Cryptor ⚡️

@cryptorinweb3

Onchain Analyst | OG since '17 | Running Onchain Intel Hub | Partnered with @nansen_ai @Tokenomist_ai | Cyber Security Director IRL | Previous: EY, Mazars

قد يعجبك

XPL (Plasma): Twitter Noise vs On-Chain Data - What Do You Trust More? I spent the last few hours analyzing $XPL, the Plasma blockchain token that launched 6 days ago (as of October 1, 2025). This post isn't a bottom or top signal, or a buy or sell recommendation. It's a case…

DeFi in 2025 demands transparency without surveillance and speed without censorship. Houdini solves this with abstraction, privacy and compliance baked in. Cross chain swaps without bridges across BTC, XRP, LTC and every legit chain. Here is the detailed video on @HoudiniSwap

On Nov 3, I spotted interesting wallet movements into $SURGE and shared it in my TG when it was still sitting at $0.0186. Right now, it's everywhere on CT and the price hit an ATH of $0.09143. That's almost a 5x. After digging deeper into on-chain activity and checking 50+…

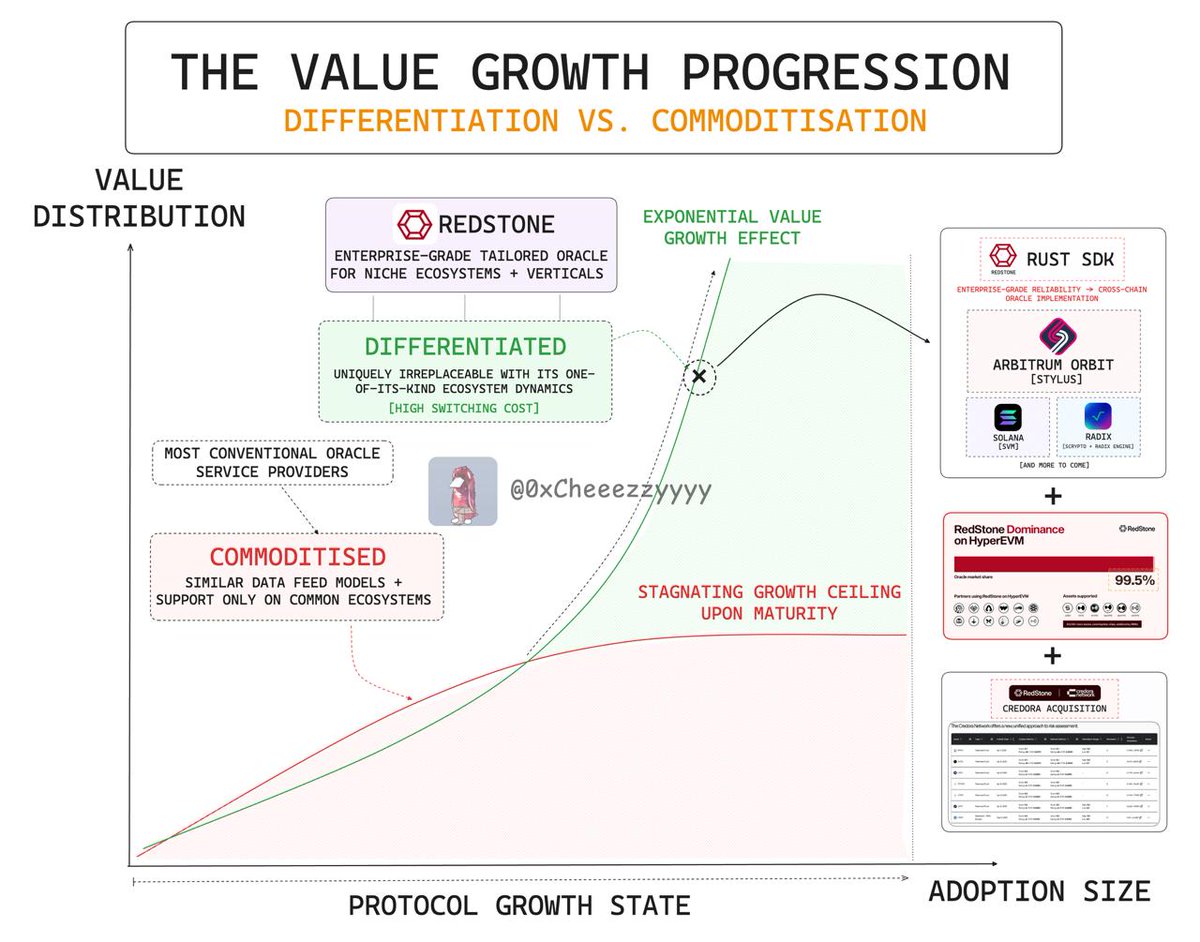

On Breaking the Oracle Ceiling: We all know that oracles form one of the most indispensable layers in DeFi → the bridge between blockchain’s endogenous logic <> the external world’s data. They are the invisible rails of onchain finance: powering everything from price feeds +…

$ORE is another gem that pumped out of nowhere, a 4200%+ run from $17 on Oct 17 to $604 on Nov 10. I haven’t dived into the protocol or verified anything yet, but based on some posts, it looks like @OREsupply is generating strong daily revenue ($1M), with most of it going toward…

Some thoughts on next-gen DeFi yield dynamics: Sustained 20%+ APY on stablecoin yields & 10%+ on BTC-based yields are absolutely achievable, but not without multi-layered, cross-platform strategies. The key is to zoom into the real yield sources behind major volatile LP pairs…

On Liquidity Provision Optimisation: The Step-Up DeFi Needs At the heart of DeFi sits the spot market (the M0 layer) the base primitive upon which every other financial primitive is built. Yet, despite ~$200B in TVL across DeFi, only ~23% is actually allocated to spot liquidity…

I'm privacy maxi, and I'm very happy to see more and more people understand the importance of privacy. The current hype around privacy-focused tokens is proof of it. One tokenless project in the proof-of-humanity and privacy narratives is on my radar. @SelfProtocol is building…

$SPRED caught my interest at $950k MC (shared in my TG). The prediction market narrative is heating up and @Polymarket is sitting at the number one spot in Kaito mindshare (6.22%). @useSpred is building a @Polymarket trading terminal with different forms of intelligence baked…

here's some insights into the apac stablecoin, payments and rwa landscape 🌏 every region has its own reason for going onchain. across the apac region, people are using stablecoin to move value, get paid, and run businesses. apac’s onchain transaction volume surged 69%…

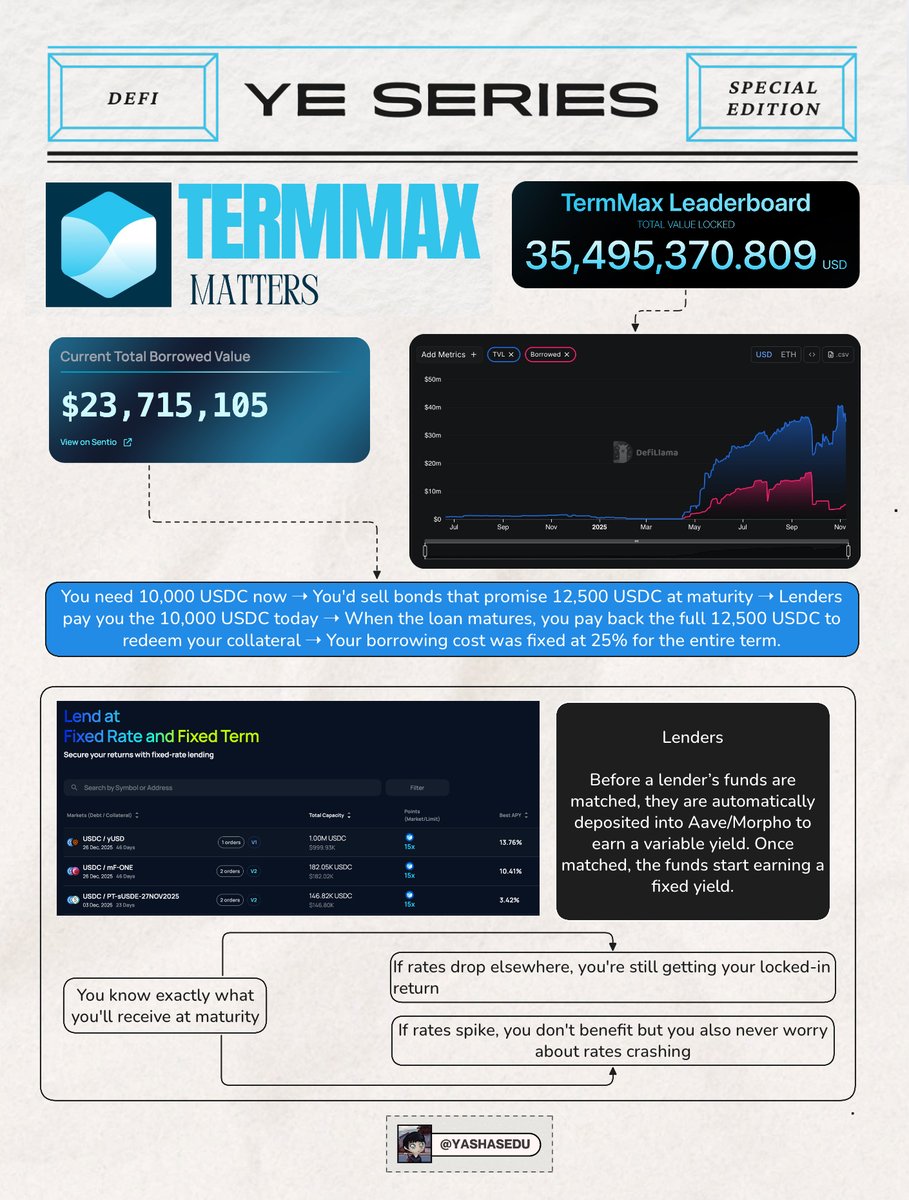

Right now when you borrow money on Aave or Compound, your interest rate keeps changing. Sometimes it's 6%, next week it's 9%, the week after it's 3%. You can't really plan anything because you don't know what you'll end up paying🧵 @TermMaxFi lets you lock in your borrowing…

Bangers like $AVICI @AviciMoney give you the perfect use case to study on-chain data. I’ve looked at 30+ wallets from @nansen_ai's 30-day PnL leaderboard (both realized and unrealized gains) and found one that really caught my attention. This wallet bought $52.28K worth of…

The History of Zero-Knowledge Proofs and ZK Economics Zero knowledge did not appear because of crypto. It began in the mid-1980s as a cryptographic idea and remained mostly academic until blockchains created a real need for it. Permit me to share that history with you, guys 👇…

$TIBBIR 90-day PnL holders are built different. All of them are holding over $1M in profit and none of them are selling. I’ve never seen this kind of on-chain strength.

Pretty based how @redstone_defi as an oracle infra,continues to prove one of the most adaptive + execution-driven. Protocols within easily commodised domains like oracle services require decisive go-to-market strategy that consistently identifies + fills market gaps, and this is…

Oracles are uniquely better on Arbitrum. The latest implementation by @redstone_defi is resulting in 34% cheaper computational overhead and 50% cheaper per-feed computation! Building on Arbitrum is a no-brainer. Arbitrum Everywhere. blog.arbitrum.io/how-redstone-i…

United States الاتجاهات

- 1. LeBron 77.9K posts

- 2. #DWTS 52.8K posts

- 3. #LakeShow 3,758 posts

- 4. Whitney 15.9K posts

- 5. Reaves 7,990 posts

- 6. Peggy 18K posts

- 7. Keyonte George 1,840 posts

- 8. Celebrini 4,671 posts

- 9. Orioles 6,873 posts

- 10. Jazz 27.1K posts

- 11. Grayson 6,979 posts

- 12. Elaine 17.4K posts

- 13. Taylor Ward 3,478 posts

- 14. #TheFutureIsTeal 1,502 posts

- 15. Dylan 25.1K posts

- 16. Winthrop 2,483 posts

- 17. #Lakers 1,605 posts

- 18. Tatum 16K posts

- 19. Angels 32.2K posts

- 20. Haiti 61.1K posts

قد يعجبك

-

EL MAGO

EL MAGO

@EL__MAG0 -

JAKE

JAKE

@JakeGagain -

PEPE SØUP 🐸

PEPE SØUP 🐸

@PEPES0UP -

Fitz

Fitz

@0xFitz -

James McAvoy 🇵🇸

James McAvoy 🇵🇸

@JamesMcavoyJr21 -

Vasiliy Shapovalov

Vasiliy Shapovalov

@_vshapovalov -

GandalfCrypto

GandalfCrypto

@gandalfcryptto -

ƁЄƝƬ

ƁЄƝƬ

@DoctorBentInu -

wassieloyer

wassieloyer

@wassielawyer -

Aeon

Aeon

@Crypto_Aeon7 -

Bera Daily 🐻⛓

Bera Daily 🐻⛓

@Bera_Daily -

rednaX

rednaX

@xander13355 -

BackBone Labs Hub

BackBone Labs Hub

@BackBoneLabsHub -

✍ 𝐂𝐫𝐲𝐩𝐭𝐨 𝐅𝐮𝐧𝐝𝐚𝐦𝐞𝐧𝐭𝐚𝐥𝐬 📒

✍ 𝐂𝐫𝐲𝐩𝐭𝐨 𝐅𝐮𝐧𝐝𝐚𝐦𝐞𝐧𝐭𝐚𝐥𝐬 📒

@BlocksNThoughts -

Laura Caldito

Laura Caldito

@lcaldito

Something went wrong.

Something went wrong.