Darrell Aden

@darrelltalksfi

I talk about investing & personal finance. Building wealth through stocks, bitcoin, and real estate. Paid off $30,000 in debt in 28 months.

You might like

Save $7,000 a year and you'll have $175,000 after 25 years. Invest $7,000 a year in a Roth IRA and you'll have $750,000 after 25 years. Once I saw the difference between saving and investing, the choice was obvious.

My mother-in-law is twice divorced, never made six figures, and still retired at 62 with a $4.5M net worth. If she can do it so can you.

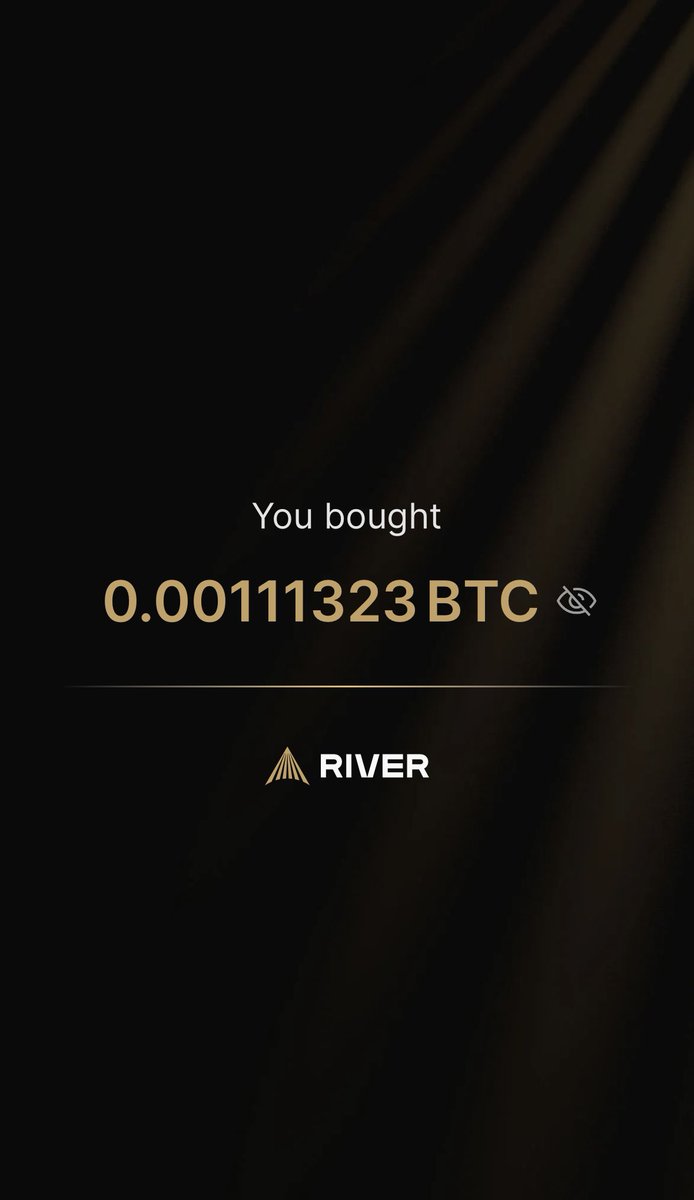

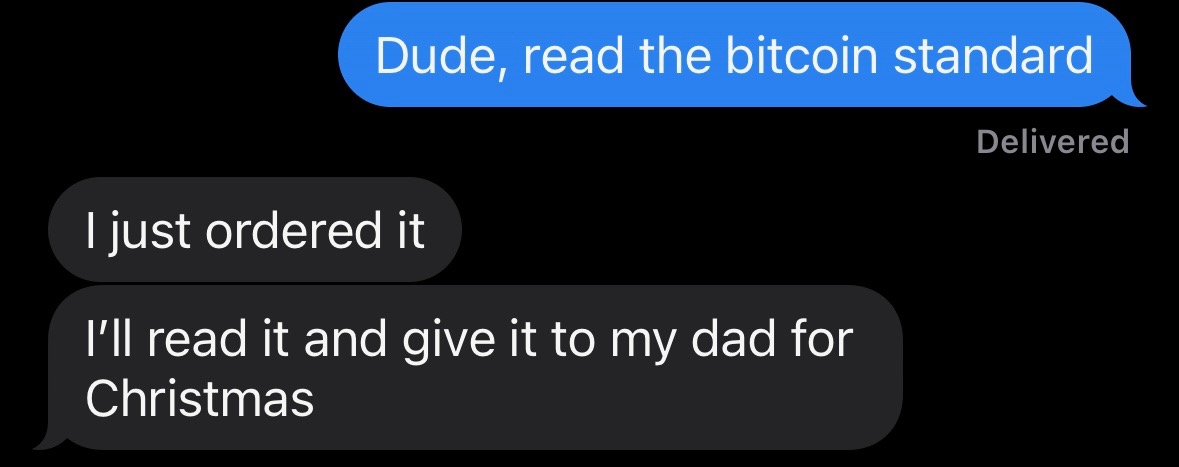

Real friends don’t tell you to buy Bitcoin. They tell you to learn about it 🧡

I get what he’s saying, but I think that’s the wrong attitude. Giving is one of the best ways to spend money. And when you accept a gift, you let someone else experience the joy of giving. It’s less about the item and more about the act.

This is going to make me sound very cheap: I can't stand buying or receiving Christmas gifts. It is nothing but an enormous waste of money I would much rather prioritize spending the money on traveling to spend time with family on the holidays and getting good food/games to…

Everyone has their own idea of what a diversified stock portfolio should look like. Warren Buffett recommends a simple 2-fund portfolio: • S&P 500 • Short-term government bonds Jack Bogle is famous for his 3-fund portfolio: • Total bond market • Total U.S. stock market •…

My old boss used to say before you marry someone check their credit score and honestly I think there’s some truth to that.

YieldMax funds like $ULTY look attractive, but the high yields come at a cost. In most cases, you’re better off just owning the underlying stock.

“Investing in this fund involves a high degree of risk” “ULTY’s indirect exposure to gains, if any, of the share price returns of the Underlying Securities is capped” “ULTY is subject to all potential losses if the shares of the Underlying Securities decrease in value” $ULTY…

Your perfect portfolio won’t look like mine. Don’t fall for “one-size-fits-all” investing advice. What you hold should depend on your goals, risk tolerance, and time horizon. Build a portfolio that fits your life.

The 9–5 you complain about puts a roof over your head, food in your fridge, money in your retirement account, and health insurance you can actually afford. Stop complaining and be grateful.

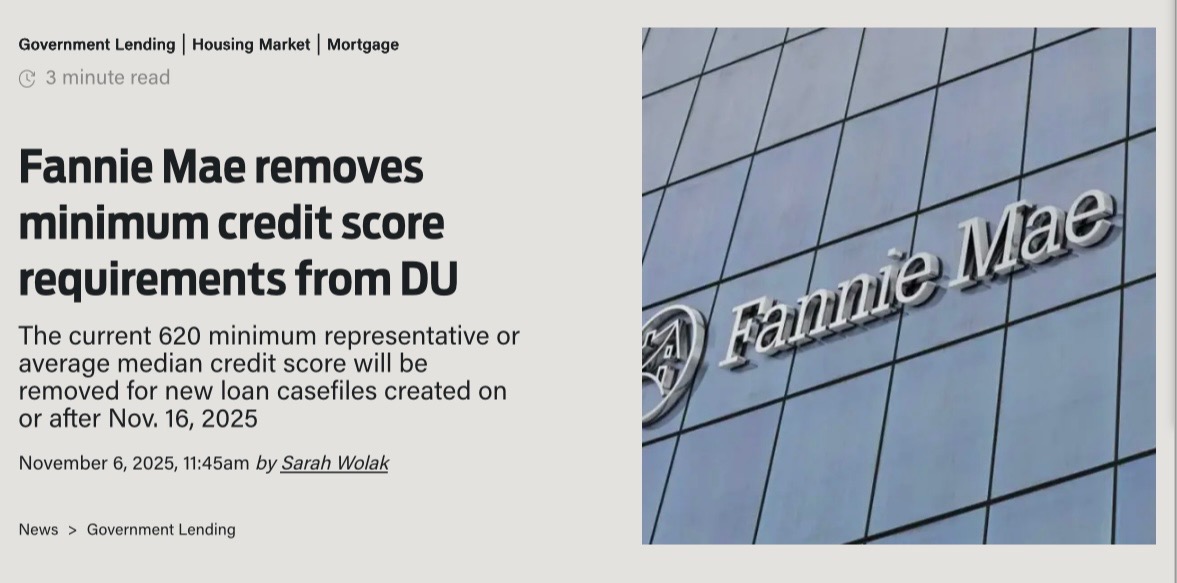

Fannie Mae removes minimum credit score requirements for mortgages. The current 620 minimum credit score will be eliminated for new loans starting on Nov. 16, 2025. I don’t see this ending well 😬

These are the historical odds of making money in the U.S. markets: • 50% over one-day periods • 68% in one-year periods • 88% in 10-year periods • 100% in 20-year periods This is why investing is a long-term game.

Friendly reminder that Life is so much more then chasing zeros in your bank account 🙂

Investment Order by Return: 1. 401(k) Match • Return: ~100% (thanks to employer match) • Risk: None 2. Paying Down Credit Card Debt • Return: ~27% (avoids high interest) • Risk: None 3. ESPP • Return: ~25% (buy at a discount through employer) • Risk: None 4. Stock…

United States Trends

- 1. Cheney 78.7K posts

- 2. Sedition 151K posts

- 3. First Take 45.7K posts

- 4. Seditious 83.1K posts

- 5. Jeanie 1,759 posts

- 6. Mark Walter 1,301 posts

- 7. Seager N/A

- 8. Constitution 107K posts

- 9. Lamelo 3,883 posts

- 10. Commander in Chief 48.3K posts

- 11. Elon Musk 276K posts

- 12. Cam Newton 4,120 posts

- 13. Trump and Vance 35.7K posts

- 14. Coast Guard 20.2K posts

- 15. Shayy 12.8K posts

- 16. UNLAWFUL 72.8K posts

- 17. #WeekndTourLeaks 1,446 posts

- 18. Nano Banana Pro 23K posts

- 19. UCMJ 9,555 posts

- 20. Dameon Pierce N/A

You might like

-

The Money Cruncher, CPA

The Money Cruncher, CPA

@money_cruncher -

Rafael Biacotti

Rafael Biacotti

@ShieldInvestor -

Gio | Income Roots

Gio | Income Roots

@DividendRoots -

Oliver | MMMT Wealth (CPA)

Oliver | MMMT Wealth (CPA)

@MMMTwealth -

Dividend Freedom

Dividend Freedom

@DividendFreed -

WealthZen

WealthZen

@HealthWealthHi1 -

The Trading Path

The Trading Path

@1debtdestroyer -

Dividend Broadcaster 🎙️

Dividend Broadcaster 🎙️

@DivIncomeBcast -

Tyro Investing

Tyro Investing

@tyro_investing -

Dividend Snowball

Dividend Snowball

@DividendSnwball -

Chris Reilly

Chris Reilly

@C_Reilly5 -

Divvy-Up Stocks

Divvy-Up Stocks

@DivvyUpStocks -

My Dividend Dreams

My Dividend Dreams

@mydividreams -

Dividend Blasters on YouTube

Dividend Blasters on YouTube

@DividendBlast99 -

RodDontCare

RodDontCare

@RodDontCare

Something went wrong.

Something went wrong.