David Wagikuyu🇰🇪🇺🇸

@davidwagikuyu

Passionate about Financial Markets.

You might like

Safaricom’s green note benefits from full tax exemption because it qualifies as an ESG-aligned instrument: —Investors keep the full 10.4% which is equal to a 12.23% gross rate on a comparable basis. —EABL’s 11.8% MTN is taxed at 15% WHT leaving a 10.03% net return.

Safaricom has opened Tranche 1 of its Green Notes offer under the newly approved KES 40B Medium Term Note programme: —This tranche will have a size of up to KES 15B with a KES 5B greenshoe option. —The 5 year notes are priced at 10.40% per annum (EABL notes were prices at 11.8%)…

GOLDMAN SEES DOWNSIDE RISKS FOR ECONOMY NEXT YEAR Goldman Sachs economists expect the Fed to cut rates in December, followed by a few more cuts in 2025, bringing rates just above 3%. Chief economist Jan Hatzius warns the economy could slow more than expected, requiring…

In Q3 2025, StanChart Kenya (@StanChartKE) pre-tax profit declined 41% YoY to KES 13.2B. The earnings drop was due to a KES 2.7B one-off employee past service cost following the Supreme Court ruling on 5 Sep 2025 and the Retirement Benefits Appeal Tribunal (RBAT) orders.

Following the loss of its 16-year pension arrears case, Standard Chartered Bank Kenya has asserted that it has adequate financial reserves to settle the KES 7 billion payout. tradingroom.co.ke/court-ruling-s…

Standard Chartered closed Q3 with net income falling by 38.27% to 9.79 Bn, driven by weaker revenue across both interest and non-interest lines and higher operating costs that rose to 19.23 Bn.

Stanchart Q3 2025 Results [KES, YoY]: ◾ Assets: +3.6% to 384.4B ◾Deposits: -0.3% to 283.4B ◾ Loans: -3.2% to 146.4B ◾ Net Interest Income: -10.3% to 22.3B ◾ Non-interest Income: -28.6% to 10.2B ◾ Loan Loss Provisions: -10.9% to 1.7B ◾ PAT: -38.2% to 9.8B ◾ EPS: -38.5% to…

![MwangoCapital's tweet image. Stanchart Q3 2025 Results [KES, YoY]:

◾ Assets: +3.6% to 384.4B

◾Deposits: -0.3% to 283.4B

◾ Loans: -3.2% to 146.4B

◾ Net Interest Income: -10.3% to 22.3B

◾ Non-interest Income: -28.6% to 10.2B

◾ Loan Loss Provisions: -10.9% to 1.7B

◾ PAT: -38.2% to 9.8B

◾ EPS: -38.5% to…](https://pbs.twimg.com/media/G6lCWG6bwAAmGc8.jpg)

Stanchart [@StanChartKE] Q3 2024 Results [KES, YoY]: ◾Assets: +0.3% to 370.9B ◾Loan Book: +5.4% to 151.3B ◾Gross NPLs: -48.4% to 12.1B ◾Deposits: -4.8% to 284.4B ◾Net Int Income: +16.9% to 24.8B ◾Provisions: +7.6% to 1.96B ◾PAT: +62.7% to 15.8B ◾EPS: +63.5% to 41.6…

![MwangoCapital's tweet image. Stanchart [@StanChartKE] Q3 2024 Results [KES, YoY]:

◾Assets: +0.3% to 370.9B

◾Loan Book: +5.4% to 151.3B

◾Gross NPLs: -48.4% to 12.1B

◾Deposits: -4.8% to 284.4B

◾Net Int Income: +16.9% to 24.8B

◾Provisions: +7.6% to 1.96B

◾PAT: +62.7% to 15.8B

◾EPS: +63.5% to 41.6…](https://pbs.twimg.com/media/Gczz36MbcAA-d6J.jpg)

Safaricom Plc is on some serious balance sheet flex with Tranche I of its medium-term note. For a 5-year paper, the telco is offering investors just 10.4%. If we thought EABL Plc at 11.8% was stretching the limits of tight credit spreads for investment grade issuers,…

@BD_Africa's @KephaMuiruri reports that Safaricom Plc has received @CMAKenya's green light to raise a multi-tranche Kes 40.0 billion note. When EABL's issuance at 11.8% registered 152.4% performance, I indicated (see quoted tweet) that the it was fundamentally a price…

Safaricom has opened Tranche 1 of its Green Notes offer under the newly approved KES 40B Medium Term Note programme: —This tranche will have a size of up to KES 15B with a KES 5B greenshoe option. —The 5 year notes are priced at 10.40% per annum (EABL notes were prices at 11.8%)…

Revival in the corporate bond market continues —Barely a week after EABL’s oversubscribed KES 16.76 billion note, Safaricom has now moved to the market with a new KES 40 billion Medium Term Note programme. —The MTN structure gives Safaricom flexibility to issue multiple…

Wheat is the worst of swallows: — It tastes bland and it contains too much sugar and inflammatory gluten. — Spikes up blood sugar — Makes you add weight unnecessarily. — Expose you to diabetes — Kills diabetics. Don't moderate this poison, eliminate it. And don't forget…

Munaonaje the new Nissan Note E-power?

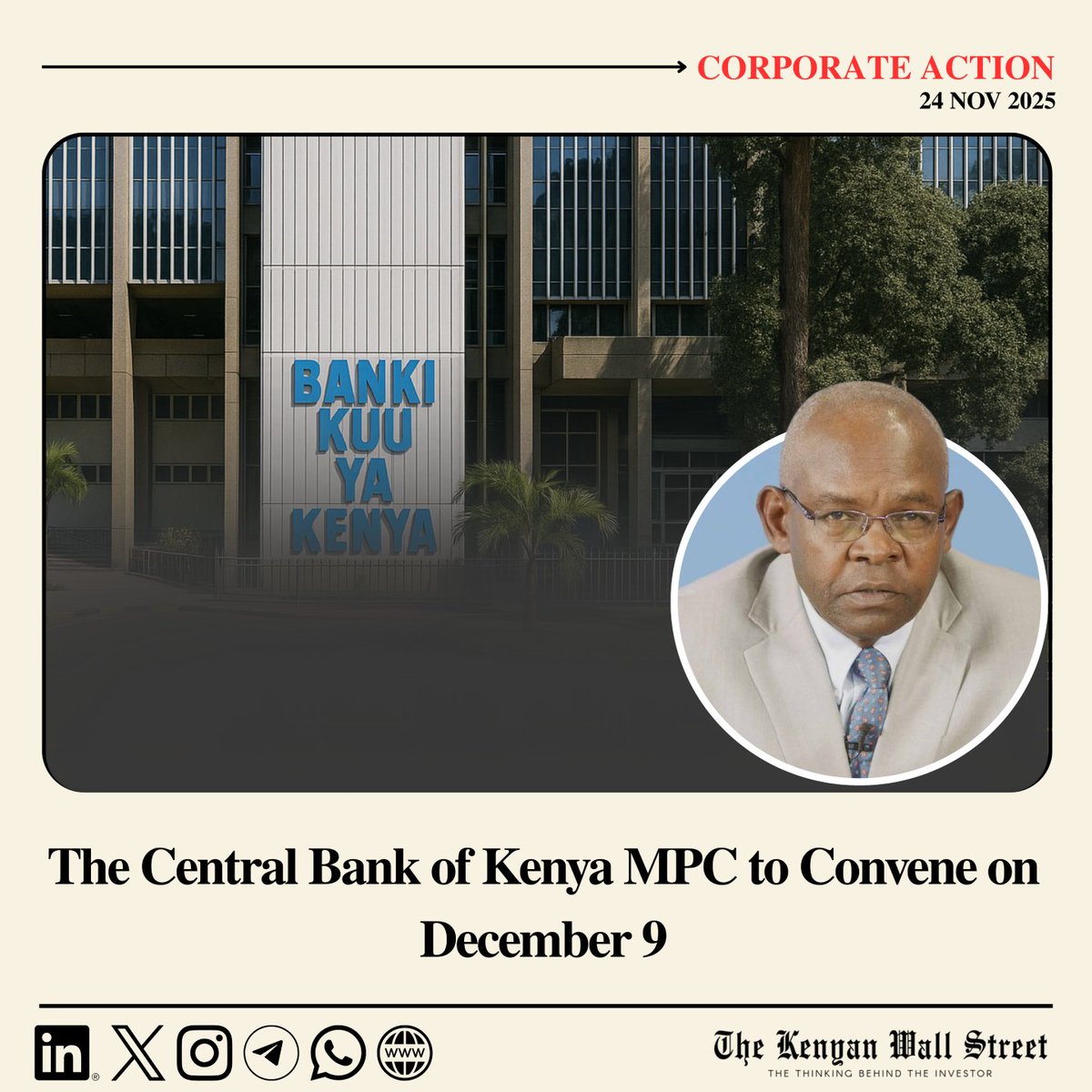

The Central Bank of Kenya has set December 9, 2025 as the date for the next Monetary Policy Committee meeting.

When someone gives you money, however little, in this economy of snake oil merchants, acknowledge... Appreciate... A simple "thank you" does the magic. It is not that they had no use for the money, and that you were entitled to it. Sometimes entitled humans buffle me to death.

Linus Kaikai has graduated from law school & admitted to the bar aged 56 years old. You can always start something afresh & be successful. The reset button is forever press-able.

TO THE MANY who inspired, guided and supported me throughout this long journey, here’s my eternal gratitude and a big THANK YOU to you all.

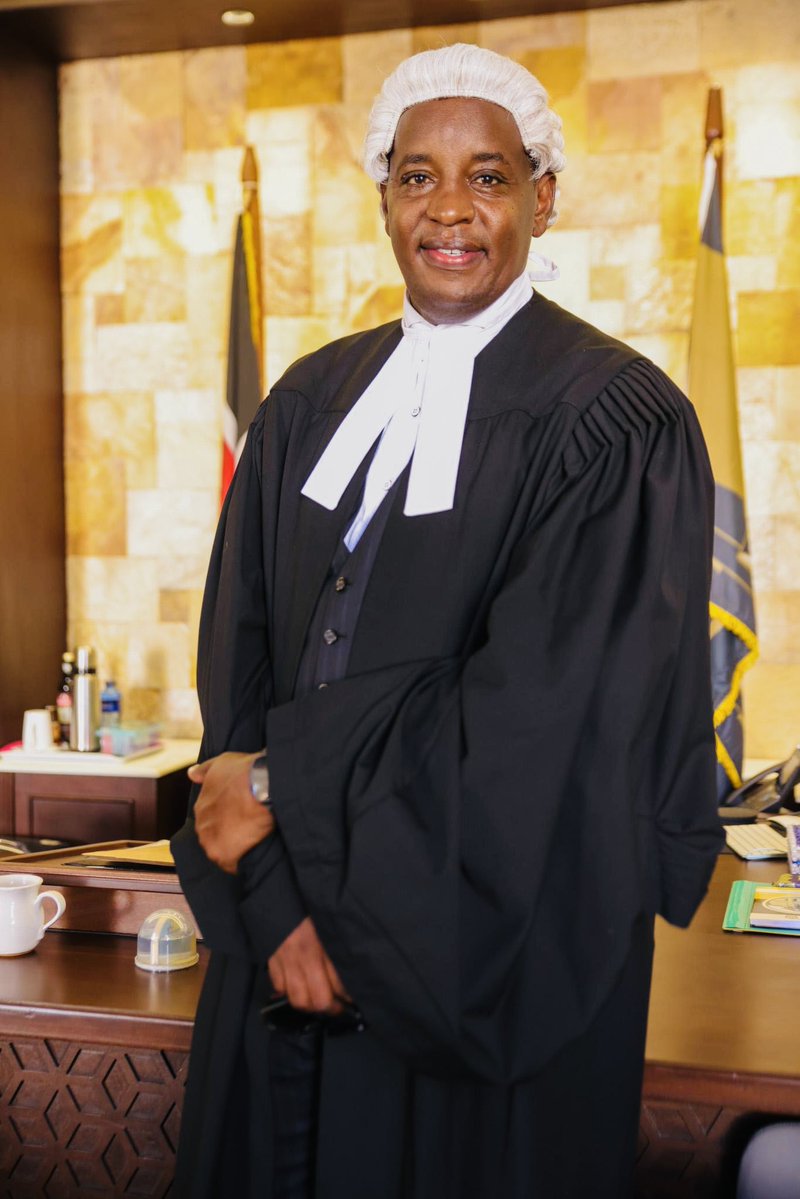

Probably one of Buffett's strongest traits: extensive research.

BREAKING: Zelensky published an urgent address to the nation: “This is one of the most difficult moments in our history. Ukraine now faces a very tough choice: either a loss of dignity or the risk of losing a key partner. Either a complex 28-point plan, or an extremely harsh…

For Kenya's government, selling some of its stake in Safaricom would assist with its efforts to raise revenue as it pushes to address growing debt costs and budget deficits bloomberg.com/news/articles/…

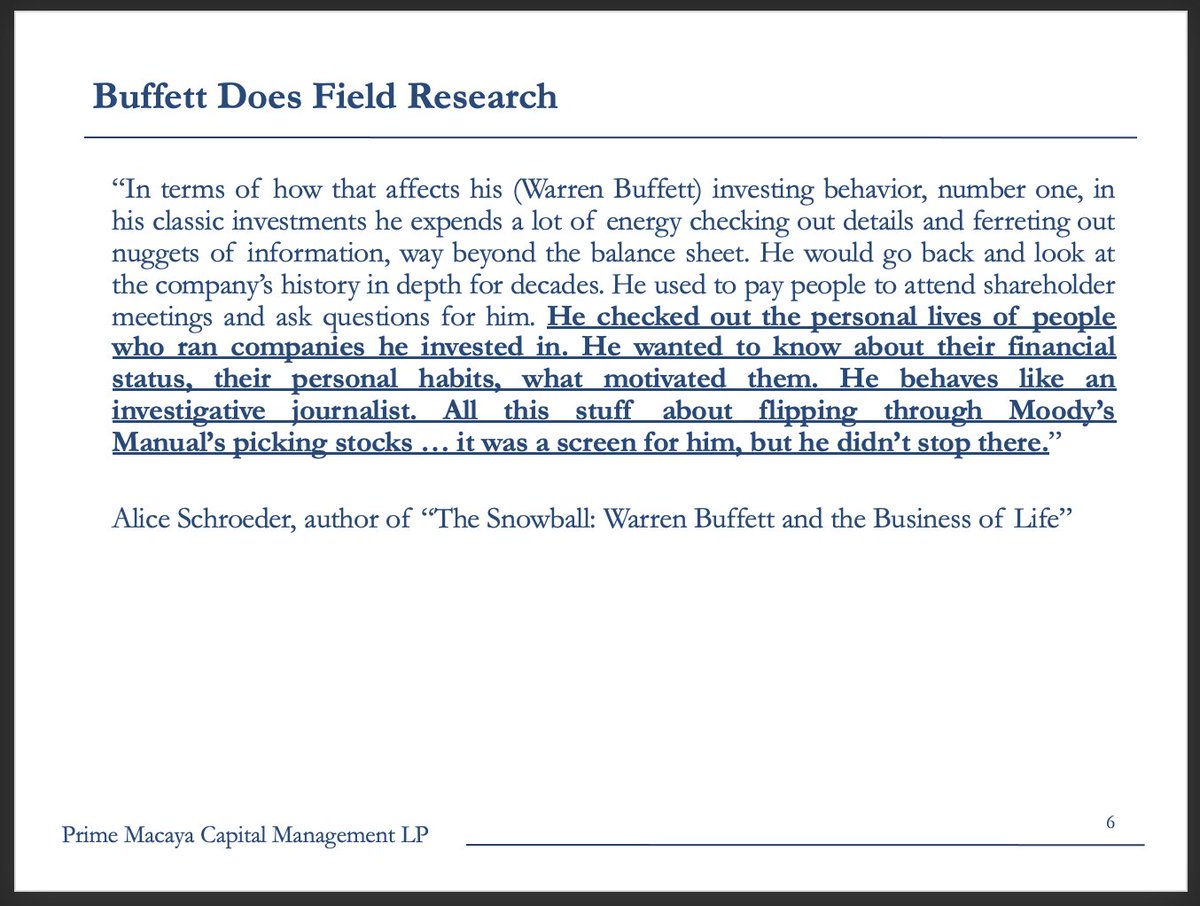

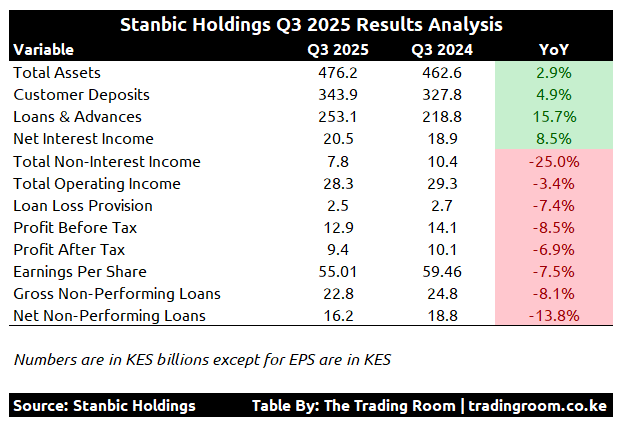

Stanbic Holdings (@StanbicKE) reports 3.4% decline in operating income to KES 28.3B, with non-interest income dropping 25.0% to KES 7.8B on account of a sharp decline of 51% in FX Trading Income to KES 3.1B. Net profit contracted 7% to KES 9.4B while EPS fell 8% to KES 55.01.

Analysis of Stanbic Holdings (@StanbicKE) set of half year 2025 results (Numbers are in KES): —Loans and advances: -14.57% to 308.7B —Deposits and Debt Funding: -9.58% to 350.4B —Total Assets: -4.86% to 473.7B —Net Interest Income: -5.78% to 11.8B —Non-interest revenue: +0.84% to…

I don't know how many times I will reiterate this, As a MAN, Don't entertain jokers in your life. Your life is hard enough. Don't lower your standards just to please others. Don't accept, Dont budge, Don't lower your frame. People who value you will always respect you.…

NSE is a dividends Market, majority of overvalued counter have a high dividends payout history. We want quick assured returns.

So we should expect KCB share price to go up over that of NCBA OR what is holding down KCB share price, Low dividends?

I&M Group Plc Q3 2025 Results [KES, YoY] ◾ Assets: +12.7% to 640B ◾ Deposits: +10% to 455.8B ◾ Loans: +7.3% to 301.9B ◾ Net Interest Income: +21.1% to 31.8B ◾ Non-interest Income: +18% to 11.2B ◾ Provisions: +21.9% to 6.7B ◾ PAT: +27% to 12.7B ◾ EPS: +24.2% to 6.88 ◾…

![MwangoCapital's tweet image. I&M Group Plc Q3 2025 Results [KES, YoY]

◾ Assets: +12.7% to 640B

◾ Deposits: +10% to 455.8B

◾ Loans: +7.3% to 301.9B

◾ Net Interest Income: +21.1% to 31.8B

◾ Non-interest Income: +18% to 11.2B

◾ Provisions: +21.9% to 6.7B

◾ PAT: +27% to 12.7B

◾ EPS: +24.2% to 6.88

◾…](https://pbs.twimg.com/media/G6LHeeqawAEMPEP.jpg)

![MwangoCapital's tweet image. I&M Group Plc Q3 2025 Results [KES, YoY]

◾ Assets: +12.7% to 640B

◾ Deposits: +10% to 455.8B

◾ Loans: +7.3% to 301.9B

◾ Net Interest Income: +21.1% to 31.8B

◾ Non-interest Income: +18% to 11.2B

◾ Provisions: +21.9% to 6.7B

◾ PAT: +27% to 12.7B

◾ EPS: +24.2% to 6.88

◾…](https://pbs.twimg.com/media/G6LHep2acAclyxk.jpg)

I&M Group [@imbankke] Q3 2024 [YoY, KES]: ◾Assets: +4.2% to 567.7B ◾Loan Book: -2.1% to 281.3B ◾Gross NPLs: -1.3% to 35.7B ◾Deposits: +2.8% to 413.8B ◾Net Int income: +37.4% to 26.3B ◾Provisions: +18.9% to 5.5B ◾PAT: +21.3% to 9.9B ◾EPS: +17.9% to 5.54 ◾Govt Securities:…

![MwangoCapital's tweet image. I&M Group [@imbankke] Q3 2024 [YoY, KES]:

◾Assets: +4.2% to 567.7B

◾Loan Book: -2.1% to 281.3B

◾Gross NPLs: -1.3% to 35.7B

◾Deposits: +2.8% to 413.8B

◾Net Int income: +37.4% to 26.3B

◾Provisions: +18.9% to 5.5B

◾PAT: +21.3% to 9.9B

◾EPS: +17.9% to 5.54

◾Govt Securities:…](https://pbs.twimg.com/media/GczO9x9bMAA4DkQ.jpg)

$IMH Q3⤵️⤵️ Interim DPS up 15%

I&M Group’s Q3 2025 profit after tax was up 27.5% to 12.68Bn on double-digit growth in both net interest and non-funded income. Shareholder equity rose 29.9% to 113.79Bn, and deposits increased 10.2% to 455.85Bn. The board declares a KSh 1.50 interim dividend, up 15.4%.

United States Trends

- 1. Sonny Gray 7,132 posts

- 2. Dick Fitts N/A

- 3. Red Sox 7,004 posts

- 4. Rush Hour 4 7,230 posts

- 5. Godzilla 20.1K posts

- 6. National Treasure 5,197 posts

- 7. Raising Arizona N/A

- 8. Gone in 60 1,892 posts

- 9. Clarke 6,306 posts

- 10. Happy Thanksgiving 20.7K posts

- 11. 50 Cent 3,905 posts

- 12. #yummymeets N/A

- 13. Lord of War 1,373 posts

- 14. Giolito N/A

- 15. NextNRG Inc N/A

- 16. #GMMTV2026 4.22M posts

- 17. Thankful 49.3K posts

- 18. Brett Ratner 2,373 posts

- 19. Chelsea 304K posts

- 20. Academic All-District N/A

You might like

-

A$AP MROCKY 🇰🇪

A$AP MROCKY 🇰🇪

@edumrocky -

![AfricanLeaders_'s profile picture. A Premier Leader-Followers Engagement Platform Focusing on Democracy and Elections Across Africa.[Currently Based in East Africa].](https://pbs.twimg.com/profile_images/1180878221140746240/yAsHNHkF.jpg) afriCAN

afriCAN

@AfricanLeaders_ -

Chandu 🇮🇳 🕉️

Chandu 🇮🇳 🕉️

@ChanduOGKRC -

NuGod Kris

NuGod Kris

@Narsiuss -

chris welsh

chris welsh

@Welsh_0001 -

Mucoki

Mucoki

@jmucoki -

Martinelli stan account

Martinelli stan account

@_Izzoh -

𝗟𝗔𝗦𝗧 𝗗𝗔𝗬𝗦 𝗘𝗩𝗘𝗡𝗧𝗦

𝗟𝗔𝗦𝗧 𝗗𝗔𝗬𝗦 𝗘𝗩𝗘𝗡𝗧𝗦

@JoelMoriasi -

otieno

otieno

@otieno_sylvery -

खंडेराव

खंडेराव

@mukesh__96 -

HaronⓂ️

HaronⓂ️

@realRuto -

The LAW is VERY CLEAR. 🇰🇪

The LAW is VERY CLEAR. 🇰🇪

@Ronn_Kinuthia -

Samir

Samir

@mbugua_sami -

its the AUDACITY

its the AUDACITY

@ireri25matador -

The Residents President

The Residents President

@thomasndungani

Something went wrong.

Something went wrong.

![AfricanLeaders_'s profile picture. A Premier Leader-Followers Engagement Platform Focusing on Democracy and Elections Across Africa.[Currently Based in East Africa].](https://pbs.twimg.com/profile_images/1180878221140746240/yAsHNHkF_x96.jpg)