Codebase Technologies

@codebtech1

A global open API banking solutions provider changing the way people bank.

You might like

We recently published a whitepaper on how MENA financial institutions can achieve operational efficiency through managed services. Download it below to understand the necessity, opportunities, challenges, and framework for success. codebtech.com/managed-servic…

Innovation in legacy financial institutions is inherently slow. Research shows that traditional banks are 40% less productive than their digital-native peers. So, how can they fast-track their processes? Learn how to achieve this in our latest blog: codebtech.com/how-managed-se…

Statistics indicate that 70% of digital transformation initiatives exceed their original budgets, while 7% end up costing more than double the initial projections. How can financial institutions address this resource burden? Read more: codebtech.com/how-managed-se…

Read our latest blog "How Managed Services Help Legacy Banks Streamline Digital Transformation.": codebtech.com/how-managed-se… #CodebaseTechnologies #Digibanc #ManagedServices #Banking

The low-code/no-code market is booming, projected to hit $187 billion by 2030 with a 31.1% CAGR. But do quick wins always mean growth? In digital banking, customizable platforms provide the flexibility, scalability, & innovation banks truly need: codebtech.com/low-code-no-co…

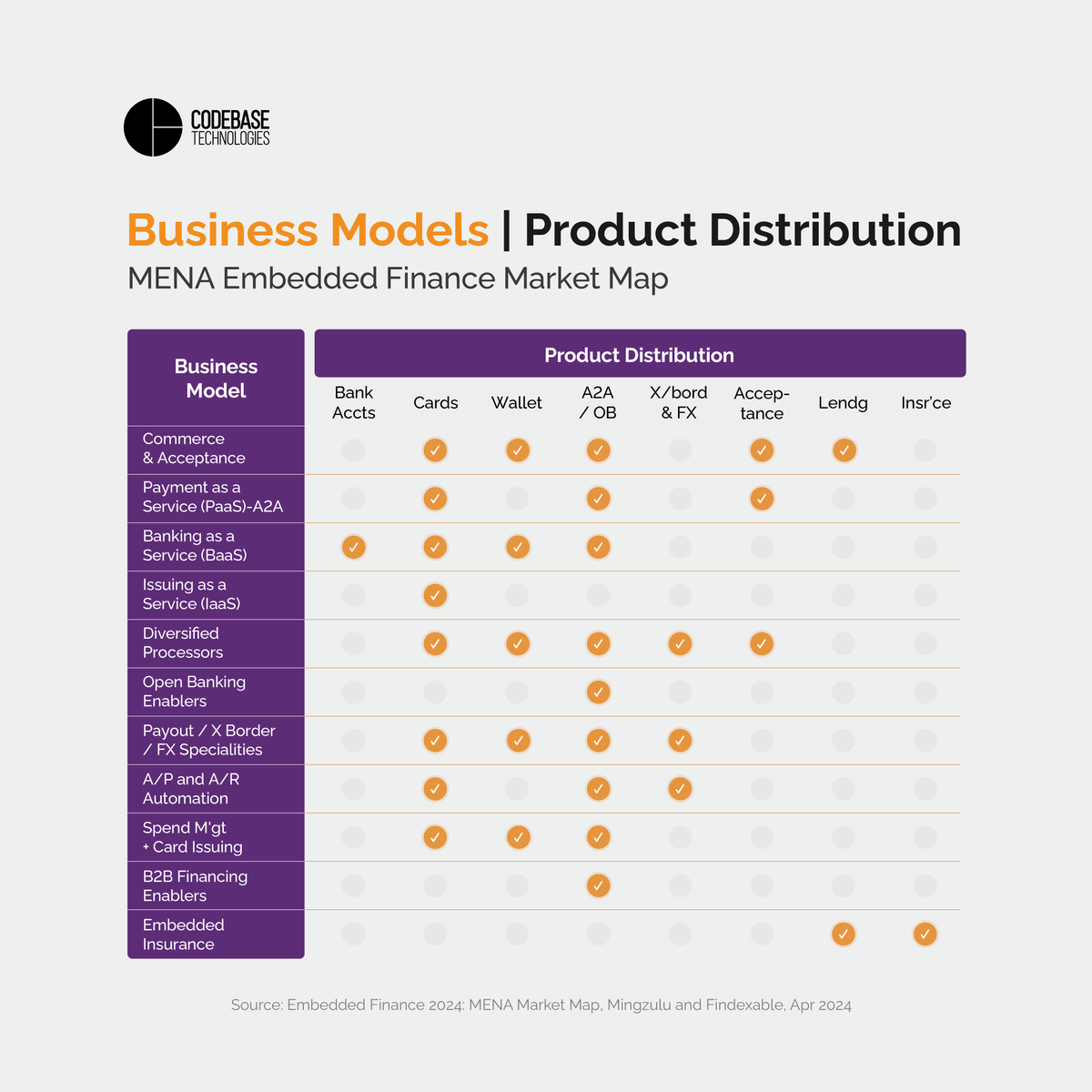

The MENA embedded finance ecosystem is evolving rapidly, driven by a mix of regional and global players adopting diverse business models to address sector-specific needs. Read our embedded finance whitepaper to explore these trends in greater detail: codebtech.com/embedded-finan…

Low-Code/No-Code (LC/NC) platforms have gained popularity for rapid development with minimal developer, with the market projected to reach $187 billion by 2030 Omar Mansur, our MD for APAC, addresses "The Pitfalls of LC/NC Platforms" in his latest blog: codebtech.com/low-code-no-co…

United States Trends

- 1. Bama 42.8K posts

- 2. Ty Simpson 6,925 posts

- 3. Georgia 57.5K posts

- 4. Miami 219K posts

- 5. #NXTDeadline 10.8K posts

- 6. #UFC323 23.4K posts

- 7. #SECChampionship 4,773 posts

- 8. #GoDawgs 12.2K posts

- 9. Ryan Williams 2,645 posts

- 10. DeBoer 4,016 posts

- 11. Frank Martin 1,226 posts

- 12. Kirby 14.9K posts

- 13. Texas Tech 31.4K posts

- 14. Jalin Turner 1,294 posts

- 15. #RollTide 2,940 posts

- 16. Grubb 2,251 posts

- 17. Messi 310K posts

- 18. Oba Femi 5,924 posts

- 19. Fowler 1,845 posts

- 20. Harry Ford 2,551 posts

Something went wrong.

Something went wrong.