dataQollab

@dataQollab

AI, big data, community, bond trading

.@Pulte seems to have taken on @FHFA press secretary responsibilities so I started using @impactcapitoldc's AI to track his tape bombs. Have enjoyed the layered perspective it provides re: the potential impacts on housing and the mortgage market. Quarter end can't come soon…

FHA has decided to "end the wasteful misappropriation of taxpayer dollars to benefit illegal aliens" ie you gotta have a green card to get an FHA loan now. Times are certainly changing but Alf, ET, and the Dos Equis guy aren't too worried because all 12 of their FHA insured…

AEI says Donald and his team of Rescue Rangers should consider selling or leasing unused government property to help alleviate the housing affordability crisis. Realtors are lining up to stage CFPB's headquarters for showings and rental agents have been spotted putting bunk beds…

Treasury Secretary Scott Bessent ("Bessy") says the American Dream is all about homeownership, finding purpose, and achieving financial security without having to work two jobs. Bessy also believes "hopelessness" eats away at the American Dream which explains why some loan…

A WSJ story claims there's a secret Fannie Mae blacklist preventing condo owners from selling their units. Reporters were unable to confirm the story after DOGE eliminated Fannie Mae's condo review team. FED DAY. Jerome sees clouds but has no idea when/if it will actually rain..

Commentary opener today: All five parties of Greenland’s parliament have bluntly dismissed Donald’s bid to take over the Arctic island. I guess U.S. property insurers will have to find another less risky geo to replace the business they’ve abandoned in Florida and California.

.@dataQollab Class A 48hr day marks. Three different marks provided. Each with a distinct pricing recipe. One of the benefits for hedgers trading OTC products with embedded optionality. There is no right price as long as you can explain logic and demonstrate consistency...#mbs

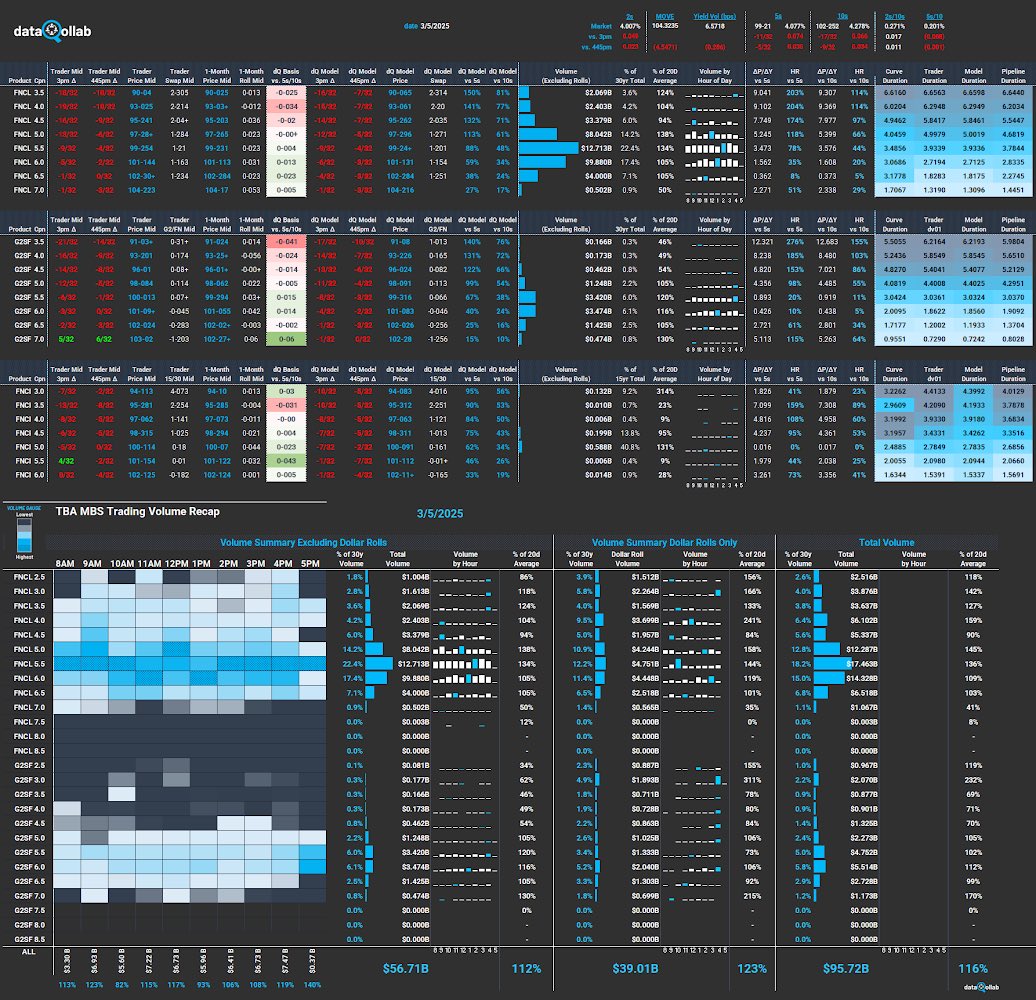

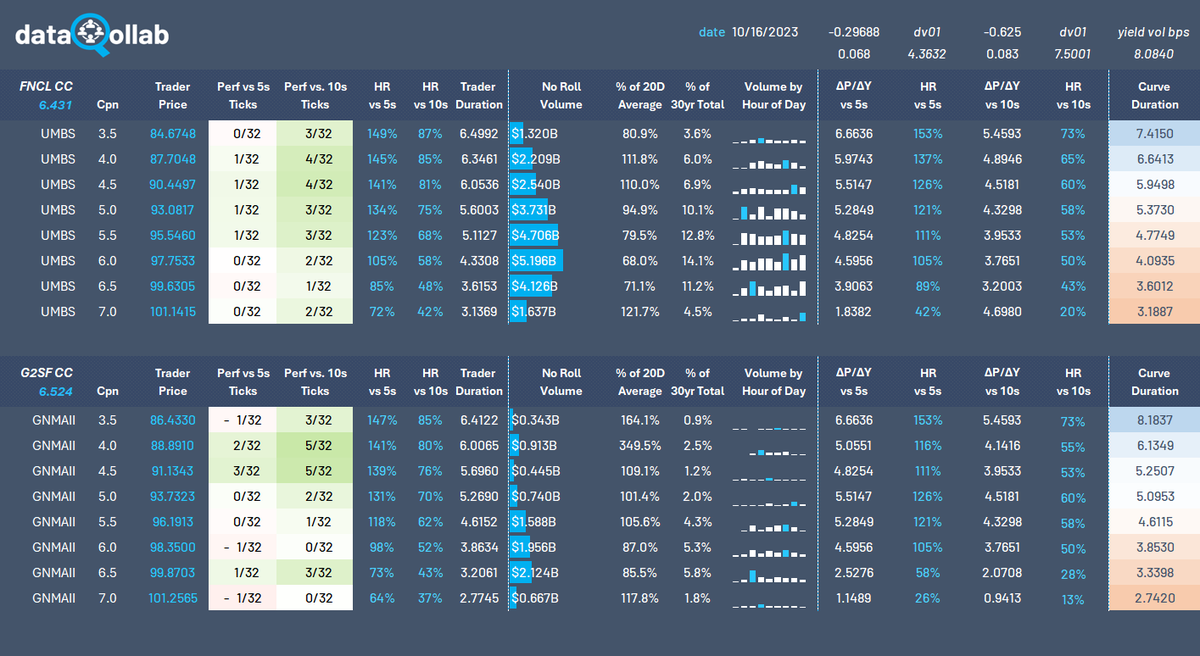

Pre-NFP TBA MBS marks and trading volume summary. Busy morning. Slow afternoon.

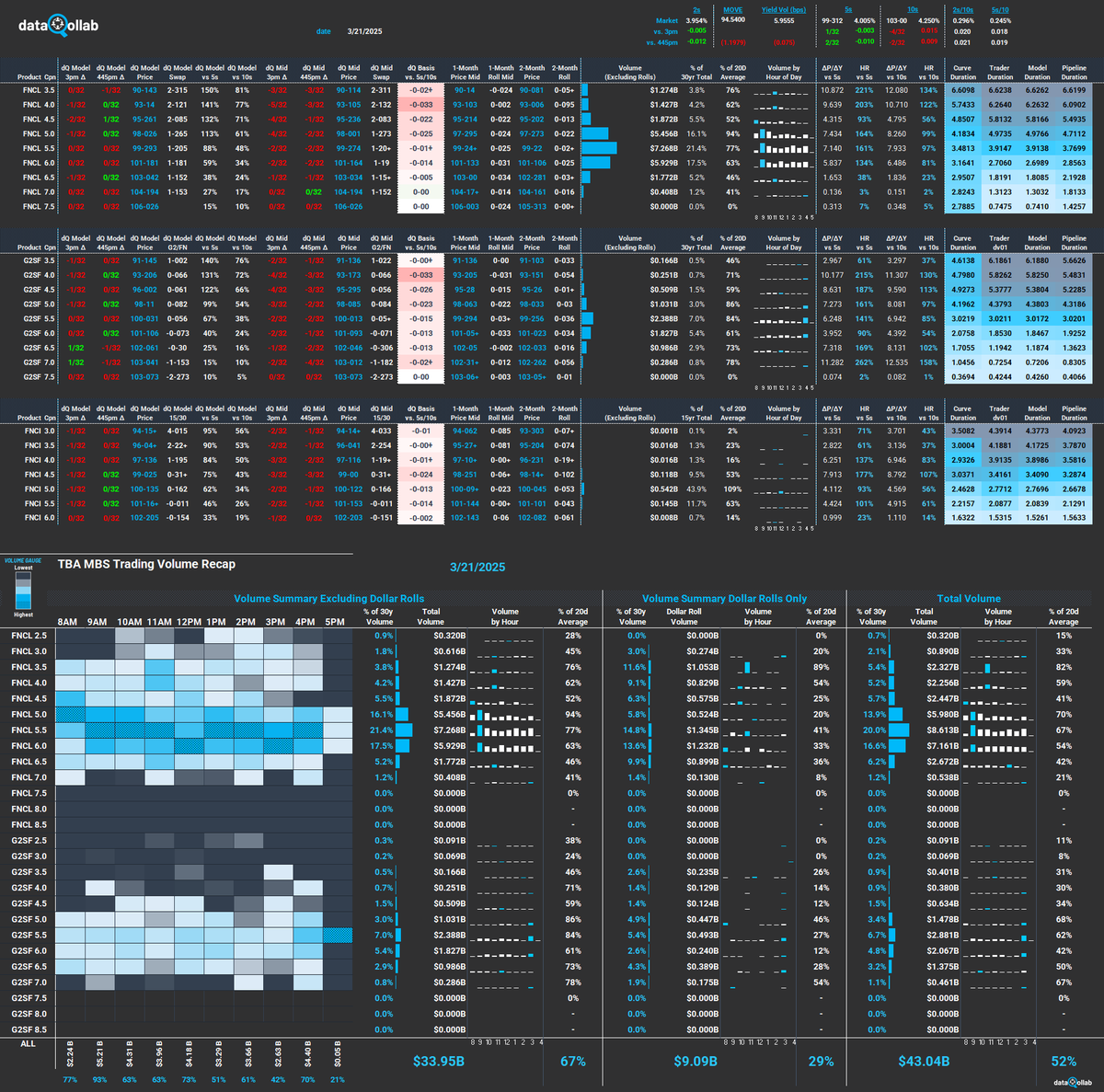

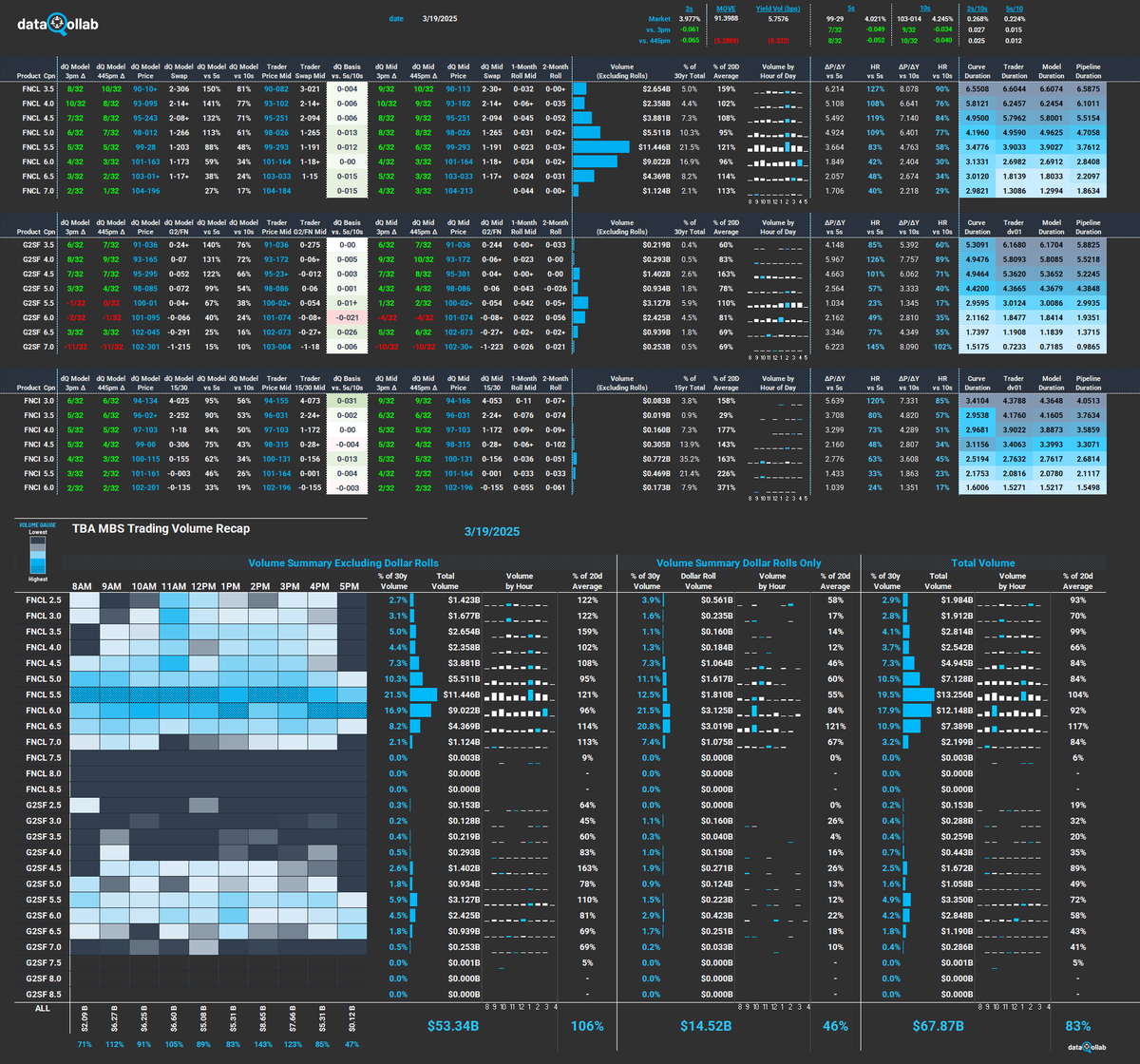

Our 445pm mortgage market screen. TBA basis has been squirrelly intraday since rate touched max resistance on 3/4/25. LOs now taking calls instead of making them. Will be interesting to see through-the-box reports. Expecting steep <12 WALA ramps next month. #IRRRL #recapture

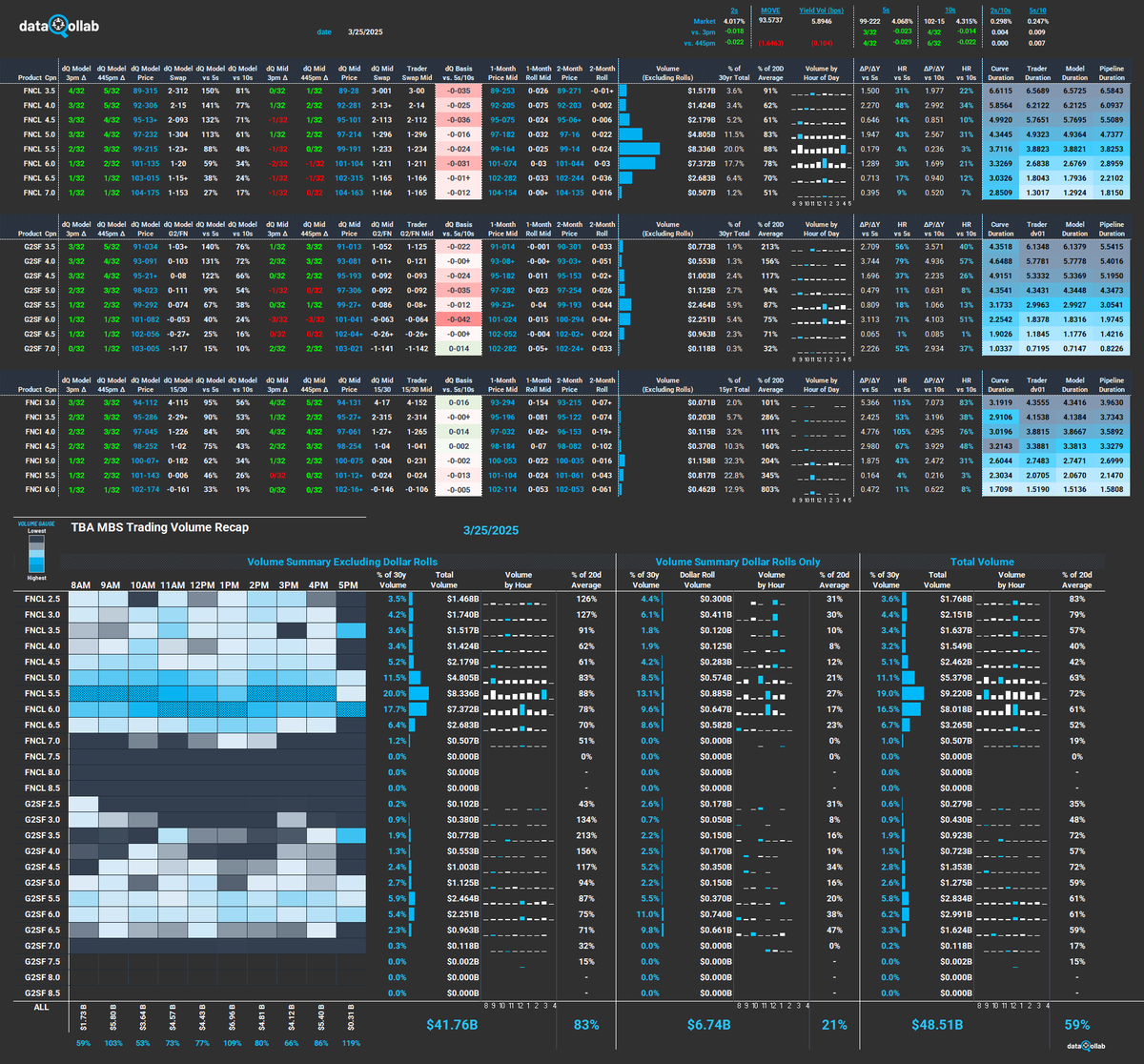

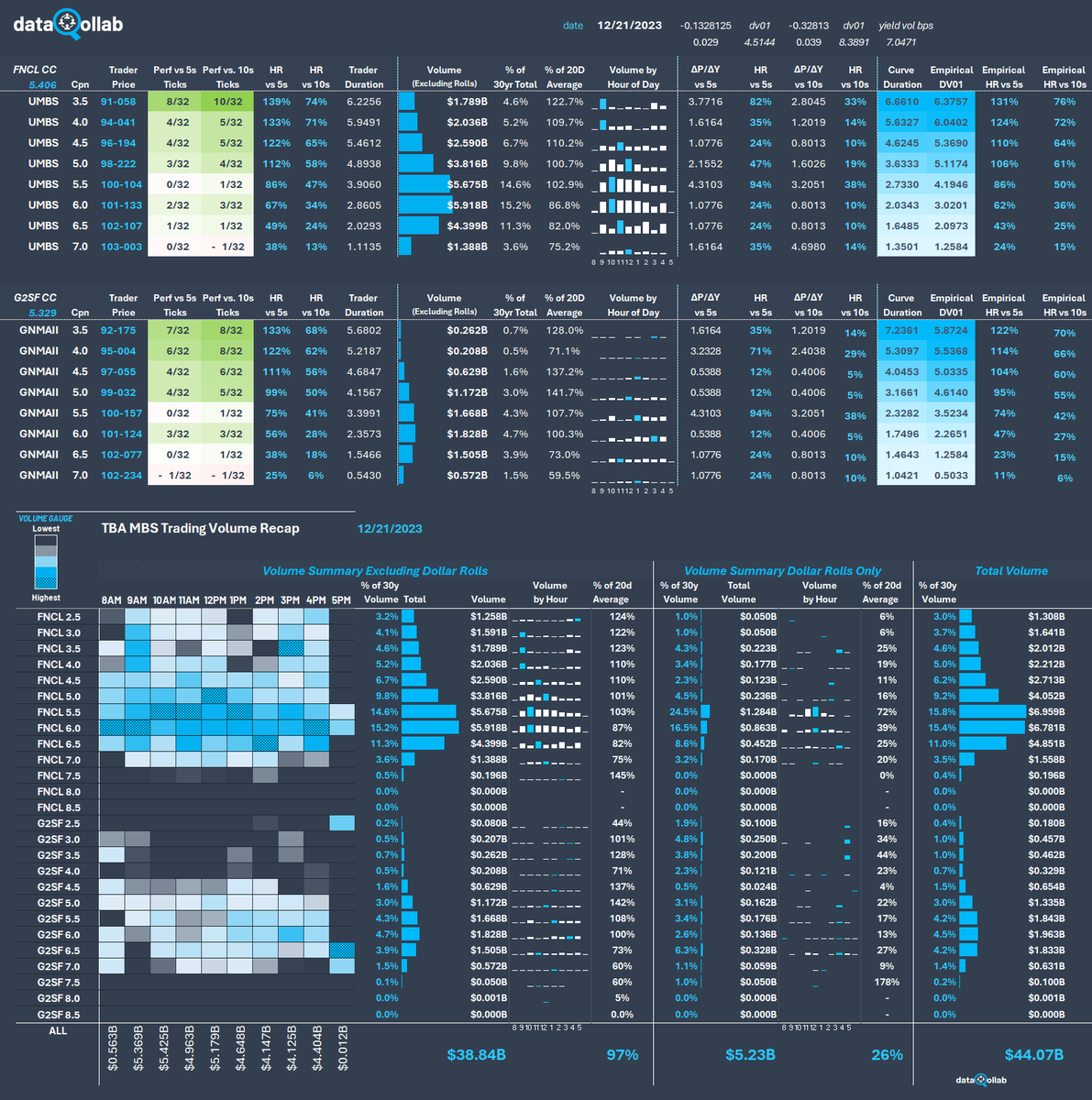

Mortgages saw their heaviest trading volume since May 15th yesterday. FNCL 6s priced near par are the biggest contributor with consistent spikes in the 4pm hour as lenders hedge out. Do not wait for 72-hour day to roll! @MBSLive @dataQollab

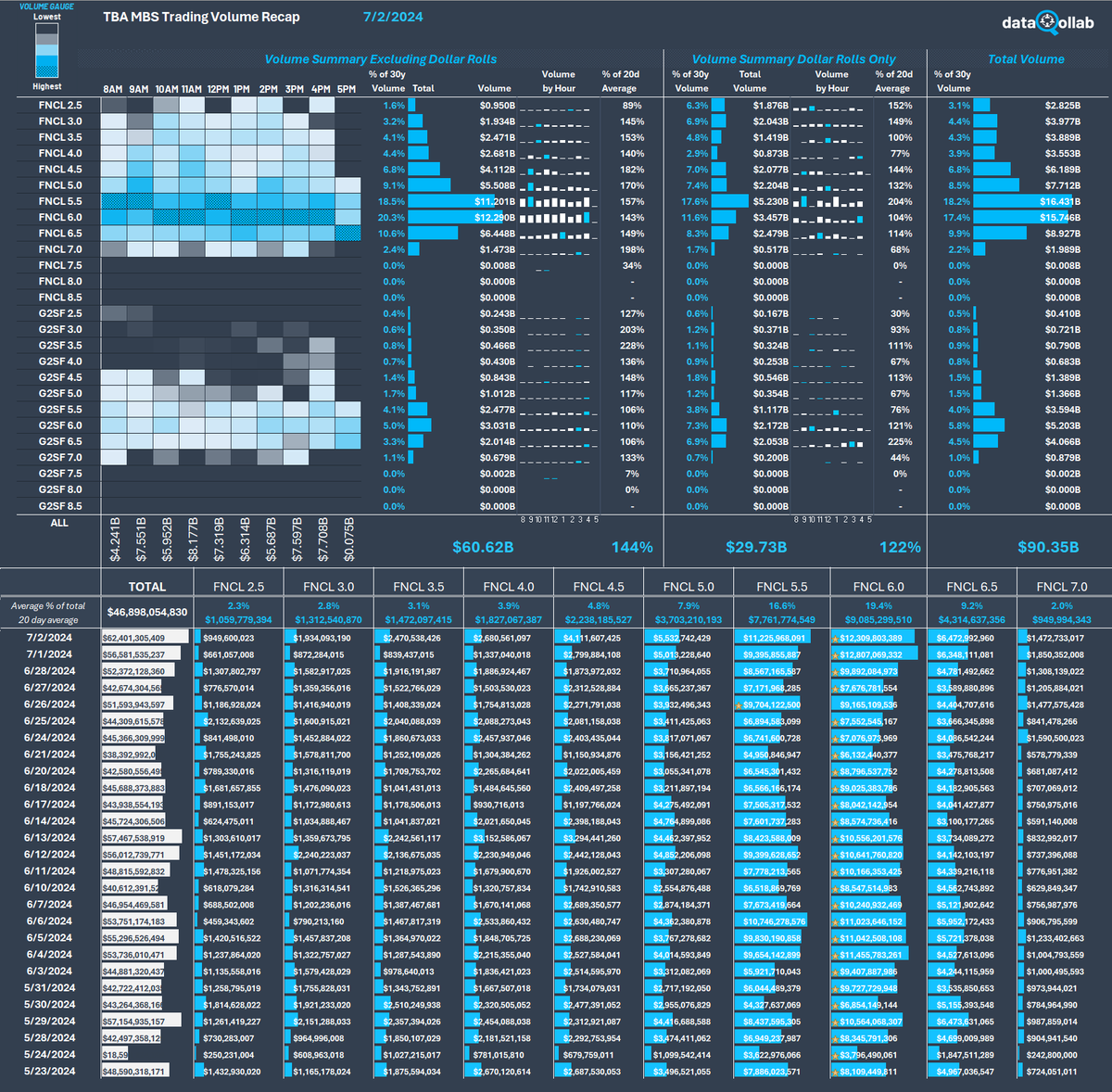

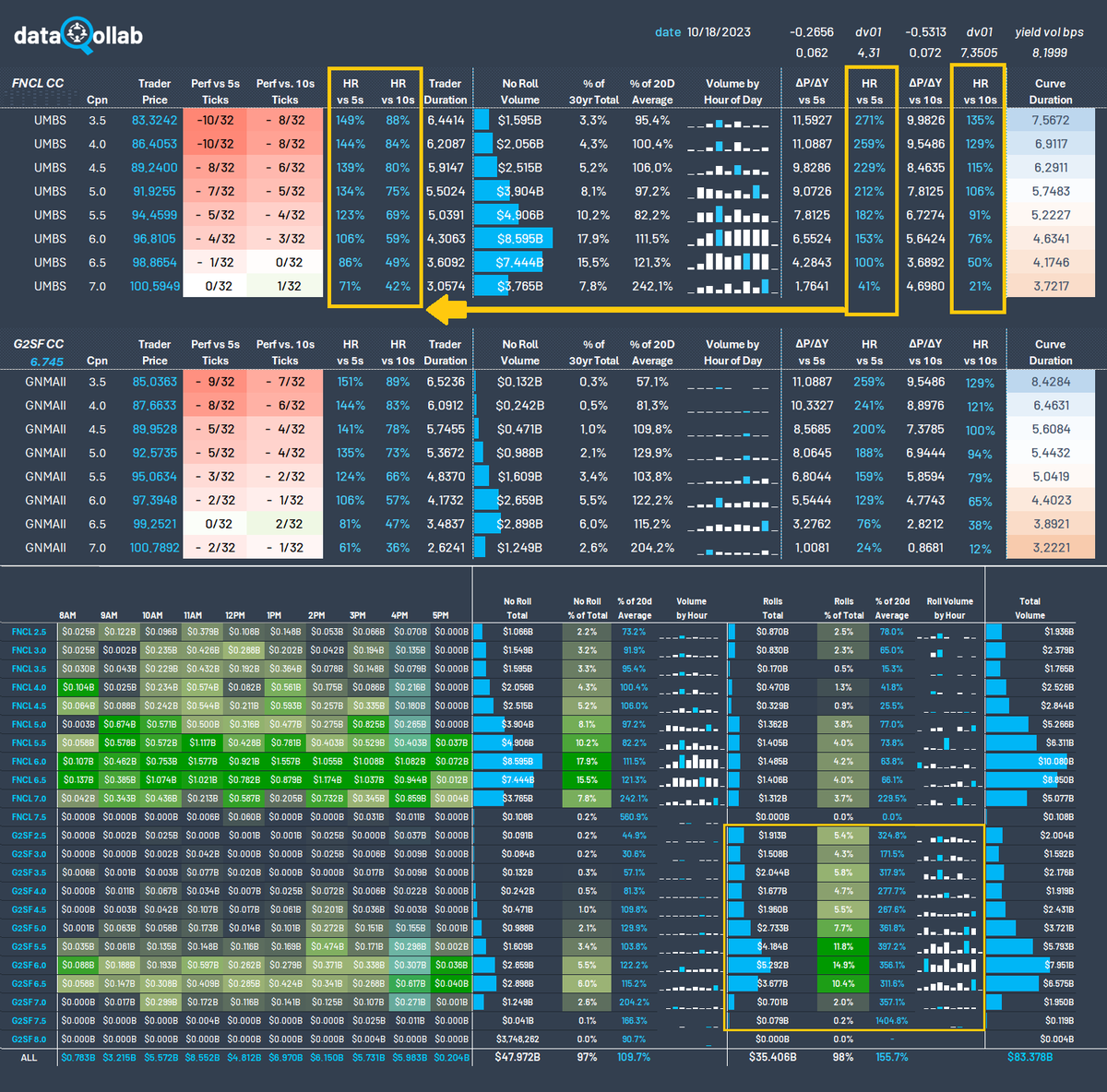

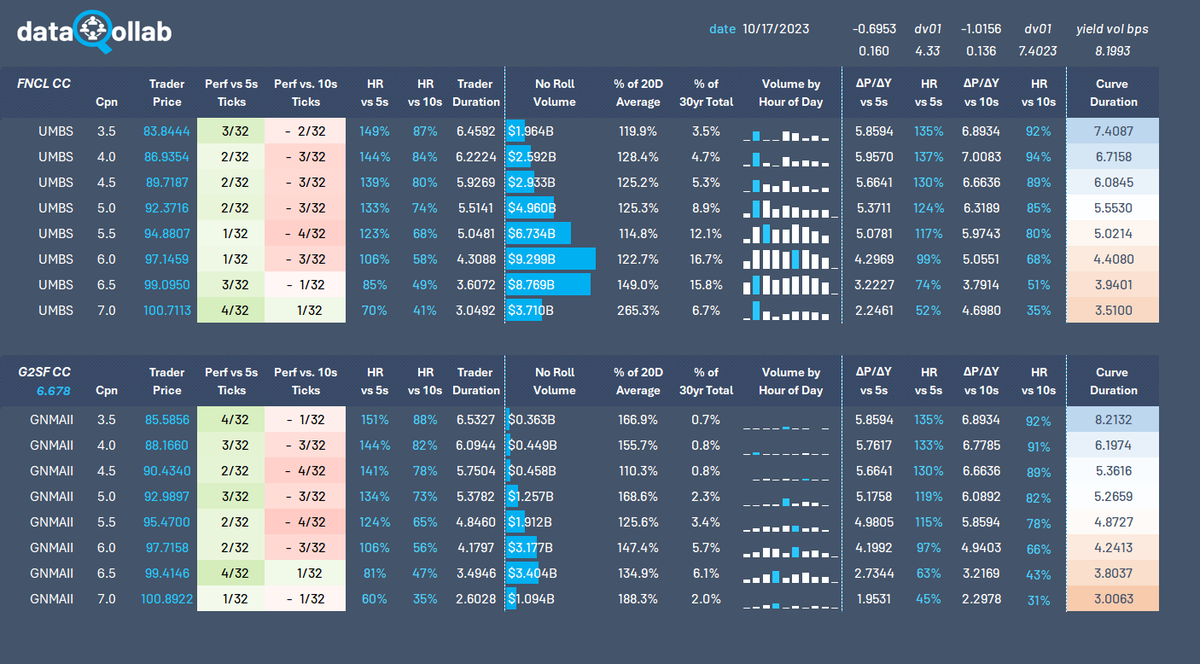

Did rates go too far too fast again? Benchmark 10s rallied all the way down to 3.77% on a potential Fed pivot but quickly jumped back to 4.00% once 2024 trading opened. Fast Money added heavy new short positions into the move. Market profile matters when setting desk durations.

Heavy post-4pm volume today as lenders squared up risk ahead of the holiday. Bid/ask gapped wider when originators were most active though. Dealers finally paying respect to their models again. Steep S-curves have pressed moneyness coupon hedge ratios noticeably lower this week.

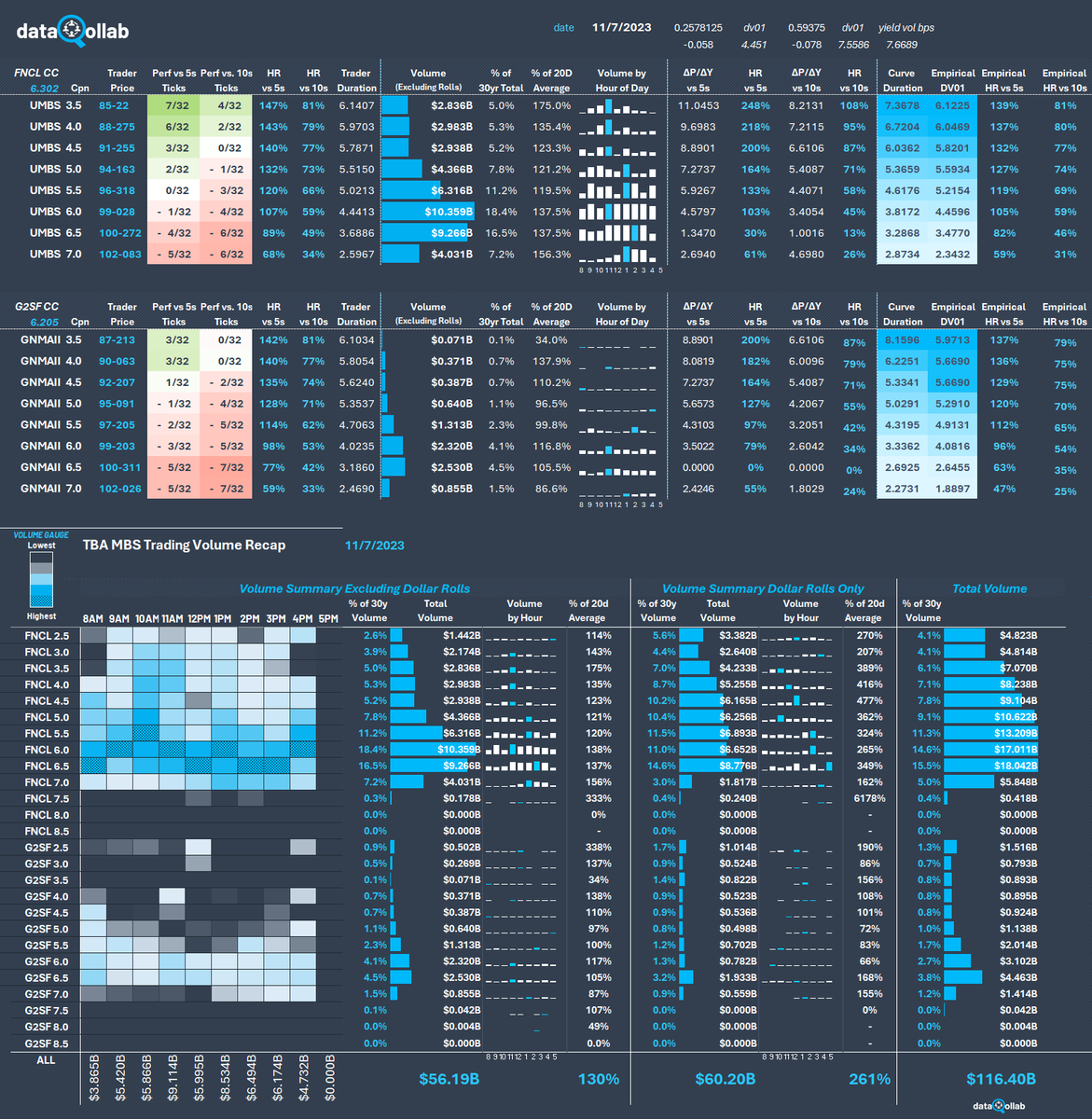

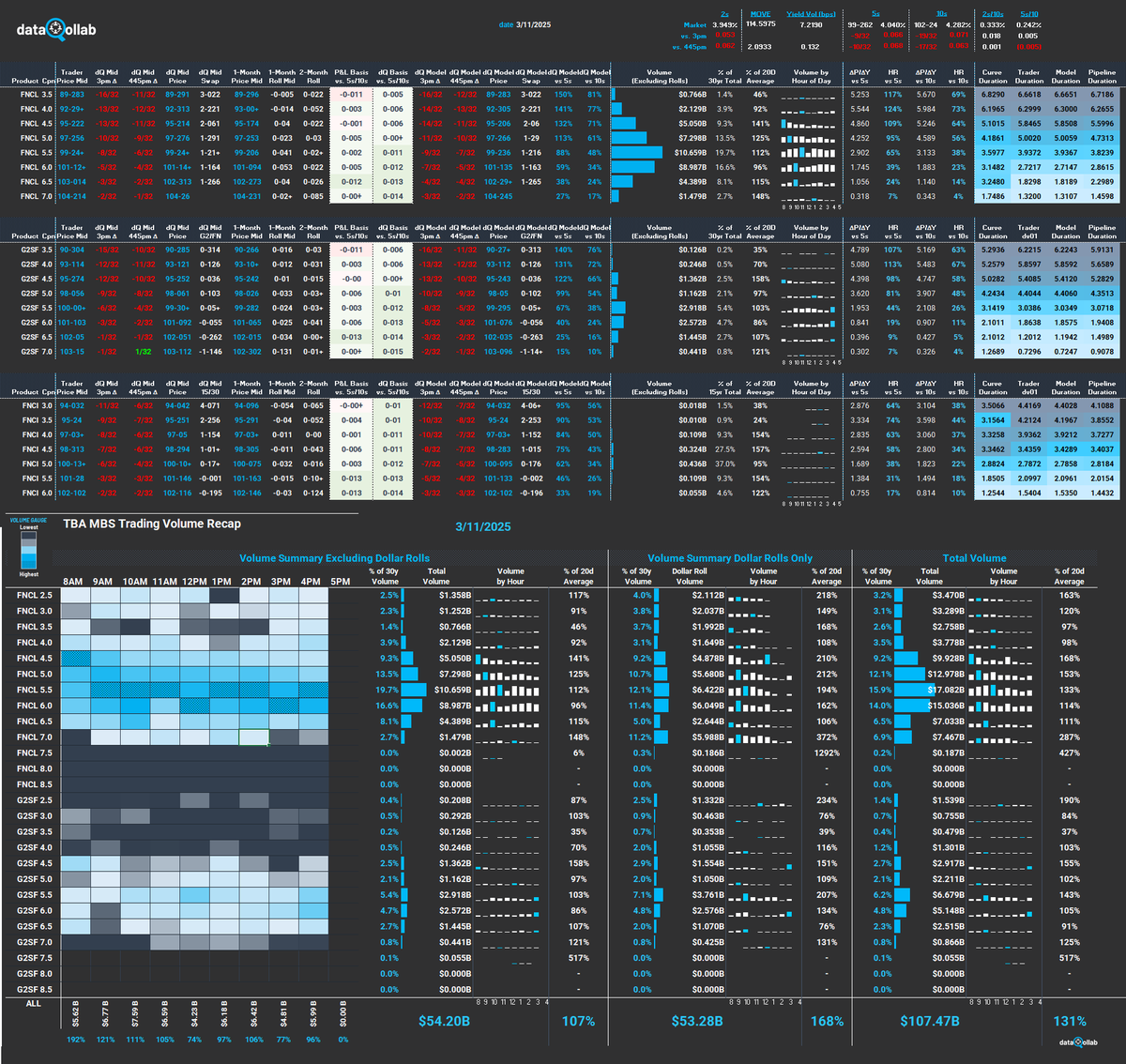

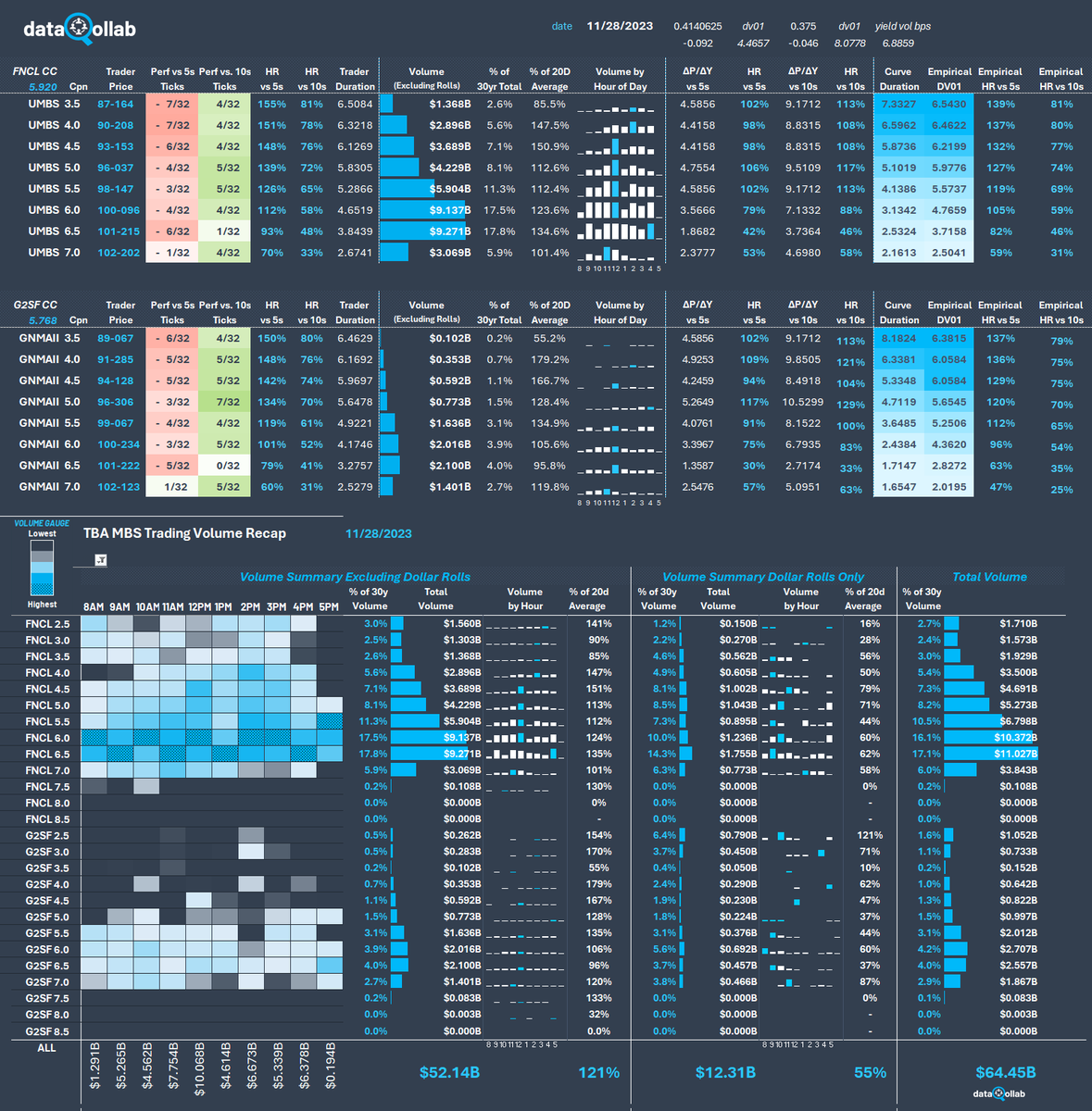

The mortgage basis couldn't keep pace with the post-FOMC rates rally yesterday. Higher and wider in heavy trading volume. 156% of the 20 day moving average. Lender P&Ls will struggle with margin calls, lock renegotiations, and MSR multiple repricing....

TBA MBS closing marks and desk ratios for 11282023. Take note of basis outperformance and volume spikes in 4.5s, 5s, and 5.5s. This is becoming a trend as investors chase a potential 2024 bull steepener. Buying on the relative cheapness of future moneyness within the stack

Waterlogged and playing possum...

Wonky session along the curve. No amount of lipstick can pretty up this pig. Duration flows were full-bodied as desks scrambled to cover risk amidst an unexpectedly immense bear steepener. Hedge ratios somehow traded thru weightings. Fast below par pls once credit cards come due

Lenders are in Philadelphia for the mortgage bankers conference this week. Attendees will be treated to free samples at Costco, gift bags from Five Below, and a set of Britney Spears steak knives. Registration also includes raffle entry. Winner gets one free GSE loan repurchase.

Fixed rate MBS pools flashed an aggregate 5.2CPR in September. That's the ninth month in the past twelve below 100PSA. 2023 UMBS 7s at 13.9CPR though and 2023 G2SF 7.5s at 18.8CPR. Float is only $4b but worth noting when considering new-add MSR multiples. Daily TBA perf recap...

United States Trends

- 1. #AEWDynamite N/A

- 2. Skubal N/A

- 3. #NASCAR N/A

- 4. Andrade N/A

- 5. Stout N/A

- 6. Gavin McKenna N/A

- 7. #AbbottElementary N/A

- 8. Jamal Murray N/A

- 9. Maxx N/A

- 10. McAvoy N/A

- 11. Overwatch N/A

- 12. #ChicagoMed N/A

- 13. #TheMaskedSinger N/A

- 14. Bowman Gray N/A

- 15. Matt Boldy N/A

- 16. WaPo N/A

- 17. Framber Valdez N/A

- 18. Jeremy Fears N/A

- 19. Drury N/A

- 20. Mark Davis N/A

Something went wrong.

Something went wrong.