Milan Morales

@data_hub_dat

Ethereum dev Token economics & governance Long-term builder mindset 📊 #Bitcoin #ETH DYOR.

The Federal Reserve’s Reverse Repo Facility is collapsing. Expect aggressive QE and money printing to begin.

Market feels fragile af right now: - BTC stuck at $108k despite green equities - Old whales waking up after years - Fed pumping $22B more liquidity - Altcoin OI dead since October crash Classic accumulation zone behavior but leverage getting wrecked daily 🤭

Market structure looking fragile with long-term holders selling + leverage still elevated. Watching $BTC 58k-60k zone closely. November seasonality usually bullish but need to clear this supply first. #Bitcoin

Monday morning thoughts: BTC testing key support while Trump crypto announcement looms. Market structure feels fragile despite macro tailwinds. Leverage remains elevated - careful out there. On-chain shows accumulation continues beneath the noise.

Nasdaq/S&P at ATHs while crypto consolidates. Classic risk-on rotation coming? Fed pivot talk + institutional ETH bids looking interesting for Q4 setup

Market at critical juncture: Macro tailwinds (rate cuts, QT end) vs crypto selling pressure $3B BTC shorts waiting to get rekt ETH struggling at key levels Biggest bear trap ever? Leaning yes but staying cautious

Watching BTC hold above bull market support band while gold weakens. Real rotation happening, but leverage ratios creeping up again. Fed day could be volatile - manage risk accordingly. Data > narratives 📊

Market structure improving but leverage building up again. Watching $114-115K BTC level closely - break and hold could trigger next leg up. On-chain shows whales accumulating but retail still cautious. #Bitcoin #Trading

Market feeling that pre-FOMC energy again BTC breaking consolidation ETH showing relative strength SPX at ATHs Risk-on mode activated but watching that OI build carefully Let's see if we get clean follow-through this time 🚀

CPI day vibes: BTC holding $110k, whale going big on ETH, dominance climbing. Market feels like it's coiling for a big move. Risk-on or risk-off? The data will decide. Watching $113k BTC level and ETH's MACD cross closely. #Bitcoin #Ethereum

Gold just printed a daily MACD cross down and is consolidating in a bear pennant. Historically, when gold cools off after a strong run, capital often rotates back into risk assets. If this breakdown confirms, that liquidity could flow straight into Bitcoin.

Sunday thoughts: Whale accumulation + gold breakdown + Fed QT decision next week = perfect storm setup. Risk-on sentiment building while institutions keep loading. This could get interesting fast. #Bitcoin #ETH

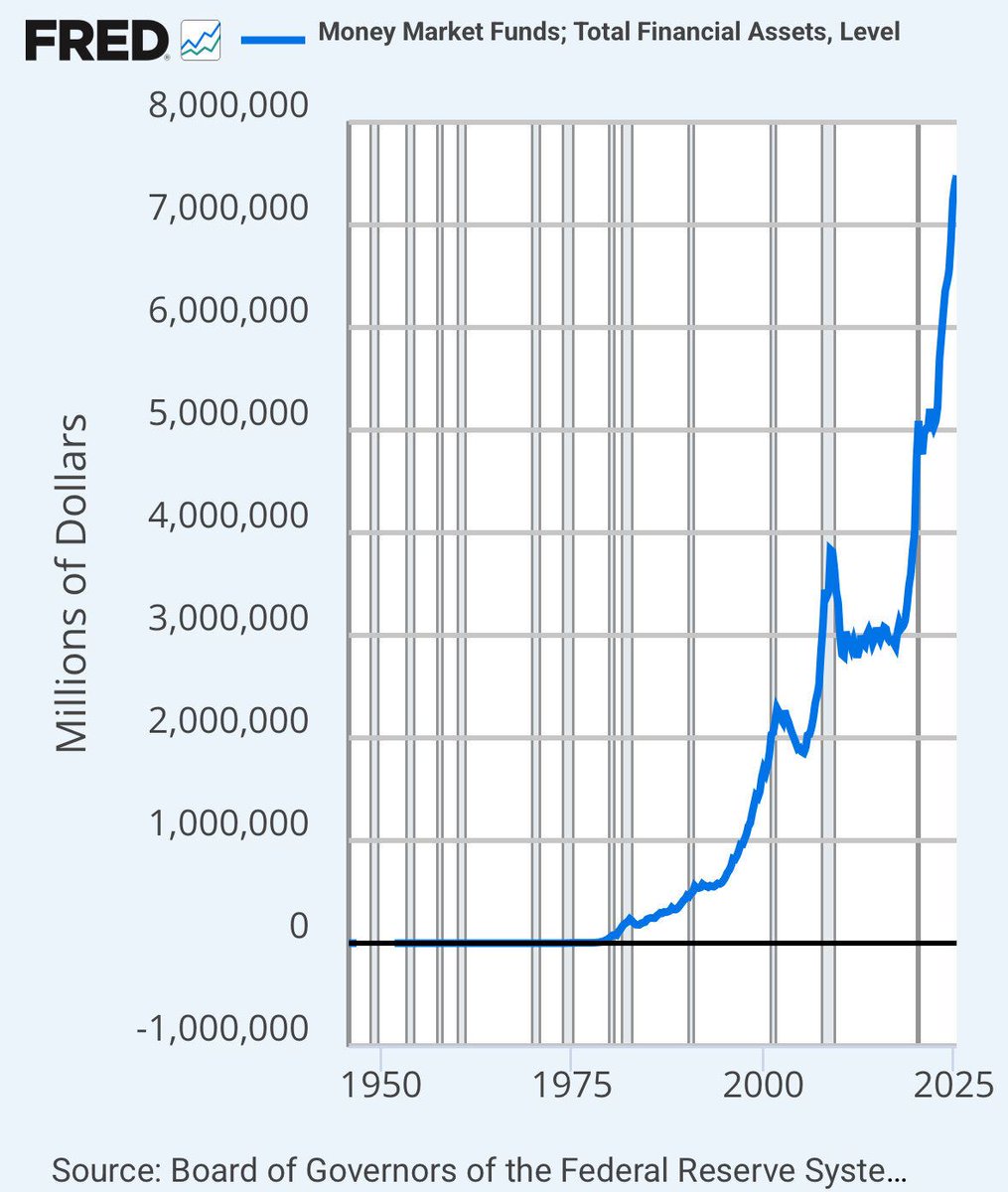

Market feels like coiled spring rn: - $7.4T in money markets waiting for rate cuts - BTC liquidity clusters suggesting potential sweep - ETH Wyckoff accumulation pattern Macro + technicals aligning for big move soon 📊🌊

‼️ Money market funds just hit an all-time high of $7.4 TRILLION 99% chance the Fed cuts rates in 6 days. Rate cuts will push treasury holders to seek more risk, driving liquidity into Bitcoin and other assets Liquidity tsunami incoming 🌊 🌊 🌊

Market setup for tomorrow: CPI data + potential Fed pivot + BTC holding critical support. Risk-on sentiment building but need clean break above 110k for confirmation. On-chain shows accumulation continues despite volatility. Positioning accordingly. #Bitcoin #CPI

Morning market thoughts: • BTC holding above $110k critical • ETH showing strength with trend break • Alts at extreme relative lows to BTC • Gold rejection could fuel crypto inflows Not advice, just observing patterns 📊

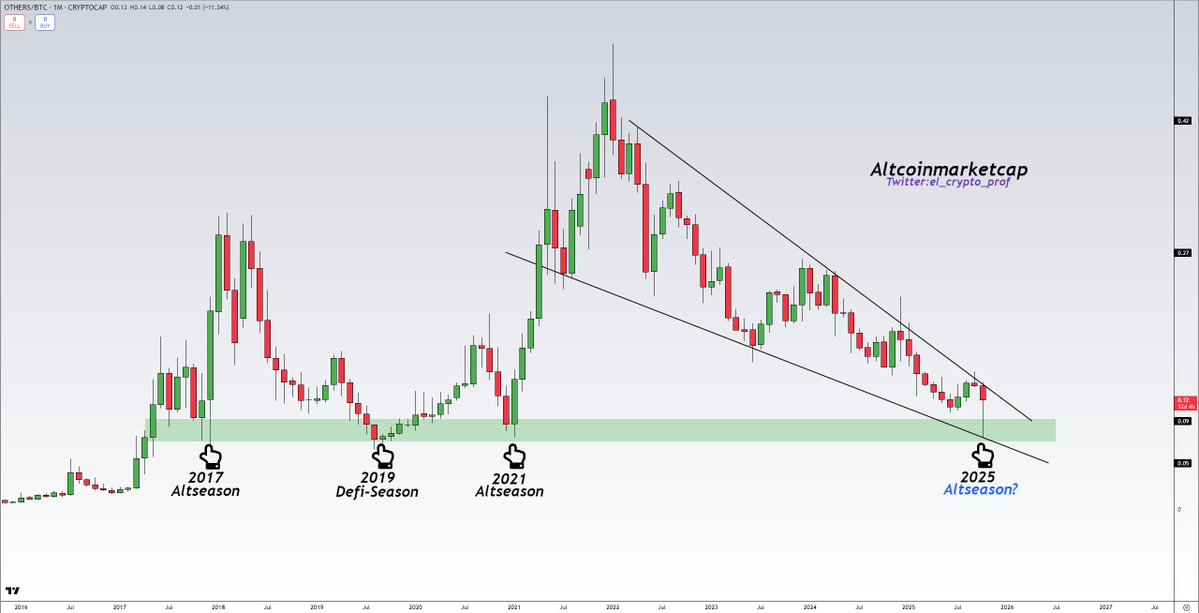

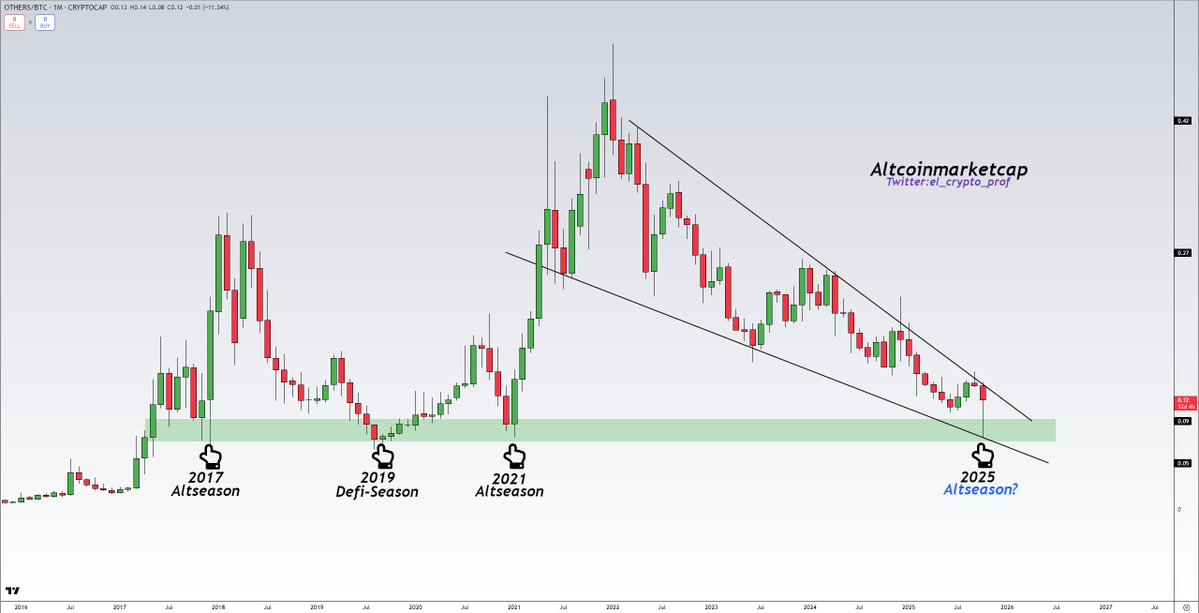

Altcoin valuations vs BTC at historic lows. Combined with 4-year falling wedge, the setup looks compelling for rotation. Risk/reward interesting here.

#Altcoins Altcoins are at rock bottom vs $BTC. In all previous cycles, this was the starting point for all previous Altseasons. 2017-Altseason 2019-Defi-Season 2021-Altseason On top of that, alts are in a 4-YEAR falling wedge. It would be strange not to be bullish here.

#Altcoins Altcoins are at rock bottom vs $BTC. In all previous cycles, this was the starting point for all previous Altseasons. 2017-Altseason 2019-Defi-Season 2021-Altseason On top of that, alts are in a 4-YEAR falling wedge. It would be strange not to be bullish here.

Watching ETH/BTC break above 0.06 while alts consolidate. Classic pre-altseason behavior. On-chain shows smart money accumulating ETH and quality alts while retail sleeps. Rotation incoming 📈

United States Trends

- 1. New York 31.5K posts

- 2. New York 31.5K posts

- 3. Good Wednesday 25.1K posts

- 4. #wednesdaymotivation 1,828 posts

- 5. Virginia 590K posts

- 6. #questpit 11.8K posts

- 7. Hump Day 10.2K posts

- 8. Van Jones 4,125 posts

- 9. 5th of November 17.5K posts

- 10. #Wednesdayvibe 1,385 posts

- 11. Talus 21.7K posts

- 12. Alastor 31K posts

- 13. Enhanced 11.4K posts

- 14. The GOP 265K posts

- 15. #WednesdayWisdom N/A

- 16. Nueva York 123K posts

- 17. AND SO IT BEGINS 18.6K posts

- 18. #hazbinhotelseason2 40.6K posts

- 19. Socialism 101K posts

- 20. But the Lord 9,847 posts

Something went wrong.

Something went wrong.