Liverpool Cotton Brokers x WizCot

@cot_wiz

Cotton broker/consultant. Any views or opinions are solely that of the author for information only. No post shall be intended or construed as promotion to trade

你可能會喜歡

🔔Results of the Bloomberg US cotton planting intentions survey ahead of tonight’s eagerly anticipated USDA Prospective Plantings report. #cotton #futures #oatt #agtrading #commoditymarkets

Aside from technicals the market has us on high alert for a swift move to the upside, driven largely by short covering by MM, continuing stimulus in China and weakening USD. Over the next 7 weeks MM will either have to roll or liquidate their short position in the front month.…

Unfortunately the shorter timeframe reversal signals previously identified were unable to transfer into the daily and #cotton succumbed to bad habits, slipping back into the downtrend, and making a new seasonal low of 62.54 on 4th March basis CTK5. One thing we noted lacking last…

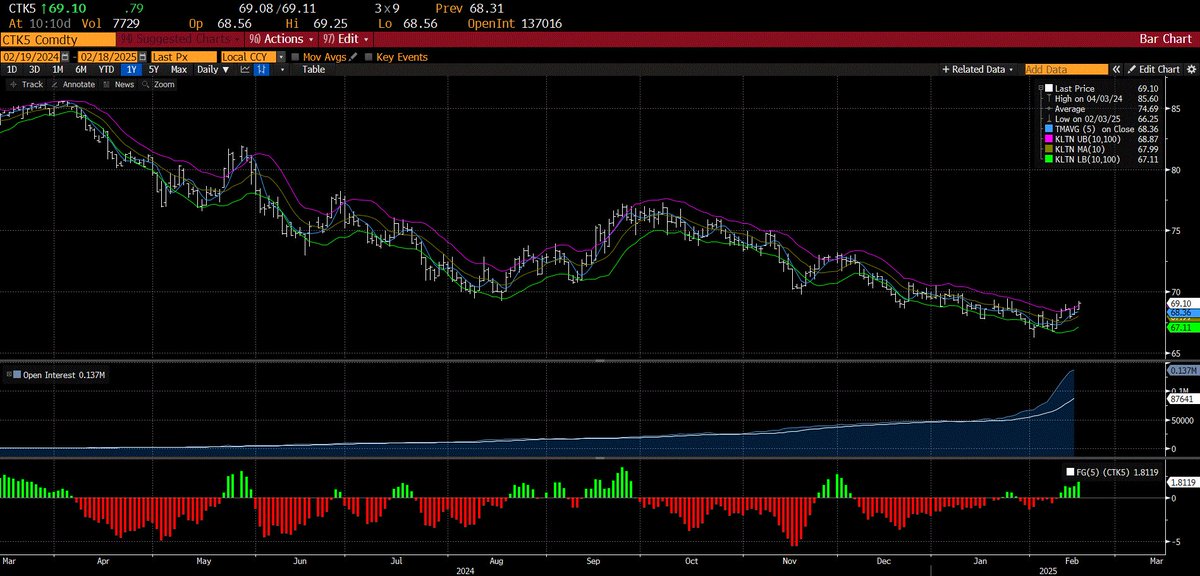

🚨Cotton technicals update CTK5 Daily - broken downtrend, just above 50 day SMA, MACD bullish strengthening CTK5 240 Mins - above all major SMA’s with 50 heading towards bullish cross of 100 and trending up CTK5 daily showing the most successful technical indicators of the…

Based on the NCC acreage survey results for the 25/26 MY, if we take the 10 year avg yield & abandonment we could see US cotton production drop to 13.54 mln stat bales, or based on the 5 year avg as low as 12.46 mln. In extreme circumstances with abandonment as high as 22/23 MY,…

Still preemptive and lacking daily confirmation, but CTK5 is setting up nicely for a bull rally! COT analysis also supports a tipping point is near. Distribution SD & fib retracements align. H/K spread narrowing supporting #cotton #futures #oatt #agtrading #commoditymarkets

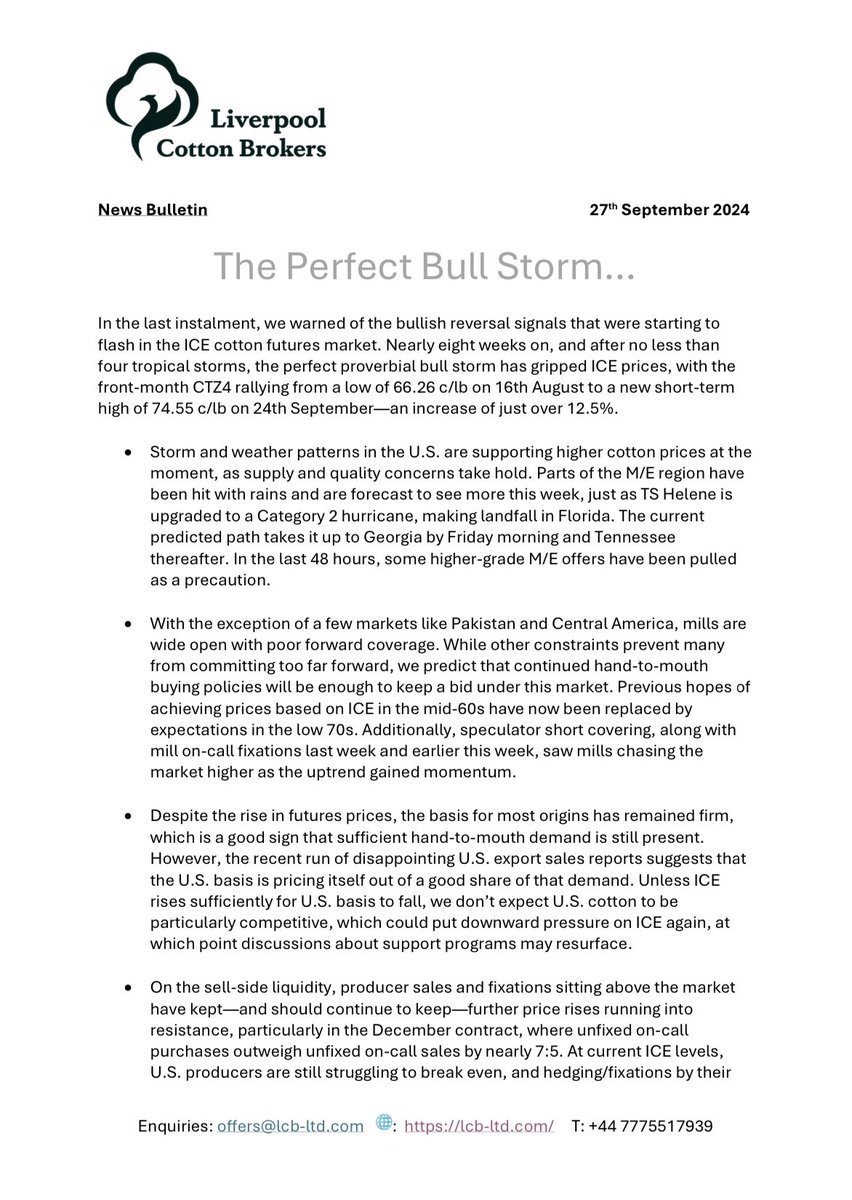

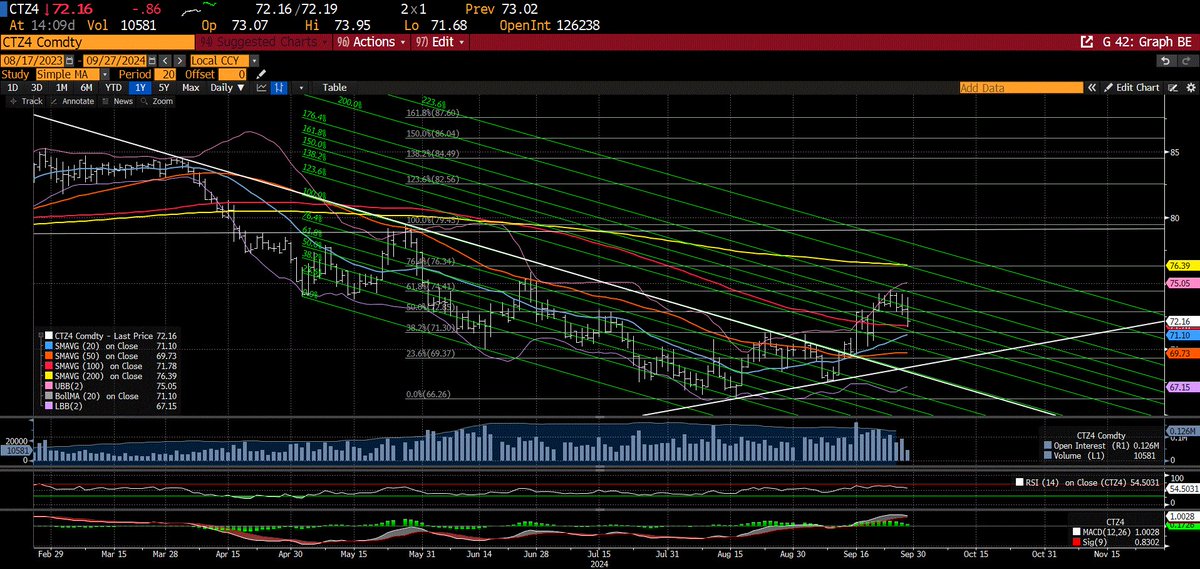

US production is in focus ahead of this month’s WASDE report after multiple storms hit the Midsouth and Hurricane Helene impacted the Southeast cotton belt. Although full damage assessments are weeks away, there's likely enough evidence already to justify further cuts to US…

The Perfect Bull Storm… 🐂⛈️ ICE cotton futures have surged over 12.5% in 8 weeks, driven by storms like Hurricane Helene 🌪️ and global economic shifts. Read our latest insights below! 📈 #cotton #futures #oatt #agtrading #commoditymarkets #bullmarket #weathermarket #Helene

While another test of the lows cannot be ruled out, here are some arguments that support why we may have seen our seasonal low in cotton… #cotton #futures #oatt #agtrading #commoditymarkets #hedging #riskmanagement

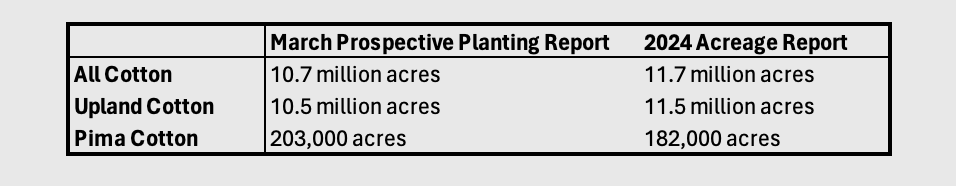

USDA Acreage Report: 11.7 million acres of cotton planted, up 14%, including 11.5 million acres of Upland cotton, up 14%, and 182,000 acres of American Pima, up 24%. Higher than the March Prospective Plantings of 10.7 million acres total, and analyst average estimates (10.8).

Not a lot of life left in #CTN4, but I suspect we’re in for more volatility before it’s over. Spec shorts look most under pressure and the trade controls the board. Structurally I have to favour the long side. Chart supports a continued rally to 38.2% fib retrace #cotton #oatt

"The mills backs are against the wall" Also the mills

On an average weighted price basis spec longs are taking on water and it’s potentially only a matter of time now until they head sharply for the exits. Although there is fundamental support under the market with ICE at current levels and non US basis as low as it’s been for some…

Without doubt, the US balance sheet is tight but don’t be blind to the fact that specs are the reason #ICE is where it is. There are plenty of US cancellations and switches taking place, US sales have slowed to snail pace and non US growth basis is getting slashed, not just at…

Higher cotton prices driven by speculation not fundamentals -InsideDenim.com/News/167865 Thanks for the quote @insidedenimWTP #cotton #oatt

Ahead of Friday’s WASDE report, below are the early analyst survey results for #cotton. Rumours in the trade support further US production cuts and based latest ginnings report seems justified. What’s less likely is an increase in consumption, given where ICE is #oatt #agtrading

After a sizeable contribution from the specs, today’s US #cotton export sales report is confirmation that ICE has more than done its job of rationing physical demand to preserve ending stocks. Calling a top during a short squeeze is fool worthy but you can draw plenty comparisons…

The @NCottonCouncil’s annual survey, taken between mid-December & mid-January, revealed projected 2024 planted acreage will be 9.849 million acres. Since the survey, the market has trended up, making cotton more opportune for planting.

United States 趨勢

- 1. Good Sunday 51.3K posts

- 2. Discussing Web3 N/A

- 3. #HealingFromMozambique 18.2K posts

- 4. #SundayMorning 1,346 posts

- 5. #sundayvibes 4,509 posts

- 6. Wordle 1,576 X N/A

- 7. Blessed Sunday 16.9K posts

- 8. Trump's FBI 11K posts

- 9. Biden FBI 17.3K posts

- 10. Gilligan's Island 5,471 posts

- 11. Macrohard 9,385 posts

- 12. #SEVENTEEN_NEW_IN_TACOMA 41.6K posts

- 13. The CDC 32K posts

- 14. Go Broncos 1,260 posts

- 15. Pegula 5,438 posts

- 16. FDV 5min 2,172 posts

- 17. Nor'easter 1,679 posts

- 18. Utah 25.3K posts

- 19. Market Cap Surges N/A

- 20. QUICK TRADE 2,171 posts

你可能會喜歡

-

ICAC

ICAC

@ICAC_cotton -

The Seam

The Seam

@TheSeam -

Alok Sekhsaria

Alok Sekhsaria

@aloksekhsaria -

CottonG

CottonG

@cottonglobal -

globalcottonadvisory

globalcottonadvisory

@globalcotton9 -

Thrakika Ekkokistiri

Thrakika Ekkokistiri

@ThrakikaE -

Jim Nunn

Jim Nunn

@nunncottoninc -

Cotton News

Cotton News

@CottonNews -

Jeff Lander

Jeff Lander

@landeragcotton -

Black Belt Gin, Inc.

Black Belt Gin, Inc.

@blackbeltgininc -

Todd Straley

Todd Straley

@todd_straley -

Steve Verett

Steve Verett

@sverett -

Yash

Yash

@Yash03040332 -

loucottonballs

loucottonballs

@loucottonballs -

Earlam & Partners Ltd

Earlam & Partners Ltd

@Earlampartners

Something went wrong.

Something went wrong.