내가 좋아할 만한 콘텐츠

For the first time in its history, Truth Social might actually be about the Truth. Cheers @cryptocom

Number one Chinese scammer that liquidated the entire market for 50b now promotes CBDCs

Perhaps Jez was simply ahead of his time Robinhood integrates Hyperliquid builder codes and they'd capture more revenue than options via PFOF

yeah thats the pt, robinhood users just want levg and otm weekly calls/puts are their only options, they dont know what greeks or IV or anything they just fking slamming high delta, if perps existed on robinhood options would have 0 volume

TL;dr Binance scammed the whole industry. Their users, market makers and even everyone trading on chain or other CeX's. Rather than denying this, you say the statement doesn't belong to the investment firm because they fired the employee that spoke out about your actions. CZ &…

Meet our new browser—ChatGPT Atlas. Available today on macOS: chatgpt.com/atlas

FUCK THE BANKS

JUST IN: 🇺🇸 Federal Reserve looks into "payment accounts" that would grant crypto and fintech companies access to Fed payment rails.

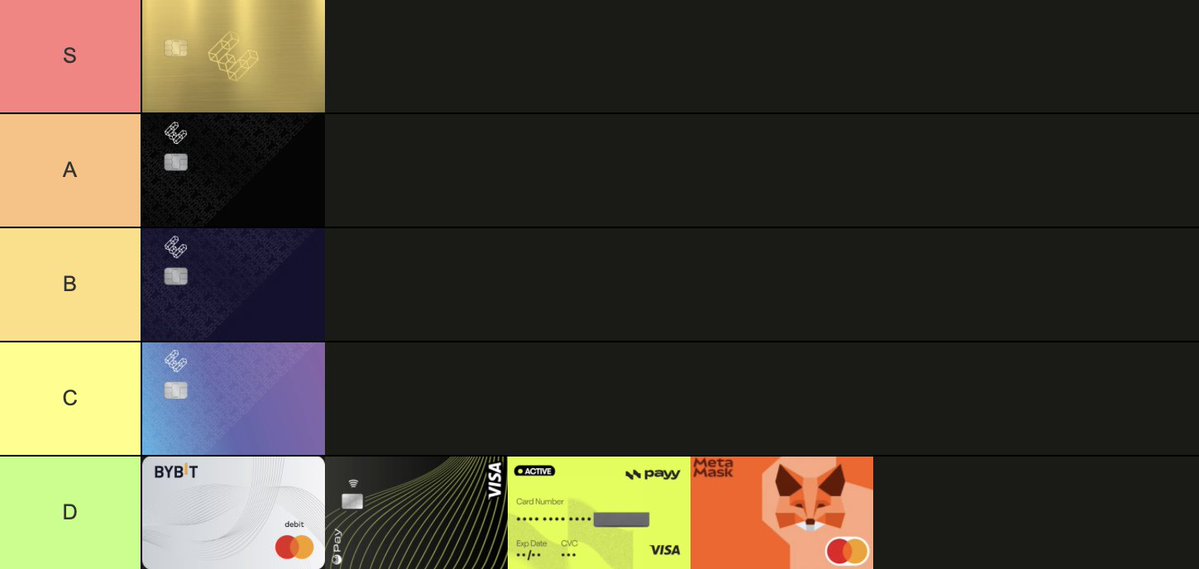

THE ONLY CRYPTO CARD/NEOBANK TIER LIST YOU NEED. S-C: @ether_fi VIP, Pinnacle, Luxe, Core D: every other “neobank”

Maybe a very prosaic observation, but I've been reflecting on just how much the pandemic changed the world in ways that are completely unrelated to the pandemic itself. I think I've underestimated it 'till now. In a recent interview, I was struck by the comment that so many of…

It just routes to Jupiter? They’re not even deploying any contracts or liquidity on solana? — does Uniswap really just suck?

🚨JUST IN: @Uniswap has launched support for Solana on its Web App, allowing users to connect Solana wallets and trade Solana tokens directly alongside Ethereum and other networks. Swaps on Solana are powered by Jupiter’s API.

Kalshi’s outage today was a perfect example of why it’s the most trustworthy financial platform in existence and a source of truth for all. Higher. Written in sarcasm font.

genuine question: who actually uses the XRP Ledger??

Banks are getting disrupted this decade. CEXs are getting disrupted this decade. The future is onchain. Onchain is the future.

I’ve joined @xplaceapp waitlist and claimed 500XP. It pays to be early. Join the movement now: x.place/r/NCE37MS66

1. Operating a neobank is 10x lower cost, which means those savings can be passed on to users. 2. New products can be launched much faster, because less regulatory overhead because they’re non custodial. 3. Crypto neobanks are plugged into DeFi which offer much higher yields.…

On Hyperliquid, there is no listing fee, no listing department, and no gatekeepers. Spot deployment on Hyperliquid is permissionless. Anyone can deploy a spot asset by paying a gas fee in HYPE. Deployers can choose to receive up to 50% of trading fees on their spot pairs.…

Also worth pointing out—if it had been BUIDL that was trading with that oracle design, it also would've also flash crashed on Friday. The problem was not the asset but the market design. (BUIDL is also harder to mint/redeem than USDe is!)

Hyperliquid’s fully onchain liquidations cannot be compared with underreported CEX liquidations Hyperliquid is a blockchain where every order, trade, and liquidation happens onchain. Anyone can permissionlessly verify the chain’s execution, including all liquidations and their…

Did Ethena Really Depeg? I’ve seen a lot of chatter about the Ethena depeg during the market mayhem this weekend. The story is that USDe briefly depegged to ~68c before recovering. Here’s the Binance chart everyone is quoting: But digging into the data and talking to a bunch of…

While we share these suggestions privately with any partner we work with across both DeFi and CeFi, want to surface this publicly so there is zero doubt going forward on what we view as appropriate oracle design and risk management for USDe:

TLDR: During recent volatility, Hyperliquid had 100% uptime with zero bad debt. This was Hyperliquid’s first cross-margin ADL in more than 2 years of operation. ADL does not change the outcome for any liquidated users. While some specific ADL providing trades were unfavorable,…

United States 트렌드

- 1. Trey Yesavage 32.5K posts

- 2. Jake LaRavia 2,675 posts

- 3. Blue Jays 80.5K posts

- 4. #LoveIsBlind 3,767 posts

- 5. #AEWDynamite 21.6K posts

- 6. jungwoo 85.5K posts

- 7. Snell 13.1K posts

- 8. Pelicans 3,940 posts

- 9. Austin Reaves 7,057 posts

- 10. Anthony Davis 3,885 posts

- 11. Kacie 1,630 posts

- 12. #WorldSeries 64.5K posts

- 13. Bulls 25.8K posts

- 14. #Survivor49 3,414 posts

- 15. #WANTITALL 35.6K posts

- 16. Happy Birthday Kat N/A

- 17. Dodgers in 7 1,343 posts

- 18. Dwight Powell N/A

- 19. Donovan Mitchell 5,543 posts

- 20. Cavs 9,561 posts

내가 좋아할 만한 콘텐츠

-

Verireva

Verireva

@verireva -

crypto878

crypto878

@crypto__878 -

diouf3 Lingo ꧁IP꧂(✸,✸)

diouf3 Lingo ꧁IP꧂(✸,✸)

@diouf35 -

derf.liw

derf.liw

@derf_liw -

币圈小陈

币圈小陈

@olivialeid -

coco cheung 🩴

coco cheung 🩴

@coco1987_1987 -

卓凡

卓凡

@zhuofan188 -

Cyphercat💎

Cyphercat💎

@cyphercat_web3 -

Little Pinscher 🛸❤️

Little Pinscher 🛸❤️

@RebelPinscher -

ModernCalculators .NYAN🔫😼

ModernCalculators .NYAN🔫😼

@nayan_sushma -

Scarabaeus Sacer

Scarabaeus Sacer

@veter13inside -

小熊熊

小熊熊

@xiaoxiong67890 -

老堆

老堆

@xichang_eth -

ranger

ranger

@ranger08549675

Something went wrong.

Something went wrong.