codon.pro

@codon_pro

Trading Architect | Founder @ http://codon.pro Pine Script v6 frameworks. Replacing the noise of bias with the clarity of structure. Execution over prediction.

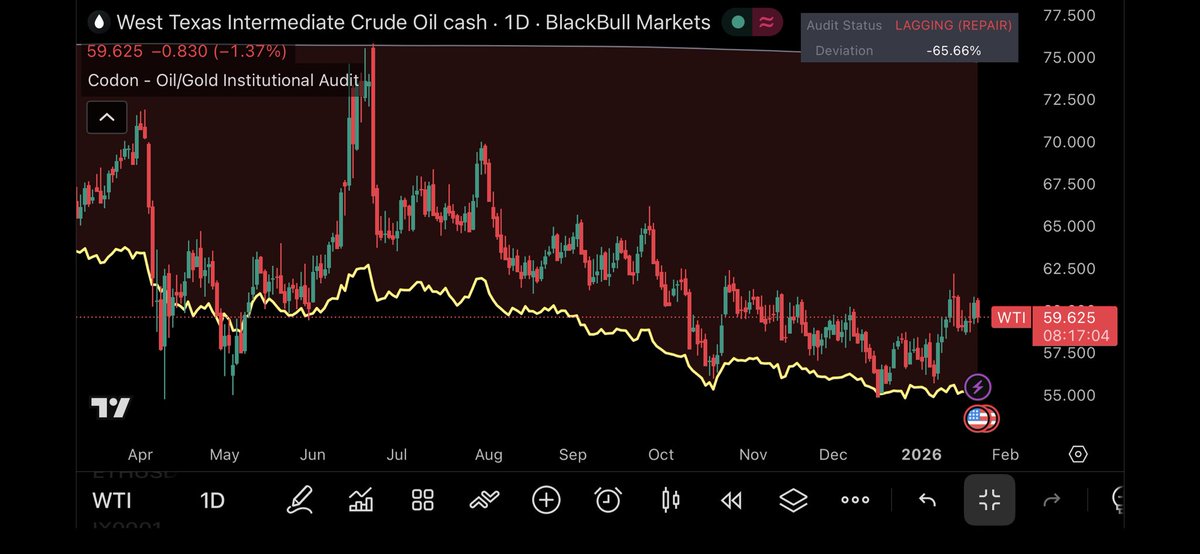

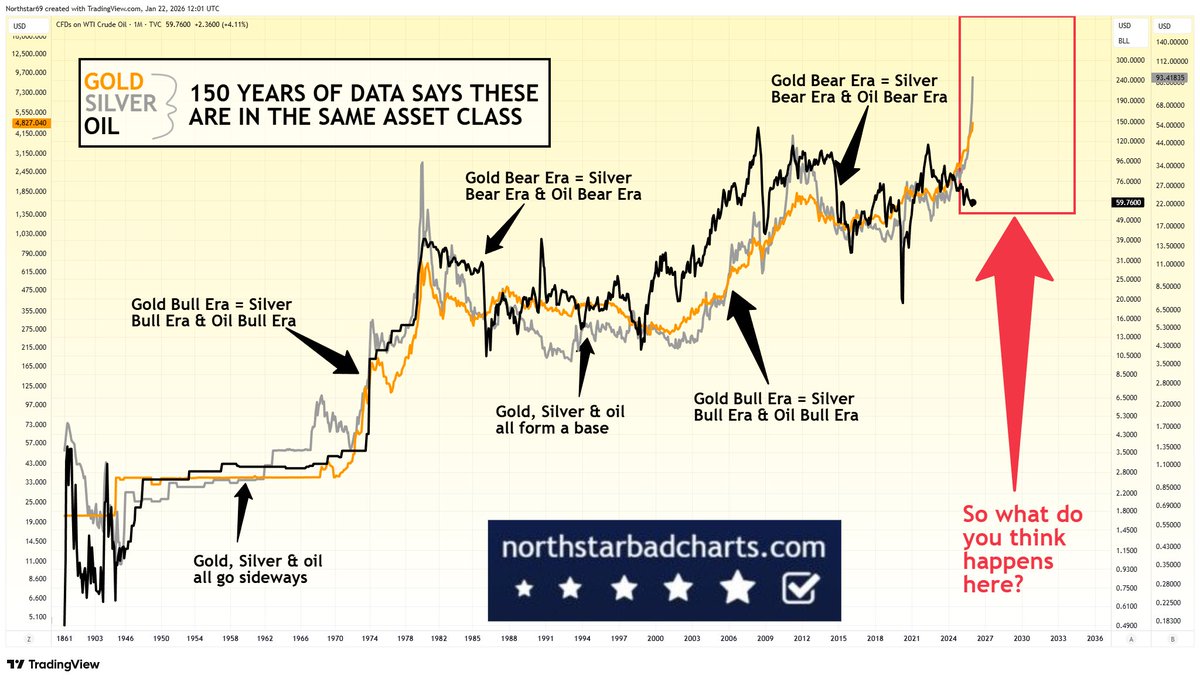

Oil isn't forecasting a future; it’s performing a structural repair of its purchasing power. The 150-year correlation confirms that energy is the ultimate laggard in the debasement cycle. When the fiat floor collapses, the physical world catches up via oil. $200 is simply the…

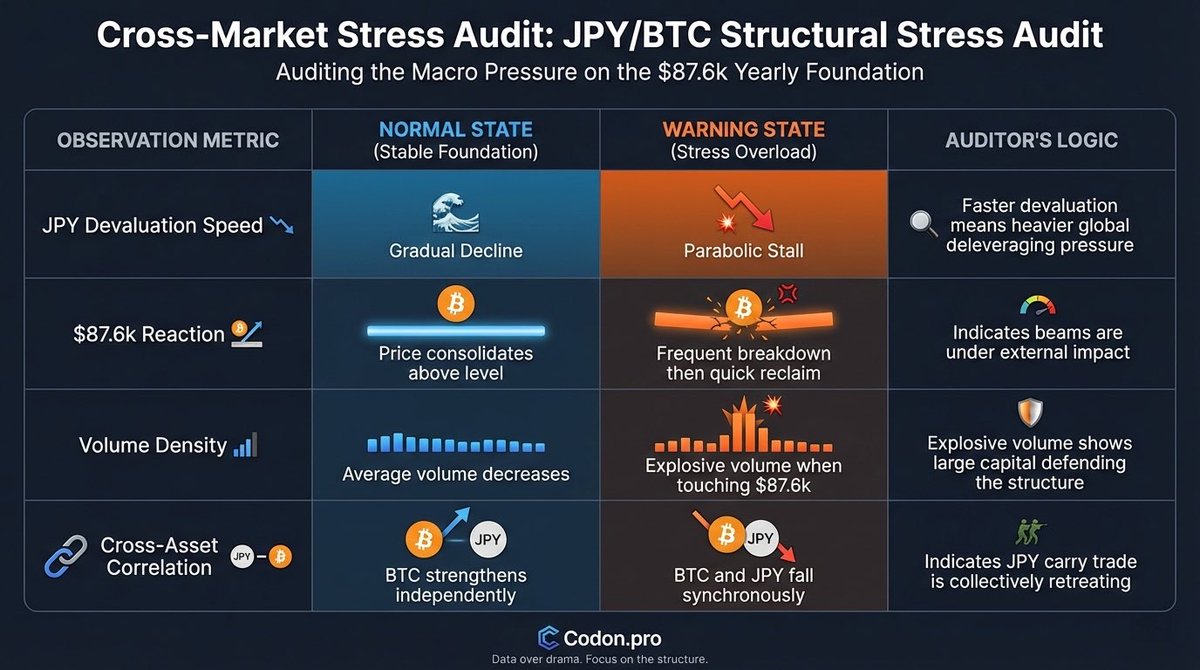

Maintaining 89k for nine weeks creates the material density needed for the next move. Most mistake this duration for stagnation, but the structural audit confirms the 81k floor has absorbed every stress test. This is a necessary settle for purchasing power parity alignment…

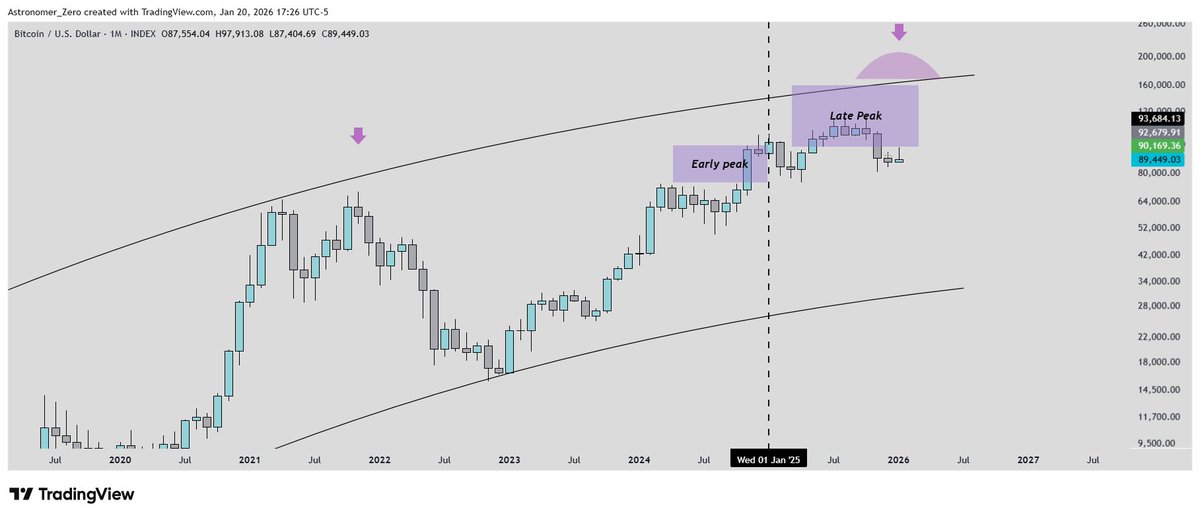

$BTC - high timeframe bottom call (the single most important reminder in the market) 89k, and so 9 weeks of holding almost done ✅, 10 incoming. Alright, we are about to close week 9 which fulfills our promise of 9 weeks of the bottom holding, and soon, the 10th week opening…

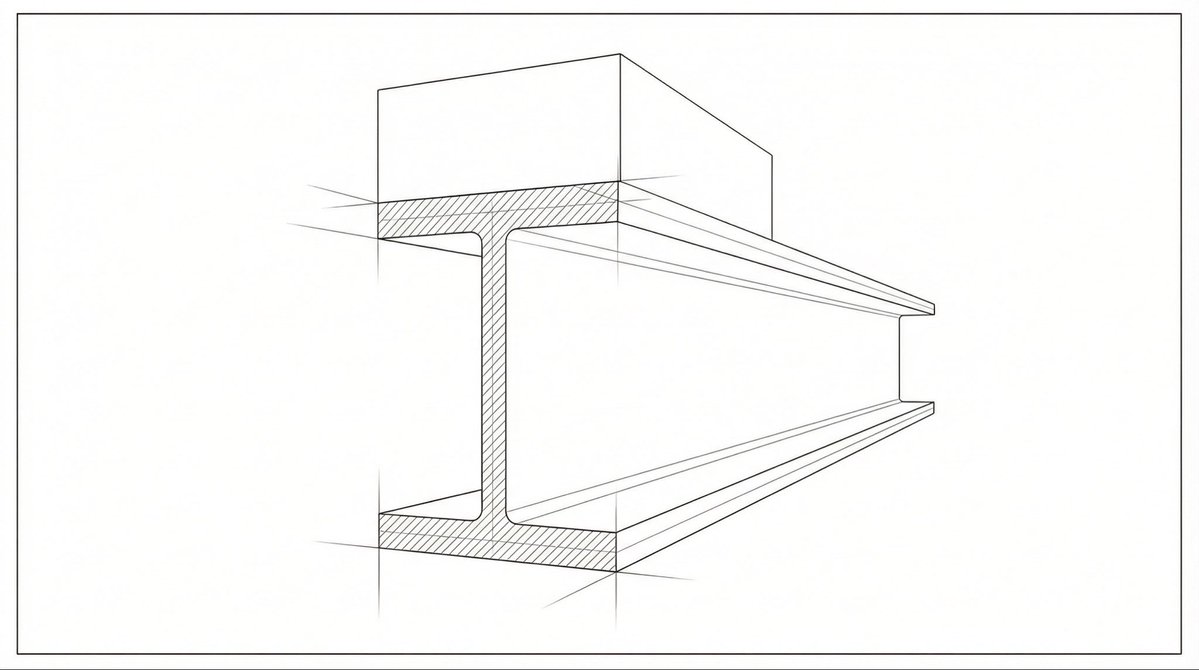

The market operates on physical laws, not academic effort. Adding variables only adds stress points to the frame. The transition from student to operator happens when you stop decorating the chart and start auditing the steel. Execution is the only material that carries actual…

Headlines sell the scream; we’re just here to audit the bolts. A rollercoaster is only terrifying if you haven't checked the engineering specs. To an auditor, all these loops are just a stress test for the seatbelts. Keep your eyes on the blueprint, not the heights.…

Are you prepared for the big red rollercoaster this year? According to the headlines, you should be terrified.

Veteran validation isn’t just agreement; it’s a sign that the structural failure is becoming undeniable. Brandt’s recognition proves the -65.66% energy dislocation is no longer a hidden stress—it’s a breakdown in plain sight. We don't guess the moon; we audit the re-anchoring…

Super interesting Kevin. Thanks. I see it the same way

Quantifying the Macro Gap: A Structural Audit of $CL / $GC Parity. Validating @NorthstarCharts’ 150-year macro thesis requires shifting the lens from "price guessing" to "structural auditing." At Codon.pro, we measure the stress within asset classes to identify…

If you expect oil to stay below $200/barrel for the next 5-8 years, you're ignoring 150 years of evidence 👇

The Japanese Yen isn't just a currency; it’s the global liquidity anchor. When this anchor slips, it triggers a massive deleveraging event that tests the structural integrity of every risk asset on the planet. For us at @codon_pro, the $87.6k BTC yearly foundation is our primary…

People aren’t ready for the next leg lower in the Yen I laid out everything in the video below and will be sending out a report to subscribers on the website tomorrow. If you want to be prepared for this next move, click the link in my bio and lock in It’s time

Glad to see this perspective resonates. I’ve always believed that price action is the only objective reality we have in the market—this is the exact philosophy I’m building into Codon.pro. Appreciate Peter Brandt for the share and for keeping the focus on the…

Focusing on the "paint" instead of the "foundation" is why most structures fail. An architect doesn't audit the color of the blueprint paper; he only audits the integrity of the load-bearing beams. Price is the only objective reality—the rest is just theater.

The most critical skill in architecture: Timeframe Isolation. Most participants get crushed because they mistake a daily tremor for a structural collapse. As Astronomer highlights, the $80k-$85k zone is the macro floor we’re auditing. Until the weekly structure fails at those…

Comment on $BTC macro You are right and we did indeed hit our "late peak" box quite centered. But implications are everything and I kindly urge you to not mix up timeframes nor bias on each. The post you highlighted is indeed monthly (macro) timeframe. The longs we entered at…

"Extreme conviction" is an architectural achievement, not a gamble. It is the patience to wait for every structural beam to align before you ever inject load into the market. Most participants mash the market buy/sell buttons because they are chasing noise. Architects use limit…

If you have patience and seek trades of extreme conviction (life or death type shit), you WILL be profitable. It will take time, but you'll also receive education from price while observing n more setups will appear in time. Either that or keep mashing market buy/sell till zero.

"Trading like a robot" is perhaps the most misunderstood protocol in the industry. It is not about becoming an emotionless machine; it is about architectural rerouting. Yumi’s distinction between primary survival instincts and secondary emotional noise is precisely why our audit…

Market Audit: $BTC / USD 1D — Structural Integrity vs. Macro Noise In a market currently dominated by the "Tariff Narrative" and the liquidity vacuum of the US holiday (MLK Day), it is essential to separate expressive volatility from structural truth. At…

The $460,000 loss described here isn't a failure of effort; it is an architectural collapse. The most dangerous moment in a trader's journey isn't a bad trade—it's the moment your identity becomes the collateral. When this entrepreneur lost his business, he didn't just trade to…

Stop viewing Risk Management as a defensive shield. It’s an offensive strategy. ⚙️ As the framework defines it, "Clarity is a structural requirement." Protecting mental capital means cutting losses by the rules to keep the system running properly. This is the only way to stack…

United States Trends

- 1. #SNME N/A

- 2. #UFC324 N/A

- 3. Alex Pretti N/A

- 4. Minnesota N/A

- 5. Minneapolis N/A

- 6. #skyscrapperlive N/A

- 7. Gautier N/A

- 8. #DragonBallSuper N/A

- 9. Walz N/A

- 10. Umar N/A

- 11. Kyle Rittenhouse N/A

- 12. Arthur Smith N/A

- 13. Noem N/A

- 14. Moro N/A

- 15. Pulyaev N/A

- 16. Rhea N/A

- 17. #Genkidamatsuri N/A

- 18. Taipei 101 N/A

- 19. Josh Hokit N/A

- 20. Charles Johnson N/A

Something went wrong.

Something went wrong.