Yannis Couletsis

@couletsis

Volatility is the only asset class.

You might like

From the moment you decide to exchange your cash for equities, or sell TBills to buy Venezuela, or had enough from Bitcoin and switch back to utility stocks, you in effect trade volatility, either knowingly or not.

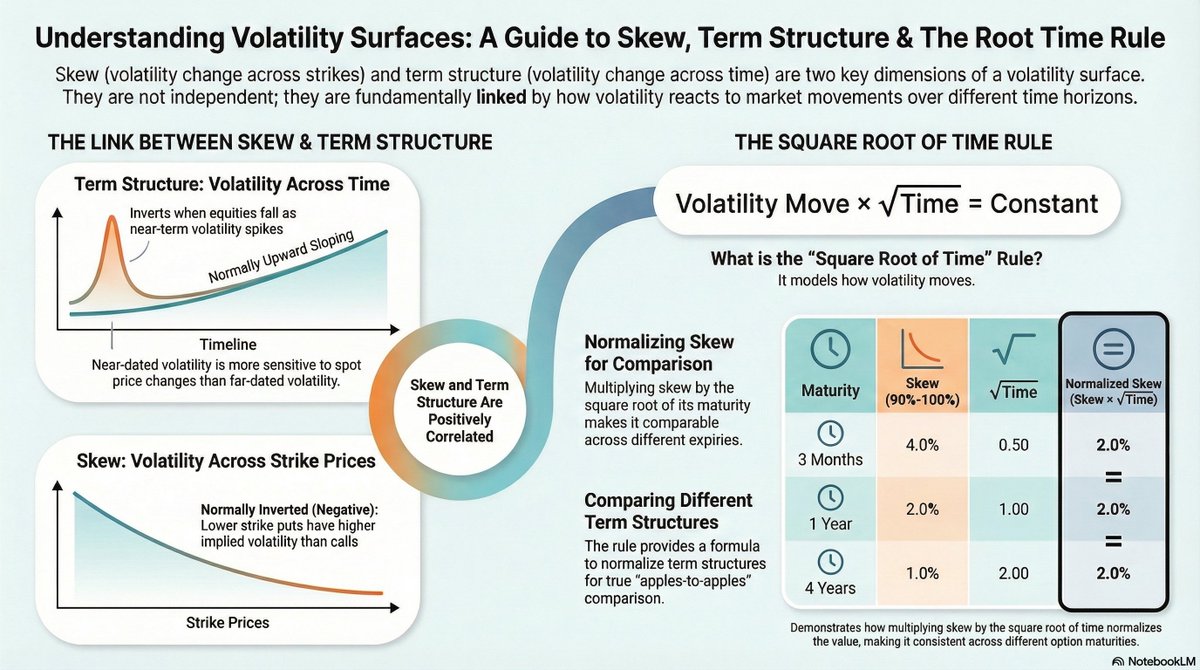

I created a quick overview of skew and vol term structure, including the concept of how vol scales in root time.

Educational tweet: The biggest misunderstanding around selling volatility or options is the idea that the act itself is bad. It is not. Selling an option is no different from buying or selling any other security. The real issue is how most people implement the trade. When…

This 👇

avoid short tails (don't have risk that gets worse and worse for big moves). short near the money options or vol swaps, not far otm or ratios or variance swaps

50% of successful trading is avoiding other people's narrative.

Narratives that cannot be backtested are of dubious value, in my view.

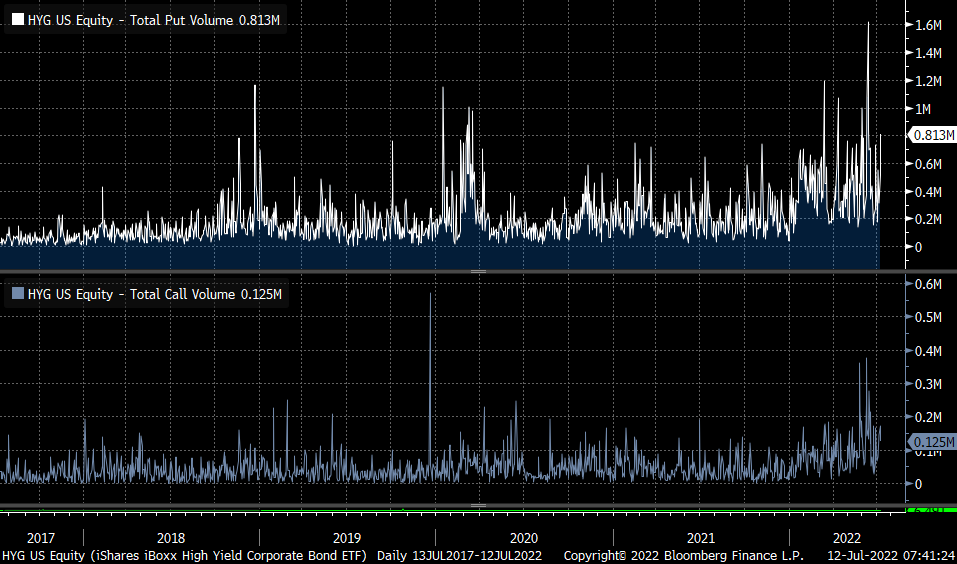

Credit behaves similar to equity vol → trading HYG options is somewhat akin to trading VVIX (?) There's a credit VRP to harvest and increased volume suggests many are working around the best way to pick that. Ideally, you'd want HYGH to gain traction and trade that instead.

General uptick in $HYG option volumes, (puts on top) still out pacing calls roughly 6 to 1.

Insightful thread. Skew is all about spot-vol covariance. Steep skew in some strike or maturity calls for one more layer of analysis: How vol may be bid at those low strikes and how crowded dealers' positioning may reflect to pricing if the underlying trades through those levels.

skew tells me where the bodies are (what risk the world is offsides on) but the implied parameter never often never reaches a level that you want to take the world on even at 100th percentile. Almost like the implied param fwd discounting machine won't allow an easy trade...

This concept rises as the most common trait particularly for volatility-related strategies. Variance premium; skew premium; dispersion -- Premia that have structural causes to exist, persistently harvested in a systematic manner.

"reasons" generally come down to identifying excessive price insensitive buying or selling of something, and thinking about how to turn that into a trade or recurring strategy

..."markets are best understood as a complex adaptive system"...

Earlier this month I wrapped up my 30th consecutive year of teaching Security Analysis @Columbia_Biz. I am often asked how the curriculum has changed over the decades. Here are some thoughts. The course has four sections - the first is on markets (i.e., are markets efficient?)

United States Trends

- 1. Bears 115 B posts

- 2. Ben Johnson 15,8 B posts

- 3. Caleb Williams 13 B posts

- 4. Panthers 106 B posts

- 5. Rams 76 B posts

- 6. #GoPackGo 15,3 B posts

- 7. Dennis Allen 3.294 posts

- 8. Jordan Love 9.202 posts

- 9. #GBvsCHI 3.166 posts

- 10. Stafford 38 B posts

- 11. Green Bay 12,3 B posts

- 12. Bryce Young 25,5 B posts

- 13. Al Michaels 1.938 posts

- 14. Dan Campbell 2.058 posts

- 15. Nixon 16,2 B posts

- 16. Bob Weir 18,3 B posts

- 17. Carolina 71,4 B posts

- 18. Matt LaFleur 2.358 posts

- 19. #KeepPounding 14,8 B posts

- 20. Bobby 45,8 B posts

You might like

-

Jay Soloff

Jay Soloff

@jsoloff -

Scott

Scott

@VolatilityWiz -

Hari P. Krishnan

Hari P. Krishnan

@HariPKrishnan2 -

Jason C. Buck 🪳🏴☠️

Jason C. Buck 🪳🏴☠️

@jasoncbuck -

Speculator

Speculator

@TheSpeculator0 -

Corey Hoffstein 🏴☠️

Corey Hoffstein 🏴☠️

@choffstein -

Alpha_Ex_LLC

Alpha_Ex_LLC

@Alpha_Ex_LLC -

Jessica Nutt

Jessica Nutt

@JessicaNutt96 -

Vineer Bhansali

Vineer Bhansali

@longtailalpha -

EQDerivatives

EQDerivatives

@EQDerivatives -

LongConvexity

LongConvexity

@LONGCONVEXITY -

Jeff Malec

Jeff Malec

@AttainCap2 -

Jim Carroll

Jim Carroll

@vixologist -

Hull Tactical

Hull Tactical

@HullTactical -

Joel Rubano

Joel Rubano

@TCK_JRubano

Something went wrong.

Something went wrong.