Stanley Druckenmiller

@SD_MarketMaster

Macro investor with a focus on global trends and long-term value. Mastering market timing and risk management. Be humble, be patient, and always learn from the

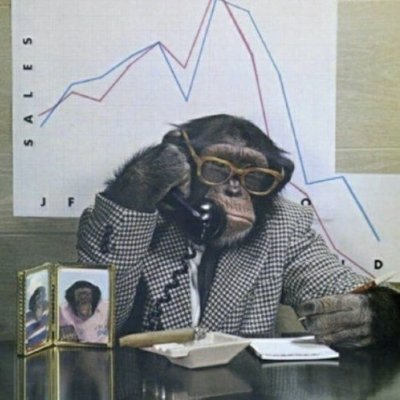

The labor market showed a sharp shift this month, with full-time employment rebounding from -890K to +135.2K, while part-time jobs flipped from +740K to -28.7K. This represents a clear reversal from last month, pointing to an improvement in job quality and stronger employer…

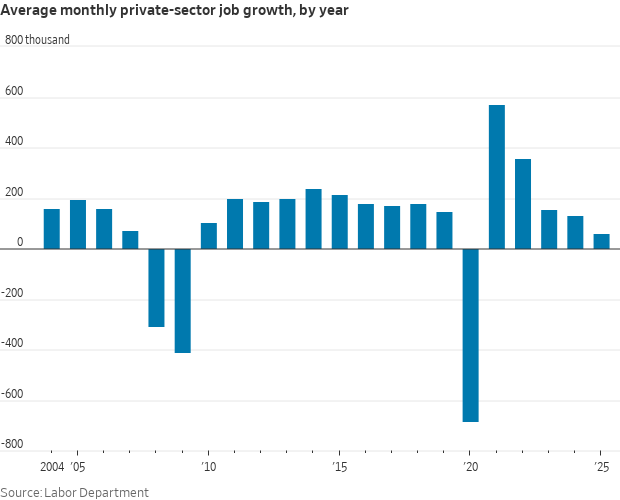

The 2026 Tesla Model Y Standard just posted its best real world result yet. Edmunds measured 337 miles of range, beating the EPA estimate of 321 miles and setting a new high for any Model Y they have tested. Even more impressive, it did it with a smaller battery, using just 22.8…

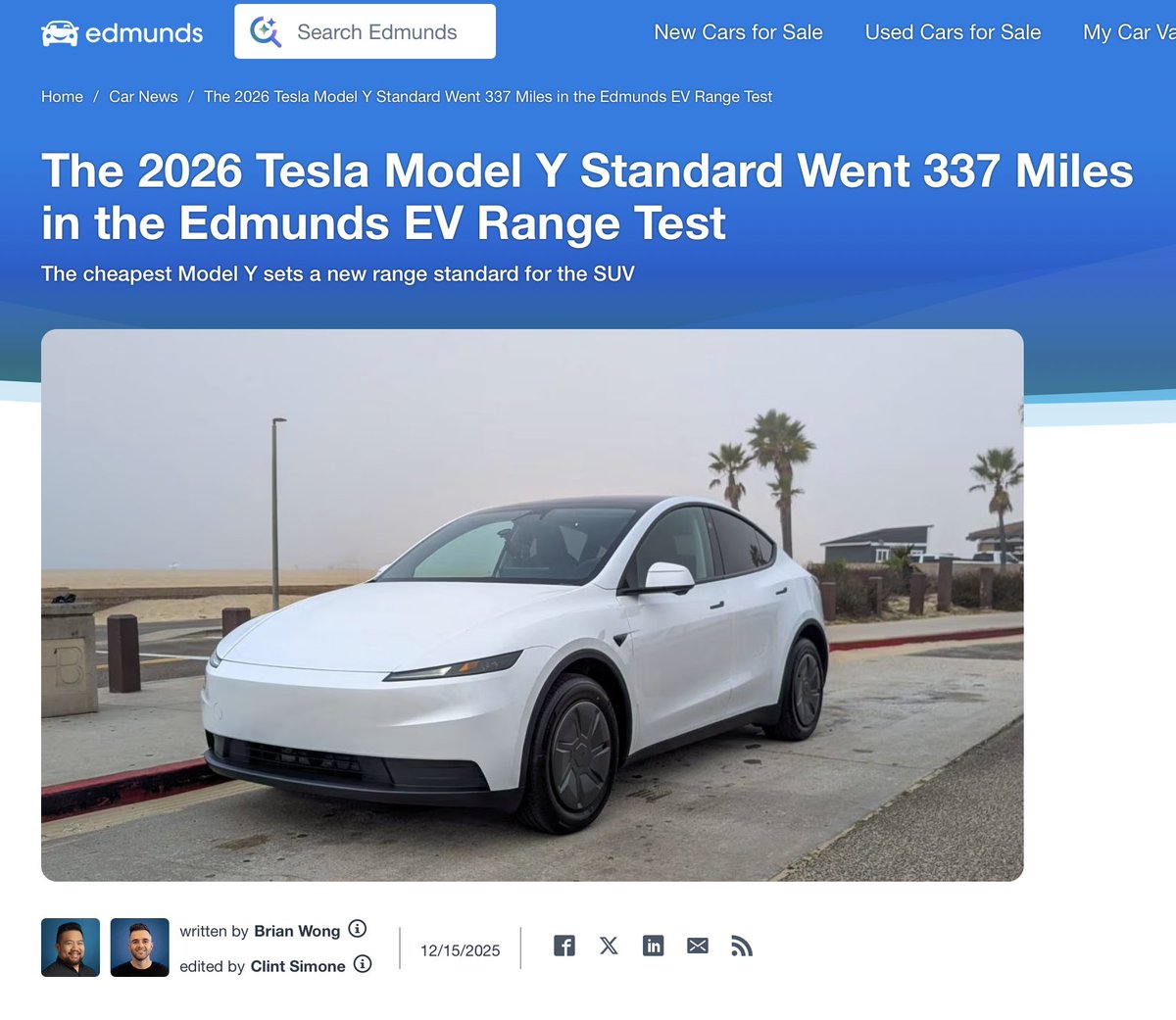

NVIDIA ($NVDA) is moving higher again. Shares are up 1.7% premarket, hitting new highs as the company announces the NVIDIA Nemotron 3 family — a new open model, data, and library stack designed to power transparent, efficient, and specialized agentic AI across industries. The…

2025: The year AI's full potential broke free. From disruptive innovation to existential concerns, there's no turning back. TIME's 2025 Person of the Year? It has to be the "Architects of AI." They brought thinking machines to life and reshaped our reality. The future is here.…

$NVDA Rolls Out "Chip Geolocation": The New Era of Compliance? Nvidia ($NVDA) introduced an opt-in geolocation tag for GPUs, allowing operators to prove where the chips are running. This is a "technical compliance" move by the tech giant to navigate tightening export controls.…

Trump: Changes are coming to the Fed. With potential policy shifts ahead, markets are set to face new challenges and opportunities. This will undoubtedly affect investor strategies, particularly against the backdrop of rates and inflation pressures. The next few months will be…

YTD Results: $BRK.B 7% $TSLA +14% $BTC +22% $ARKK +56% 🚀Our Chill Menu +347% Just two trades that took one minute to open. No need to do research or read news.

NVIDIA ($NVDA) Performance Over the Last 8 Years: Largest peak to trough drawdowns: 2018: -30% 2019: Calm markets 2020: +122% (AI boom pushes the stock skyward) 2021: +125% (Continued dominance in AI and gaming) 2022: -45% (Market correction) 2023: +80% (AI growth…

Warren Buffett’s Berkshire Hathaway Portfolio Breakdown: Top 5 Holdings: 1.Apple – 22.7% 2.American Express – 18.8% 3.Bank of America – 11.0% 4.Coca-Cola – 9.9% 5.Chevron – 7.1% Buffett’s strategy? Stick to high-quality, cash-flowing businesses.…

U.S. Market Note: Classic Gap-Up Fade Another textbook gap-up then fade in the U.S. markets tonight. • Indexes opened strong, then lost momentum • Nvidia led the early push but got sold into • Mega-cap tech turned red one by one • Clear signs of institutions taking profits…

December Sector Outlook: • AI Chips: ARM, AVGO showing steady leadership as enterprise spending ramps. • Cloud & Data: MSFT, ORCL, NET positioned well for Q4 workloads. • Cybersecurity: PANW, CRWD remain high-conviction trends into 2025. • EV & Energy: TSLA stabilizing; ENPH…

December Market Watch: • NVDA — Momentum strong, but avoid chasing • META — Cautious outlook • INTC — Solid AI-related recovery trend • AMD — Still a key beneficiary of AI demand • SNOW — Watching for growth reacceleration • PATH — Automation theme remains intact • TSLA —…

December market watchlist: • NVDA — Too extended, wait for better entry • META — Weak setup, staying sidelined • INTC — Watching $32–$34 for AI momentum • AMD — Tracking $243–$245 • SNOW — $248–$253 range in focus • PATH — Monitoring $9–$12 • AAPL — Soft demand trends, no…

Warren Buffett’s Berkshire Hathaway Portfolio Breakdown: Top 5 Holdings: 1.Apple – 22.7% 2.American Express – 18.8% 3.Bank of America – 11.0% 4.Coca-Cola – 9.9% 5.Chevron – 7.1% Buffett’s strategy is clear: focus on strong, cash-generating…

Nov 18 Market Take: • NVDA — Don’t chase • META — Avoid • INTC — $32–$34, AI growth • AMD — $243–$245 • SNOW — $248–$253 • PATH — $9–$12 Not a buy list, just strategy. Discipline > emotion. Hit like for more insights.

One of the best scanner It will scan Low debt companies the stocks It also consider the volume whether price move is real or fake. To get the scanner Follow @breakoutchart__ , like and re-tweet and comment as "LDC". I will DM the scanner.

Mr. President, I’m getting tired of all this winning.

United States Trends

- 1. Packers 176 B posts

- 2. Caleb Williams 47,3 B posts

- 3. McManus 16,9 B posts

- 4. Ben Johnson 32,7 B posts

- 5. LaFleur 37,8 B posts

- 6. Jordan Love 18 B posts

- 7. Bregman 24 B posts

- 8. Cubs 23,9 B posts

- 9. #GBvsCHI 6.758 posts

- 10. Matthew Golden 8.321 posts

- 11. Red Sox 6.991 posts

- 12. DJ Moore 6.979 posts

- 13. Devers 3.643 posts

- 14. Cancun 6.246 posts

- 15. #NFLPlayoffs 16,2 B posts

- 16. Al Michaels 3.386 posts

- 17. Colston Loveland 6.301 posts

- 18. Rams 80,6 B posts

- 19. Nixon 21,7 B posts

- 20. Dennis Allen 3.865 posts

Something went wrong.

Something went wrong.