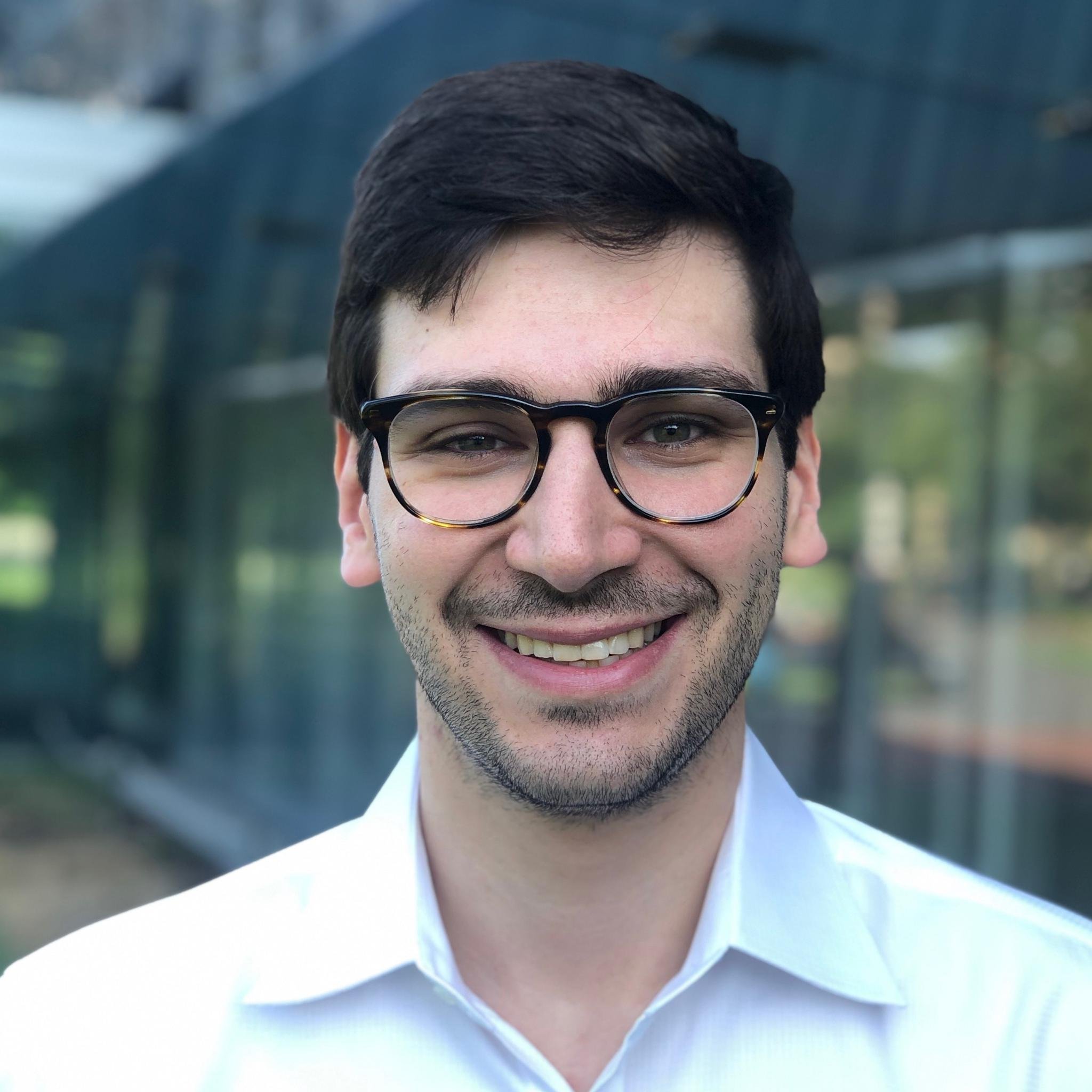

Cameron LaPoint

@cslapoint

Assistant Prof. of Finance @YaleSOM. I study real estate & spatial corporate finance. @UofR alum & @Columbia_econ PhD.

You might like

📢NEW WP!📢 Property Tax Policy and Housing Affordability, joint w/Emily Horton, Byron Lutz, Nathan Seegert, and Jared Walczak. Some new facts about the prevalence and use of local property tax relief policies and how these often make housing less affordable. 🧵👇 #econtwitter

Thanks @OxfordFrom for the invitation to talk about how government-backed lending to homeowners in the form of PACE can help improve climate resilience of the housing stock. The full paper is here: papers.ssrn.com/sol3/papers.cf…

Why don't landlords make green investments, even when they could boost property value? New episode of @OxfordFORE's Property Pod with Brian Lancaster & Cameron LaPoint (@cslapoint) explores PACE financing. YT: youtu.be/-uV8MleO080 Spotify: open.spotify.com/episode/04gq3V… ➡️

📣📣📣 Menaka Hampole (@menaka_hampole), Ashley Wong (@ashleyywong) and I are hiring a pre-doc at University of Michigan starting Sept 2025 to work on a project on student debt, innovation, and entrepreneurship. More details: bit.ly/3UfXp6y Apply by August 8! @econ_ra

Exciting call for proposals below for a conference at @Unibocconi in September with a special issue from the #ReviewofFinance on the issue of the #FutureOfPayments & #DigitalCapitalMarkets. Check this out, and consider submitting, see you in Milan. Link revfin.org/special-issue-…

Thanks to the @VoxDev team for featuring our recent work on interest rate caps on corporate loans in Bangladesh. I'll also be presenting our work in the WEFIDEV webinar on Mon. 5/12 at 11am EST: lnkd.in/e5tYy5Bs Full paper available here 🫱 lnkd.in/e24HruAm

🆕 How interest rate caps increased the provision of credit to firms in Bangladesh Yusuke Kuroishi (@Hitotsubashi_U), @cslapoint (@YaleSOM) & Yuhei Miyauchi (@bu_economics) discuss the impact of a cap on corporate loan interest rates in Bangladesh: voxdev.org/topic/macroeco…

🚀 𝐅𝐢𝐫𝐬𝐭 𝐔𝐩𝐝𝐚𝐭𝐞: 𝐆𝐥𝐨𝐛𝐚𝐥 𝐌𝐚𝐜𝐫𝐨 𝐃𝐚𝐭𝐚𝐛𝐚𝐬𝐞 (𝐆𝐌𝐃), 𝟐𝟎𝟐𝟓-𝟎𝟑 🚀 This week, we published the first update of the 𝗺𝗼𝘀𝘁 𝗰𝗼𝗺𝗽𝗿𝗲𝗵𝗲𝗻𝘀𝗶𝘃𝗲 𝗺𝗮𝗰𝗿𝗼𝗲𝗰𝗼𝗻𝗼𝗺𝗶𝗰 𝗱𝗮𝘁𝗮𝗯𝗮𝘀𝗲 𝗲𝘃𝗲𝗿 𝗰𝗿𝗲𝗮𝘁𝗲𝗱. 🧵

New work in @JournalTax: “Property Tax Policy and Housing Affordability” By @emilyhearsawho @cslapoint @byron_lutz Nathan Seegert @JaredWalczak Read more here: bit.ly/4gZmZ8O

📣new paper alert: An Alpha in Affordable Housing? a collaboration with with @damensven and @MKorevaar_ showing that low-rent/low-income housing earns the highest returns for landlords in the U.S., Belgium, and The Netherlands.

US data since 1919 shows that volatility in building permits foreshadows financial market volatility. “Cities and states with more elastic housing supply consistently predict financial market downturns at 12-month horizons.”@cslapoint @CortesGustavoS edwardconard.com/macro-roundup/…

Call for papers for the very 1st UMass Amherst Finance Conference isomfinancedept.wixsite.com/finance-confer… The conference is on Friday, May 9, 2025 The deadline for submitting your paper is February 1 @econ_conf #econtwitter @UMassAmherst @IsenbergUMass

The call for paper of the 1st CCAxESCP Finance workshop is out! Please submit your best papers by Feb 15th, 2025. 📝Looking forward to this event in beautiful Turin! 🏫

We are delighted to announce the first edition of the CCA-ESCP Workshop on Financial Institutions and Corporate Finance. It will be held on June 5th and 6th, 2025, on our brand new campus in Turin! Submit your papers 👉🏻 escp.eu/events/ccaescp… @CollegioCA @ESCP_bs

🚨 Excited to debut my new paper, "Housing Is the Financial Cycle: Evidence from 100 Years of Local Building Permits," joint with @CSLaPoint. We document that building permits predict financial market volatility across *a century* of U.S. economic history! papers.ssrn.com/abstract=48553…

@YaleSOM's @cslapoint found in a new study that periods of rapid increases in building permits followed by quick declines predict subsequent booms and busts in both stock and bond markets. #business #housing #Finance #stocks #financialmarkets insights.som.yale.edu/insights/swing…

We’re excited to host our annual research symposium with UF on March 20-22, 2025, focusing on housing economics and finance. Be sure to check out the CFP and submit your work by Dec 1. Looking forward to seeing many of you in Tally!

Housing policy researchers! As you plan your fall schedule, don't forget that JHEC is doing a special issue on upzoning (exciting & timely topic). Nov 30 deadline. @coulsoncommaed & I are reviewing submissions as they arrive. Send us your awesome papers! sciencedirect.com/journal/journa…

United States Trends

- 1. Alabama 85,4 B posts

- 2. Indiana 97,6 B posts

- 3. Indiana 97,6 B posts

- 4. Mendoza 28,6 B posts

- 5. Ole Miss 13,1 B posts

- 6. DeBoer 8.554 posts

- 7. Saban 15,7 B posts

- 8. Cignetti 15,6 B posts

- 9. Ty Simpson 6.435 posts

- 10. #iufb 7.498 posts

- 11. Notre Dame 26,8 B posts

- 12. Georgia 66,7 B posts

- 13. #RollTide 6.880 posts

- 14. Oregon 60,6 B posts

- 15. #SugarBowl 1.813 posts

- 16. #NeverDaunted 5.514 posts

- 17. The SEC 60,1 B posts

- 18. #CFPplayoff 1.565 posts

- 19. Mamdani 343 B posts

- 20. Tuscaloosa 1.043 posts

You might like

-

Stijn Van Nieuwerburgh

Stijn Van Nieuwerburgh

@SVNieuwerburgh -

Asaf Manela

Asaf Manela

@AsafManela -

Lakshmi Naaraayanan

Lakshmi Naaraayanan

@lakshminyn -

Erica Xuewei Jiang

Erica Xuewei Jiang

@EXjiang -

Andreas Fuster

Andreas Fuster

@ndreas_f -

David H Zhang

David H Zhang

@dhzecon -

Mindy Xiaolan

Mindy Xiaolan

@MindyXiaolan -

Dmitriy Muravyev

Dmitriy Muravyev

@dmuravyev -

Marius Ring

Marius Ring

@mariusring -

Mahyar Kargar

Mahyar Kargar

@mahyarkargar -

Gregor Schubert

Gregor Schubert

@gregorschub -

Jean-Marie Meier

Jean-Marie Meier

@JeanMarieMeier -

Tyler Muir

Tyler Muir

@tylersmuir -

Yue Qiu

Yue Qiu

@qiuyueruc -

Tony Cookson

Tony Cookson

@prof_cookson

Something went wrong.

Something went wrong.