gmc

@dinmunk

Stock Trader, Options Trader, Value Investor, Observer, Commenter. My tweets are only thoughts and opinions.

You might like

If you don't use your time, knowledge and resources to build yourself People use your time, knowledge and resources to build themselves. They will take whatever you have. Choice is yours.

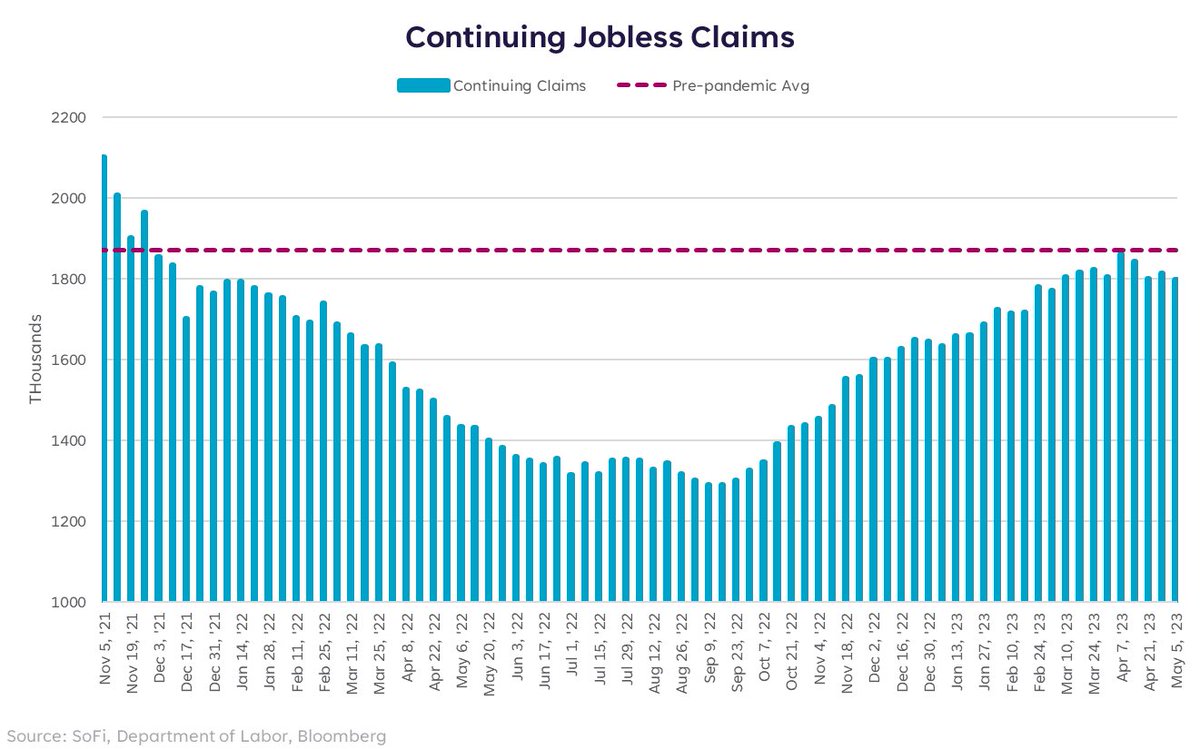

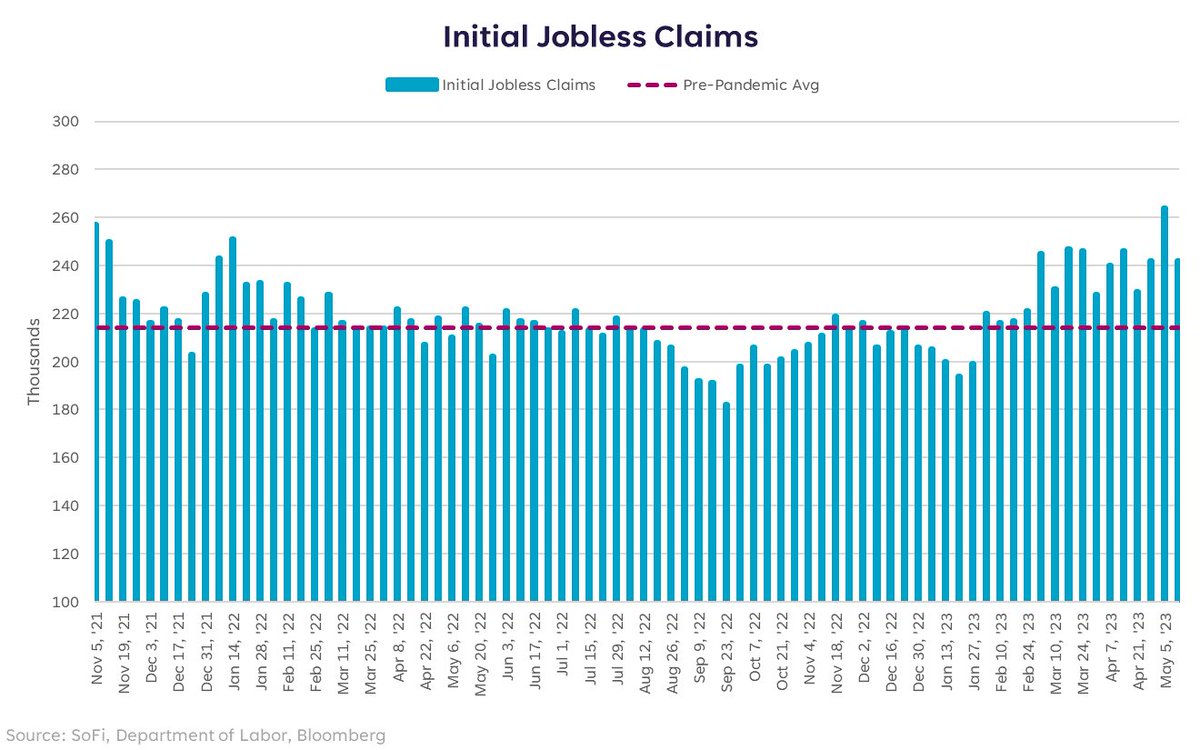

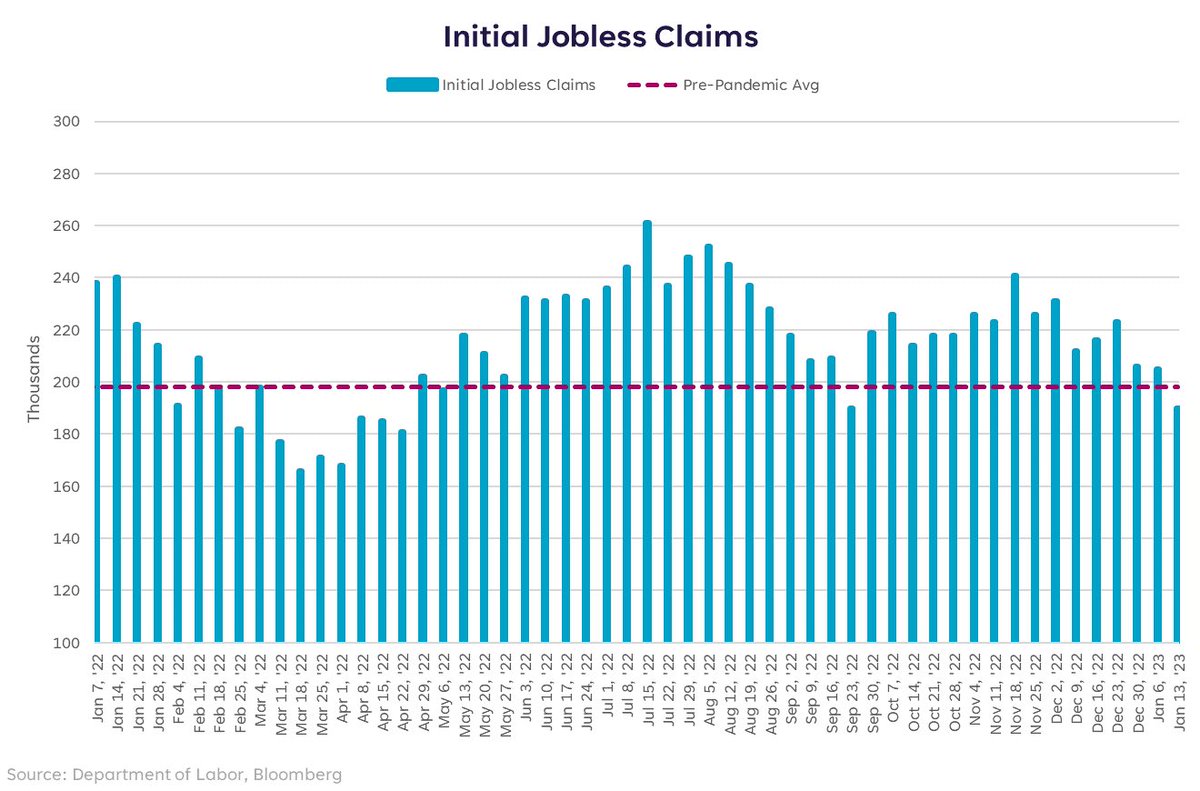

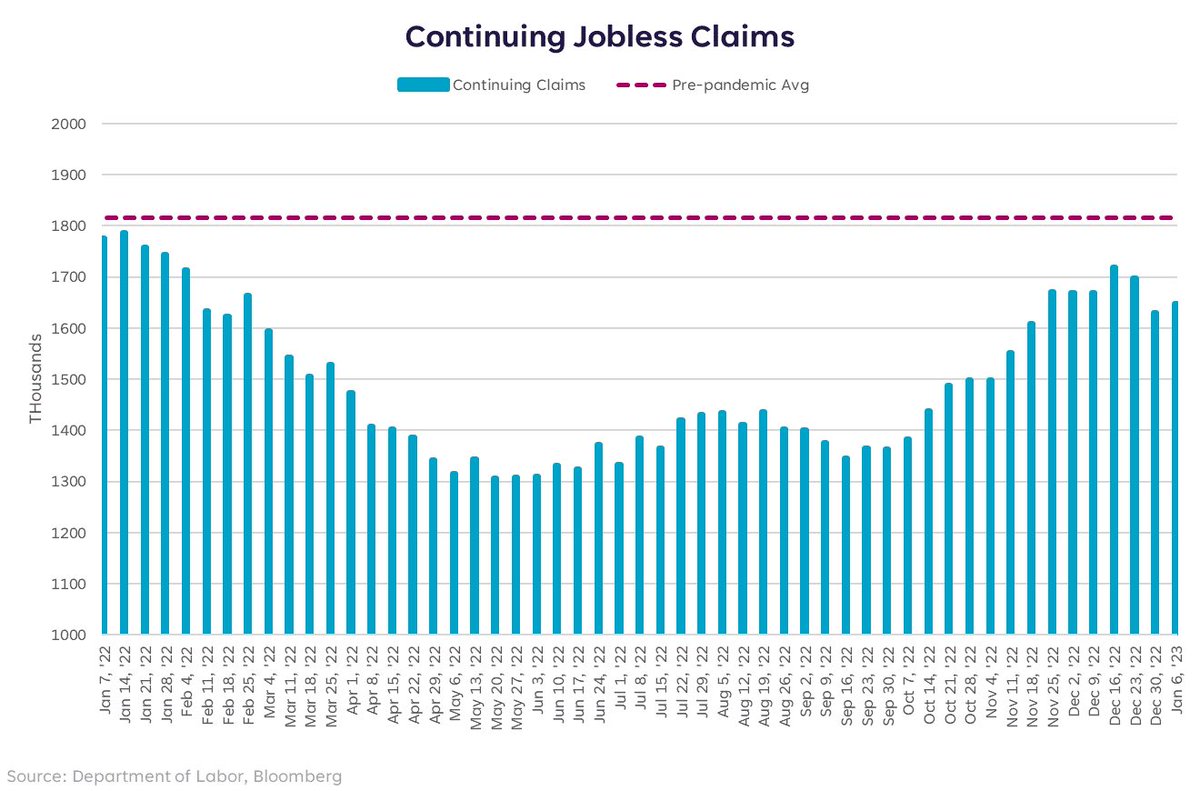

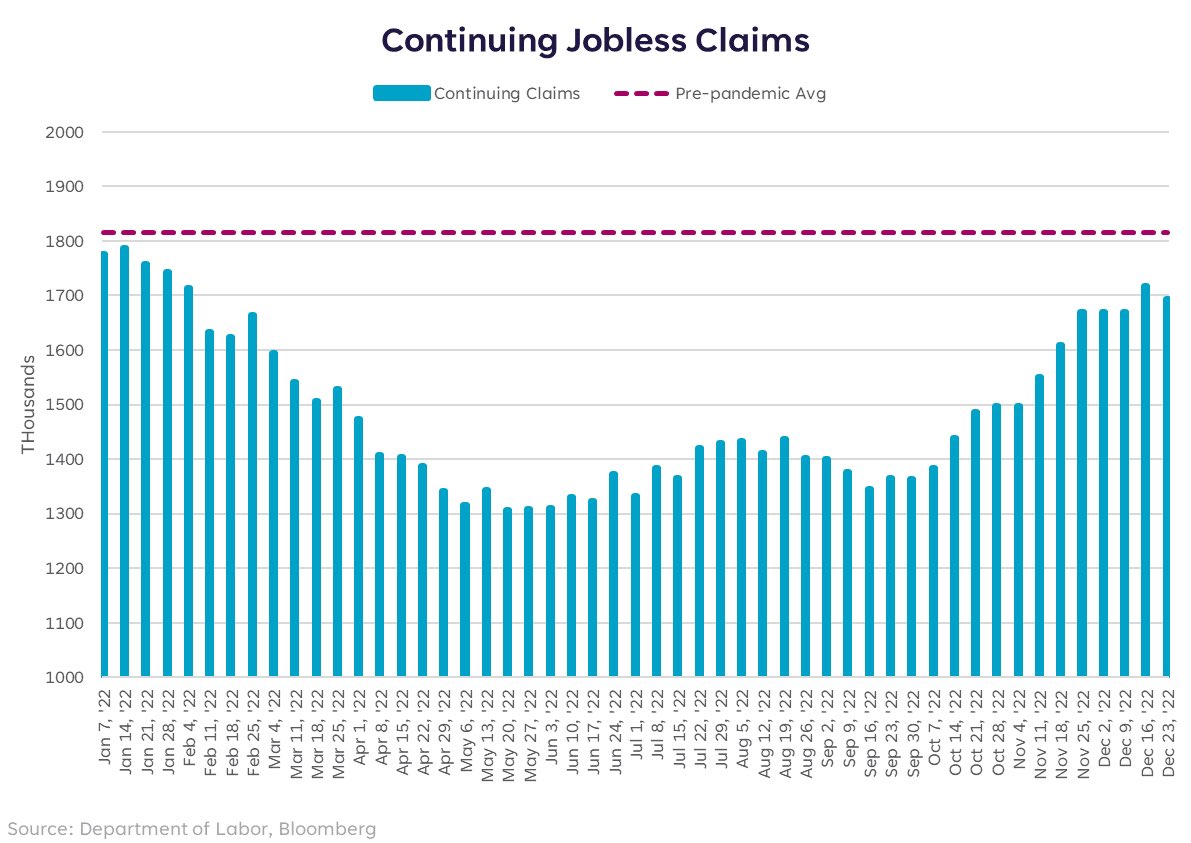

Continuing claims came in at 1.799m, below est of 1.82m. Since peaking on April 7, continuing claims have fallen while initial claims have risen. The contradiction could just be a timing effect, we'll see in coming weeks. Yields up in response.

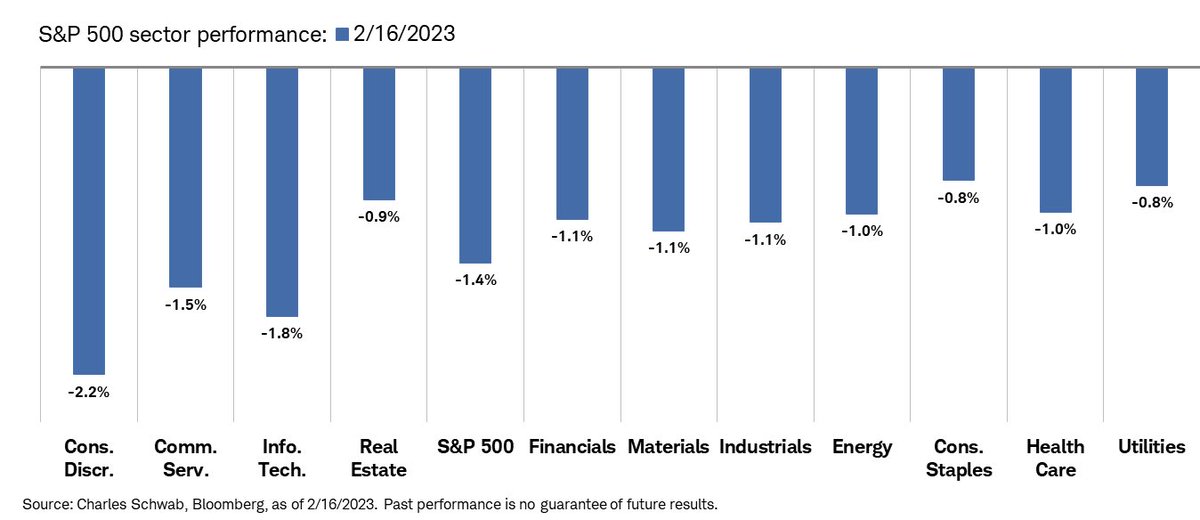

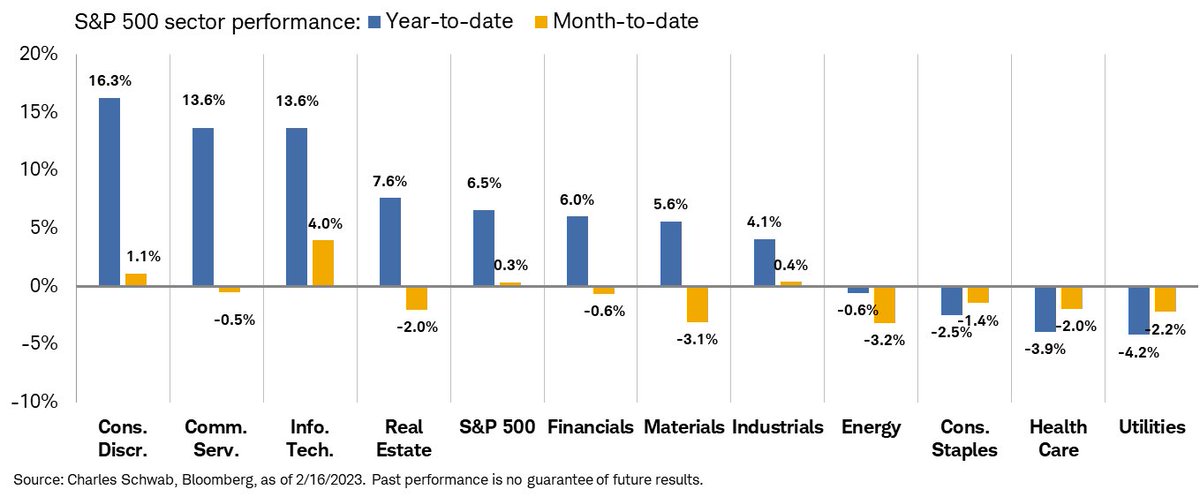

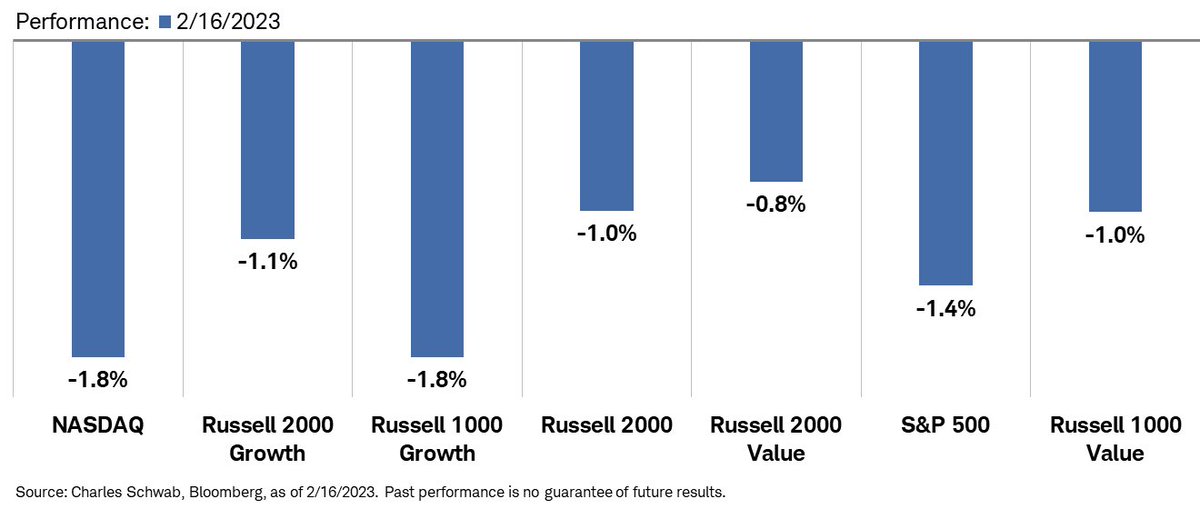

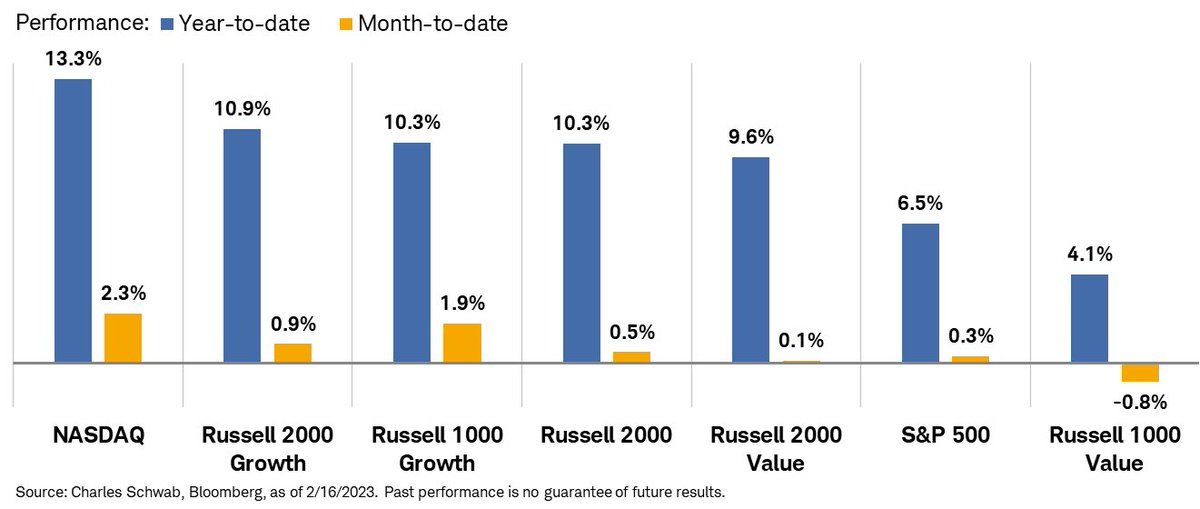

Quick reversal to downside to finish day, with this year’s leaders losing most; traditional defensives were relative gainers but still fell by -0.8% and are lagging YTD … Russell 1000 Growth and NASDAQ struggled most today but are still up MTD (and up >10% YTD)

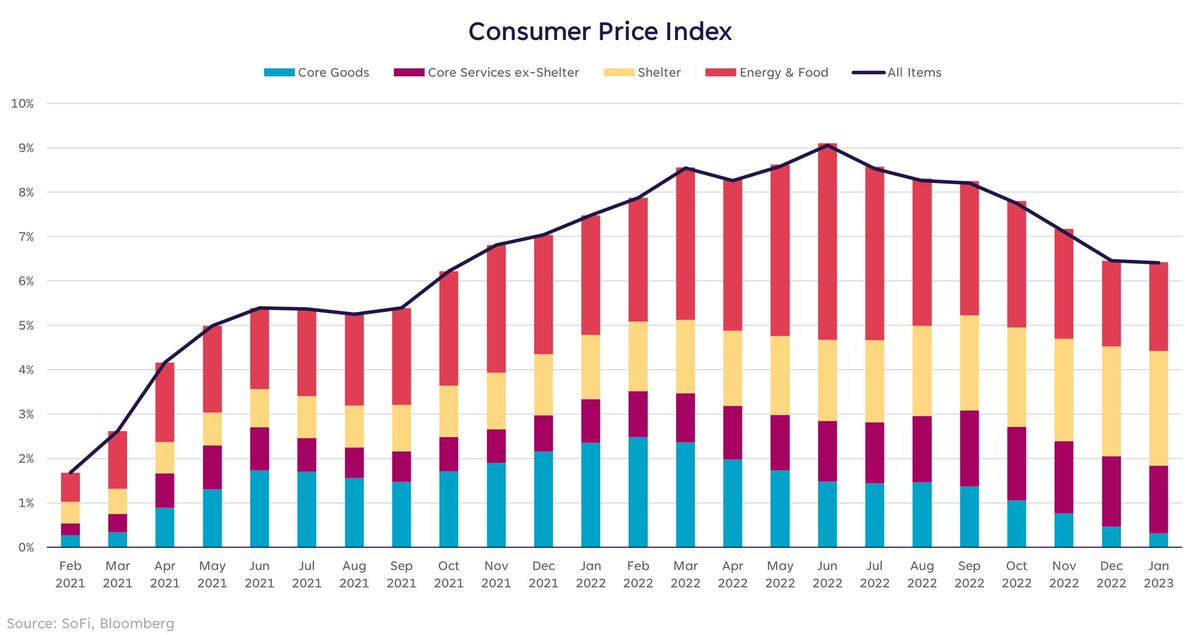

CPI came in at 6.4% y/y above expectations of 6.2%, and Shelter remained persistent due to the long lags before home & rental price declines feed through--Shelter is adding 3% to the y/y rate. This print was sticky.

Idk why experts bother with these metrics anymore. You can’t compare reasonable historical data to a video game market with endless liquidity and fully insured by the fed. There’s no precedent for the market now

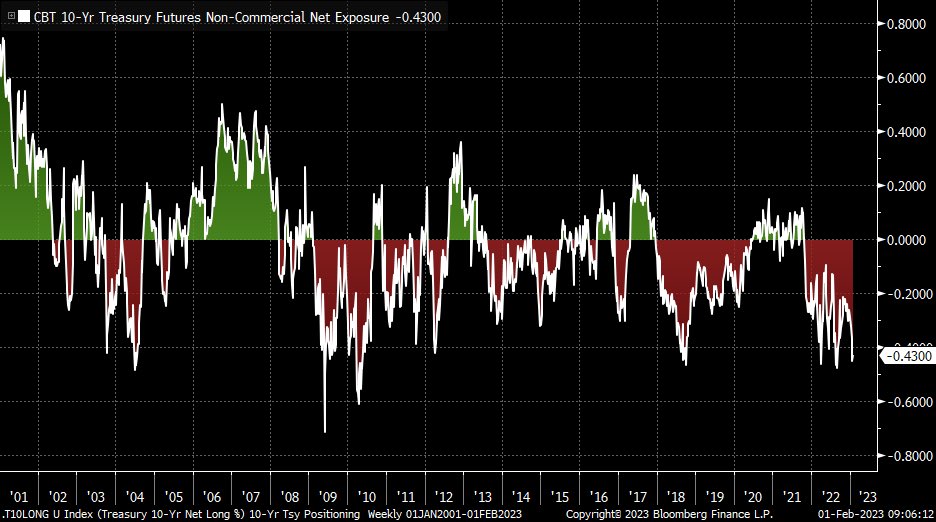

Speculative 10-Yr Treasury futures positioning is the most net-bearish since Sept. Long-end poised for a rise in yields?

This👇🏼

Yesterday was the first good example of bad economic data being bad for the market. I believe this will become the new reaction function as we move through 2023.

Jobless claims continue to throw stones at us cautionary types--initial claims back down to 190k (lowest since Apr & Sept), while continuing claims ticked up just a smidge to 1.647m.

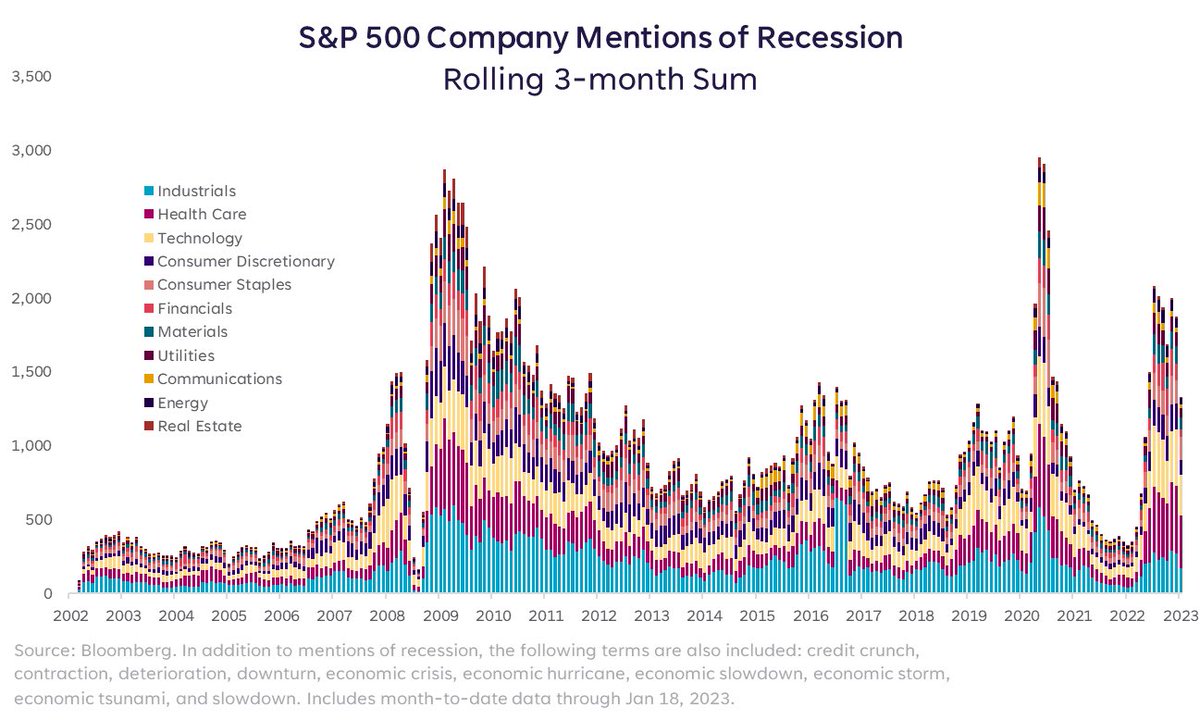

Company mentions of the word "recession" & related terms have been elevated for 6 mos now, rivalled only by 2008/2009 & 2020. Up most notably in Technology, Cons Discretionary, and Materials companies.

Something to watch 👀

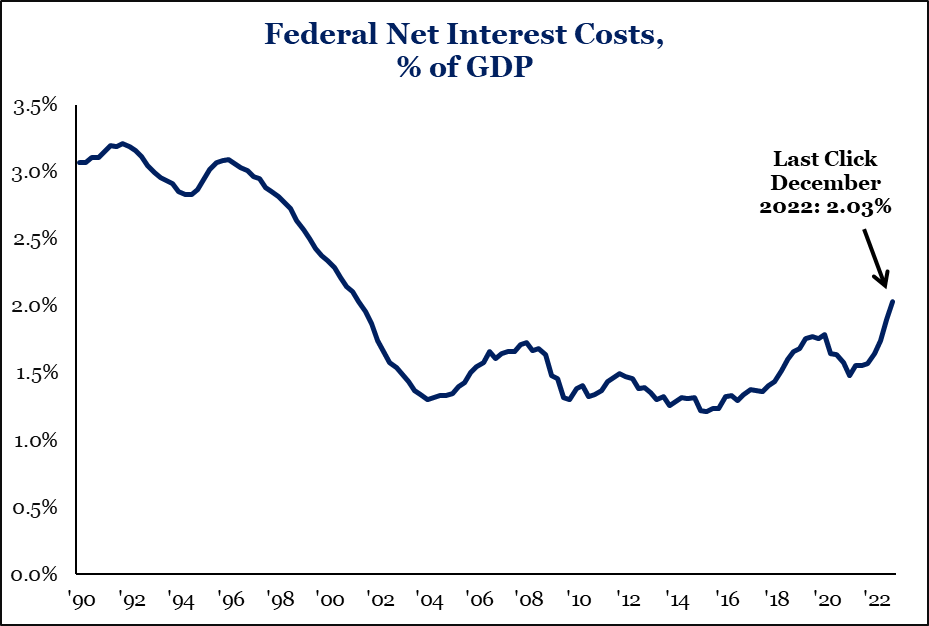

The US government is facing a regime change with interest costs. Higher interest rates on a larger stock of debt lifts interest costs to their largest % of the US economy in 21 years. Only going higher in 2023 and pressuring policymakers ahead of the debt ceiling debate.

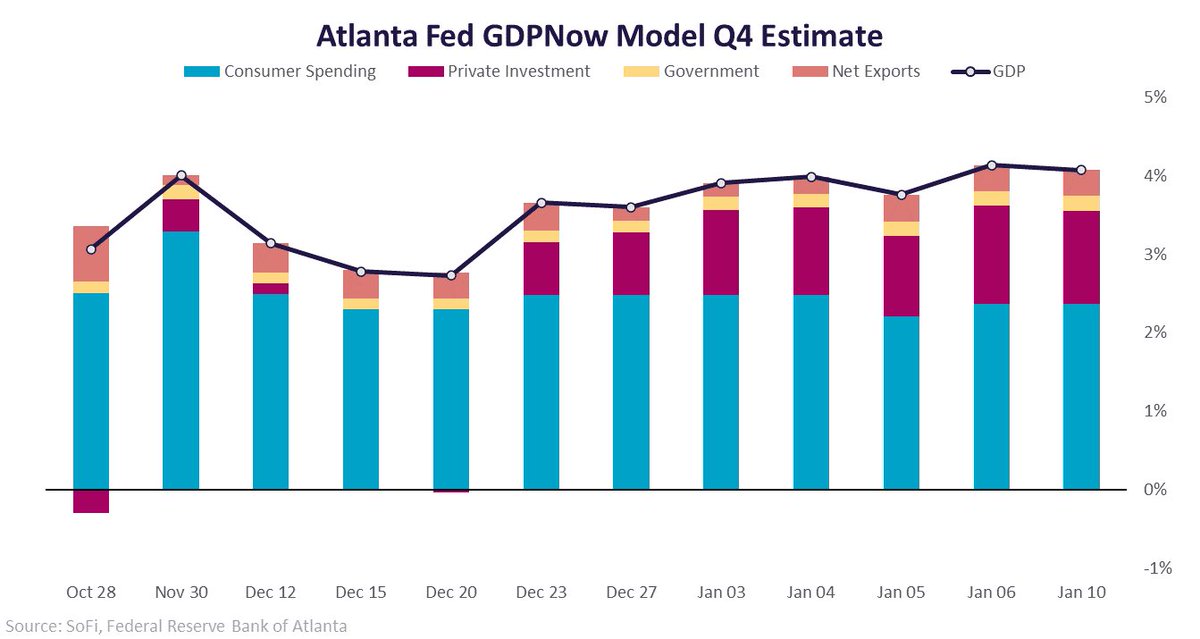

Q4 GDP is tracking at a robust +4.1% according to the Atl Fed's Nowcast. Components strong pretty much across the board, but in Private Investment residential investment declines are being offset by strong inventories. Official BEA data comes out Jan 26.

Continuing claims came down a bit to 1.69m, and ADP estimates showed that job growth actually accelerated in Dec. I still think something's gotta give, but this data is stubbornly arguing with me. Let's see what NFP says tomorrow...

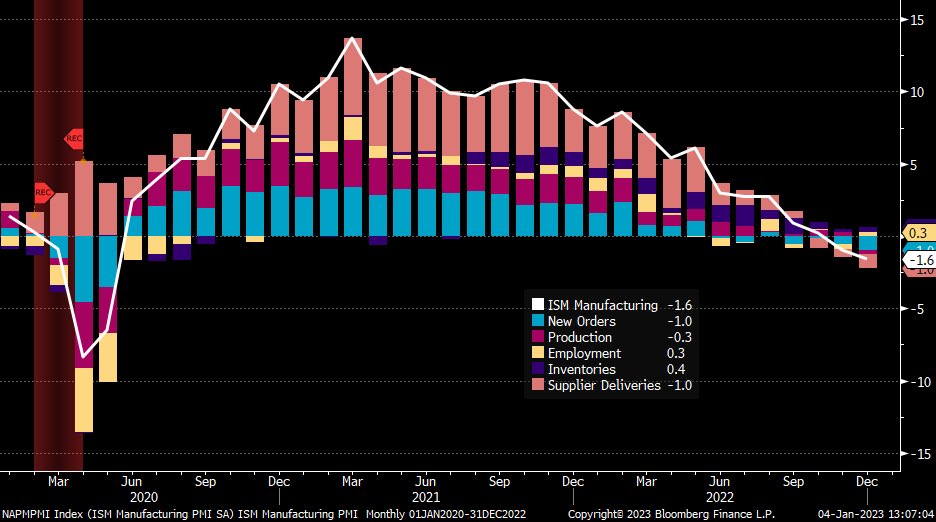

Overall ISM Manufacturing PMI continued to weaken in Dec. New Orders fell, but Employment was actually a tad positive. The Prices Paid component (not in the chart) fell much further, pointing to outright declines in supply costs. Summary: activity and prices falling, jobs steady.

$TSLA TESLA Q4 DELIVERY NUMBERS ARE OUT TOTAL DELIVERIES 405,278 EST. 420,760 ( MISS ❌) MODEL S/X 17,147 EST. 18,577 ( MISS ❌ ) MODEL 3/Y 388,131 EST. 405,597 ( MISS ❌)

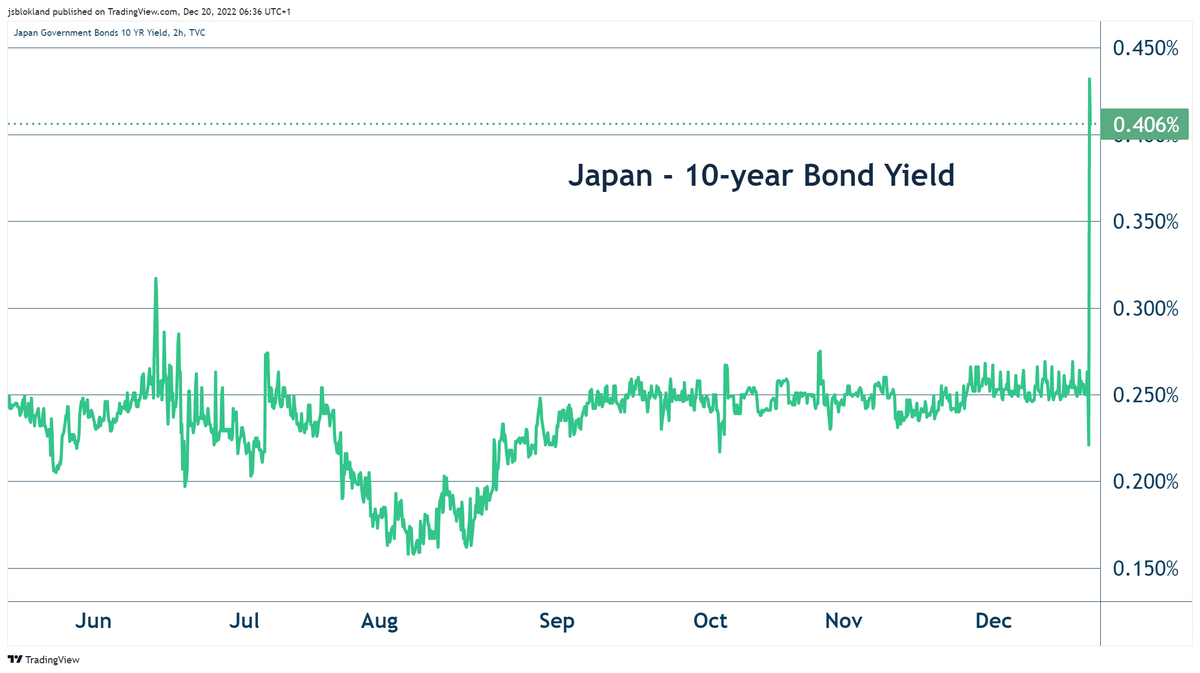

⚠️BREAKING: *BANK OF JAPAN ANNOUNCES UNSCHEDULED BOND BUYING OPERATION 🇯🇵🇯🇵

There will be books written about the greed and folly that's been created in the last few years. The 80s have nothing on us!

Oh boy! The Bank of Japan unexpectedly expands the band in which it allows the 10-year bond #yield to move from 0.25 percentage points to 0.50 percentage points. Yes, the Bank of Japan, too, is worried about #inflation!

Tesla sends Shanghai boss and aides to jumpstart US output reut.rs/3HZgg0O

*JAPAN BOND FUTURES TRADING HALTED: OSAKA EXCHANGE

United States Trends

- 1. Good Sunday 72,5 B posts

- 2. Go Birds 9.583 posts

- 3. Muhammad Qasim 18,1 B posts

- 4. 4E FIRST FAMILY TIME 1,29 Mn posts

- 5. #Unveiling4Elements 1,33 Mn posts

- 6. #SundayFunday 1.468 posts

- 7. Bregman 31,8 B posts

- 8. Pond 110 B posts

- 9. Packers 227 B posts

- 10. #IranianRevolution2026 40,5 B posts

- 11. Blessed Sunday 21,1 B posts

- 12. Portsmouth 16,3 B posts

- 13. Victory Sunday N/A

- 14. Devers 5.696 posts

- 15. LaFleur 51,1 B posts

- 16. Red Sox 9.516 posts

- 17. #sundayvibes 3.079 posts

- 18. #H2HseriesFinalEP 157 B posts

- 19. Pulisic 1.302 posts

- 20. Caleb 122 B posts

Something went wrong.

Something went wrong.