SFRA

@comdtygo

usd rates, son of the king

You might like

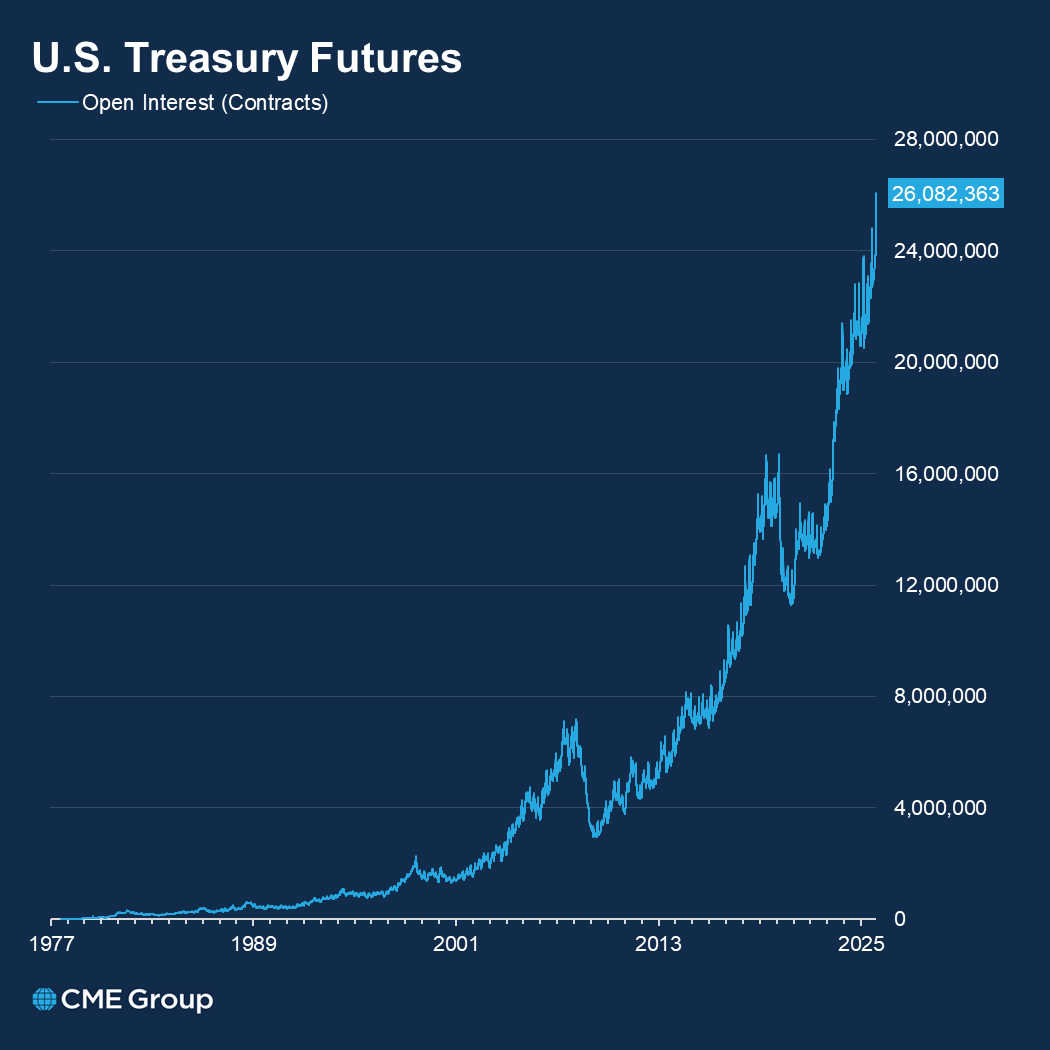

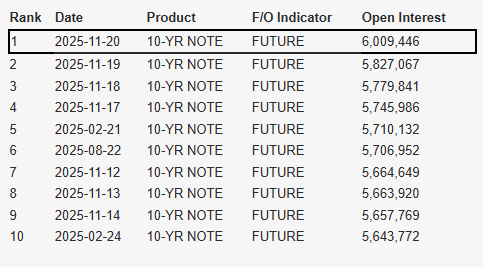

26 million! New record for Treasury futures open interest.

Markets look to gobble up data releases for clues ahead of the holiday: Mon: Auctions: 2-Yr ($69B), T-Bills ($163B) Tue: PPI, Auctions: 5-Yr ($70B), 52-Wk ($50B) Wed: 7-Yr Auction ($44B), Durable Goods Thu: Thanksgiving 🦃 U.S. Markets Closed Fri: German Inflation, Canada GDP

E-mini Nasdaq-100 (NQ) options marked their third highest volume day on Nov. 20. Demand is clear for liquid $NQ options as traders hedge and navigate tech uncertainty following $NVDA earnings and #NFP data. More on E-mini Nasdaq-100 options ▶️ spr.ly/60117YDEJ

10-Year Note (TY) futures open interest has surpassed 6 million contracts for the first time ever.

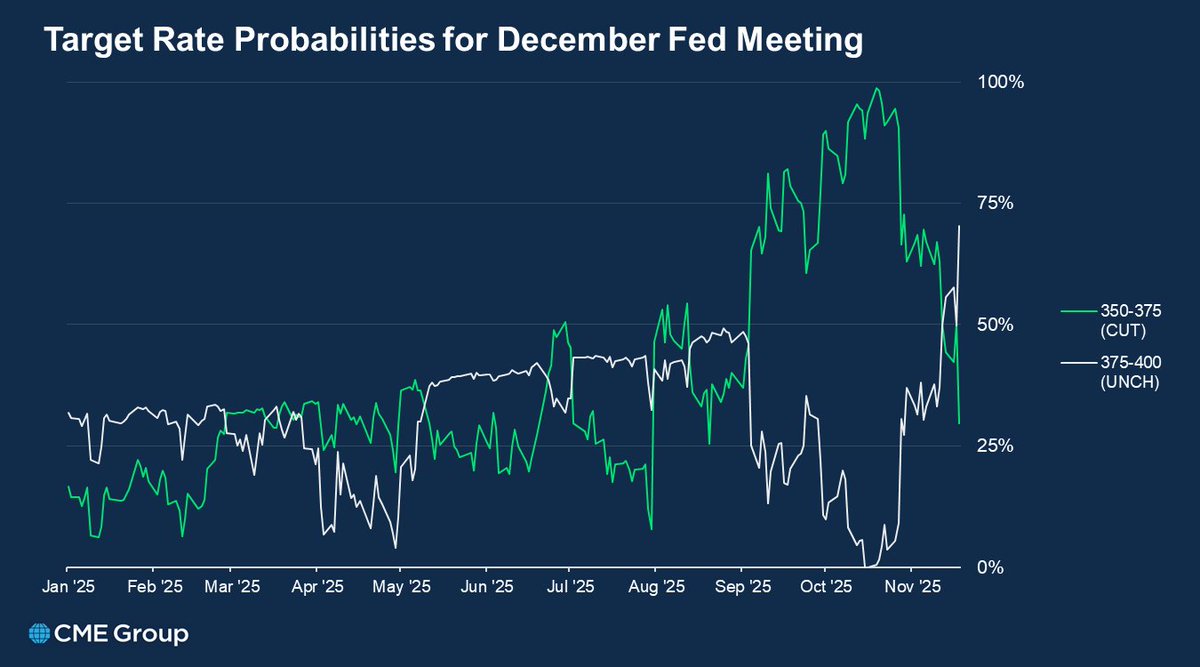

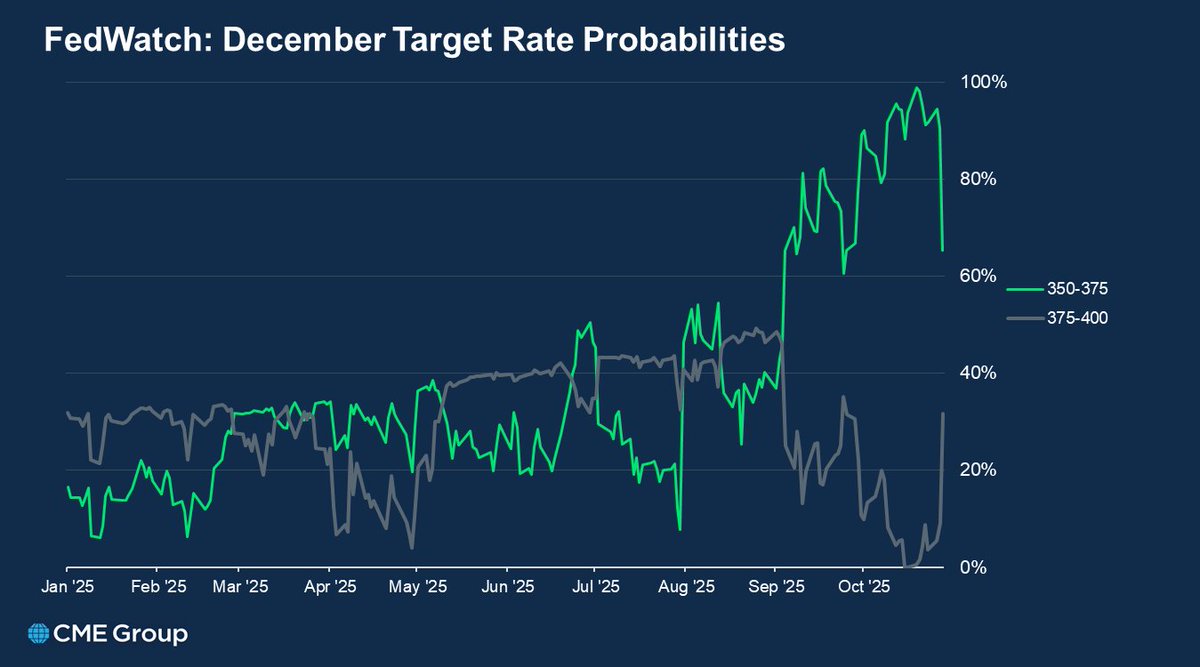

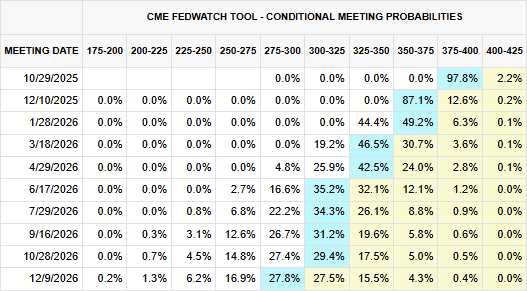

#FedWatch: "Strongly differing views" continue to define December Fed meeting.

10-Year Note (TY) futures open interest hits all-time high. On the back of 27% growth YTD, which outpaces all other tenors, TY open interest reached 5.74 million yesterday.

With the shutdown over, Fed minutes and NFP are in focus this week: Mon: T-Bill Auctions ($163B) Tue: RBA Meeting Minutes Wed: 20-Yr Auction ($16B), #FOMC Minutes Thu: Nonfarm payrolls (Sep), 10-Yr TIPS Auction ($19B) Fri: Japan Inflation Rate

Equity options traders brace for $NVDA and jobs data. According to our Event Volatility Calculator, Thursday E-mini Nasdaq 100 (Q3DX5) options—which expire after NVIDIA earnings (Wed PM) and Nonfarm payrolls (Thu AM)—currently imply a +/- 375 point move by Thursday close.

#Ag futures and options see historic open interest as traders await USDA data and manage risks impacting nearly all sectors of agribusiness. OI has soared to over 11M contracts for just the third time ever, propelled by records in Soybeans, Cattle, Dairy, options and more.

Front month Natural Gas (#NG) futures rise to highest level in nearly three years.

“Liquidity closely tracks volatility” Liberty street really breaking some new ground.

UST 30yr Auction Stats: Awards (%) and WI Stop-Through/Tail

#SOFR options have added over 1M contracts of new open interest in the last 4 days. Most active strikes/expiries by OI change week to date 👇

Pressure continues today, with the Nov25 spread trading down to a new low of -13 bps.

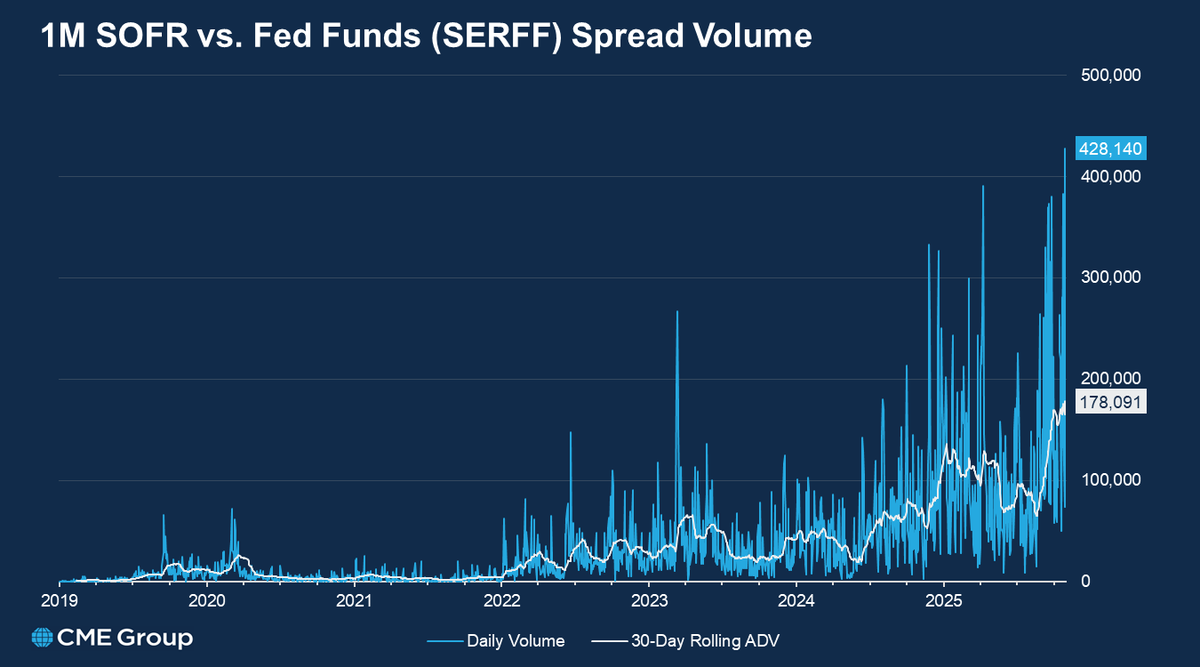

STIR traders continue to turn to SOFR-Fed Funds (SERFF) spreads to navigate waves in funding markets. A record 550K spreads traded on Friday, +28% vs. the prior high from two days earlier. This propelled SR1 to record day of 835K contracts.

The surging supply of government debt is hitting the term premium. With massive deficits looming in 2026, the Treasury faces a tough choice: issue short-term bills or venture further out the curve? Cameron Dawson, CIO of NewEdge Wealth discusses.

Quiet SOFR-Fed Funds basis? Far from it. Trading in SOFR vs. Fed Funds futures (SERFF) spreads hit an all-time high yesterday, as the Fed cut its policy rate by 25 bps and announced the end of QT (maturing MBS to be reinvested in Bills).

Powell: "There were strongly differing views about how to proceed in December. A further reduction in the policy rate at the December meeting is not a foregone conclusion, far from it." #FedWatch: December rate cut probability falls to 65%.

Happy Fed day! Ahead of today's decision, here are the market-implied probabilities for the next ten FOMC meetings according to #FedWatch. Cut Cut UNCH Cut UNCH Cut UNCH UNCH UNCH Cut

As the shutdown drags on, rate decisions take center stage, featuring the Fed (FedWatch: ~97% chance of a cut) Mon: UST Auctions (T-Bills $163B, 2-Yr $69B, 5-Yr $70B) Tue: Case-Shiller Home Price Index Wed: FOMC and BoC Thu: BoJ and ECB Fri: Fed Speeches

United States Trends

- 1. Sonny Gray 5,346 posts

- 2. Dick Fitts N/A

- 3. #yummymeets N/A

- 4. Red Sox 5,883 posts

- 5. Clarke 5,836 posts

- 6. #GMMTV2026 4.29M posts

- 7. Giolito N/A

- 8. National Treasure 4,365 posts

- 9. Thankful 50.7K posts

- 10. Gone in 60 1,490 posts

- 11. Happy Thanksgiving 19.9K posts

- 12. Breslow N/A

- 13. Joe Ryan N/A

- 14. Chaim 1,050 posts

- 15. Mark Kelly 250K posts

- 16. Raising Arizona N/A

- 17. #csm221 4,453 posts

- 18. Academic All-District N/A

- 19. #OurCosmicClue_Wooyoung 27.5K posts

- 20. Lord of War 1,058 posts

Something went wrong.

Something went wrong.