David Ryan | Private

@dryan310_p

Only private elite here! I will mainly talk about the stock market, price action analysis etc. ONLY FOR A FEW PEOPLE 🛑main page; @dryan310

You might like

An area of the market that is starting a move is in mid-cap weighted stocks. The way I would take advantage of this is by buying the XMMO. That is the Invesco S&P Mid Cap Momentum ETF. Its RS line is breaking into a 8 month high.

My good friend Thomas Ryan @tryan310 (yes, David Ryan's son) started a new belt company with some friends. He was kind enough to send me a belt customized with my company logo (Minervini Private Access) on it. Included was a note that read "this gives private access a whole new…

Just recorded an Investor's Business Daily podcast with Justin Nielsen that you can access from this link. investors.com/ibd-videos/vid… I cover the general market and the weakness developing in the "FANG" stocks. I also suggest groups that are just emerging.

Cracks developing in technology stocks. Combine that with many extended in price, calls for profit taking in that area. There is a rotation into more conservative areas like medical, energy and infrastructure. It is also an environment to buy pullbacks and not highs.

If you are holding too many technology stocks, consider names in other groups: AGI, NVO, GNRC, KKR and GE.

SMCI has all the signs of a climatic top: Yesterday the largest price move on biggest volume, three gaps in a row. Last to occur, should be a higher opening closing lower. This could mark a top in this sector.

The QQQ reversal yesterday and the continuation today is telling that the best of the rally is over. Time to take profits and reduce your invested position.

Weak rally so far, but up 3 days in a row is a positive. If volume doesn’t pick up and rally stalls then look for the downtrend to continue. My son Sean and I will be on the Blue Sky6 Investing Event this Sat. Here is the link us06web.zoom.us/webinar/regist…

Markets are very over sold and has hit at least a short term bottom. If your time frame is short enough, you can trade this market. I still believe the QQQ’s will not see new highs this year, as I mentioned late August.

The QQQ has seen it’s high for the year on 7/19/23. NVDA’s earnings mark the final move in tech. Raise cash and get defensive.

How will this rally end, which I missed, but was going through the loss of my own dad at 99 and Bill O’Neil three weeks before? It should end with 2 to 3 week climatic moves of 30%, which might be starting now, in the key tech stocks that have led: META and NVDA.

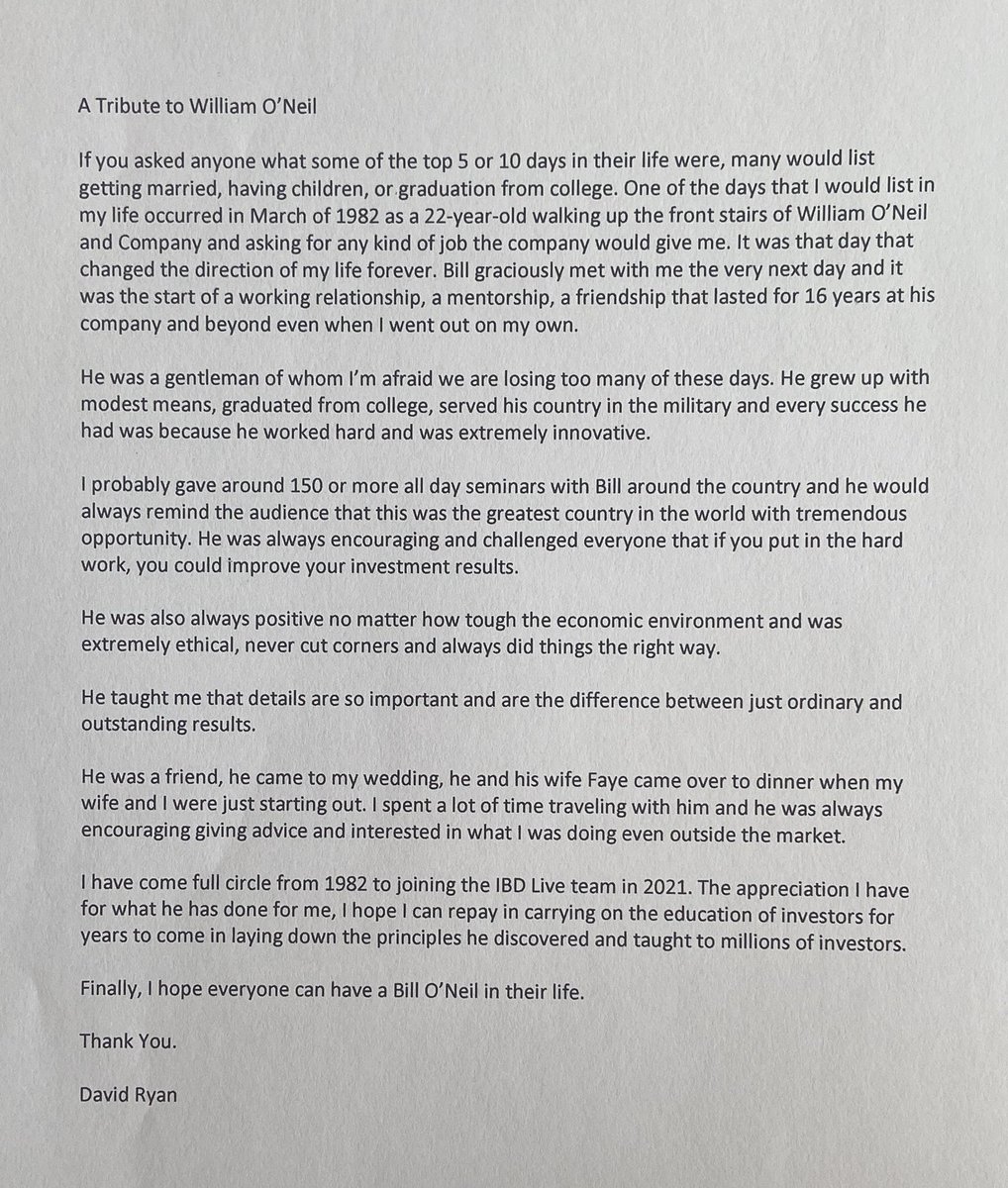

Here is the tribute I gave about Bill O’Neil on IBD Live this morning. He will be missed.

SPY failed to surpass the 2/2/23 high and is now rolling over. Look for another move back to the lower end of this trading range that has existed since June 2022. QQQ has been the stronger index, but that also, could drop 10-15% from here.

The market has settled down now two weeks after the SVB collapse. Look for the market to rally, but the SPY must first get above 400 and its downtrend line. This should be treated as another rally in this on going trading range. Top of the range should be 420 to 430.

SPY closed Friday below my trading range low of 390. Even with a large gap up on tomorrow’s opening, wait for volatility to subside over the next few weeks and for leading stocks to base before initiating any new positions.

SPY surpassed my 1/6/23 target of 410 and is now running into overhead supply from last year. With lots of momentum and liquidity, SPY should have a new trading range between 390 and 431. Stay flexible moving money from extended stocks to names just breaking out.

Tradable rally underway with interest rates and dollar dropping. This is not a new bull market, but another rally that could take the SPY back to 410. Industrials, resource names should lead.

Rally since the October lows has indexes above or close to their 200 day ma’s. Time to take profits. QQQ has lagged badly and will continue do so. Expect a S&P 500 range of 4100 to 3400 next year, so there is limited upside. Stock selection will be key to outperform in 2023.

Tradable bottom is likely in. Most indexes pulled back to pre-Covid highs. Near term positives should include: GOP majority in Congress, weaker dollar, slowing inflation, and interest rate stability. Target is the 200 day moving average. Mid-cap stocks staring to lead.

The 6/12/22 targets I tweeted for QQQ and SPY are getting very close to being hit. From there a tradable rally could get underway. Even if this is a low, you should get a retest in 6 to 8 weeks. Volatility will reign.

United States Trends

- 1. Baker 27.5K posts

- 2. Cowboys 71.8K posts

- 3. Fred Warner 10K posts

- 4. Panthers 72.8K posts

- 5. Packers 26.6K posts

- 6. Tez Johnson 2,497 posts

- 7. Zac Taylor 2,747 posts

- 8. Niners 4,660 posts

- 9. Browns 64K posts

- 10. Titans 22.1K posts

- 11. #FTTB 3,794 posts

- 12. Yoshi 32.8K posts

- 13. Ravens 63.9K posts

- 14. Dolphins 46.4K posts

- 15. Cam Ward 2,144 posts

- 16. #49ers 5,991 posts

- 17. #KeepPounding 8,174 posts

- 18. Eberflus 9,935 posts

- 19. #Bengals 2,735 posts

- 20. Penn State 63.5K posts

You might like

-

𝕂𝕒𝕝𝕚𝕞 𝔸𝕙𝕞𝕒𝕕 کلیم احمد 🇵🇸

𝕂𝕒𝕝𝕚𝕞 𝔸𝕙𝕞𝕒𝕕 کلیم احمد 🇵🇸

@realkalimahmad -

Saheb Alam 🇮🇳

Saheb Alam 🇮🇳

@Sahebalam728 -

_KHAN_SK(SAEED)🌐🌐🌐🌐

_KHAN_SK(SAEED)🌐🌐🌐🌐

@SaiedHaiderKha1 -

Rebelboysahilsrk

Rebelboysahilsrk

@Rebelboysahil -

Mohammad Amir

Mohammad Amir

@amirnadwi007 -

Mohammad Fazal

Mohammad Fazal

@MohammadFazal_ -

Lakhwinder

Lakhwinder

@Lakhwin71071979 -

Dhaval Bhimjiyani धवल भीमजीयाणी🇮🇳

Dhaval Bhimjiyani धवल भीमजीयाणी🇮🇳

@BhimjiyaniDP -

Israul Haque

Israul Haque

@IsarShaikh -

Irshad Raza

Irshad Raza

@imIrshadRaza -

Merajul Hasan Advocate

Merajul Hasan Advocate

@mairajulhasan -

پاکستان کا شہری پاکستان کا مالک

پاکستان کا شہری پاکستان کا مالک

@Pak_Ka_Sipahi -

Aasim Chauhan

Aasim Chauhan

@AasimRajput786

Something went wrong.

Something went wrong.