Curve Intern

@curve_intern

Curve Finance Aspiring Intern $CRV

great thread and article

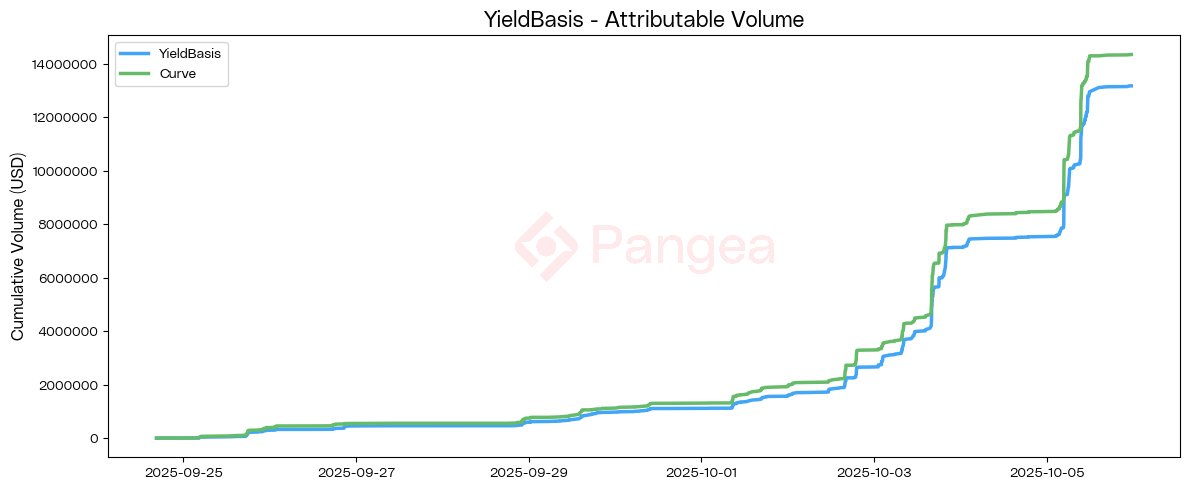

We investigated how much volume YieldBasis generates for Curve. We found: - Every $1 traded on YieldBasis generates at least $1.089 volume on Curve - >88% of this volume was due to crvUSD swaps - YieldBasis has a disproportionate impact in increasing Curve’s market share

YB full in less than 20mins They going to need a bigger credit line $crvUSD 👀👀

and $CRV 👀

Just wait untill people start figuring out that they can earn $yb tokens as vote incentives with their locked $CVX. 👀

Going to be wild when people realize they can just deposit and earn $YB Or better yet, lock $CRV or $CVX to (most likely) earn $YB birbs

Spark loves Curve ❤️ Curve loves Spark ❤️ It's an Ethereum love story

trust and safety- curve is rock solid infra and we feel comfortable holding 8-9 figures in curve smart contracts integrations- whether users go to curve frontend or an aggregator/wallet, they’ll always have access to curve liquidity usability- curve just works, very easy to…

Who's noticed the negative rates on Llamalend's new borrowing page? Looping anyone?

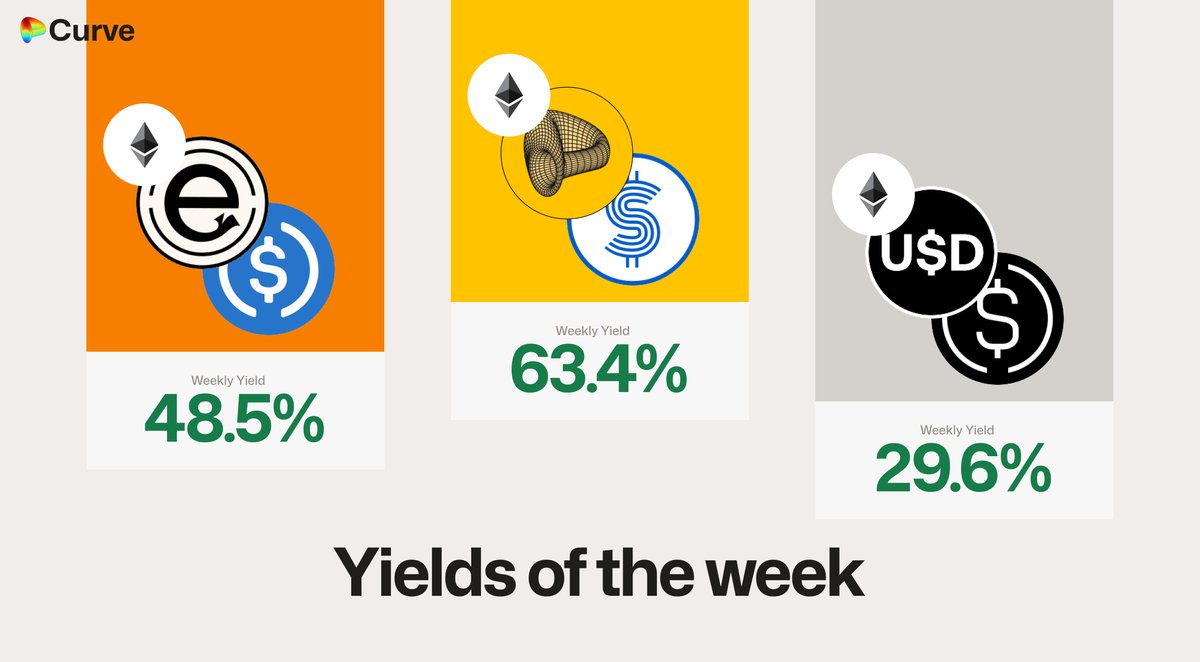

👀 Curve and Convex win the top risk-adjusted yields this week

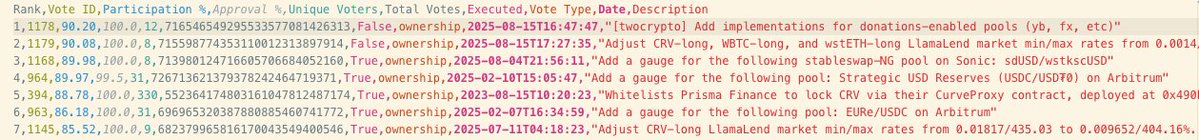

btw the proposal to implement donations-enabled pools (powering _yb and fx pools) has the highest participation (90.2%) of any vote on @CurveFinance

Yields of the week, many $USD opportunities over 12% This is the first week of yields with the lower inflation rate, will $CRV's value increase because of the inflation reduction? news.curve.finance/curve-best-yie…

The Rise of the Home of Stablecoins news.curve.finance/curve-finance-…

title looks oddly familiar hmmm: news.curve.finance/curve-finance-…

Introducing Arc, the home for stablecoin finance. @Arc is an open Layer-1 blockchain purpose-built to drive the next chapter of financial innovation powered by stablecoins. Designed to provide an enterprise-grade foundation for payments, FX, and capital markets, Arc delivers…

This has always been Curve's ethos. DeFi thrives when everyone can participate. AMMs need to be good for issuers, traders and LPs all at the same time, which is why Curve still builds around passive full range LPing Otherwise everything just becomes brittle

been saying this for a million years but Uniswap v3 was a downgrade not an upgrade Paradigm and Hayden won at the cost of onchain farmers and regular defi users Glad to see people finally realizing this, although it’s too late to do much

Everyone seems to be searching for yield right now, and Curve has some of the best available R/R wise, Also there's some interesting new metrics for you to chew on in this newsletter, take a look if you haven't recently. Feedback is always appreciated. news.curve.finance/curve-best-yie…

This is becoming dishonest. If every shill of a DEX focuses on only one metric, it is a giant red flag. You know how much revenue Fluid today? $35k The measure of a DEX is its ability to capture and redistribute value — and this ain’t it guys.

Some people did not quite understand, so this needs explanation. Concentrated liquidity in ranges (like Uniswap3 and others doing that) tend to have liquidity from price A to price B. And this range of prices for stable pairs is VERY tight. Asset sometimes like to go out of…

United States Tendencias

- 1. Auburn 43.6K posts

- 2. Brewers 61.2K posts

- 3. Georgia 66.6K posts

- 4. Cubs 54.3K posts

- 5. Kirby 23.1K posts

- 6. Arizona 41K posts

- 7. Michigan 61.9K posts

- 8. Hugh Freeze 3,117 posts

- 9. #BYUFOOTBALL N/A

- 10. #GoDawgs 5,464 posts

- 11. Gilligan 5,486 posts

- 12. Boots 49.8K posts

- 13. Kyle Tucker 3,092 posts

- 14. Amy Poehler 3,672 posts

- 15. #ThisIsMyCrew 3,184 posts

- 16. Tina Fey 2,711 posts

- 17. Utah 23.1K posts

- 18. #MalimCendari3D 3,443 posts

- 19. Jackson Arnold 2,159 posts

- 20. #Toonami 1,793 posts

Something went wrong.

Something went wrong.