你可能会喜欢

Was bored so I dug up the major Hacker News threads about Bitcoin from 10 and 11 years ago, when it hit $100 and $10. No surprise, the arguments/debates/discussions in those threads are the exact same ones you'll find in $BTC threads on HN today. Intrinsic value, crime, etc, smh

Wonder what percentage of $GAS fell into the hands of people like me, who used to run bots to arbitrage minting and selling $CHI and $GST2. Nice to have keepsakes beside all those screenshots of being on top of the "gas spenders" leaderboard. Not that I plan to "keep".

With @infura_io and gas prices down, I'm seeing a flurry of new pending transactions to mint $CHI. Do people not realise that at any given time (including now) you can just buy $CHI for the same price as it costs to mint it? All without needlessly clogging up the network, too.

If looking for smart contracts to exploit, the best opportunities probably lie in the arbitrage/market-making/liquidation/etc bots, most of which were likely hacked together in haste by a single dev without a semblance of an audit. The challenge is that they're not open-source.

There's a lack of documentation for how to do flash loans with @dydxprotocol out there, so I wrote the simplest possible (yet complete and extensively documented) single-file Solidity implementation for use as a starting point for anyone who wants it: gist.github.com/cryptoscopia/1…

If you haven't yet migrated your $LEND to $AAVE, right now you can get a 15% bonus on your holdings by selling your LEND and using the proceeds to buy AAVE, instead of using the migration contract. That number usually ranges between -1% and +3%, so this 15% offer won't last long

Test transaction successful. Now to wait for a proper profit opportunity. Thanks @DegenSpartan for the alpha, hit me up if you ever need something like this built.

Disappointed how @mooniswap claims to improve on @UniswapProtocol, yet chose not to replicate its handy swap() logic, which allows smart contracts to trade any ERC-20 tokens without needing to approve() them first. Not to mention the lack of flash-loaning.

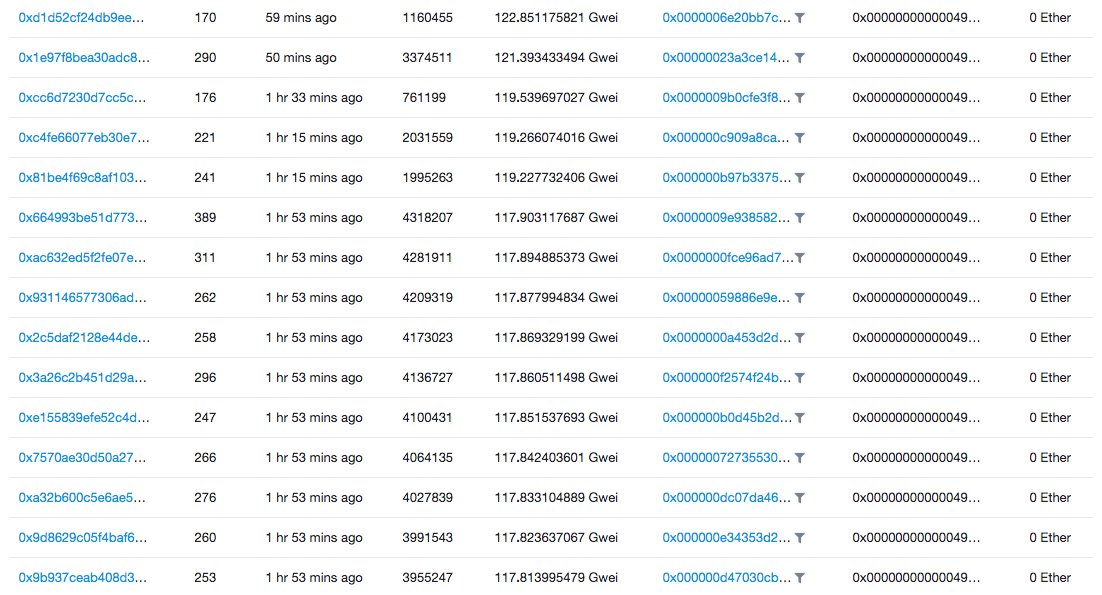

Wow, the current price of the $CHI gastoken makes it profitable to mint at over 100 gwei gas price. The minting bot army is currently paying as much as 120. etherscan.io/txsPending?a=0…

Wild theory: current crypto market upswing is caused by @Garmin market-buying crypto to pay off its ransomware attackers.

Wow. Sneaking in a vulnerability under the guise of an innocuous pull request, then exploiting it for profit. It's an attack vector every dev has thought about at some point, but seeing it successfully executed is mind-blowing. An amazing read. medium.com/@tronblack/rav…

So the @AaveAave web interface has been down for over 6 hours now, during which time $SNX went up by 20%. I wonder how many users were tech-savvy enough to invoke repay() on the smart contract manually to avoid liquidation. I'm guessing not many.

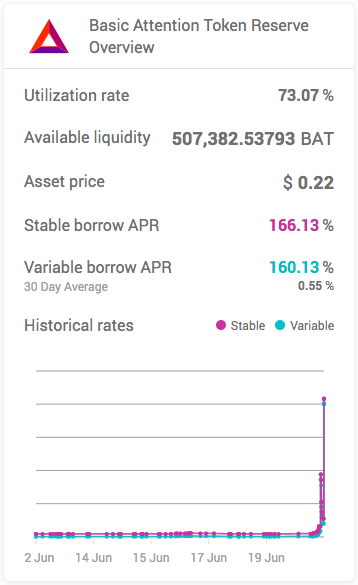

Let's hope none of the people who borrowed $BAT on @AaveAave to lend it out on @compoundfinance went to sleep thinking they made a sound financial decision, without considering what happens when everyone else gets the same idea. The money lego pendulum is swinging in full force.

Parsed 3 months of trades of a random crypto on a small exchange (with no washtrading). Graphed order size against the percentage of all orders that were below that size. Almost a perfectly straight line on a log scale. Not sure if this information is useful in any way.

Incredibly thorough and insightful, yet concise, research effort by @AdamScochran on $ETH distribution and movement patterns/data. One of the most worthwhile things I've read in a while. adamcochran.substack.com/p/32-findsing-…

United States 趋势

- 1. Good Thursday 28.9K posts

- 2. #WeekndTourLeaks N/A

- 3. #thursdaymotivation 1,767 posts

- 4. Happy Friday Eve N/A

- 5. #ThursdayThoughts 1,720 posts

- 6. #thursdayvibes 2,423 posts

- 7. FEMA 83K posts

- 8. Nnamdi Kanu 69.8K posts

- 9. #หลิงออมปฏิทินช่อง3ปี2569 805K posts

- 10. LINGORM CH3 CALENDAR SIGN 796K posts

- 11. Crockett 61.9K posts

- 12. The 2024 90.4K posts

- 13. NO CAP 15K posts

- 14. The 1990 7,771 posts

- 15. FREE HAT 1,973 posts

- 16. But Jesus 22.4K posts

- 17. Alignerz 216K posts

- 18. Shamet 3,250 posts

- 19. Lee Zeldin 14.1K posts

- 20. Hire American 5,661 posts

你可能会喜欢

-

Tom Dunleavy

Tom Dunleavy

@dunleavy89 -

Paul Razvan Berg

Paul Razvan Berg

@PaulRBerg -

Cole

Cole

@cole0x -

Patricio Palladino

Patricio Palladino

@alcuadrado -

Oliver

Oliver

@onbjerg -

Criptomonedas Gratis

Criptomonedas Gratis

@CriptomonedasG2 -

yalu 🔆 (🤖,🌏)

yalu 🔆 (🤖,🌏)

@bitsikka -

kirk

kirk

@OneTrueKirk -

Idgy Dean (Lindsay Sanwald)

Idgy Dean (Lindsay Sanwald)

@IdgyDean -

◻️ Hydway

◻️ Hydway

@Hydway -

Cubby

Cubby

@rorshockbtc -

Hodleroflastresort

Hodleroflastresort

@AoTpokerplayer -

Fillin Trader $SPICE

Fillin Trader $SPICE

@filllintrader -

gadget

gadget

@0xgadget -

Gale Dribble

Gale Dribble

@GaleDribble2

Something went wrong.

Something went wrong.