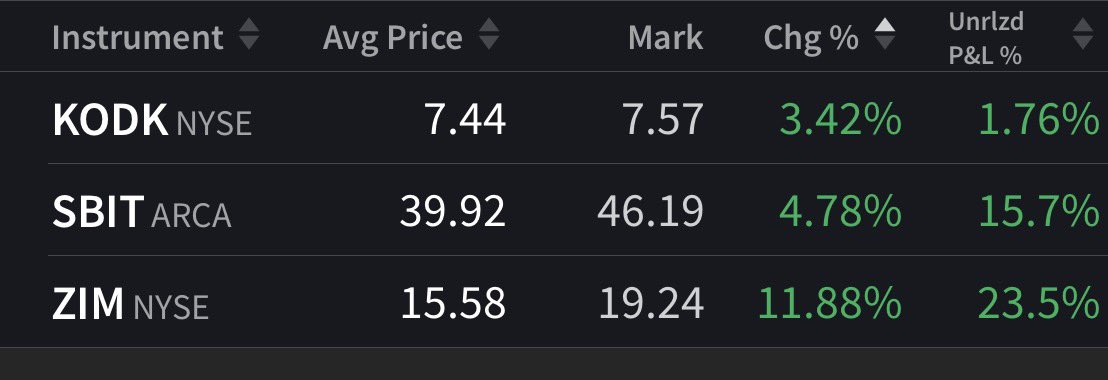

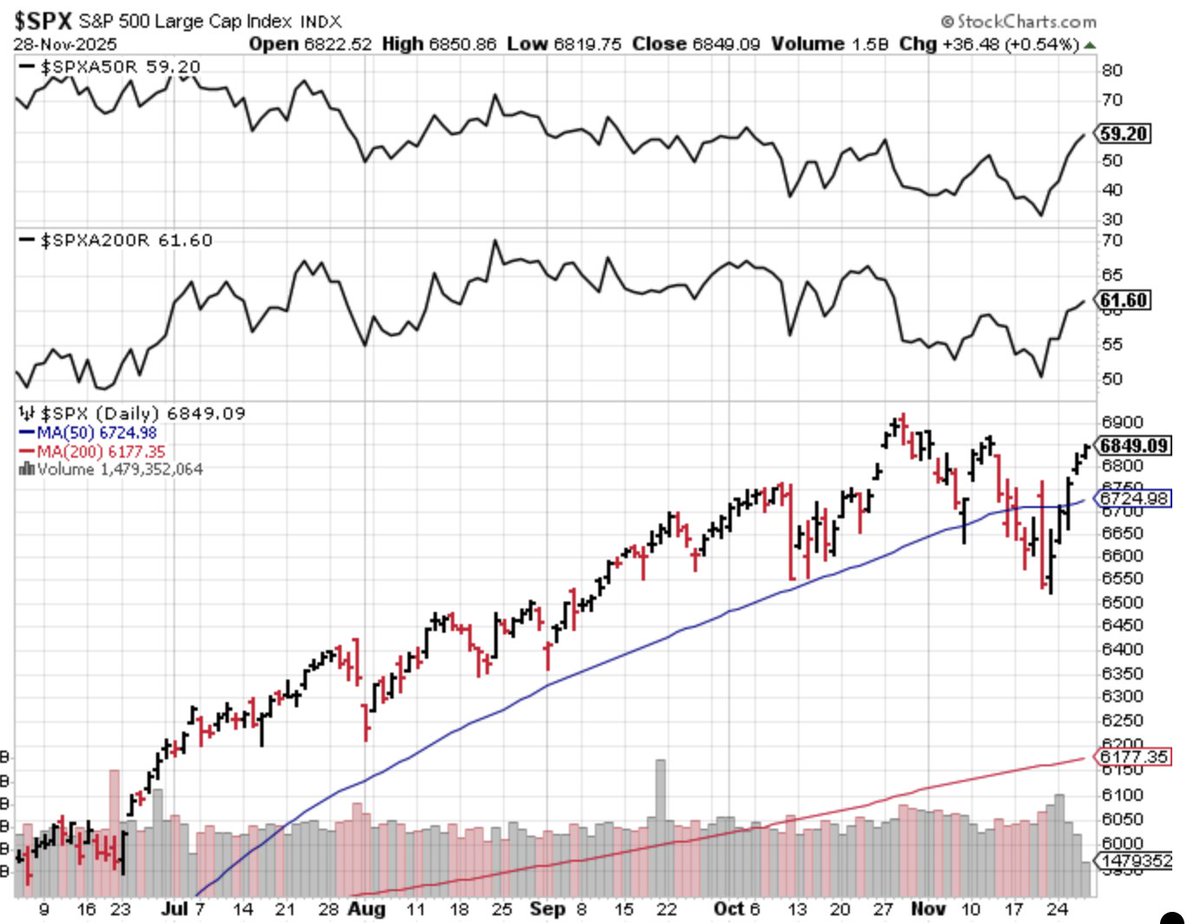

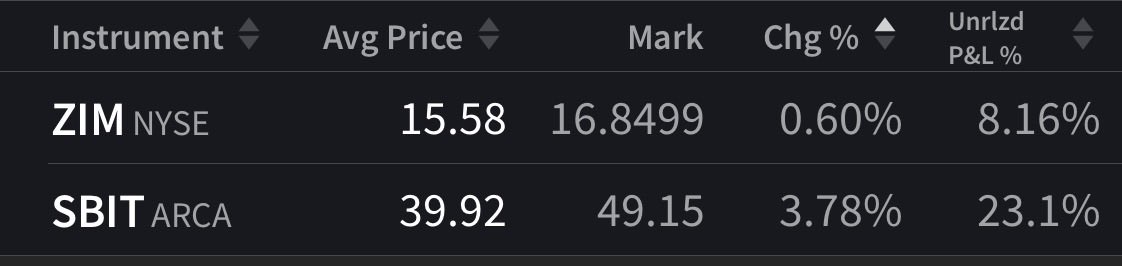

I like the upturn in the number of stocks slowly gaining momentum. Recent small trades have also started gaining traction. Will look to increase exposure again. $RDDT $FROG $ESTA $GFI especially catching my attention. Already own $ZIM $AU $LMND $KODK $BVN $OPEN $TSLA

Expecting a quiet, range-bound week ahead with low volume due to the holiday-shortened week. Real directional moves likely on hold until the Fed rate decision. Wouldn’t mind one final high-volume flush lower if we get it — still hunting for that last shakeout. After that, not…

FWIW these are my only 2 positions. Thought the market was gonna flip after $NVDA reported beast earnings as usual, but as always, always sell into the first rip after a period of market weakness, which was what happened on Thursday and Friday. Now is a period of observing…

This is what 2020-2021 looked like: - Spending hundreds of thousands or even millions on JPEGs of rocks, animals, etc - Investing in “Metaverse land” - GameStop going +3,000% in two weeks - SPACs going public daily - EV sector worth $300B - Tom Brady and other celebrities with…

Today was the S&P's worst breadth day ever for an "up" day. Since 1990, the S&P has never had weaker breadth on a day that it closed positive. The index closed up 0.23% with a net advance/decline line of -294. There were 104 stocks up and 398 down. 🤮

Hi @YouTube @YouTubeCreators I saw a message today that my channel youtube.com/richardmoglen is no longer eligible for monetization because of re-used content. I don't re-use content and have submitted an appeal. I have been posting videos to your platform for years now and…

What a bounce. The gap up held, and made back the losses on Friday, and more. Even managed to sell some into strength. $CRWD looks ready

Qullamaggie on Always being Long at Market Tops "Like the thing is for me, I'm always going to be long at the top. I will always be long at the top. I do not anticipate where the top is going to be. I sell on the downside when it starts violating the moving averages. I will…

United States Trends

- 1. Luka N/A

- 2. Lakers N/A

- 3. Clippers N/A

- 4. #TheTraitorsUS N/A

- 5. #River N/A

- 6. Rublev N/A

- 7. Kawhi N/A

- 8. Colton N/A

- 9. Paolini N/A

- 10. Ayton N/A

- 11. Vando N/A

- 12. Iva Jovic N/A

- 13. Maki N/A

- 14. #criticalrolespoilers N/A

- 15. #thepitt N/A

- 16. Jihyo N/A

- 17. Ari Lennox N/A

- 18. #TNAiMPACT N/A

- 19. Autopilot N/A

- 20. louis tomlinson N/A

Something went wrong.

Something went wrong.